Answered step by step

Verified Expert Solution

Question

1 Approved Answer

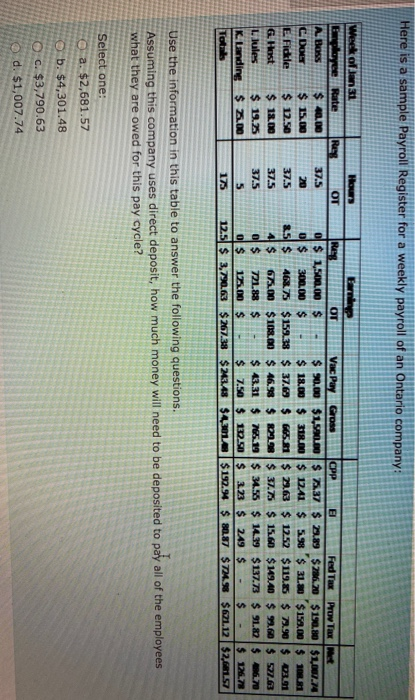

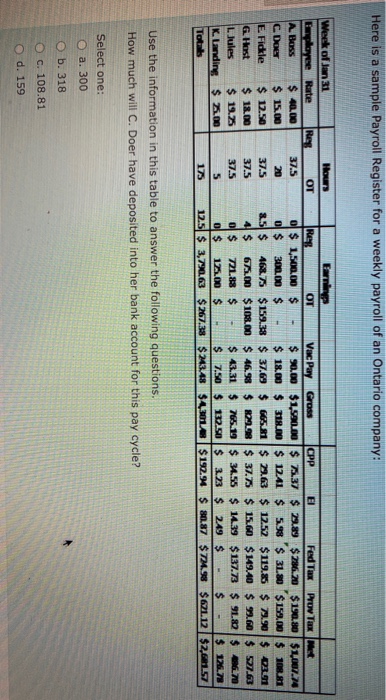

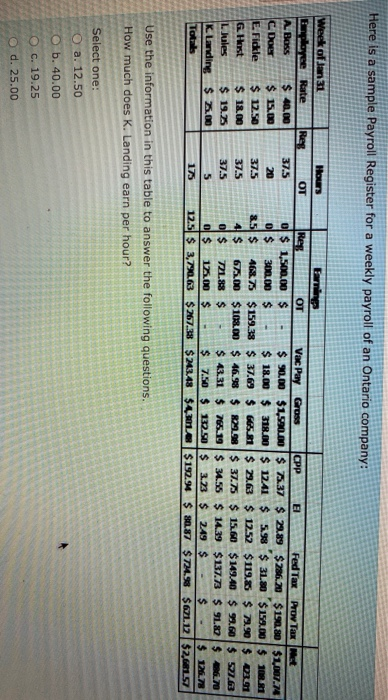

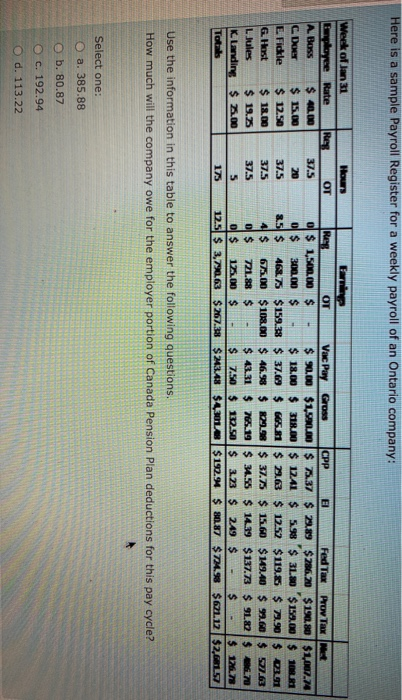

Here is a sample Payroll Register for a weekly payroll of an Ontario company: Res Week of Jan 31 Employee Rate A Boss $ 40,00

