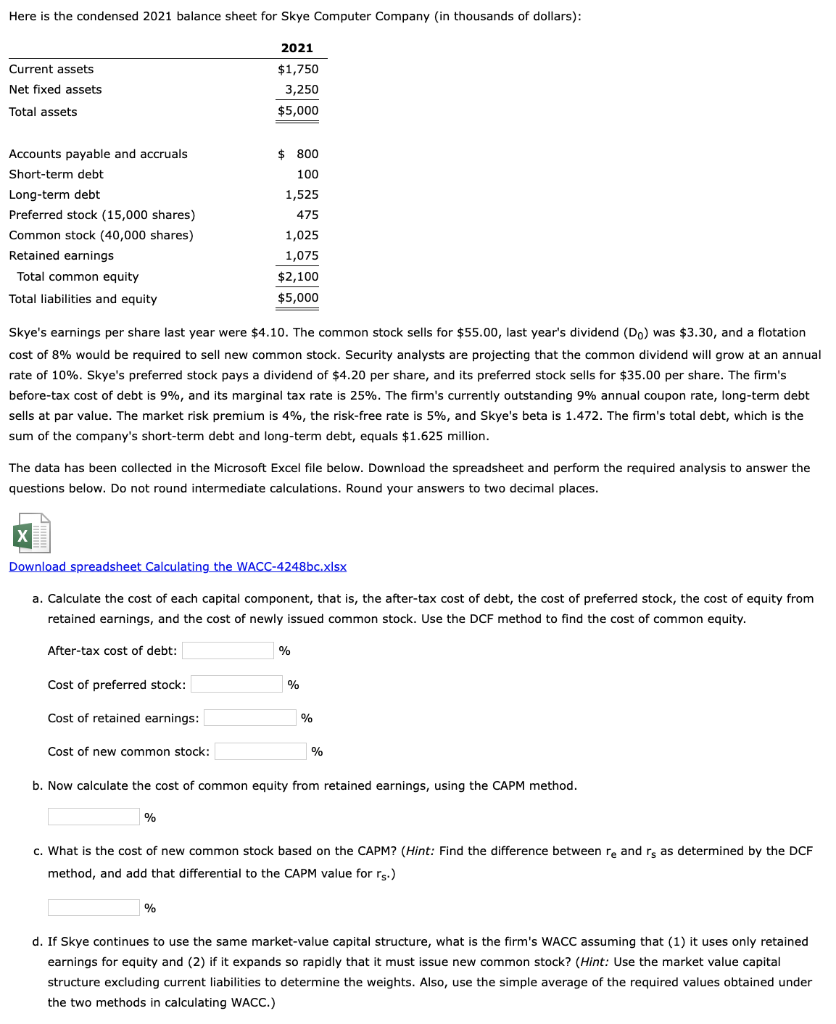

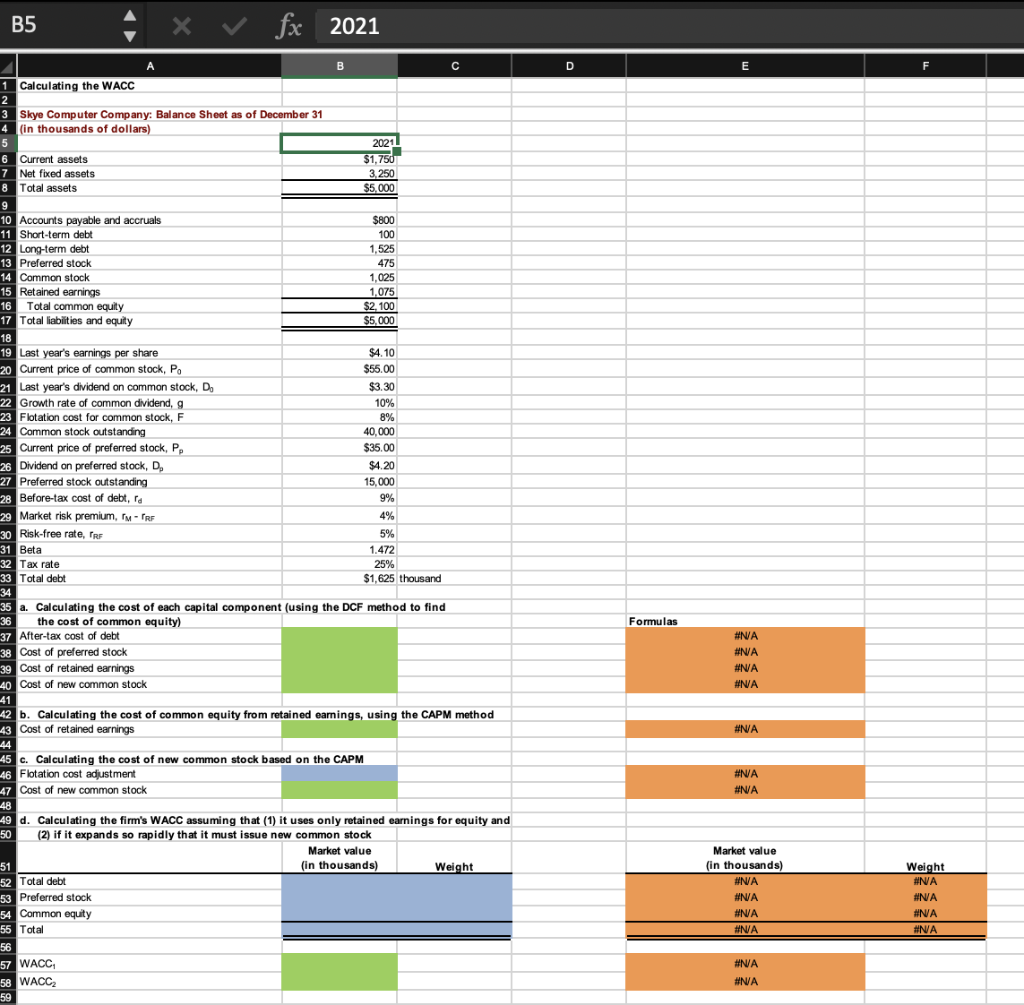

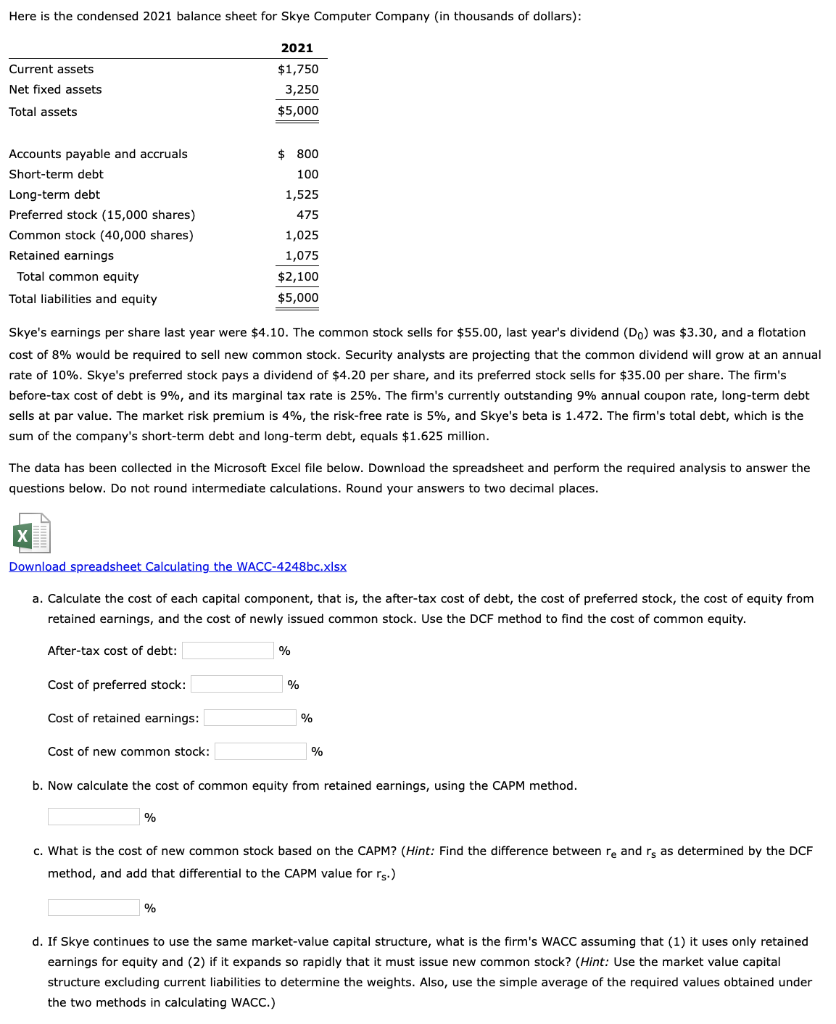

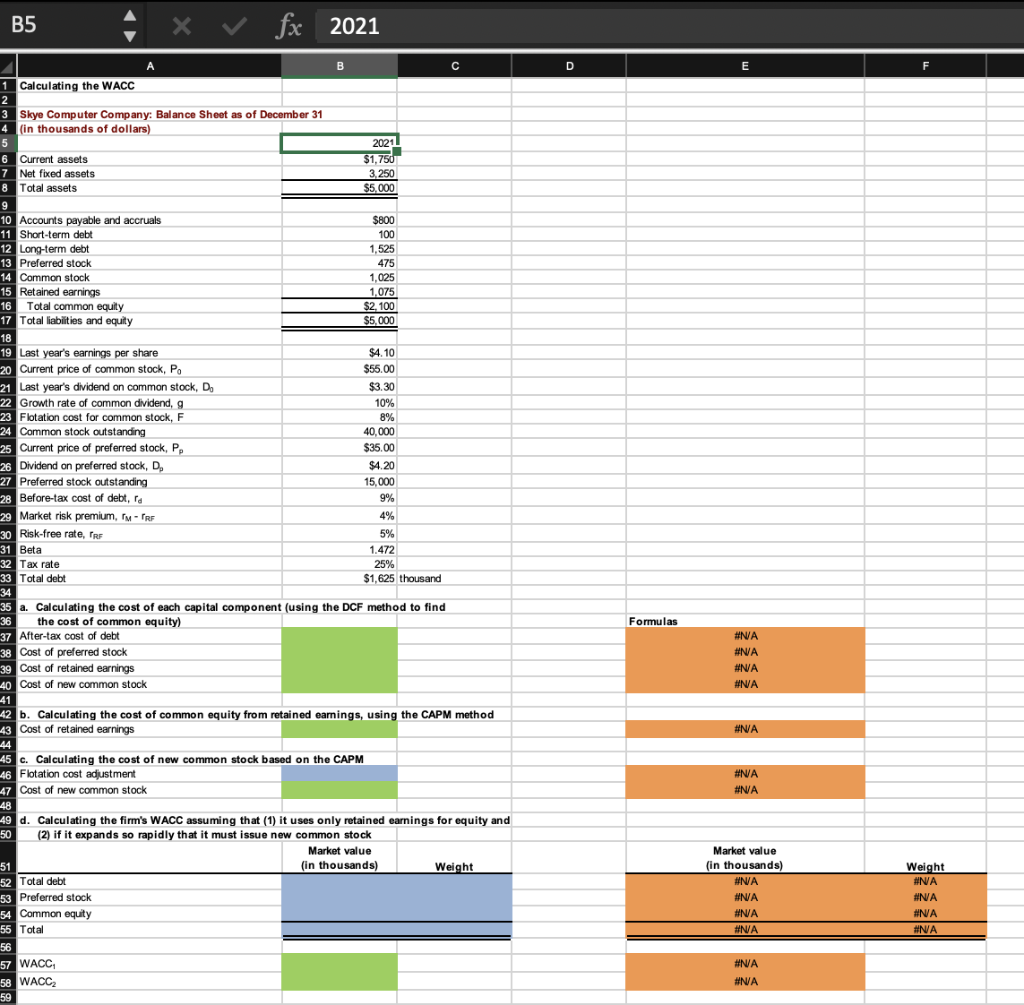

Here is the condensed 2021 balance sheet for Skye Computer Company (in thousands of dollars): Skye's earnings per share last year were $4.10. The common stock sells for $55.00, last year's dividend (D0) was $3.30, and a flotation cost of 8% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 10%. Skye's preferred stock pays a dividend of $4.20 per share, and its preferred stock sells for $35.00 per share. The firm's before-tax cost of debt is 9%, and its marginal tax rate is 25%. The firm's currently outstanding 9% annual coupon rate, long-term debt sells at par value. The market risk premium is 4%, the risk-free rate is 5%, and Skye's beta is 1.472 . The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1.625 million. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Round your answers to two decimal places. Download spreadsheet Calculating the WACC-4248bc. xlsx a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. After-tax