Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is the background information on your task KCJ Sporting Goods Ltd. (KCJ) is headquartered in Vancouver, British Columbia, and has five retail mega-stores in

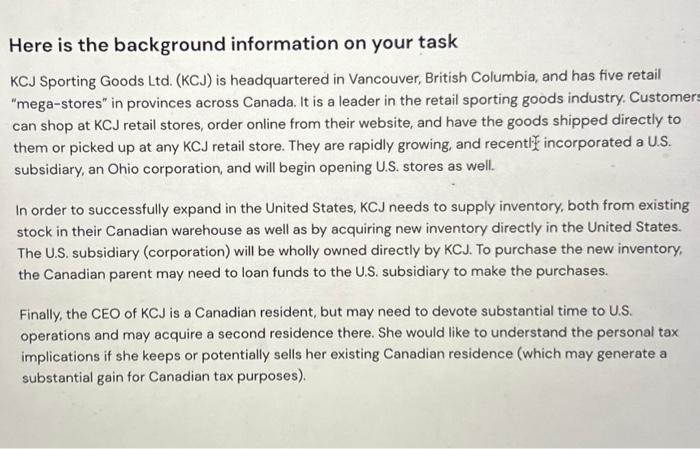

Here is the background information on your task KCJ Sporting Goods Ltd. (KCJ) is headquartered in Vancouver, British Columbia, and has five retail "mega-stores" in provinces across Canada. It is a leader in the retail sporting goods industry. Customers can shop at KCJ retail stores, order online from their website, and have the goods shipped directly to them or picked up at any KCJ retail store. They are rapidly growing, and recently incorporated a U.S. subsidiary, an Ohio corporation, and will begin opening U.S. stores as well. In order to successfully expand in the United States, KCJ needs to supply inventory, both from existing stock in their Canadian warehouse as well as by acquiring new inventory directly in the United States. The U.S. subsidiary (corporation) will be wholly owned directly by KCJ. To purchase the new inventory, the Canadian parent may need to loan funds to the U.S. subsidiary to make the purchases. Finally, the CEO of KCJ is a Canadian resident, but may need to devote substantial time to U.S. operations and may acquire a second residence there. She would like to understand the personal tax implications if she keeps or potentially sells her existing Canadian residence (which may generate a substantial gain for Canadian tax purposes).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started