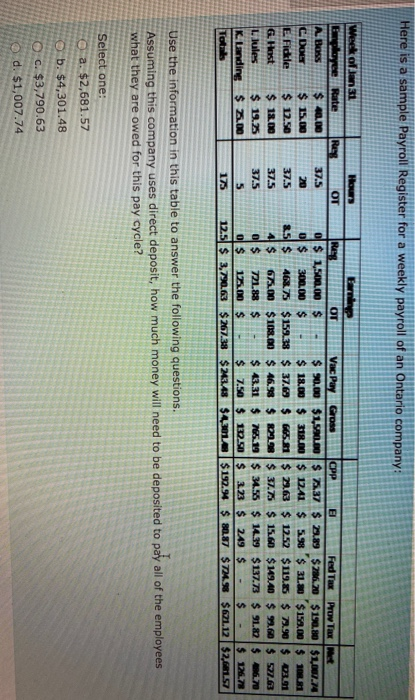

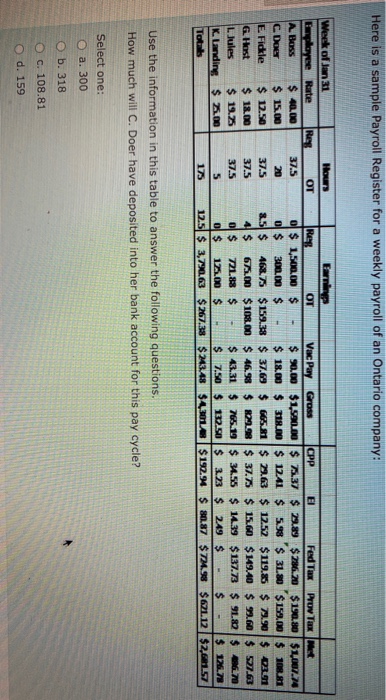

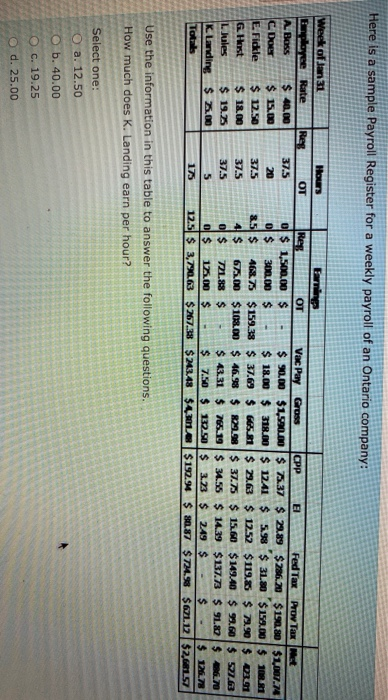

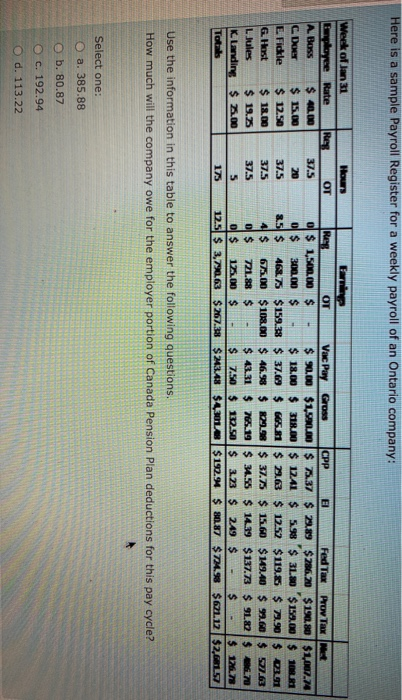

Here is a sample Payroll Register for a weekly payroll of an Ontario company: Res Week of Jan 31 Employee Rate A Boss $ 40,00 C DOG $ 15.00 E Fidle $ 12.50 G. Hest $ 18.00 Llules $ 19.25 K. Landing $ 200 Total Hours OT 37.5 20 37.5 37.5 37.5 5 175 Earni OT Vac Pay Gross CPP E Fed Tax Prov Taxe 0 $ 1,500.00 $ $ 90.00 $1,900.00 $ 75.37 $ 2.89 $236.20 $190.80 $1,007.74 0 $ 300.00 $ $ 18.00 $ 318.00 $ 1241 $ 5.98 $ 31.20 $199.00 $ 1081 &S $ 40S $159.38 $ 37.69 $ 65.81 $ 20.63 $ 12.52 $119.85 $ 22.90 $ 03.91 4 $ 675.00 $10.00 $ 46.98 $ 04.98 $ 37.75 $ 15.60 $149.40 $ 99.60 $ 527.63 0 $ 721.88 $ $ 43.31 $ 785.19 $ 34.55 $ 14.39 $137.73 $ 91.82 $ 46.70 0 $ 175.00 $ $ 7.50 $ 122.50 $ 3.23 $ 249 $ $ $ 12678 12.5 $ 3.770.63 $267.38 $23.48 $4,301.40 $132.99 $ 80.87 $72.98 $621.12 $2,61.SI Use the information in this table to answer the following questions. Assuming this company uses direct deposit, how much money will need to be deposited to pay all of the employees what they are owed for this pay cycle? Select one: O a. $2,681.57 b. $4,301.48 O c. $3,790.63 d. $1,007.74 Here is a sample Payroll Register for a weekly payroll of an Ontario company: Hours OT Week of Jan 31 Employee Rate A Bass $ 40.00 C D $ 15.00 E. Fickle $ 12.50 G. Host $ 18.00 Llules $ 19.75 K landing $ 2.00 Tots 37.5 20 37.5 37.5 37.5 5 Reg OT Vac Pay Gross CPP Fed Tax Prov Tax Det o $ 1,500.00 $ $ 90.00 $1,990.00 $ 1.37 $ 79.89 $236.20 $ 190.80 $1,007.74 0 $ 300.00 $ $ 18.00 $ 318.00 $ 12.41 $ 5.98 $ 31.80 $ 159.00 $ 100.81 &5 $ 468.75 $ 159.38 $ 37.69 $ 665.81 $ 79.63 $ 12.52 $119.85 $ 79.90 $ 03.1 4 $ 65.00 $ 108.00 $ 46.98 $ 29.98 $ 37.75 $ 15.60 $149.40 $ 99.60 $ $27.63 0 $ 721.88 $ $ 43.31 $ 765.19 $ 32.55 $ 14.39 $137.73 $ 91.82 $ 66.70 0 $ 126.00 $ $ 7.50 $ 102.50 $ 3.23 $ 249 $ $ $ 126.78 12.5 $ 3,70.63 $267.38 $ 243.48 $4,2014 $192.9 $ 80.87 $ 74.98 $621.12 $2,61.57 175 Use the information in this table to answer the following questions. How