Answered step by step

Verified Expert Solution

Question

1 Approved Answer

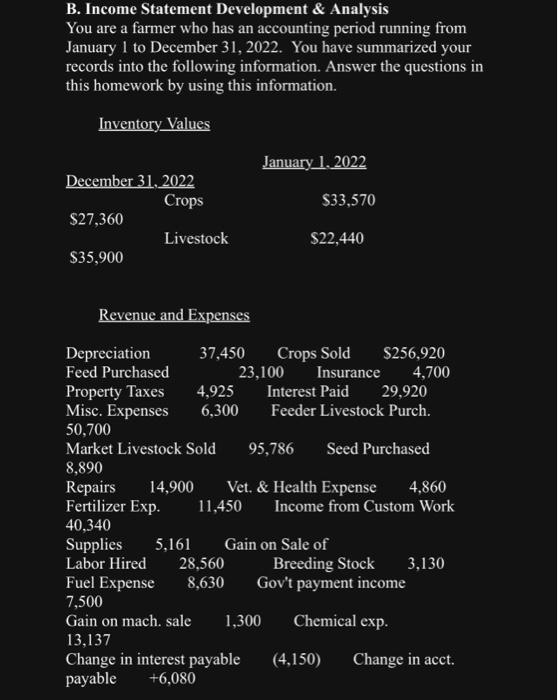

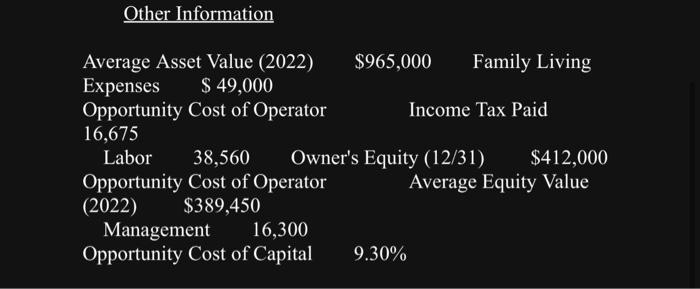

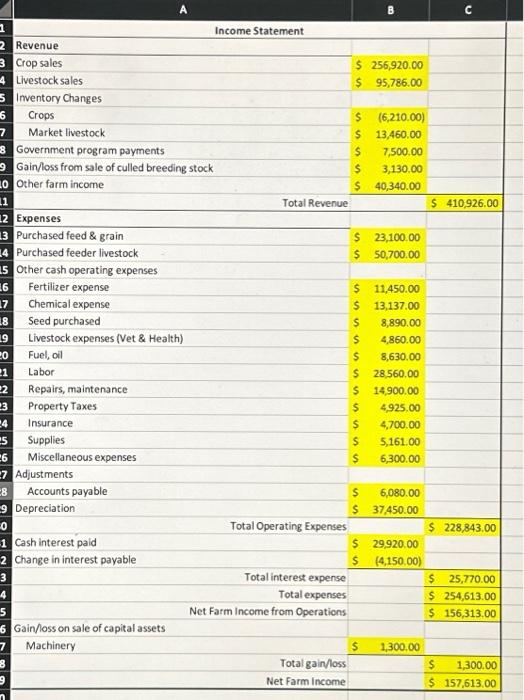

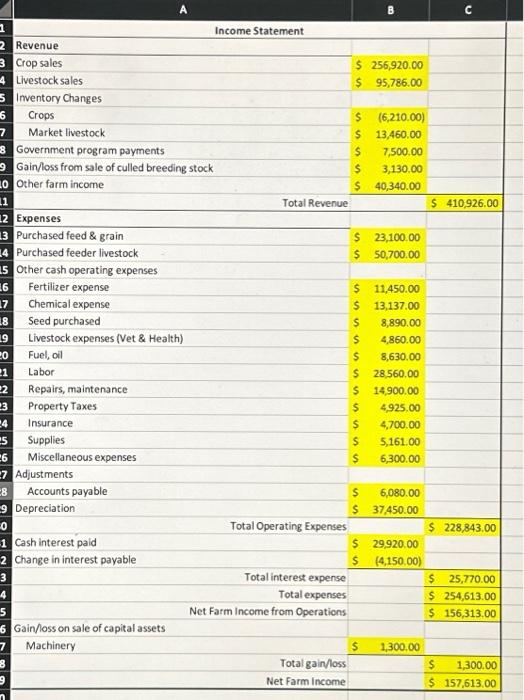

here is the income statement. Other Information Average Asset Value (2022) $965,000 Family Living Expenses $49,000 Opportunity Cost of Operator Income Tax Paid 16,675 Labor

here is the income statement.

