Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hey could you explain what method you use to solve this problem? Parvis Inc. wants to calculate its cost of equity. The company paid a

Hey could you explain what method you use to solve this problem?

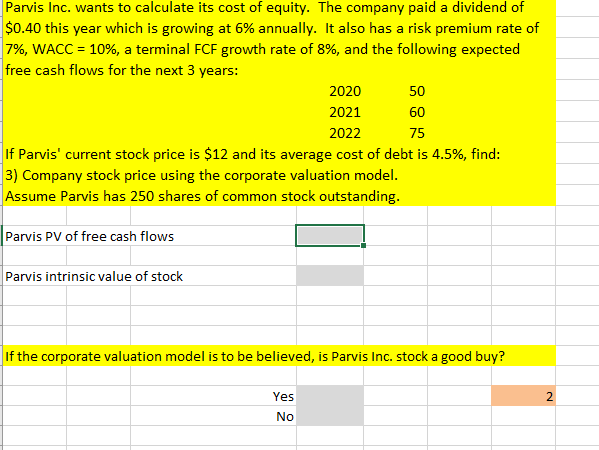

Parvis Inc. wants to calculate its cost of equity. The company paid a dividend of 0.40 this year which is growing at 6% annually. It also has a risk premium rate of 796, WACC-10%, a terminal FCF growth rate of 8%, and the following expected free cash flows for the next 3 years: 2020 2021 2022 50 60 75 If Paris' current stock price is $12 and its average cost of debt is 4.5%, find: 3) Company stock price using the corporate valuation model Assume Parvis has 250 shares of common stock outstanding Parvis PV of free cash flows Parvis intrinsic value of stock If the corporate valuation model is to be believed, is Parvis Inc. stock a good buy? Yes 2 No Parvis Inc. wants to calculate its cost of equity. The company paid a dividend of 0.40 this year which is growing at 6% annually. It also has a risk premium rate of 796, WACC-10%, a terminal FCF growth rate of 8%, and the following expected free cash flows for the next 3 years: 2020 2021 2022 50 60 75 If Paris' current stock price is $12 and its average cost of debt is 4.5%, find: 3) Company stock price using the corporate valuation model Assume Parvis has 250 shares of common stock outstanding Parvis PV of free cash flows Parvis intrinsic value of stock If the corporate valuation model is to be believed, is Parvis Inc. stock a good buy? Yes 2 NoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started