Answered step by step

Verified Expert Solution

Question

1 Approved Answer

here is an example of what a similar question with the correct answer looks like. Please let me know if you require additional information. Thank

here is an example of what a similar question with the correct answer looks like. Please let me know if you require additional information. Thank you so much!

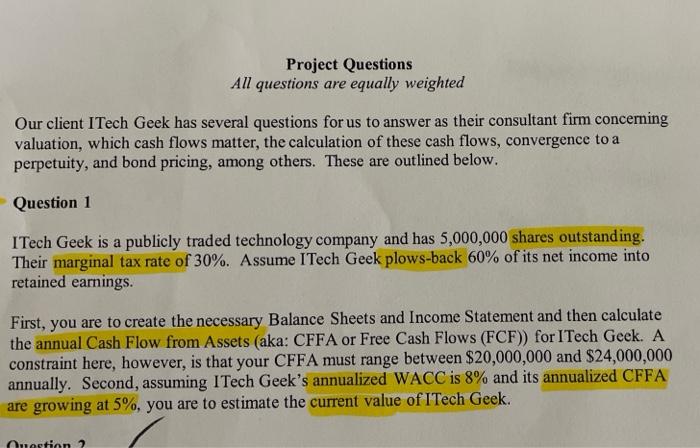

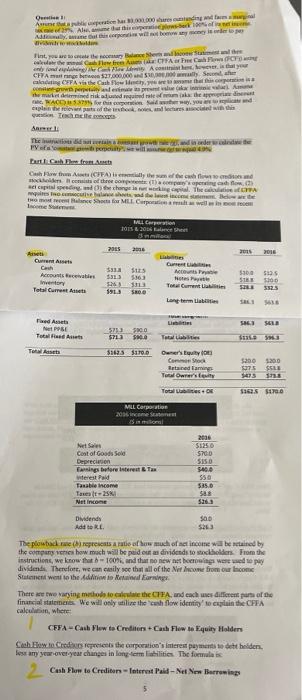

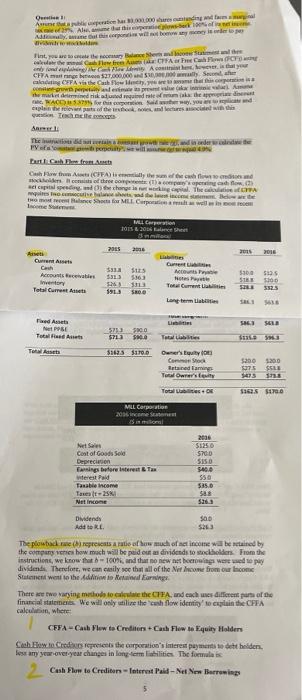

Project Questions All questions are equally weighted Our client ITech Geek has several questions for us to answer as their consultant firm concerning valuation, which cash flows matter, the calculation of these cash flows, convergence to a perpetuity, and bond pricing, among others. These are outlined below. Question 1 a ITech Geek is a publicly traded technology company and has 5,000,000 shares outstanding. Their marginal tax rate of 30%. Assume I Tech Geek plows-back 60% of its net income into retained earnings. First, you are to create the necessary Balance Sheets and Income Statement and then calculate the annual Cash Flow from Assets (aka: CFFA or Free Cash Flows (FCF)) for ITech Geek. A constraint here, however, is that your CFFA must range between $20,000,000 and $24,000,000 annually. Second, assuming I Tech Geek's annualized WACC is 8% and its annualized CFFA are growing at 5%, you are to estimate the current value of ITech Geek. Orestian 7 Ore Authentic 3.000.000 din Alle price tian harm Fint your eyes heefree CFA CF nyere there is the CFA range 200.00 Suche Avis the cash flow mp3 wwww the deed ik ed equired to make the per dient WAD www.youtud perceptions scientis Technics The were Femme Earth The front Cashowth CFFA) willy when e consid the concern how et capital change in fingul . The Rechtsadece The Man Shot for MLL Corp will MELL Con 10 & 2016 2005 2006 2015 C Am Cash Acontece wony Total Current Assets 531 1125 333 5363 3261111 1903 SRDO Garten Neste Tort Current 5 SUS ST 100 3525 38 SES Assets NE TRA 5232900 $7135 353 Tereta 31625 $170. Owner's Co Stock Intained lamin Toulousy 5200 75 43 1200 SELE - Totale 1925 180 MLL Corporation 2006 income Simul Coat of Goods Sold Depreciation Ein bere interes wterested Taxable income Taxat-2581 Notice 2006 $1250 5700 SISD 3400 350 $35.0 S 5205 Dividends $0.0 Add to RL The powtade represents a ratio of how much of net income will be retained by the companies how much will be paid out as dividends to stockholder From the instructions, we know that 0 -100, and that no new borrowings were wed to pay dividends. Therefore, we can carily see that all of the Norcome from our com Seni wet to the door There we varying methods to the CITA, and each wee different of the financial statement. We will only utilize the cash flowide to explain the CFFA calow, where CFFA-Cash Flow to Creditors + Cash Flow to Equity Holders Cache in Credits the corporations interest payment to theiden. best any years over your changes in long-term libilities. The formula is Cash Flow to Crediten Interest Pall - Net New Brewing 2 Project Questions All questions are equally weighted Our client ITech Geek has several questions for us to answer as their consultant firm concerning valuation, which cash flows matter, the calculation of these cash flows, convergence to a perpetuity, and bond pricing, among others. These are outlined below. Question 1 a ITech Geek is a publicly traded technology company and has 5,000,000 shares outstanding. Their marginal tax rate of 30%. Assume I Tech Geek plows-back 60% of its net income into retained earnings. First, you are to create the necessary Balance Sheets and Income Statement and then calculate the annual Cash Flow from Assets (aka: CFFA or Free Cash Flows (FCF)) for ITech Geek. A constraint here, however, is that your CFFA must range between $20,000,000 and $24,000,000 annually. Second, assuming I Tech Geek's annualized WACC is 8% and its annualized CFFA are growing at 5%, you are to estimate the current value of ITech Geek. Orestian 7 Ore Authentic 3.000.000 din Alle price tian harm Fint your eyes heefree CFA CF nyere there is the CFA range 200.00 Suche Avis the cash flow mp3 wwww the deed ik ed equired to make the per dient WAD www.youtud perceptions scientis Technics The were Femme Earth The front Cashowth CFFA) willy when e consid the concern how et capital change in fingul . The Rechtsadece The Man Shot for MLL Corp will MELL Con 10 & 2016 2005 2006 2015 C Am Cash Acontece wony Total Current Assets 531 1125 333 5363 3261111 1903 SRDO Garten Neste Tort Current 5 SUS ST 100 3525 38 SES Assets NE TRA 5232900 $7135 353 Tereta 31625 $170. Owner's Co Stock Intained lamin Toulousy 5200 75 43 1200 SELE - Totale 1925 180 MLL Corporation 2006 income Simul Coat of Goods Sold Depreciation Ein bere interes wterested Taxable income Taxat-2581 Notice 2006 $1250 5700 SISD 3400 350 $35.0 S 5205 Dividends $0.0 Add to RL The powtade represents a ratio of how much of net income will be retained by the companies how much will be paid out as dividends to stockholder From the instructions, we know that 0 -100, and that no new borrowings were wed to pay dividends. Therefore, we can carily see that all of the Norcome from our com Seni wet to the door There we varying methods to the CITA, and each wee different of the financial statement. We will only utilize the cash flowide to explain the CFFA calow, where CFFA-Cash Flow to Creditors + Cash Flow to Equity Holders Cache in Credits the corporations interest payment to theiden. best any years over your changes in long-term libilities. The formula is Cash Flow to Crediten Interest Pall - Net New Brewing 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started