Answered step by step

Verified Expert Solution

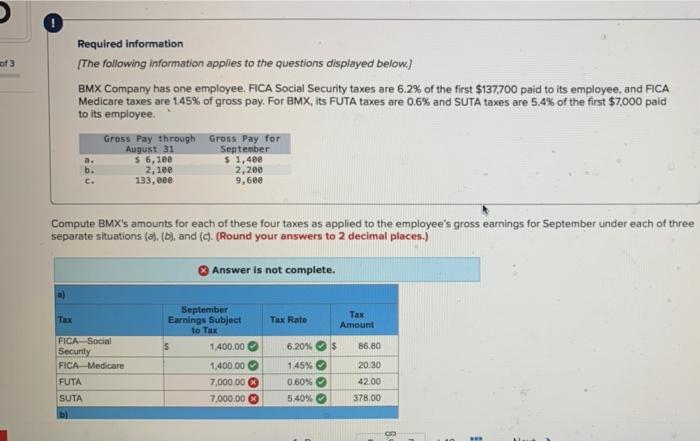

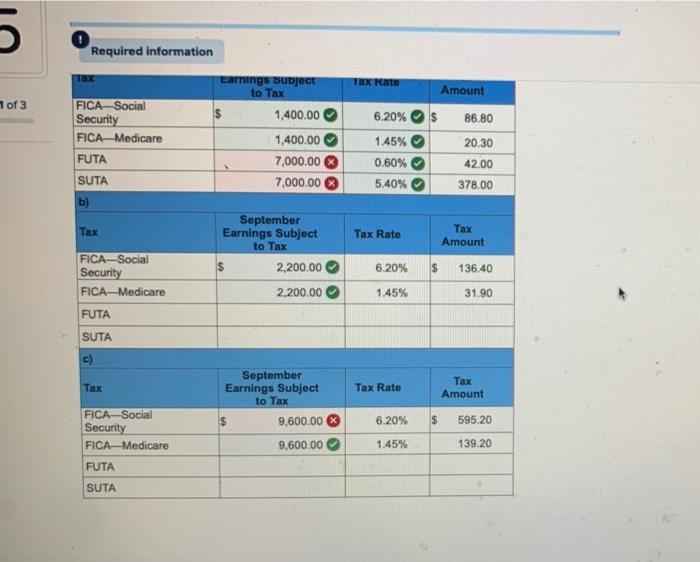

Question

1 Approved Answer

hey there someone has already answered this but i need explanation that's why i am posting this how do you calculate earnings subject to tax

hey there someone has already answered this but i need explanation that's why i am posting this

how do you calculate earnings subject to tax

is 137,700 the gross pay in this question?

how about the lists they gave us?

how is the SUTA taxes 5.4% of the first 7000 situation calculated?

can yiu go briefly over what is going on in here?

everything in red you see is mostly where i am confused thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started