Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is tables link. table 1: http://lectures.mhhe.com/connect/0073527122/Tables/table1.JPG table 2: http://lectures.mhhe.com/connect/0073527122/Tables/table2.JPG table 3:http://lectures.mhhe.com/connect/0073527122/Tables/table3.JPG table 4:http://lectures.mhhe.com/connect/0073527122/Tables/table4.JPG the house they want will cost approximately $325,000. They hope to

Here is tables link.

table 1: http://lectures.mhhe.com/connect/0073527122/Tables/table1.JPG

table 2: http://lectures.mhhe.com/connect/0073527122/Tables/table2.JPG

table 3:http://lectures.mhhe.com/connect/0073527122/Tables/table3.JPG

table 4:http://lectures.mhhe.com/connect/0073527122/Tables/table4.JPG

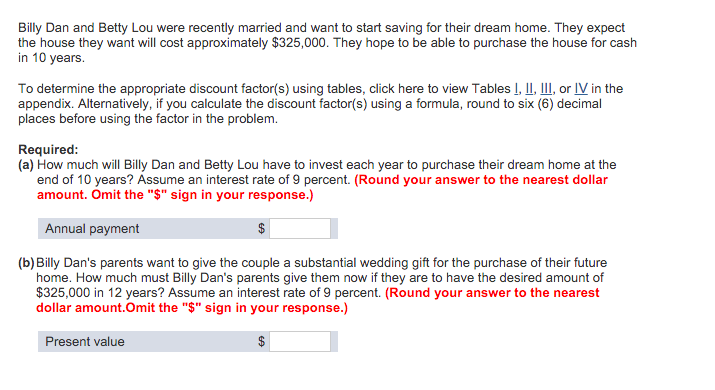

the house they want will cost approximately $325,000. They hope to be able to purchase the house for cash in 10 years. To determine the appropriate discount factor(s) using tables, click here to view Tables I, II. Ill, or IV in the appendix. Alternatively, if you calculate the discount factor(s) using a formula, round to six (6) decimal places before using the factor in the problem. Required: (a) How much will Billy Dan and Betty Lou have to invest each year to purchase their dream home at the end of 10 years? Assume an interest rate of 9 percent. (Round your answer to the nearest dollar amount. Omit the "$" sign in your response.) Annual payment (b) Billy Dan's parents want to give the couple a substantial wedding gift for the purchase of their future home. How much must Billy Dan's parents give them now if they are to have the desired amount of $325,000 in 12 years? Assume an interest rate of 9 percent. (Round your answer to the nearest dollar amount.Omit the "$" sign in your response.) Present valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started