much will C. Doer have deposited into her bank account for this pay cycle? Select one: O a. 300 b. 318 c. 108.81 O d. 159 Here is a sample Payroll Register for a weekly payroll of an Ontario company: Week of Jan 31 Employee Rate Res A Boss $ 40,00 C. DOG $ 15.00 E Fidkle $ 12.50 G. Hast $ 18.00 LJules $ 19.75 K Landing $ 2.00 Totals Hours OT 37.5 20 37.5 37.5 37.5 5 175 Earning Res OT Vac Pay Gross CPP Fed Tax Proy Tax Net 0 $ 1,500.00 $ $ 90,00 $1,500.00 $ 2.37 $ 29.89 $286.20 $190.80 $1,007.74 0 $ 300.00 $ $ 18.00 $ 318.00 $ 1241 $ 5.98 $ 3.80 $159.00 $ 108,81 85 $ 46675 $ 159.38 $ 37.69 $ 65.81 $ 23.63 $ 12.52 $119.86 $ 1.90 $ 03.91 4 $ 65.00 $ 108.00 $ 46.98 $ 109.98 $ 37.75 $ 15.60 $149.40 $ 99.60 $ 27.63 0 $ 721.88 $ $ 43.31 $ 765.19 $ 3.55 $ 14.39 $137.73 $ 91.87 $ 40670 0 $ 125.00 $ $ 7.50 $ 132.50 $ 3.23 $ 249 $ $ 12478 12.5 $ 3.790.63 $267.38 $ 243.48 $400 $ 192.94 $ 80.87 $24.98 $71.12 $2,681.57 Use the information in this table to answer the following questions. How much does K. Landing earn per hour? Select one: O a. 12.50 b. 40.00 C. 19.25 d. 25.00 Here is a sample Payroll Register for a weekly payroll of an Ontario company: Hours OT 37.5 Week of Jan 31 Bployee Rate Res A Boss $ 40.00 C D $ 15.00 E Fickle $ 12.50 G. Horst $ 18.00 L.lules $ 19.25 K.Landing $ 22.00 Total 20 37.5 37.5 37.5 5 Earn Res OT Vac Pay Gross CPP EI Fed Tax Prov Tax Net o $ 1,500.00 $ $ 90.00 $1,900.00 $ 7.37 29.89 $286.20 $190.80 $1,007.74 0 $ 300.00 $ $ 18.00 $ 318.00 $ 1241 $ 5.98 $ 31.80 $159.00 $ 1021 8.5 $ 468.75 $159.38 $ 37.69 $ 65.81 $ 29.33 $ 12.52 $119.85 $ 79.90 $ 03.91 4 $ 6/5.00 $108.00 $ 46.98 $ RM2.08 $ 37.75 $ 15.60 $149.40 $ 99.60 $ $27.63 0 $ 721.88 $ $ 43.31 $ 765.19 $ 3.55 $ 14.39 $137.73 $ 91.82 $ 86.70 0 $ 12.00 $ $ 7.50 $ 132.50 $ 3.23 $ 249 $ $ $ 126.78 12.5 $ 3.770.63 $267.33 $23.48 $4,2014 $132.4 $ 80.87 $74.98 $621.12 $2,68157 175 Use the information in this table to answer the following questions. How much will the company owe for the employer portion of Canada Pension Plan deductions for this pay cycle? Select one: a. 385.88 b. 80.87 C. 192.94 O d. 113.22

