Answered step by step

Verified Expert Solution

Question

1 Approved Answer

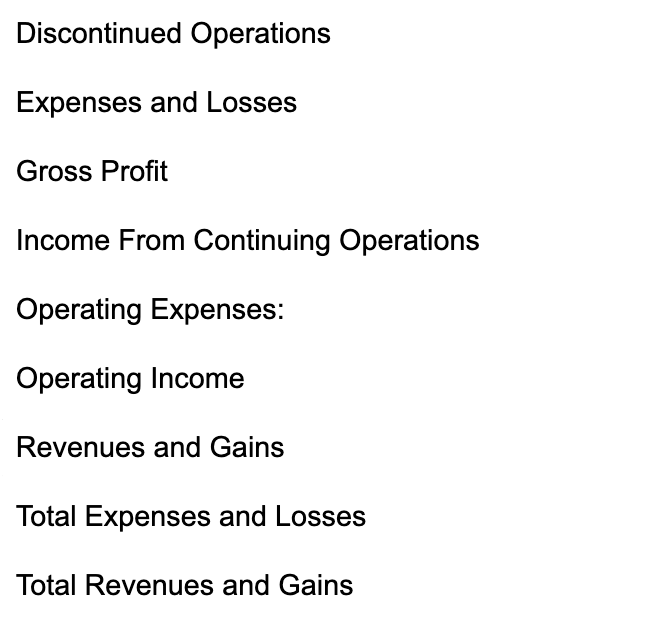

Hi. All I need are the last three dropdowns and the amounts as well. I DO NOT need the full income statement of the answers

Hi. All I need are the last three dropdowns and the amounts as well. I DO NOT need the full income statement of the answers I already have correct. Thanks.

