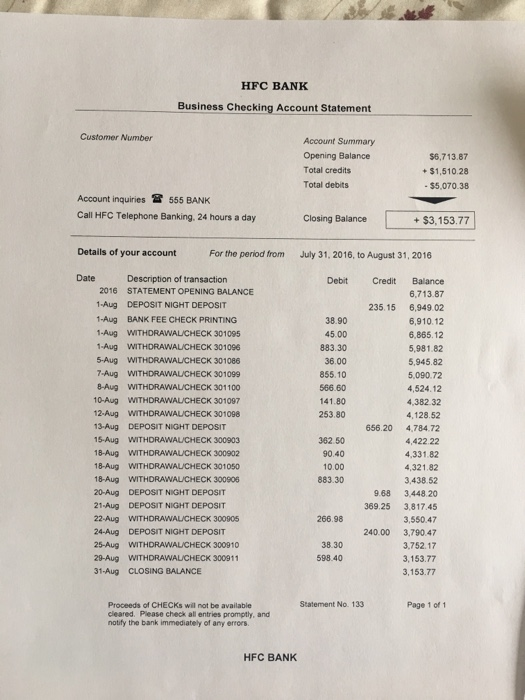

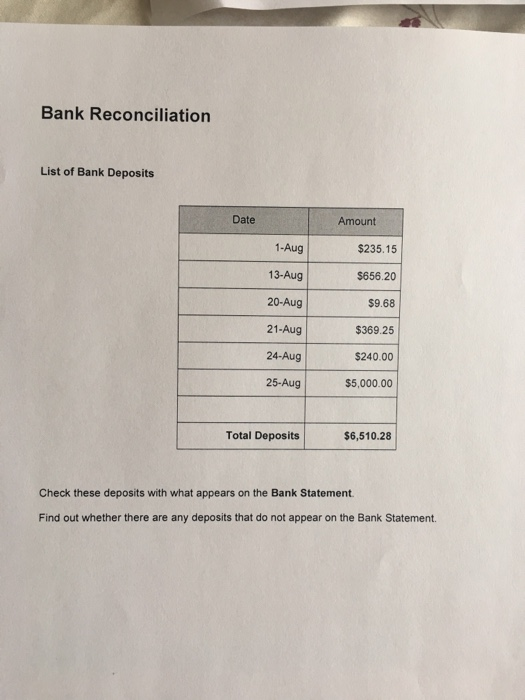

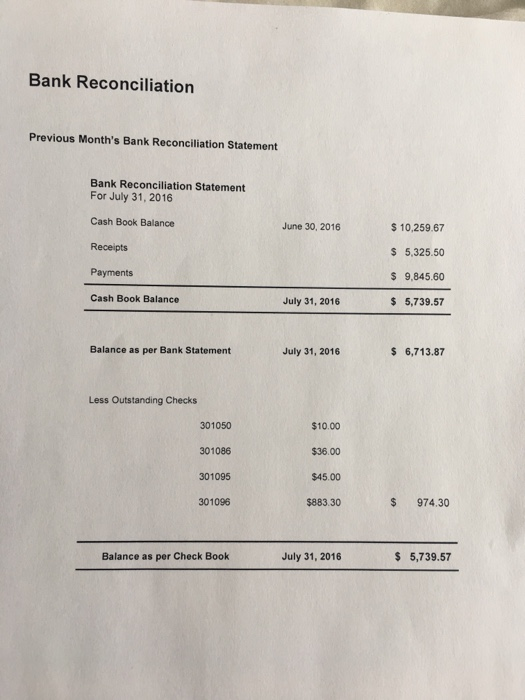

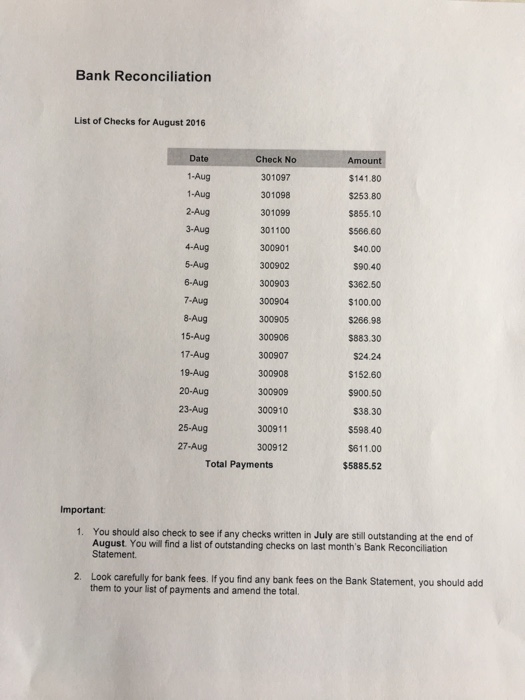

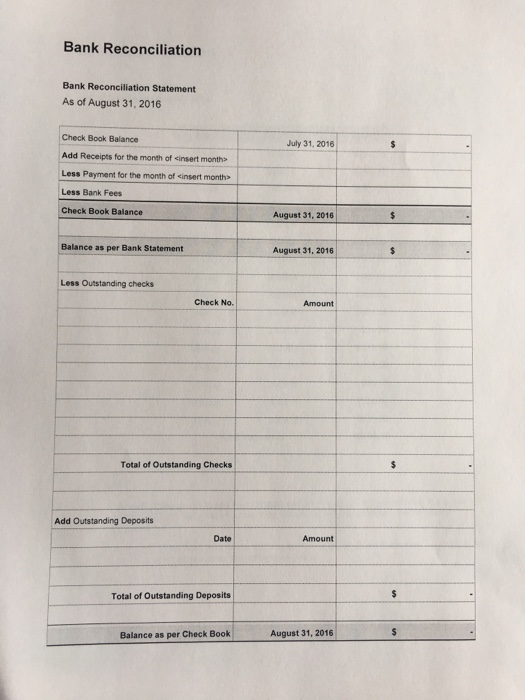

HFC BANK Business Checking Account Statement Customer Number Account Summary Opening Balance Total credits Total debits $6,713.87 $1,510.28 $5,070.38 Account inquiries 555 BANK Call HFC Telephone Banking, 24 hours a day Closing Balance +$3,153.77 Details of your account For the period from July 31, 2016, to August 31, 2016 Description of transaction Debit Credit Balance 6,71387 235.15 6,949.02 2016 STATEMENT OPENING BALANCE 1-Aug DEPOSIT NIGHT DEPOSIT 1-Aug BANK FEE CHECK PRINTING 1-Aug WITHDRAWALICHECK 301095 1-Aug WITHDRAWALICHECK 301096 5-Aug WITHDRAWALICHECK 301086 7-Aug WITHDRAWALUCHECK 301099 8-Aug WITHDRAWALCHECK 301100 10-Aug wITHDRAWALICHECK 301097 12-Aug WITHDRAWALICHECK 301098 3Aug DEPOSIT NIGHT DEPOSIT 15-Aug WITHDRAWAUCHECK 300903 18-Aug WITHORAWAUCHECK 300902 18-Aug WITHDRAWALICHECK 301050 18-Aug WITHORAWALICHECK 300906 6,910.12 6.865.12 45.00 883.30 5,981.82 5,945.82 855.10 566.60 141.80 5,090.72 4,524.12 4,382.32 4,128.52 656.20 4,784.72 4,422.22 4,331.82 4,321.82 3,438.52 9.68 3,448.20 369.25 3,817.45 3,550.47 240.00 3,790.47 3,752.17 362.50 90.40 883.30 20Aug DEPOSIT NGHT DEPOSIT 21-Aug DEPOSIT NIGHT DEPOSIT 22-Aug wITHDRAWALICHECK 300905 24-Aug DEPOSIT NIGHT DEPOSIT 25-Aug WITHDRAWALICHECK 300910 29-Aug WITHDRAWAL/CHECK 300911 31-Aug CLOSING BALANCE 266.98 38.30 598.40 3,153.77 3,153.77 Proceeds of CHECKs will not be available cleared. Please check all entries promptly, and notify the bank immediately of any errors Statement No. 133 Page 1 of 1 HFC BANK Bank Reconciliation List of Bank Deposits Amount Date $235.15 $656.20 $9.68 $369.25 $240.00 25-Aug$5,000.00 1-Aug 13-Aug 20-Aug 21-Aug 