Here is a sample Payroll Register for a weekly payroll of an Ontario company: Res Week of Jan 31 Employee Rate A Boss $ 40,00 C DOG $ 15.00 E Fidle $ 12.50 G. Hest $ 18.00 Llules $ 19.25 K. Landing $ 200 Total Hours OT 37.5 20 37.5 37.5 37.5 5 175 Earni OT Vac Pay Gross CPP E Fed Tax Prov Taxe 0 $ 1,500.00 $ $ 90.00 $1,900.00 $ 75.37 $ 2.89 $236.20 $190.80 $1,007.74 0 $ 300.00 $ $ 18.00 $ 318.00 $ 1241 $ 5.98 $ 31.20 $199.00 $ 1081 &S $ 40S $159.38 $ 37.69 $ 65.81 $ 20.63 $ 12.52 $119.85 $ 22.90 $ 03.91 4 $ 675.00 $10.00 $ 46.98 $ 04.98 $ 37.75 $ 15.60 $149.40 $ 99.60 $ 527.63 0 $ 721.88 $ $ 43.31 $ 785.19 $ 34.55 $ 14.39 $137.73 $ 91.82 $ 46.70 0 $ 175.00 $ $ 7.50 $ 122.50 $ 3.23 $ 249 $ $ $ 12678 12.5 $ 3.770.63 $267.38 $23.48 $4,301.40 $132.99 $ 80.87 $72.98 $621.12 $2,61.SI Use the information in this table to answer the following questions. Assuming this company uses direct deposit, how much money will need to be deposited to pay all of the employees what they are owed for this pay cycle? Select one: O a. $2,681.57 b. $4,301.48 O c. $3,790.63 d. $1,007.74 Here is a sample Payroll Register for a weekly payroll of an Ontario company: Hours OT Week of Jan 31 Employee Rate A Bass $ 40.00 C D $ 15.00 E. Fickle $ 12.50 G. Host $ 18.00 Llules $ 19.75 K landing $ 2.00 Tots 37.5 20 37.5 37.5 37.5 5 Reg OT Vac Pay Gross CPP Fed Tax Prov Tax Det o $ 1,500.00 $ $ 90.00 $1,990.00 $ 1.37 $ 79.89 $236.20 $ 190.80 $1,007.74 0 $ 300.00 $ $ 18.00 $ 318.00 $ 12.41 $ 5.98 $ 31.80 $ 159.00 $ 100.81 &5 $ 468.75 $ 159.38 $ 37.69 $ 665.81 $ 79.63 $ 12.52 $119.85 $ 79.90 $ 03.1 4 $ 65.00 $ 108.00 $ 46.98 $ 29.98 $ 37.75 $ 15.60 $149.40 $ 99.60 $ $27.63 0 $ 721.88 $ $ 43.31 $ 765.19 $ 32.55 $ 14.39 $137.73 $ 91.82 $ 66.70 0 $ 126.00 $ $ 7.50 $ 102.50 $ 3.23 $ 249 $ $ $ 126.78 12.5 $ 3,70.63 $267.38 $ 243.48 $4,2014 $192.9 $ 80.87 $ 74.98 $621.12 $2,61.57 175 Use the information in this table to answer the following questions. How much will C. Doer have deposited into her bank account for this pay cycle? Select one: O a. 300 b. 318 c. 108.81 