cost of debt: % Cost of preferred stock: Cost of retained earnings: Cost of new common stock: % b. Now calculate the cost of common equity from retained earnings, using the CAPM method. % c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between re and rs as determined by the DCF method, and add that differential to the CAPM value for r5.) % d. If Skye continues to use the same market-value capital structure, what is the firm's WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock? (Hint: Use the market value capital structure excluding current liabilities to determine the weights. Also, use the simple average of the required values obtained under the two methods in calculating WACC.) B5 4fx2021 A Calculating the WACC 3 Skye Computer Company: Balance Sheet as of December 31 4 (in thousands of dollars) 6 Current assets 7 Net fixed assets 8 Total assets \begin{tabular}{|r|} \hline 2021 \\ \hline$1,750 \\ \hline 3,250 \\ \hline$5,000 \\ \hline \end{tabular} 9 10 Accounts payable and accruals 11 Short-term debt .9800100 12 Long-term debt 13 Preferred stock 14 Common stock 5 Retained earnings Total common equily Total liabilities and equity 1,075$2,100$5,000 Last year's earnings per share Current price of common stock, P0 Last year's dividend on common stock, D0 Growth rate of common dividend, g Flotation cost for common stock, F Common stock outstanding 25 Current price of preferred stock, PP Dividend on preferred stock, Dp Preferred stock outstanding Before-tax cost of debt, rd Market risk premium, rMrRF Risk-free rate, rRF Beta Tax rate Total debt a. Calculating the cost of each capital component (using the DCF method to find the cost of common equity) Formulas After-tax cost of debt Cost of preferred stock Cost of retained earnings Cost of new common stock b. Calculating the cost of common equity from retained earnings, using the CAPM method Cost of retained earnings c. Calculating the cost of new common stock based on the CAPM Flotation cost adjustment Cost of new common stock d. Calculating the firm's WACC assuming that (1) it uses only retained earnings for equity and 50 (2) if it expands so rapidly that it must issue new common stock