Hey there may I get some help, need to use the segmented income statement below to fill out these questions

You can omit # 8 thank you very much.

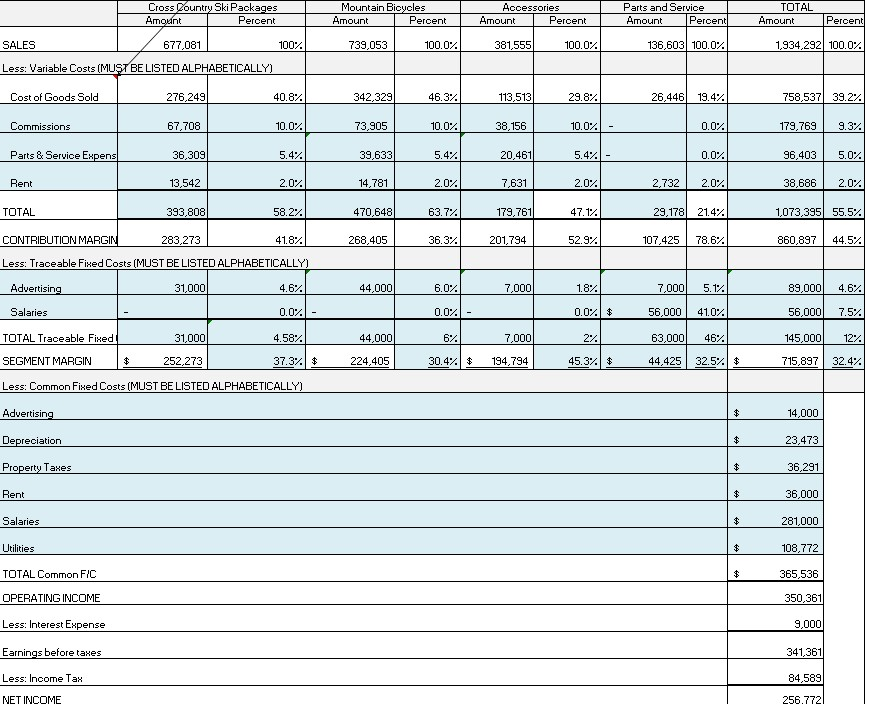

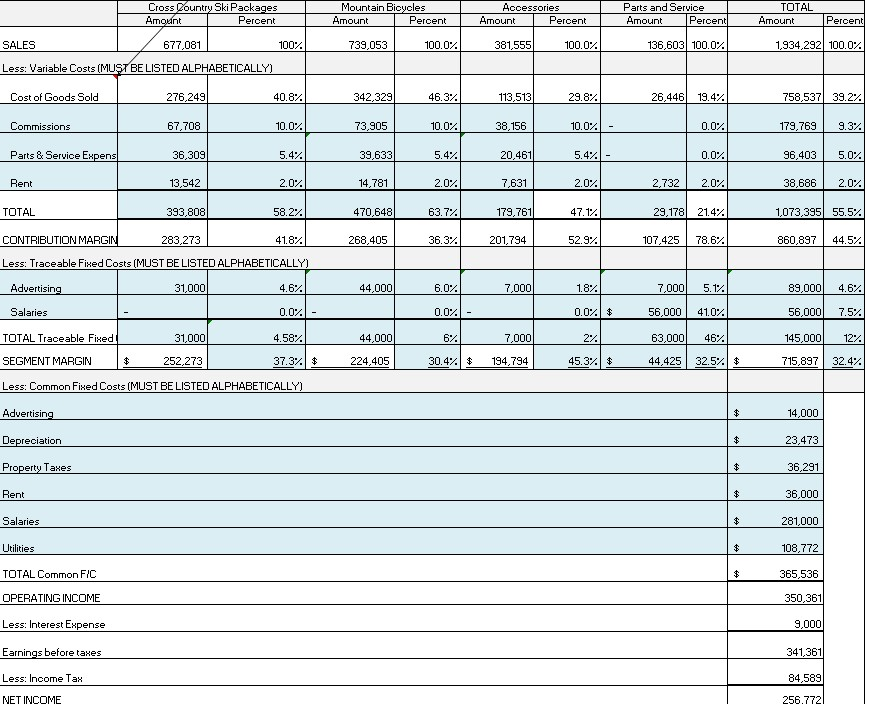

Income statement:

