Hey! I am trying to do this assignment for business but I have no clue where to start! If anyone could help that would be greatly appreciated<3

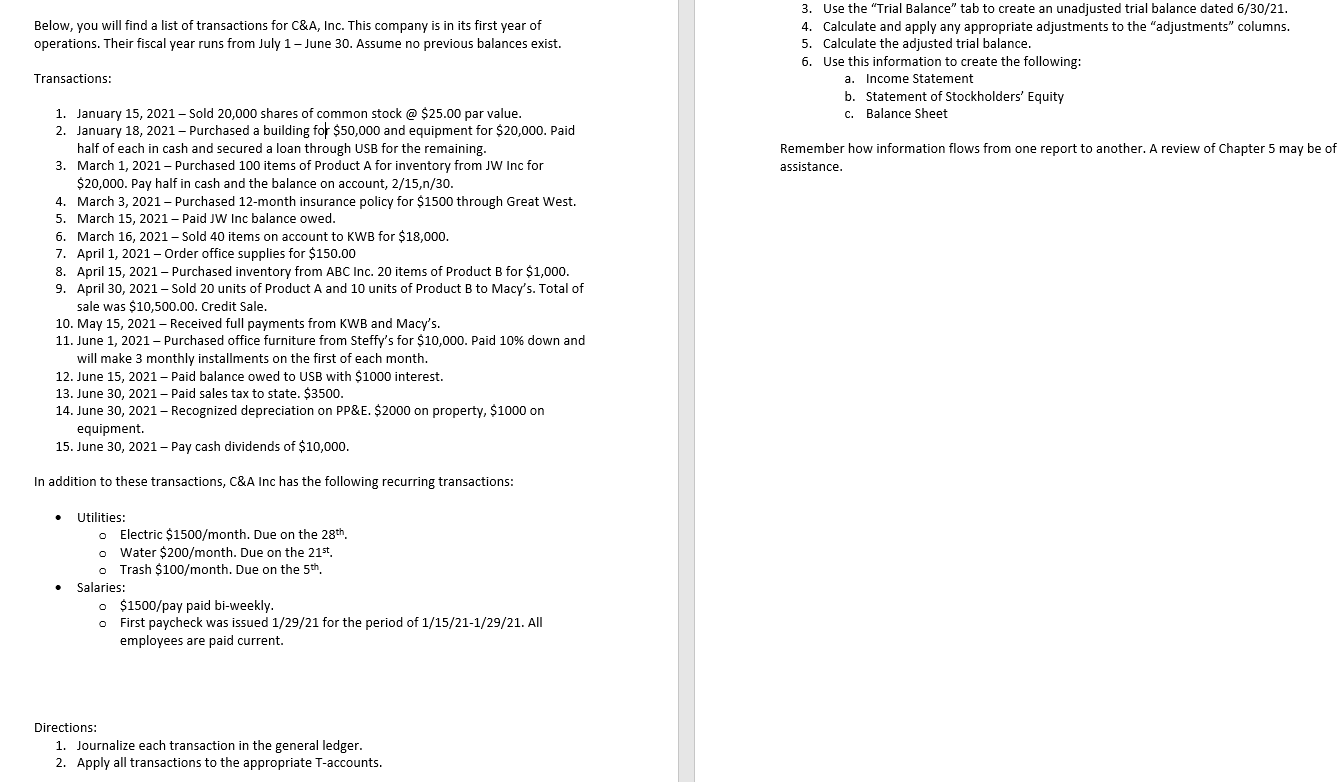

3. Use the "Trial Balance" tab to create an unadjusted trial balance dated 6/30/21. 4. Calculate and apply any appropriate adjustments to the "adjustments" columns. Below, you will find a list of transactions for C\&A, Inc. This company is in its first year of 5. Calculate the adjusted trial balance. operations. Their fiscal year runs from July 1 - June 30 . Assume no previous balances exist. 6. Use this information to create the following: Transactions: a. Income Statement b. Statement of Stockholders' Equity 1. January 15,2021 - Sold 20,000 shares of common stock @ \$25.00 par value. c. Balance Sheet 2. January 18,2021 - Purchased a building for $50,000 and equipment for $20,000. Paid half of each in cash and secured a loan through USB for the remaining. 3. March 1, 2021 - Purchased 100 items of Product A for inventory from JW Inc for Remember how information flows from one report to another. A review of Chapter 5 may be of $20,000. Pay half in cash and the balance on account, 2/15,n/30. assistance. 4. March 3, 2021 - Purchased 12-month insurance policy for $1500 through Great West. 5. March 15, 2021 - Paid JW Inc balance owed. 6. March 16,2021 - Sold 40 items on account to KWB for $18,000. 7. April 1, 2021 - Order office supplies for $150.00 8. April 15, 2021 - Purchased inventory from ABC Inc. 20 items of Product B for $1,000. 9. April 30, 2021 - Sold 20 units of Product A and 10 units of Product B to Macy's. Total of sale was $10,500.00. Credit Sale. 10. May 15, 2021 - Received full payments from KWB and Macy's. 11. June 1, 2021 - Purchased office furniture from Steffy's for $10,000. Paid 10% down and will make 3 monthly installments on the first of each month. 12. June 15, 2021 - Paid balance owed to USB with $1000 interest. 13. June 30,2021 - Paid sales tax to state. $3500. 14. June 30, 2021 - Recognized depreciation on PP\&E. \$2000 on property, $1000 on equipment. 15. June 30, 2021 - Pay cash dividends of \$10,000. In addition to these transactions, C\&A Inc has the following recurring transactions: - Utilities: - Electric $1500/ month. Due on the 28th.. - Water $200/ month. Due on the 21st.. - Trash $100/ month. Due on the 5th. - Salaries: - \$1500/pay paid bi-weekly. - First paycheck was issued 1/29/21 for the period of 1/15/211/29/21. All employees are paid current