Answered step by step

Verified Expert Solution

Question

1 Approved Answer

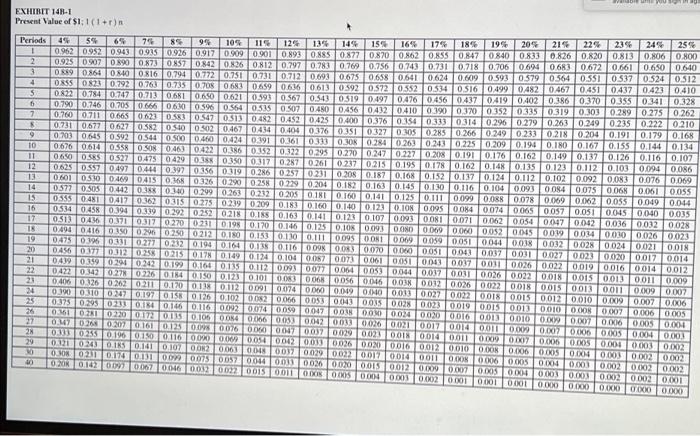

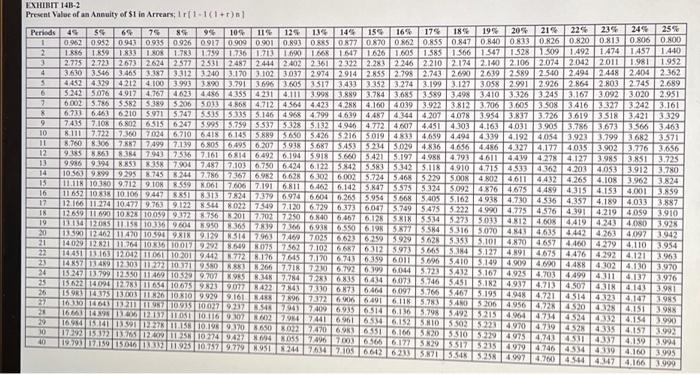

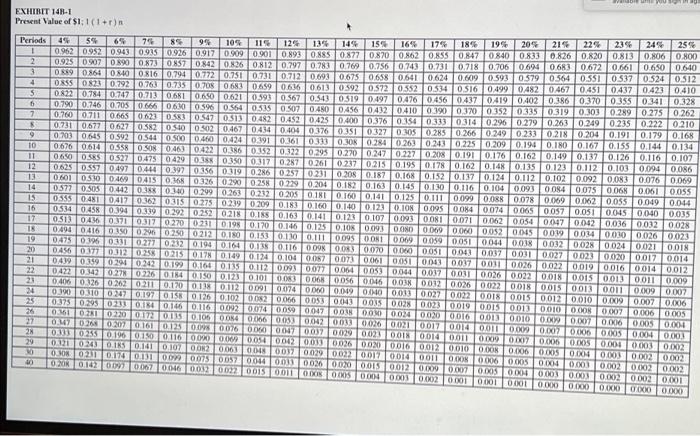

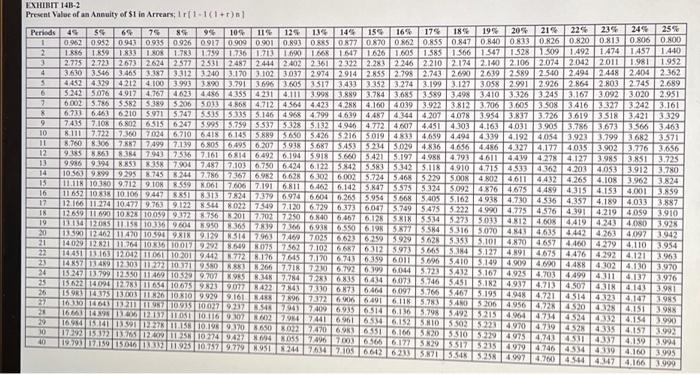

heres echibits I'm not sure we should lay out $370,000 for that automated welding machine, said Jim Alder, president of the Superior Equipment Company. That's