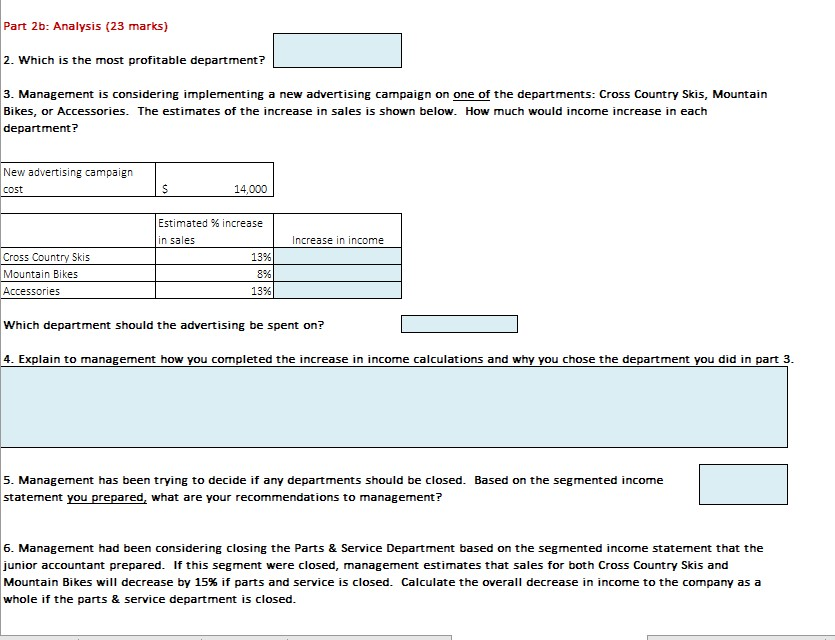

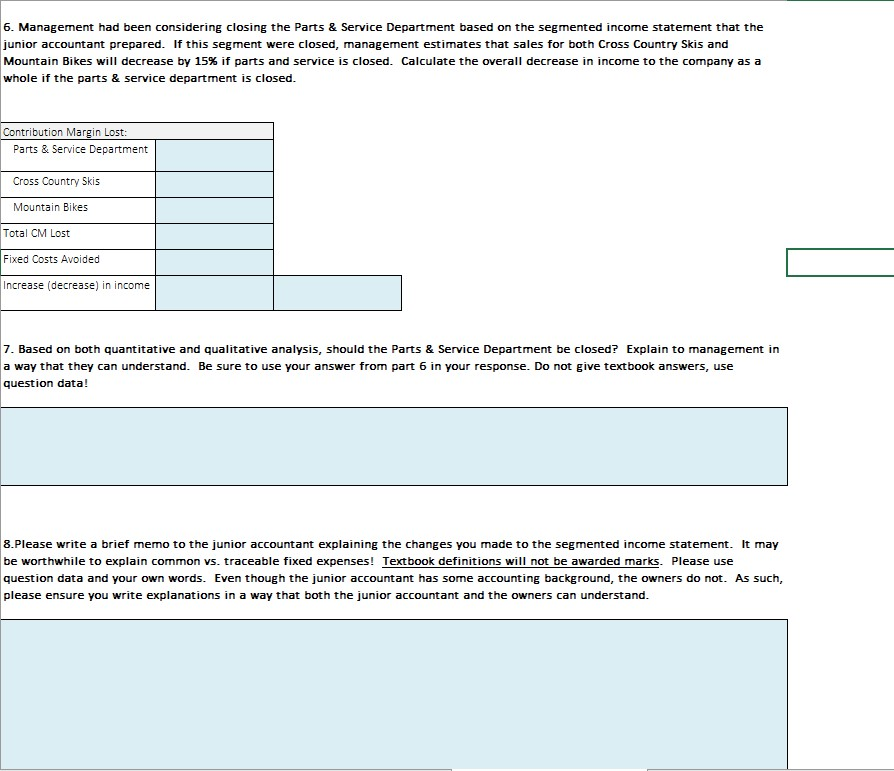

Questions #1-7:

