Answer question 2 using the table from question 1.

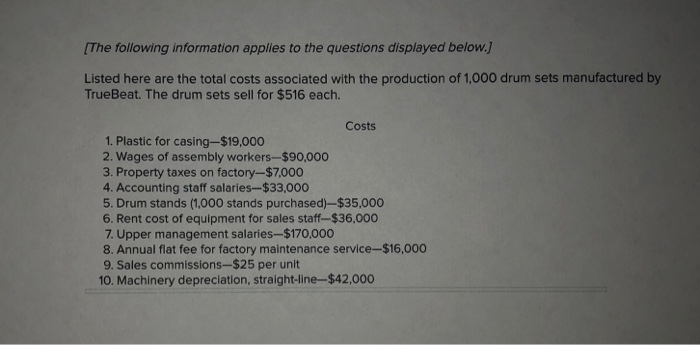

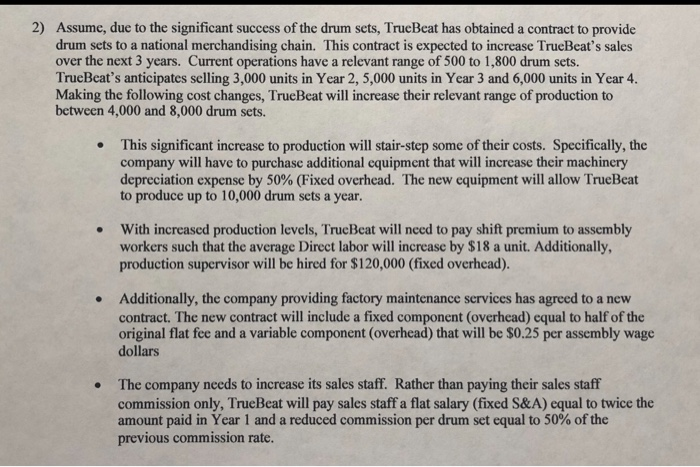

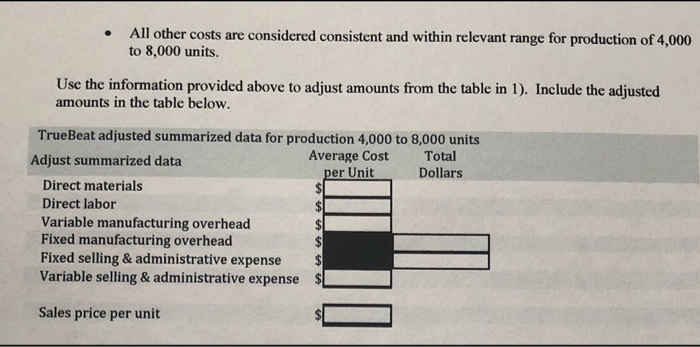

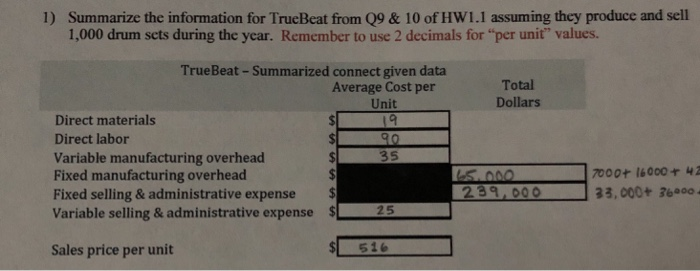

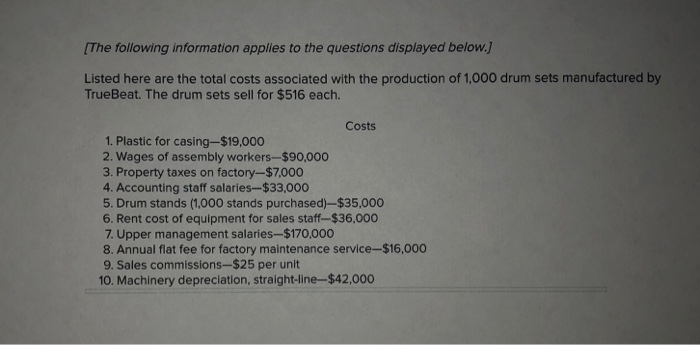

[The following information applies to the questions displayed below.) Listed here are the total costs associated with the production of 1,000 drum sets manufactured by TrueBeat. The drum sets sell for $516 each. Costs 1. Plastic for casing-$19,000 2. Wages of assembly workers--$90,000 3. Property taxes on factory-$7,000 4. Accounting staff salaries-$33,000 5. Drum stands (1.000 stands purchased)-$35,000 6. Rent cost of equipment for sales staff-$36.000 7. Upper management salaries-$170,000 8. Annual flat fee for factory maintenance service-$16,000 9. Sales commissions--$25 per unit 10. Machinery depreciation, straight-line-$42,000 2) Assume, due to the significant success of the drum sets, TrueBeat has obtained a contract to provide drum sets to a national merchandising chain. This contract is expected to increase TrueBeat's sales over the next 3 years. Current operations have a relevant range of 500 to 1,800 drum sets. TrueBeat's anticipates selling 3,000 units in Year 2, 5,000 units in Year 3 and 6,000 units in Year 4. Making the following cost changes, TrueBeat will increase their relevant range of production to between 4,000 and 8,000 drum sets. This significant increase to production will stair-step some of their costs. Specifically, the company will have to purchase additional equipment that will increase their machinery depreciation expense by 50% (Fixed overhead. The new equipment will allow TrueBeat to produce up to 10,000 drum sets a year. With increased production levels, TrueBeat will need to pay shift premium to assembly workers such that the average Direct labor will increase by $18 a unit. Additionally, production supervisor will be hired for $120,000 (fixed overhead). Additionally, the company providing factory maintenance services has agreed to a new contract. The new contract will include a fixed component (overhead) equal to half of the original flat fee and a variable component (overhead) that will be $0.25 per assembly wage dollars . The company needs to increase its sales staff. Rather than paying their sales staff commission only, TrueBeat will pay sales staff a flat salary (fixed S&A) equal to twice the amount paid in Year 1 and a reduced commission per drum set equal to 50% of the previous commission rate. . All other costs are considered consistent and within relevant range for production of 4,000 to 8,000 units. Use the information provided above to adjust amounts from the table in 1). Include the adjusted amounts in the table below. TrueBeat adjusted summarized data for production 4,000 to 8,000 units Adjust summarized data Average Cost Total per Unit Dollars Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling & administrative expense Variable selling & administrative expense A A Sales price per unit 1) Summarize the information for TrueBeat from Q9 & 10 of HW 1.1 assuming they produce and sell 1,000 drum sets during the year. Remember to use 2 decimals for "per unit" values. Total Dollars True Beat - Summarized connect given data Average Cost per Unit Direct materials Direct labor $ Variable manufacturing overhead $ 35 Fixed manufacturing overhead $ Fixed selling & administrative expense $ Variable selling & administrative expense 25 299,000 7000+ 16000+ 42 33,000+ 3600 Sales price per unit 516