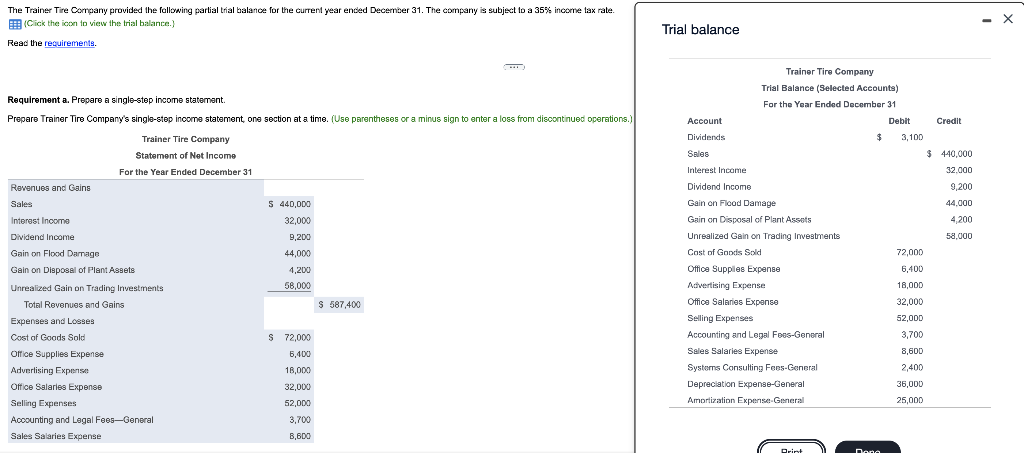

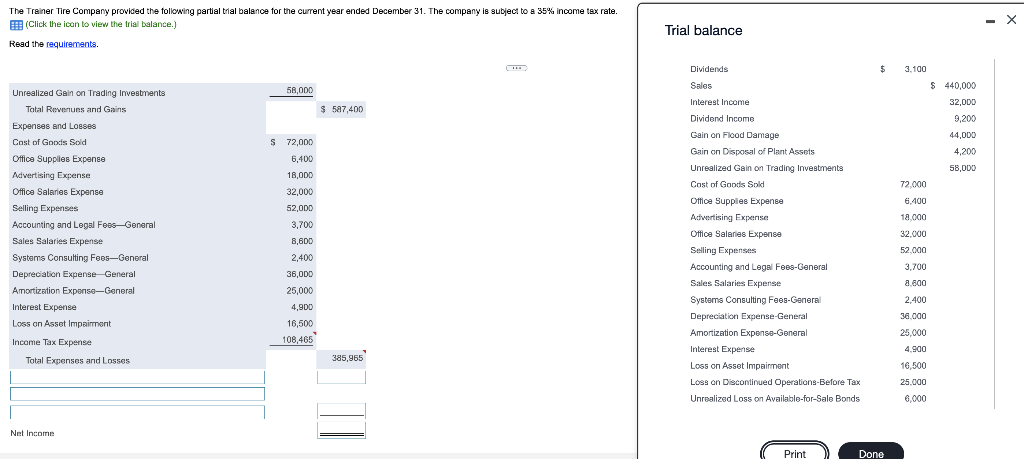

The Trainer Tire Company provided the following partial trial balance for the current year ended December 31. The company is subject to a 35% income tax rate. Click the icon to view the trial balance. Trial balance Read the requirements. Requirement a. Prepare a single-step income statement Prepare Trainer Tire Company's single-step income statement one section at a time. (Use parentheses or a minus sign to enter a loss from discontinued operations.) Trainer Tire Company Statement of Net Income For the Year Ended December 31 Revenues and Gains Sales S 440,000 Interest Income 32,000 Dividend Income 9,200 Gain on Flood Darnage 44,000 Gain on Disposal of Plant Assets 4,200 Unrealized Gain on Trading Investments 58,000 Total Revenues and Gains S 587,400 Expenses and Losses Cost of Goods Sold $ 72,000 Office Supplies Expense 5,400 Advertising Expense 18,000 Office Salaries Expense 32,000 Selling Expenses 52.000 Accounting and Legal Fees-General 3,700 Sales Salaries Expense 8.600 Trainer Tire Company Trial Balance (Selected Accounts) For the Year Ended December 31 Account Debit Credit Dividends $ 3,100 Sales $ 440,000 Interest Income 32,000 Dividend Income 9.200 Gain on Flood Damage 44.000 Gain on Disposal of Plant Assets 4,200 Unrealized Gain on Trading Investments 58,000 Cost of Goods Sold 72,000 Office Supples Expense 6,400 Advertising Expense 18,000 Office Salaries Expense 32,000 Selling Expenses Salg 52,00D Accounting and Legal Fees-General nuceno 3,700 w Sales Salaries Expense Sande 8,60D Systems Consulting Fees General 2,400 Depreciation Expense-General 36,000 Amortization Experise General 25,000 Print D The Trainer Tire Company provided the following partial trial balance for the current year ended December 31. The company is subject to a 35% income tax rate. (Click the icon to view the trial balance.) - X Trial balance Read the requirements. $ 3.100 58,000 $ 587,400 $ 440,000 32.000 9,200 44.000 S 72,000 4.200 6,400 58,000 18,000 72,000 6,400 Unrealized Gain on Trading Investments Total Revenues and Gains Expenses and Losses Cost of Goods Sold Office Supplies Expense Advertising Expense Office Salaries Expense Selling Expenses Accounting and Legal FeesGeneral Sales Salaries Expense Systems Consulting Fees-General Depreciation Expense General Amortization Expense-General Interest Expense Loss on Asset Impairment 18.000 32,000 -2.000 52,000 3,700 8,600 2,400 SEO 36,000 25,000 4.900 16,500 108,465 Dividends Sales Interest Income Dividend Income Gain on Flood Damage Gain on Disposal of Plant Assets Unrealized Gain on Trading Investments Cost of Goods Sold Office Supples Expense Advertising Expense Office Salaries Expense Selling Expenses Accounting and Legal Fees-General Sales Salaries Expense Systems Consulting Fees-General Depreciation Expense-General Amortization Expense-General Interest Expense Loss on Asset Impairment Loss on Discontinued Operations-Before Tax Unrealized Loss on Available-for-Sale Bonds 32,000 52.000 3,700 2.600 2.400 36.000 25,000 4.900 Income Tax Expense Total Expenses and Losses 385,965 16,500 25.000 6.000 Net Income Print Done Discontinued Operations Expenses and Losses Gross Profit Income From Continuing Operations Operating Expenses: Operating Income Revenues and Gains Total Expenses and Losses Total Revenues and GainsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started