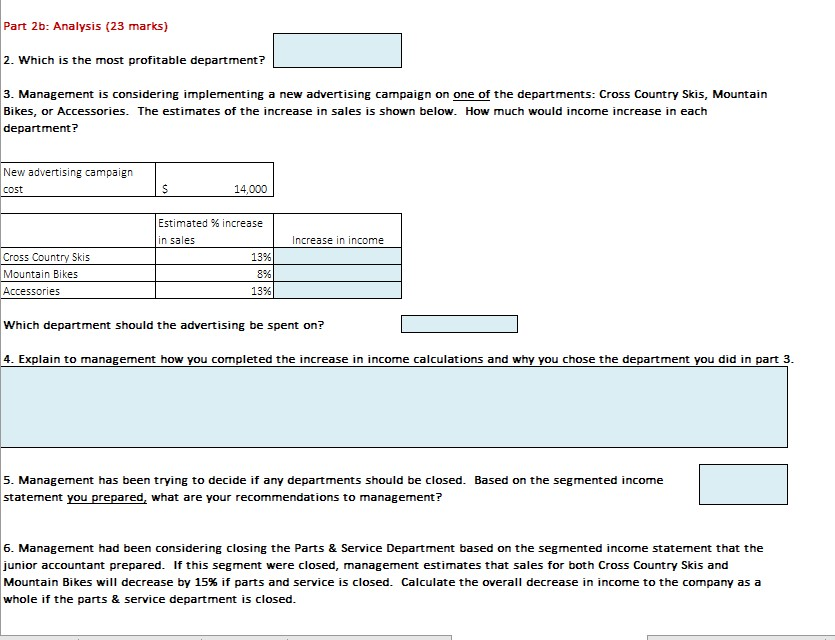

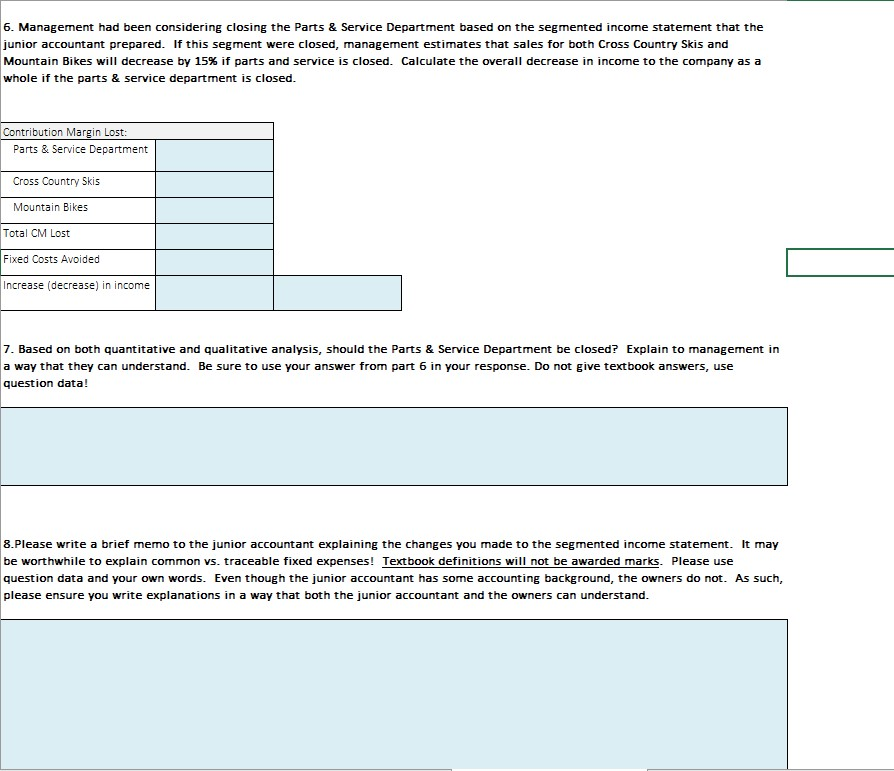

Mountain Bicycles Amount Percent Accessories Amount Percent Parts and Service | Amount Percent TOTAL Amount Percent Cross Country Ski Packages Amount Percent SALES I Z 677,081 1002 Less: Variable Costs (MUST BE LISTED ALPHABETICALLY) 739,053 100.02 381,555 100.02 136,603 100.02 1,934,292 100.0% Cost of Goods Sold 276,2491 40.821 342,329 46.37 113,513 29.82 26,446 19.42 758,537 39.27 Commissions 67,708 10.02 73,905 10.02. 38,156 10.02 - 0.02 179,769 9.32 Parts & Service Expens 36,309 5.422 0.02! 96,403 5.04 5.42 2.02 39,633 14,781 5.42 2.0% 20,461 7,631 Rent 13,542 2.02 2,732 2.02| 38,686 2.02 TOTA L 393,808 392 809 58.22 470,648 63.72 179,761 47.12 29,178 21.42 1,073,395 55.5% 268,405 36.3%|_ 201,794 52.92 107,425 78.6% 860,897 44.5% CONTRIBUTION MARGIN 283,273 41.82| Less: Traceable Fixed Costs (MUST BE LISTED ALPHABETICALLY) Advertising 31,000 4.62 44,000 6.02 7,000 7,000 5.12 89,000 4.62 1.82 0.02 $ Salaries 0.07 - 0.02 - 56,000 41.041 56.000 7.54 44,000 24 627,000 30.42 $ 194,794 63,000 44,425 462 32.54 $ 145,000 122 715,897 32.42 224,405 45.32 $ TOTAL Traceable Fixed 31,000 4.584 SEGMENT MARGIN 252,273 37.32 $ Less: Common Fixed Costs (MUST BE LISTED ALPHABETICALLY) Advertising 14,000 Depreciation 23,473 Property Taxes 36,291 Rent 36,000 281,000 Salaries Utilities TOTAL Common FIC OPERATING INCOME Less: Interest Expense 108,772 365,536 350,361 9,000 Earnings before taxes 341,361 Less: Income Tax NET INCOME 84,589 256.772) Part 26: Analysis (23 marks) 2. Which is the most profitable department? 3. Management is considering implementing a new advertising campaign on one of the departments: Cross Country Skis, Mountain Bikes, or Accessories. The estimates of the increase in sales is shown below. How much would income increase in each department? New advertising campaign cost $ 14,000 Increase in income Cross Country Skis Mountain Bikes Accessories Estimated % increase in sales 13% 891 13% Which department should the advertising be spent on? 4. Explain to management how you completed the increase in income calculations and why you chose the department you did in part 3. 