24-Aug $6,510.28 Total Deposits Check these deposits with what appears on the Bank Statement Find out whether there are any deposits that do not appear on the Bank Statement. Bank Reconciliation Previous Month's Bank Reconciliation Statement Bank Reconciliation Statement For July 31, 2016 Cash Book Balance Receipts Payments Cash Book Balance 10,259.67 5,325.50 $9,845.60 5,739.57 June 30, 2016 July 31, 2016 Balance as per Bank Statement 6,713.87 July 31, 2016 Less Outstanding Checks 301050 301086 301095 301096 $10.00 $36.00 $45.00 $883.30 $ 974.30 Balance as per Check Book $ 5,739.57 July 31, 2016 Bank Reconciliation List of Checks for August 2016 Amount Check No 301097 301098 301099 301100 300901 300902 300903 300904 300905 300906 300907 300908 300909 300910 300911 300912 Date 1-Aug 1-Aug 2-Aug $141.80 $253.80 $855.10 $586.60 $40.00 $90.40 $362.50 $100.00 $266.98 $883.30 $24.24 $152.60 $900.50 $38.30 $598.40 $611.00 $5885.52 4-Aug 6-Aug 7-Aug 8-Aug 15-Aug 17-Aug 19-Aug 20-Aug 23-Aug 25-Aug 27-Aug Total Payments Important: You should also check to see if any checks written in July are still outstanding at the end of August. You will find a list of outstanding checks on last month's Bank Reconciation Statement 1. Look carefully for bank fees. If you find any bank fees on the Bank Statement, you should add them to your list of payments and amend the total. 2. Bank Reconciliation Bank Reconciliation Statement As of August 31, 2016 Check Book Balance Add Receipts for the month of cinsert month> Less Payment for the month of xinsert month> Less Bank Fees Check Book Balance July 31, 2016 August 31, 2016 Balance as per Bank Statement August 31, 2016 Less Outstanding checks Check No. Amount Total of Outstanding Checks Add Outstanding Deposits Date Amount Total of Outstanding Deposits August 31, 2016 Balance as per Check Book