Answered step by step

Verified Expert Solution

Question

1 Approved Answer

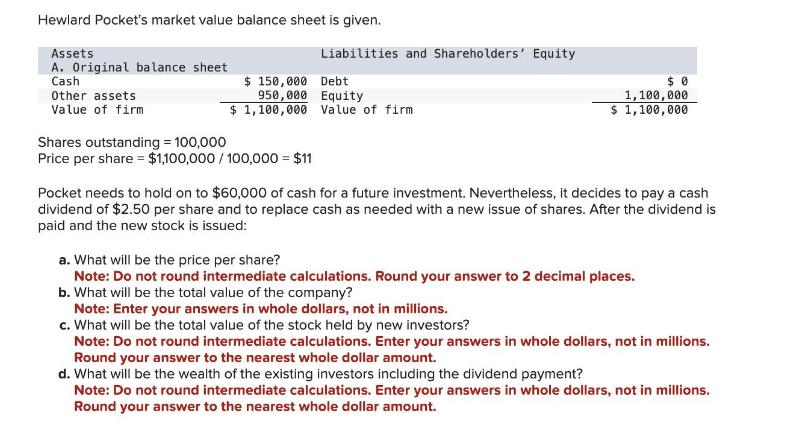

Hewlard Pocket's market value balance sheet is given. Assets A. Original balance sheet Cash Other assets Value of firm $ 150,000 950,000 Debt Equity

Hewlard Pocket's market value balance sheet is given. Assets A. Original balance sheet Cash Other assets Value of firm $ 150,000 950,000 Debt Equity $1,100,000 Value of firm Liabilities and Shareholders' Equity Shares outstanding = 100,000 Price per share = $1,100,000/100,000 = $11 $0 1,100,000 $ 1,100,000 Pocket needs to hold on to $60,000 of cash for a future investment. Nevertheless, it decides to pay a cash dividend of $2.50 per share and to replace cash as needed with a new issue of shares. After the dividend is paid and the new stock is issued: a. What will be the price per share? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. What will be the total value of the company? Note: Enter your answers in whole dollars, not in millions. c. What will be the total value of the stock held by new investors? Note: Do not round intermediate calculations. Enter your answers in whole dollars, not in millions. Round your answer to the nearest whole dollar amount. d. What will be the wealth of the existing investors including the dividend payment? Note: Do not round intermediate calculations. Enter your answers in whole dollars, not in millions. Round your answer to the nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Price per share after dividend and new issue of shares First calculate the amount of cash distribu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started