heres echibits

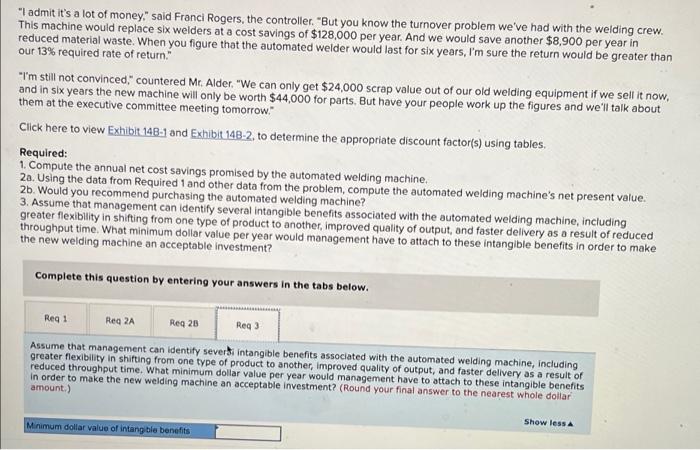

"I'm not sure we should lay out $370,000 for that automated welding machine," said Jim Alder, president of the Superior Equipment Company. "That's a lot of money, and it would cost us $98,000 for software and installation, and another $64,800 per year just to maintain the thing. In addition, the manufacturer admits it would cost $61,000 more at the end of three years to replace worn-out parts." "admit it's a lot of money," said Franci Rogers, the controller. "But you know the turnover problem we've had with the welding crew. This machine would replace six welders at a cost savings of $128,000 per year. And we would save another $8,900 per year in reduced material waste. When you figure that the automated welder would last for six years, I'm sure the return would be greater than our 13% required rate of return "I'm still not convinced." countered Mr. Alder. "We can only get $24,000 scrap value out of our old welding equipment if we sell it now. and in six years the new machine will only be worth $44,000 for parts. But have your people work up the figures and we'll talk about them at the executive committee meeting tomorrow." Click here to view Exhibit 148-1 and Exhibit 148-2. to determine the appropriate discount factor(s) using tables. Required: 1. Compute the annual net cost savings promised by the automated welding machine. 2o. Using the data from Required 1 and other data from the problem, compute the automated welding machine's net present value. 2b. Would you recommend purchasing the automated welding machine? 3. Assume that management can identify several intangible benefits associated with the automated welding machine, including greater flexibility in shifting from one type of product to another, improved quality of output, and faster delivery as a result of reduced throughput time. What minimum dollar value per year would management have to attach to these intangible benefits in order to make the new welding machine an acceptable investment? Complete this question by entering your answers in the tabs below. Reg 3 Reg 1 Req 2A Reg 2 Compute the annual net cost savings promised by the automated welding machine. Annual net cost savings maintain the thing. In addition, the manufacturer admits it would cost $61,000 more at the end of three years to replace worn-out parts." "I admit it's a lot of money," said Franci Rogers, the controller. But you know the turnover problem we've had with the welding crew. This machine would replace six welders at a cost savings of $128,000 per year. And we would save another $8,900 per year in reduced material waste. When you figure that the automated welder would last for six years, I'm sure the return would be greater than our 13% required rate of return "I'm still not convinced, countered Mr. Alder. "We can only get $24,000 scrap value out of our old welding equipment if we sell it now. and in six years the new machine will only be worth $44,000 for parts. But have your people work up the figures and we'll talk about them at the executive committee meeting tomorrow." Click here to view Exhibit 14B-1 and Exhibit 14B-2. to determine the appropriate discount factor(s) using tables. Required: 1. Compute the annual net cost savings promised by the automated welding machine. 2a. Using the data from Required 1 and other data from the problem, compute the automated welding machine's net present value. 2b. Would you recommend purchasing the automated welding machine? 3. Assume that management can identify several intangible benefits associated with the automated welding machine, including greater flexibility in shifting from one type of product to another, improved quality of output, and faster delivery as a result of reduced throughput time. What minimum dollar value per year would management have to attach to these intangible benefits in order to make the new welding machine an acceptable investment? Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Req 28 Reg 3 Using the data from Required 1 and other data from the problem, compute the automated welding machine's net present value. (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) Net present value maintain the thing. In addition, the manufacturer admits it would cost $61,000 more at the end of three years to replace worn-out parts." "I admit it's a lot of money," said Franci Rogers, the controller. "But you know the turnover problem we've had with the welding crew. This machine would replace six welders at a cost savings of $128,000 per year. And we would save another $8,900 per year in reduced material waste. When you figure that the automated welder would last for six years, I'm sure the return would be greater than our 13% required rate of return.' I'm still not convinced countered Mr. Alder. "We can only get $24,000 scrap value out of our old welding equipment if we sell it now, and in six years the new machine will only be worth $44,000 for parts. But have your people work up the figures and we'll talk about them at the executive committee meeting tomorrow." Click here to view Exhibit 148-1 and Exhibit 148-2. to determine the appropriate discount factor(s) using tables. Required: 1. Compute the annual net cost savings promised by the automated welding machine. 2a. Using the data from Required 1 and other data from the problem, compute the automated welding machine's net present value. 2b. Would you recommend purchasing the automated welding machine? 3. Assume that management can identify several Intangible benefits associated with the automated welding machine, including greater flexibility in shifting from one type of product to another, improved quality of output, and faster delivery as a result of reduced throughput time. What minimum dollar value per year would management have to attach to these intangible benefits in order to make the new welding machine an acceptable investment? Complete this question by entering your answers in the tabs below. Req1 Reg 2A Reg 28 Reg 3 Would you recommend purchasing the automated welding machine? Yes ONO "I admit it's a lot of money" said Franci Rogers, the controller. "But you know the turnover problem we've had with the welding crew. This machine would replace six welders at a cost savings of $128,000 per year. And we would save another $8,900 per year in reduced material waste. When you figure that the automated welder would last for six years, I'm sure the return would be greater than our 13% required rate of return I'm still not convinced" countered Mr. Alder. "We can only get $24,000 scrap value out of our old welding equipment if we sell it now, and in six years the new machine will only be worth $44,000 for parts. But have your people work up the figures and we'll talk about them at the executive committee meeting tomorrow." Click here to view Exhibit 148-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using tables, Required: 1. Compute the annual net cost savings promised by the automated welding machine. 20. Using the data from Required 1 and other data from the problem, compute the automated welding machine's net present value. 2b. Would you recommend purchasing the automated welding machine? 3. Assume that management can identify several intangible benefits associated with the automated welding machine, including greater flexibility in shifting from one type of product to another, improved quality of output, and faster delivery as a result of reduced throughout time. What minimum dollar value per year would management have to attach to these intangible benefits in order to make the new welding machine an acceptable investment? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3 Assume that management can identify severi intangible benefits associated with the automated welding machine, including greater flexibility in shifting from one type of product to another, improved quality of output, and faster delivery as a result of reduced throughout time. What minimum dollar value per year would management have to attach to these intangible benefits In order to make the new welding machine an acceptable investment? (Round your final answer to the nearest whole dollar amount.) Show less Minimum dollar value of intangible benefits 58 %6 1 9 6 OOSOTSO TASOST90 TOLO EXHIBIT 141-1 Present Value of $1:1 (1) Periods 55 76 64 10% 125 115 135 149 155 175 16% 185 245 1950 25% 205 215 225 235 0.962 0.952 0.943 0.9350 926 0.917 0.9090901 0.893 0.885 0.872 0.870 0.862 0855 0.8470840 0.833 0.826 0.820 0.813 0.806 0.800 2 0925 0907 0990 0.873 0857 0.8420.8.26 0.812 0.797 0.700.769 0.756 0.7490.7310.718 0.706 069406830.672 0.661 0.650 0.640 3 028908640 8400X160,7940.772 0.750 0.731 0.7120.693 06750658 0.641 0624 0.609 0.593 05790 564 0.5510 537 0.524 0.512 4 0335 08230.7920.7630.7350.70806304590636 061305920.572 0.5520 534 0516049904820.467 0.451 043704230410 S 0.820.784 0.747 0.713 0681 0.650 0.621 0.593 0.567 0.54305190.49704760.456 0.437 04190402 0.386 0.3700355 0.341 0.328 0.790 0.746 0.705 0666 0610 0596 0.5640315 0507 0.400.456 0412041003900 370015203350319 0.303 0.289 0.2750262 7 07000 711 06650623050547031304820452 0.425 0.4000376 0.1540133 03140.2960279 0.263 0.2490235 0.222 0.210 0.7310.577062705820.50 0 502 04670434 0.40401760 351 0327 0.305 0.285 0 2660 2490.233 0.218 0.204 0.191 0.179 0.168 0.400.42401910.361 03330 MOR 0.2840.263 0241 0.225 0,2090.198 0.18 0.167 0.155 0.144 0.134 10 06760,6140558 OSO80 460,422038603520322 0.295 0.270 0.2470227 0.208 0.1910.176 0.162 0.149 0.137 0.126 0.116 0.107 11 0660 OSRS 05270,47504290150 300 3170.2870.261 02170215 0.195 0.1780 1620.148 0.135 0.123 0.112 0.103 0.094 0086 12 0.625 05570.49704440 1970356 0319 0.2860257 0231 0208 0.187 0.1680.152 0.1370.1240.112 0.102 0.092 0.083 0.076 0.069 13 0401 051004690415 0.168 033610290025 0 20.204 0.182 0.160.145 0.10 0.116 0.104 0.0930084 0075 0068 14 0.061 0.055 0572 05050.4420330340 0.299 0 263 02120 2050 180 160 0.141 0.125 0.111 0.099 0.088 0078 0.069 0.062 0.055 0049 15 00:44 0417 0.362 031502750290209 0.18 0.160 0.140 0.123.ION 00950084 03140.45X 0.394 03390 2920 2520218 ONS 0074 0.065 0057 16 0.051 0045 0.040 0.035 0.163 0.141 0.123 0.107 0090081 0.071 0.062 17 05104160371 031702702310198 0054 0.047 0.042 0.036 0032 0028 0.100.146 0.125 0.1080093 0.00 15 DONDO069 0052 049404160350 2960 250 0 2120-1800.15001100111 0045 0019 003400100026 0.023 0.095OONI 19 047503903010277 022 01980.160.138 OD 0059 00510044 0038 0032 0.028 0024 0.021 0018 0.116 20 0456017103120 25 0.043 0.037 0031 02150 170 1490 1240 104005700300610051 0.0270023 0020 0.01 0.014 21 04190190291 0049 0.037 0031 02420.19 0.1640 1350 112009 00260022001900160014 0012 0.077 0.064 0053 22 04220 1420 270226140 150 0.123 O 101 0.044 0.037 0001 0026 0.022 0.018 001500130011 0.009 20 0.40605260262 0211 0032 0.026 0022 0.12001 0.11200910074 000 000 000 0033 0018001500100110009 24 O0OTO 0207 0 027 0.022001800150012 0.0100009 0.1970 150 1260 10200200660051004 0035 0028 0.007 0.006 25 0751000 OR OLUSTO 1160002TOOTE 090047 0023 019 ODISODI 0007 0.006 26 003 000002400000160013010 01005 OTOWO 0.006 0005 000 27 010200 2070 161 0125 008 000 0002 OLIS 2N 002351 1950 1500 1160000054006200 0021 DOIN 0.004 0014001 00360020001600120010 ODON 0.006 TODOS 070030002 29 01100011 01072 0001 001 002 0.0290020012001400110008 