Answered step by step

Verified Expert Solution

Question

1 Approved Answer

helpppo Scenario 1: Rocky inc hired a new intern from CSU to help with year-end inventory. The intern computed the inventory counts at the end

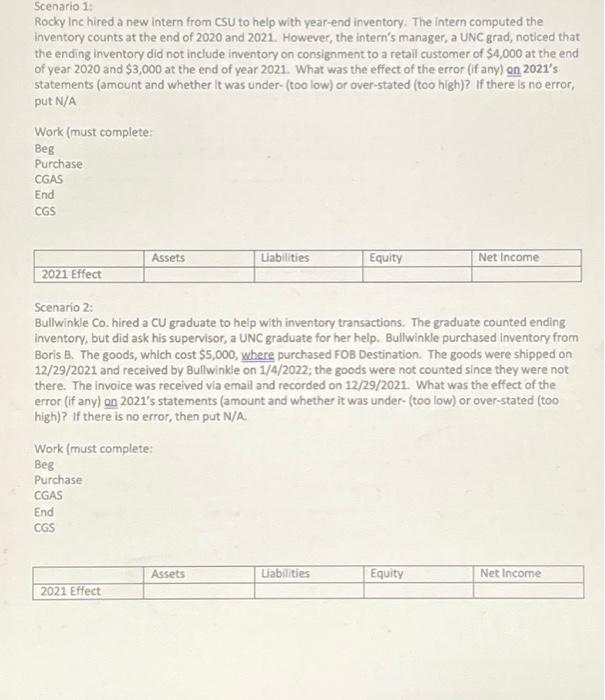

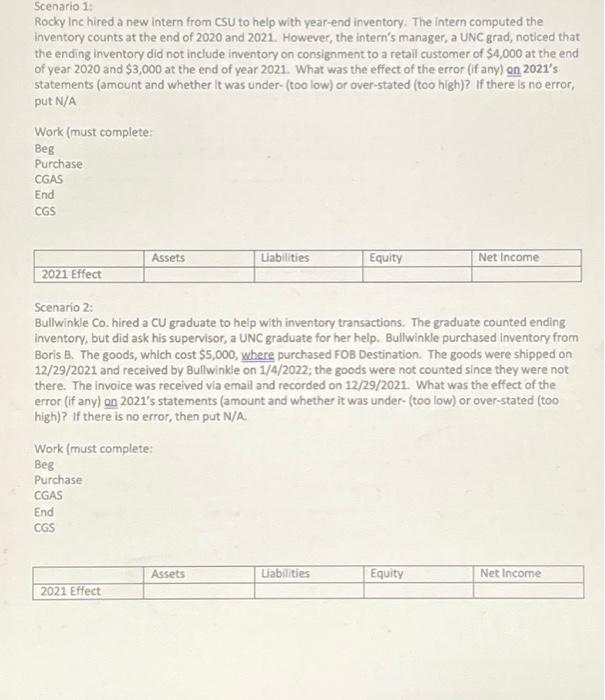

helpppo  Scenario 1: Rocky inc hired a new intern from CSU to help with year-end inventory. The intern computed the inventory counts at the end of 2020 and 2021. However, the intern's manager, a UNC grad, noticed that the ending inventory did not include inventory on consignment to a retall customer of $4,000 at the end of year 2020 and $3,000 at the end of year 2021 . What was the effect of the error (if any) on 2021's statements (amount and whether it was under- (too low) or over-stated (too high)? If there is no error, put N/A Work (must complete: Beg Purchase CGAS End CGS Scenario 2: Bullwinkle Co. hired a CU graduate to help with inventory transactions. The graduate counted ending inventory, but did ask his supervisor, a UNC graduate for her help. Bullwinkle purchased inventory from Boris B. The goods, which cost $5,000, where purchased FOB Destination. The goods were shipped on 12/29/2021 and received by Bullwinkle on 1/4/2022; the goods were not counted since they were not there. The invoice was received via email and recorded on 12/29/2021. What was the effect of the error (if any) on 2021's statements (amount and whether it was under- (too low) or over-stated (too high)? If there is no error, then put N/A Work (must complete: Beg Purchase CGAS End cos

Scenario 1: Rocky inc hired a new intern from CSU to help with year-end inventory. The intern computed the inventory counts at the end of 2020 and 2021. However, the intern's manager, a UNC grad, noticed that the ending inventory did not include inventory on consignment to a retall customer of $4,000 at the end of year 2020 and $3,000 at the end of year 2021 . What was the effect of the error (if any) on 2021's statements (amount and whether it was under- (too low) or over-stated (too high)? If there is no error, put N/A Work (must complete: Beg Purchase CGAS End CGS Scenario 2: Bullwinkle Co. hired a CU graduate to help with inventory transactions. The graduate counted ending inventory, but did ask his supervisor, a UNC graduate for her help. Bullwinkle purchased inventory from Boris B. The goods, which cost $5,000, where purchased FOB Destination. The goods were shipped on 12/29/2021 and received by Bullwinkle on 1/4/2022; the goods were not counted since they were not there. The invoice was received via email and recorded on 12/29/2021. What was the effect of the error (if any) on 2021's statements (amount and whether it was under- (too low) or over-stated (too high)? If there is no error, then put N/A Work (must complete: Beg Purchase CGAS End cos

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started