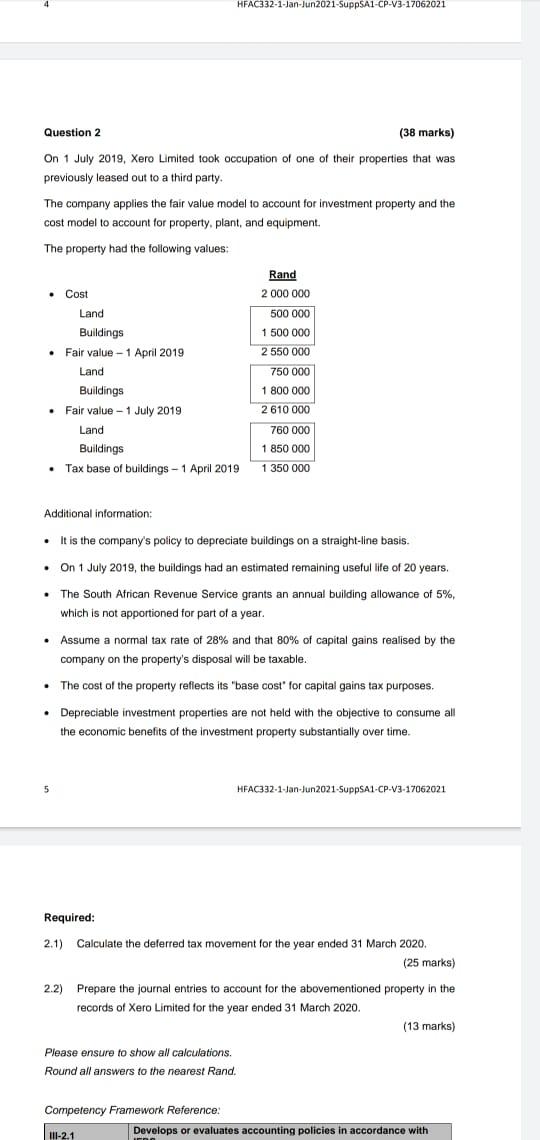

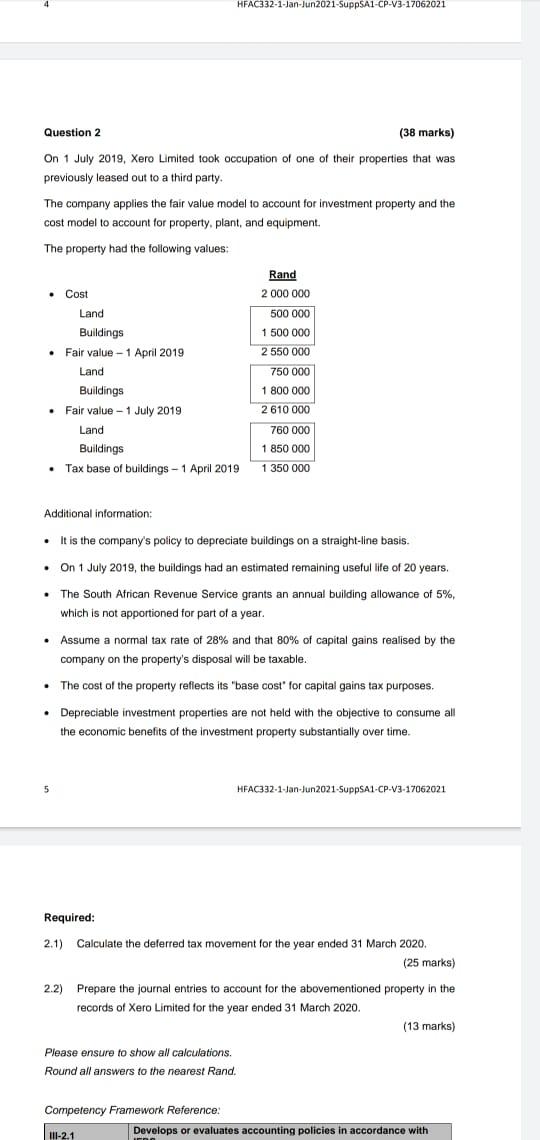

HFAC332-1-Jan-Jun2021-SuppSAL-CP-V3-17062021 Question 2 (38 marks) On 1 July 2019, Xero Limited took occupation of one of their properties that was previously leased out to a third party. The company applies the fair value model to account for investment property and the cost model to account for property, plant, and equipment The property had the following values: Cost Land Rand 2 000 000 2 500 000 1 500 000 2 550 000 Buildings Fair value- 1 April 2019 Land Buildings Fair value - 1 July 2019 Land Buildings Tax base of buildings - 1 April 2019 750 000 1 800 000 2 610 000 760 000 1 850 000 1 350 000 Additional information: It is the company's policy to depreciate buildings on a straight-line basis. . On 1 July 2019, the buildings had an estimated remaining useful life of 20 years. The South African Revenue Service grants an annual building allowance of 5%, which is not apportioned for part of a year. Assume a normal tax rate of 28% and that 80% of capital gains realised by the company on the property's disposal will be taxable. The cost of the property reflects its "base cost' for capital gains tax purposes. Depreciable investment properties are not held with the objective to consume all the economic benefits of the investment property substantially over time. 5 HFAC332-1-Jan-Jun2021-SuppSA1-CP-V3-17062021 Required: 2.1) Calculate the deferred tax movement for the year ended 31 March 2020. (25 marks) 2.2) Prepare the journal entries to account for the abovementioned property in the records of Xero Limited for the year ended 31 March 2020. (13 marks) Please ensure to show all calculations. Round all answers to the nearest Rand. Competency Framework Reference: III-2.1 Develops or evaluates accounting policies in accordance with HFAC332-1-Jan-Jun2021-SuppSAL-CP-V3-17062021 Question 2 (38 marks) On 1 July 2019, Xero Limited took occupation of one of their properties that was previously leased out to a third party. The company applies the fair value model to account for investment property and the cost model to account for property, plant, and equipment The property had the following values: Cost Land Rand 2 000 000 2 500 000 1 500 000 2 550 000 Buildings Fair value- 1 April 2019 Land Buildings Fair value - 1 July 2019 Land Buildings Tax base of buildings - 1 April 2019 750 000 1 800 000 2 610 000 760 000 1 850 000 1 350 000 Additional information: It is the company's policy to depreciate buildings on a straight-line basis. . On 1 July 2019, the buildings had an estimated remaining useful life of 20 years. The South African Revenue Service grants an annual building allowance of 5%, which is not apportioned for part of a year. Assume a normal tax rate of 28% and that 80% of capital gains realised by the company on the property's disposal will be taxable. The cost of the property reflects its "base cost' for capital gains tax purposes. Depreciable investment properties are not held with the objective to consume all the economic benefits of the investment property substantially over time. 5 HFAC332-1-Jan-Jun2021-SuppSA1-CP-V3-17062021 Required: 2.1) Calculate the deferred tax movement for the year ended 31 March 2020. (25 marks) 2.2) Prepare the journal entries to account for the abovementioned property in the records of Xero Limited for the year ended 31 March 2020. (13 marks) Please ensure to show all calculations. Round all answers to the nearest Rand. Competency Framework Reference: III-2.1 Develops or evaluates accounting policies in accordance with