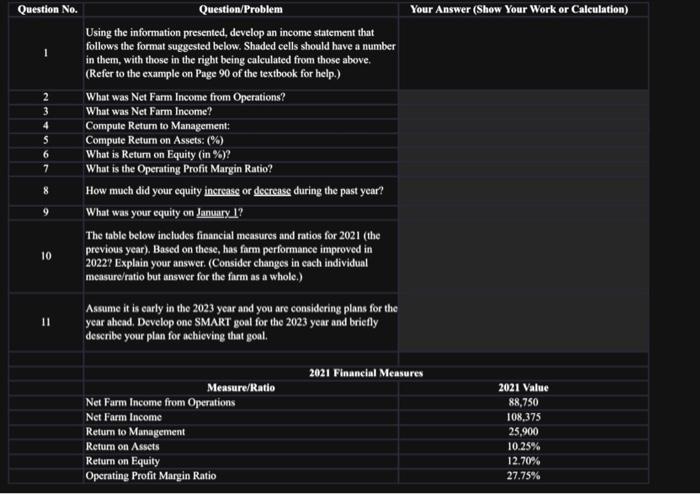

Other Information Average Asset Value (2022) $965,000 Family Living Expenses $49,000 Opportunity Cost of Operator Income Tax Paid 16,675 Labor 38,560 Owner's Equity (12/31) \$412,000 Opportunity Cost of Operator Average Equity Value (2022) $389,450 Management 16,300 Opportunity Cost of Capital 9.30% \begin{tabular}{|c|c|c|} \hline Question No. & Question/Problem & Your Answer (Show Your Work or Calculation) \\ \hline 1 & Usingtheinformationpresented,developanincomestatementthatfollowstheformatsuggestedbelow.Shadedcellsshouldhaveanumberinthem,withthoseintherightbeingcalculatedfromthoseabove.(RefertotheexampleonPage90ofthetextbookforhelp.) & \\ \hline 2 & What was Net Farm Income from Operations? & \\ \hline 3 & What was Net Farm Income? & \\ \hline 4 & Compute Return to Management: & \\ \hline 5 & Compute Return on Assets: (\%) & \\ \hline 6 & What is Return on Equity (in \%)? & \\ \hline 7 & What is the Operating Profit Margin Ratio? & \\ \hline 8 & How much did your equity increase or decrense during the past year? & \\ \hline 9 & What was your equity on January 1? & \\ \hline 10 & Thetablebelowincludesfinancialmeasuresandratiosfor2021(thepreviousyear).Basedonthese,hasfarmperformanceimprovedin2022?Explainyouranswer.(Considerchangesineachindividualmeasureiratiobutanswerforthefarmasawhole.) & \\ \hline \multirow[t]{9}{*}{11} & Assumeitisearlyinthe2023yearandyouareconsideringplansfortheyearahead.DeveloponeSMARTgoalforthe2023yearandbricflydescribeyourplanforachievingthatgoal. & \\ \hline & \multicolumn{2}{|c|}{2021 Financial Measures } \\ \hline & Measure/Ratio & 2021 Value \\ \hline & Net Farm Income from Operations & 88,750 \\ \hline & Net Farm Income & 108,375 \\ \hline & Return to Management & 25,900 \\ \hline & Retum on Assets & 10.25% \\ \hline & Return on Equity & 12.70% \\ \hline & Opcrating Profit Margin Ratio & 27.75% \\ \hline \end{tabular} B. Income Statement Development \& Analysis You are a farmer who has an accounting period running from January 1 to December 31,2022. You have summarized your records into the following information. Answer the questions in this homework by using this information. Inventory Values December31,Crops2022$27,360$35,900$33,570Livestock$22,440 RevenueandExpenses \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|l|}{ Income Statement } \\ \hline Revenue & & & \\ \hline Crop sales & $ & 256,920.00 & \\ \hline Livestock sales & $ & 95,786.00 & \\ \hline Imventory Changes & & & \\ \hline Crops & s & (6,210.00) & \\ \hline Market livestock & s & 13,460.00 & \\ \hline Government program payments & \$ & 7,500,00 & \\ \hline Gain/loss from sale of culled breeding stock & s & 3,130,00 & \\ \hline \multirow[t]{2}{*}{ Other farm income } & s & 40,340.00 & \\ \hline & & & S 410,926.00 \\ \hline \multicolumn{4}{|l|}{ Expenses } \\ \hline Purchased feed \& grain & s & 23,100.00 & \\ \hline Purchased feeder livestock & $ & 50,700.00 & \\ \hline \multicolumn{4}{|l|}{ Other cash operating expenses } \\ \hline Fertilizer expense & $ & 11,450.00 & \\ \hline Chemical expense & s & 13,137.00 & \\ \hline Seed purchased & s & 8,890.00 & \\ \hline Livestock expenses (Vet \& Health) & $ & 4,860.00 & \\ \hline Fuel, oil & s & 8,630.00 & \\ \hline Labor & $ & 28,560,00 & \\ \hline Repairs, maintenance & s & 14,900.00 & \\ \hline Property Taxes & s & 4,925,00 & \\ \hline Insurance & $ & 4,700.00 & \\ \hline Supplies & s & 5,161.00 & \\ \hline Miscellaneous expenses & \$ & 6,300,00 & \\ \hline \multicolumn{4}{|l|}{ Adjustments } \\ \hline Accounts payable & s & 6,080.00 & \\ \hline Depreciation & s & 37,450.00 & \\ \hline Total Operating Expenses & & & \$ 228,843.00 \\ \hline Cash interest paid & $ & 29,920.00 & \\ \hline Change in interest payable & s & (4,150,00) & \\ \hline Total interest expense & & & \$ 25,770.00 \\ \hline Total expenses & & & $254,613.00 \\ \hline Net Farm Income from Operations & & & \$ 156,313,00 \\ \hline \multicolumn{4}{|l|}{ Gain/loss on sale of capital assets } \\ \hline Machinery & $ & 1,300,00 & \\ \hline Total gain/loss & & & 1,300.00 \\ \hline Net Farm Income & & & \$ 157,613,00 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started