5. Management has been trying to decide if any departments should be closed. Based on the segmented income statement you prepared, what are your recommendations to management? 6. Management had been considering closing the Parts & Service Department based on the segmented income statement that the junior accountant prepared. If this segment were closed, management estimates that sales for both Cross Country Skis and Mountain Bikes will decrease by 15% if parts and service is closed. Calculate the overall decrease in income to the company as a whole if the parts & service department is closed. 6. Management had been considering closing the Parts & Service Department based on the segmented income statement that the junior accountant prepared. If this segment were closed, management estimates that sales for both Cross Country Skis and Mountain Bikes will decrease by 15% if parts and service is closed. Calculate the overall decrease in income to the company as a whole if the parts & service department is closed. Contribution Margin Lost: Parts & Service Department Cross Country Skis Mountain Bikes Total CM Lost Fixed Costs Avoided Increase (decrease) in income 7. Based on both quantitative and qualitative analysis, should the Parts & Service Department be closed? Explain to management in a way that they can understand. Be sure to use your answer from part 6 in your response. Do not give textbook answers, use question data! 8.Please write a brief memo to the junior accountant explaining the changes you made to the segmented income statement. It may be worthwhile to explain common vs. traceable fixed expenses! Textbook definitions will not be awarded marks. Please use question data and your own words. Even though the junior accountant has some accounting background, the owners do not. As such, please ensure you write explanations in a way that both the junior accountant and the owners can understand