Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hexagon Sounds has estimated the unit costs of publishing in-house its first collection of musical scores in book form. These are set out in the

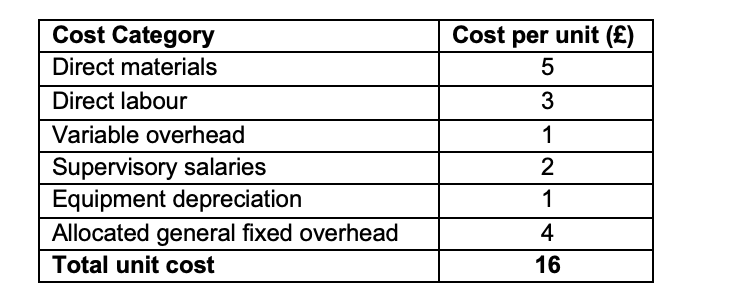

Hexagon Sounds has estimated the unit costs of publishing in-house its first collection of musical scores in book form. These are set out in the table, below:

The equipment to be used to manufacture the book has no resale value and none of the allocated general fixed overhead could be avoided. The 16 total unit cost is based on 5,000 books produced each year. Hexagon has found an outside supplier willing to provide the 5,000 books at a cost of 14 per unit.

Required:

- Identify the relevant costs in this decision and determine the additional costs or savings for Hexagon if it purchased the books from the outside supplier, showing all calculations. Would you advise Hexagon to accept the offer?

(4 marks)

- Assume now that if Hexagon accepts the offer to purchase the books from the outside supplier, the facilities now being used to make the book in-house could be switched to printing 2,000 album covers, each of which would generate a contribution of 5. Given this new information, what is the total additional cost or saving of purchasing 5,000 books from the outside supplier, rather than making them in-house.

(6 marks)

(Total: 10 marks)

Cost per unit () 5 3 Cost Category Direct materials Direct labour Variable overhead Supervisory salaries Equipment depreciation Allocated general fixed overhead Total unit cost 1 2 1 4 16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started