O d. 159 Here is a sample Payroll Register for a weekly payroll of an Ontario company: Week of Jan 31 Employee Rate Res A Boss $ 40,00 C. DOG $ 15.00 E Fidkle $ 12.50 G. Hast $ 18.00 LJules $ 19.75 K Landing $ 2.00 Totals Hours OT 37.5 20 37.5 37.5 37.5 5 175 Earning Res OT Vac Pay Gross CPP Fed Tax Proy Tax Net 0 $ 1,500.00 $ $ 90,00 $1,500.00 $ 2.37 $ 29.89 $286.20 $190.80 $1,007.74 0 $ 300.00 $ $ 18.00 $ 318.00 $ 1241 $ 5.98 $ 3.80 $159.00 $ 108,81 85 $ 46675 $ 159.38 $ 37.69 $ 65.81 $ 23.63 $ 12.52 $119.86 $ 1.90 $ 03.91 4 $ 65.00 $ 108.00 $ 46.98 $ 109.98 $ 37.75 $ 15.60 $149.40 $ 99.60 $ 27.63 0 $ 721.88 $ $ 43.31 $ 765.19 $ 3.55 $ 14.39 $137.73 $ 91.87 $ 40670 0 $ 125.00 $ $ 7.50 $ 132.50 $ 3.23 $ 249 $ $ 12478 12.5 $ 3.790.63 $267.38 $ 243.48 $400 $ 192.94 $ 80.87 $24.98 $71.12 $2,681.57 Use the information in this table to answer the following questions. How much does K. Landing earn per hour? Select one: O a. 12.50 b. 40.00 C. 19.25 d. 25.00 Here is a sample Payroll Register for a weekly payroll of an Ontario company: Hours OT 37.5 Week of Jan 31 Bployee Rate Res A Boss $ 40.00 C D $ 15.00 E Fickle $ 12.50 G. Horst $ 18.00 L.lules $ 19.25 K.Landing $ 22.00 Total 20 37.5 37.5 37.5 5 Earn Res OT Vac Pay Gross CPP EI Fed Tax Prov Tax Net o $ 1,500.00 $ $ 90.00 $1,900.00 $ 7.37 29.89 $286.20 $190.80 $1,007.74 0 $ 300.00 $ $ 18.00 $ 318.00 $ 1241 $ 5.98 $ 31.80 $159.00 $ 1021 8.5 $ 468.75 $159.38 $ 37.69 $ 65.81 $ 29.33 $ 12.52 $119.85 $ 79.90 $ 03.91 4 $ 6/5.00 $108.00 $ 46.98 $ RM2.08 $ 37.75 $ 15.60 $149.40 $ 99.60 $ $27.63 0 $ 721.88 $ $ 43.31 $ 765.19 $ 3.55 $ 14.39 $137.73 $ 91.82 $ 86.70 0 $ 12.00 $ $ 7.50 $ 132.50 $ 3.23 $ 249 $ $ $ 126.78 12.5 $ 3.770.63 $267.33 $23.48 $4,2014 $132.4 $ 80.87 $74.98 $621.12 $2,68157 175 Use the information in this table to answer the following questions. How much will the company owe for the employer portion of Canada Pension Plan deductions for this pay cycle? Select one: a. 385.88 b. 80.87 C. 192.94 O d. 113.22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started