Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Heritage Auction Galleries, a Dallas based auction company, has agreed to purchase the entire inventory of $10 gold coins from a rare coin dealer

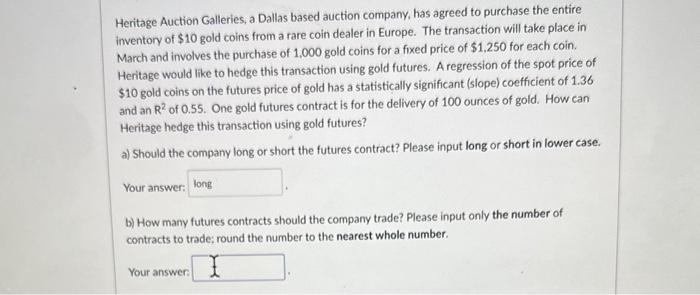

Heritage Auction Galleries, a Dallas based auction company, has agreed to purchase the entire inventory of $10 gold coins from a rare coin dealer in Europe. The transaction will take place in March and involves the purchase of 1,000 gold coins for a fixed price of $1,250 for each coin. Heritage would like to hedge this transaction using gold futures. A regression of the spot price of $10 gold coins on the futures price of gold has a statistically significant (slope) coefficient of 1.36 and an R2 of 0.55. One gold futures contract is for the delivery of 100 ounces of gold. How can Heritage hedge this transaction using gold futures? a) Should the company long or short the futures contract? Please input long or short in lower case. Your answer: long b) How many futures contracts should the company trade? Please input only the number of contracts to trade; round the number to the nearest whole number. Your answer:

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a The company should short the futures contract b First we need to find the notional value of the go...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started