Answered step by step

Verified Expert Solution

Question

1 Approved Answer

heyy can you please tell the answer for the above questions On June 1, 2024, Blossom Opportunity Ltd. (BO) purchased a piece of equipment for

heyy can you please tell the answer for the above questions

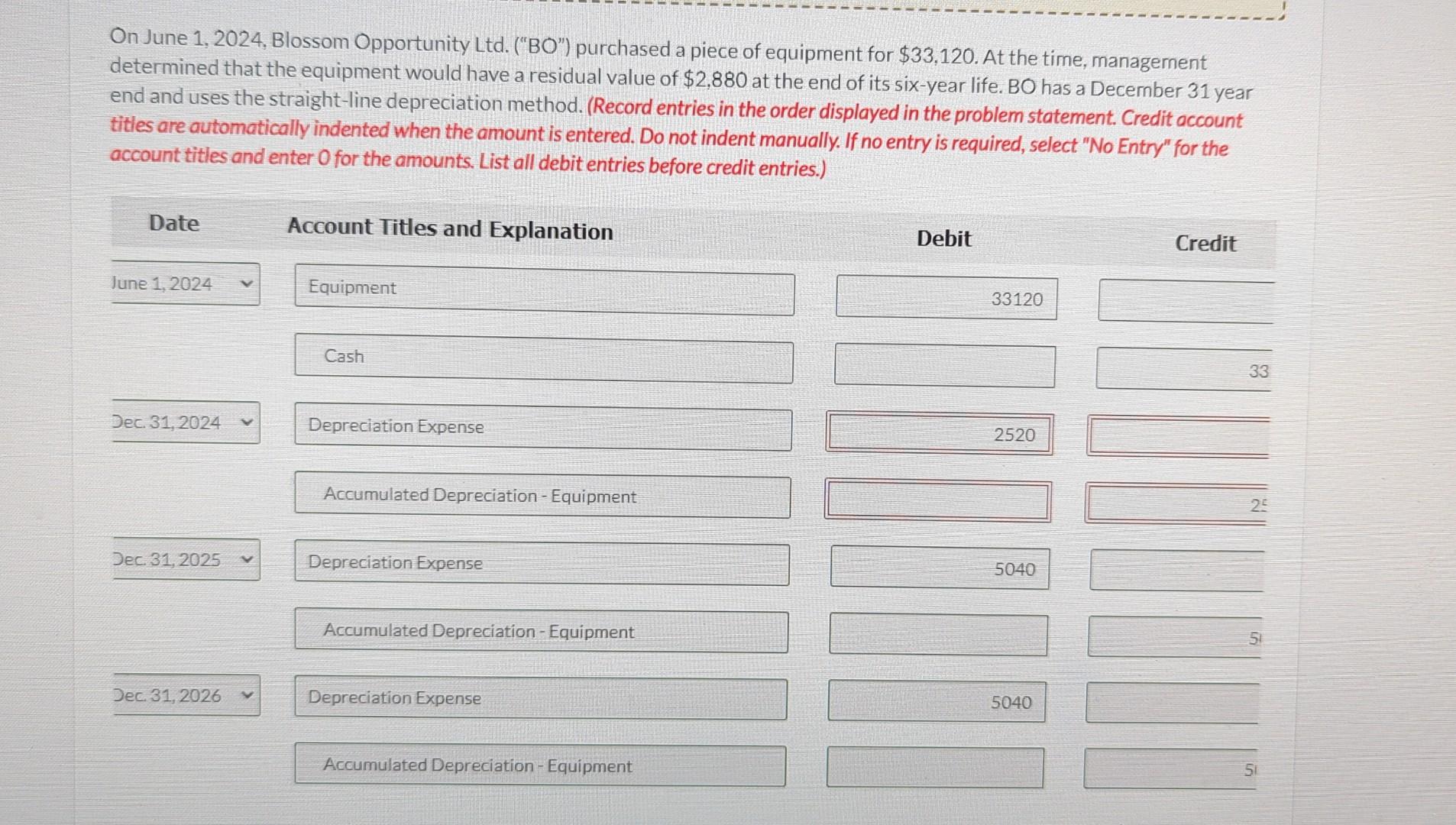

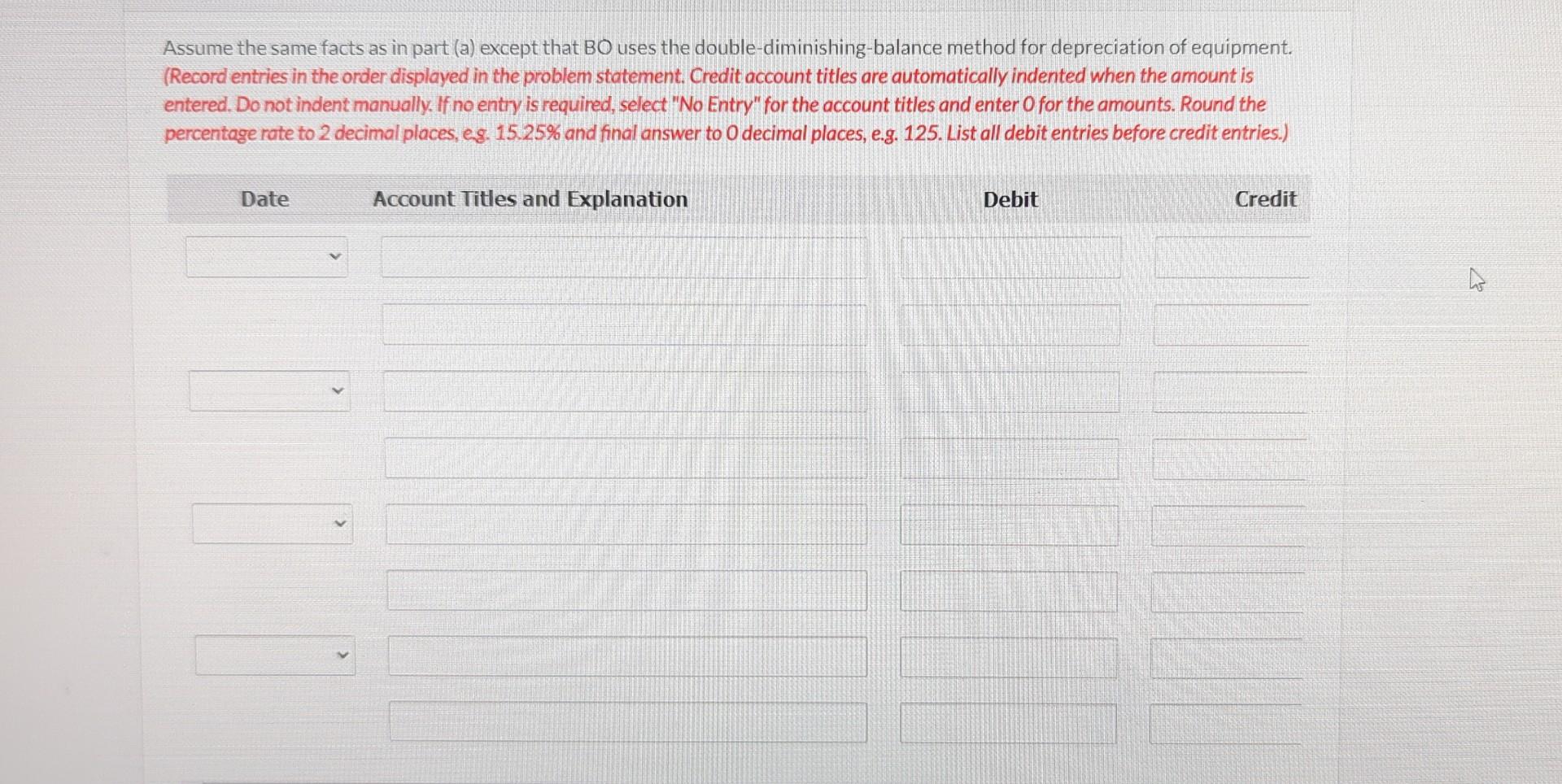

On June 1, 2024, Blossom Opportunity Ltd. ("BO") purchased a piece of equipment for $33,120. At the time, managernent determined that the equipment would have a residual value of $2,880 at the end of its six-year life. BO has a Decernber 31 year end and uses the straight-line depreciation method. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Assume the same facts as in part (a) except that BO uses the double-diminishing-balance method for depreciation of equipment. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round the percentage rate to 2 decimal places, es. 15.25% and final answer to 0 decimal places, e.g. 125 . List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started