0.006 O NON 021017411 000075 0.00 0002 0052 000 000 0026 000 00150012 000070005 0006 0005 (0 0 0002 0 0 0 1420000070060012002DOISODIO 0004 0.003 0004 0003 0.0020001 0.001 0001 100 000 0000 ODOXO INPOSSO SIEO 150 ODTOOLOOOOOO 8900 ENTO NOORTO 9500 2000 0100 NODO 1100 DOO LOO OOOOOOOO09910 DOOR STOOOOO1920 6200LCOOLNOD 0900 900 LOTO GOTO 9000 1000 TODO ON SOTO POIO NXTO TOKYO 0002 2000 CORO SOKYO OXO OXID 58 56 501 IZ 1 OONO I9080 SSE 9 SECS 6 ! ( 603 ? SILP016 CES EXHIBIT 141-2 Present Value of an Annuity of $1 in Arrears, 111 101) SS Periods 224 244 235 75 64 255 11 125 135 175 16% 1495 185 20 155 195 ! 0.9620.952 0943 09350926 0917 0.909 0.901 0.893 0.35 0.87708700 862 0.855 0.847 0.8400813 0.8260820 OX13 2 1.856 18978331171799 1796 1.713161901.668 15471626151.58515661.5471528 1309 1.492 147414571440 3 2457 2444 28022361 232 2283 2246 2210 2174 2.140 2.106 2.0742042 2011 2.7752.7232673 2624 25772531 1.981 1.952 4 3.630 3.5463465 33873312 3240 3.17031023037297429142.855 2.798 2.7432690 263925892.540 2.494 2.448 2.404 2.362 5 445243294212410039933190 3.791 396 3.05 35173.43333523.274 3.199 3.12730582.991 2.92628642.803 2.745 2.689 6 5.2425.0764.917 4.767 4623 4.4864355 4231 4.111 3.998 7.893714 3.685 35893498 3410 3.326 3.245 3.167 3.092 3.0202.951 2 6.0025.78633825395206 50i 4.6% 4.7124366 4.423 4.28 4.160 40393.922 3812 3.706 3.6053 508 3.4163327 3.2423.161 6.733 6,461 62103971 5.7475335555.146496% 4.79946394487 434442074078 3.954 3,837 3.726 3.619 3518 3.421 3.329 741500263156247952593537 53285.1924.94647724.6074451 4.303 4.163 4031 3.905 3.786 3673 3.566 3463 10 8111272226070246.2106418 6.145 588956505:42652165 019 4833 4,659 4490 41194.192 4.054 3.9233.799 3.682 3.571 11 8.7601067.32 74997119 6.4956202 5938 5.68754535 21450294836 4656 448643274.177 4035 3.902 3.776 3.656 12 9.15 6AN7917157101 681464926.195918568054215.197 4.988 4.793 4.611 4.419 4.278 4.1273.985 3.851 3.725 13 99648.853 1704 17.4877103 0.75064246,12284255835 1425.118 4.362 4.203 40531912.7NO 14 1036392998745247.786716769526.628 63026002572454685229 S.OOK 4 80246114432 4.2654.1083.9623824 15 11.11 10 9.71291019 M06176067191 6.4626142255755.324509248764.675 4.315 4.153 16 4.00 11:52OXIR 10.10694475851 4489 831378247.379 697466046.265595656685 405 5.162 3.859 4938 17 12.10611274 10.47297639.1223344802273497.1206.72963736047374954753 22 4.990 4.7754.5754391 4.790433543574.189 4.033 3887 12689 190 1025 1009993728750 2011 2.70271206.40 4.219 4059 3.910 6.4676128 SIN3534527350334812 19 39503657397306693 4608 44194 24340803.92 65506198 58773584153165.070443 20 13360124021147010590X9.129 514707070256623 4.635 4.4424.263 403942 62992962551505101470 1402928211764 108 1009292.6490251756210266671611259733665 SIN43.1274191 465741042794.110 3.954 22 1445113163 0270421106010-2019.442 0728.17676452/106.7436359 46754.476 4.292 4.121 3263 23 145570349 02-1000122107930 8266 2718 722106.126 3654105149 4.009 4.4.488 4102 4.130 3.970 24 1524213.799 12350114102902028.3622784725681564146021574634513 12 4937 6044 20421674.925 4.70344994111 4.137 3976 35 15622 14.091 12711654 10675919 422 710 68736466097578654673.195 4.71345074318 413.981 26 151437513000 100 9929 9.161 789673726664401 494 4.721451443234147195 161 16621 1920 100279223090174096,925265146.136.2989232154964474453443924154990 6115754520649564724520 4.25 4151JONS 20 16 14 12137110810116102027347441 22 1651401350102273 1.159 10. 19032027670693655161668035105N40154745114337 6610192555025234970 4719 35433541573992 10 LV20592 DS 120 1125 110274942057 20036565673551732154979079643344379 40 11150 11500 11950529792414210566420203871135685250397170045404347 4.16639 4.1593994 4.100 3995 1189 NI ZLE 1096ROSSFIT SHORTER IZ 1109 M9 OSS LOISSONS STIER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started