Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi can someone please help me answer the questions (a, b, c and d) in picture 2. The information needed to answer the questions is

Hi can someone please help me answer the questions (a, b, c and d) in picture 2. The information needed to answer the questions is provided in picture 1. Thank You.

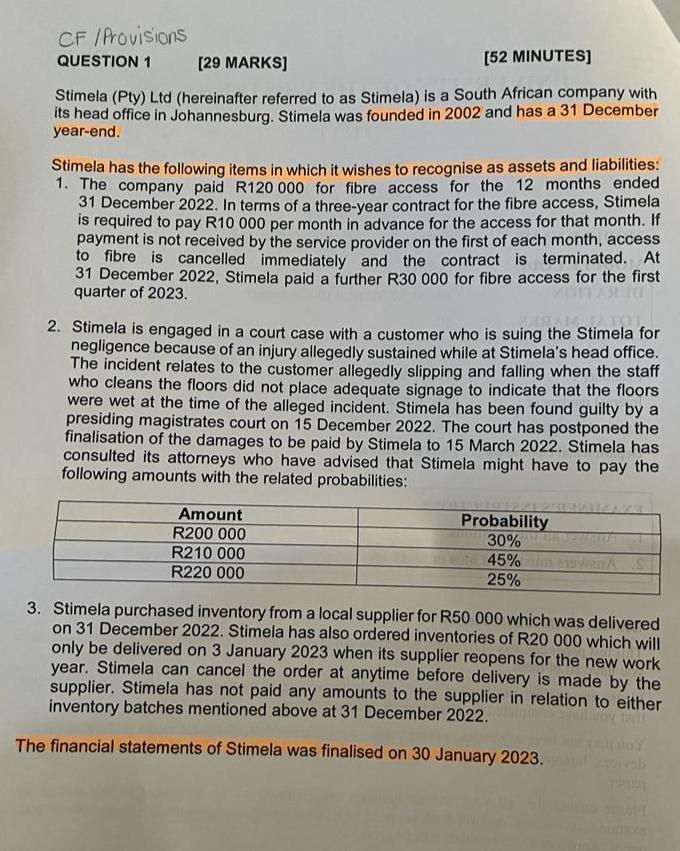

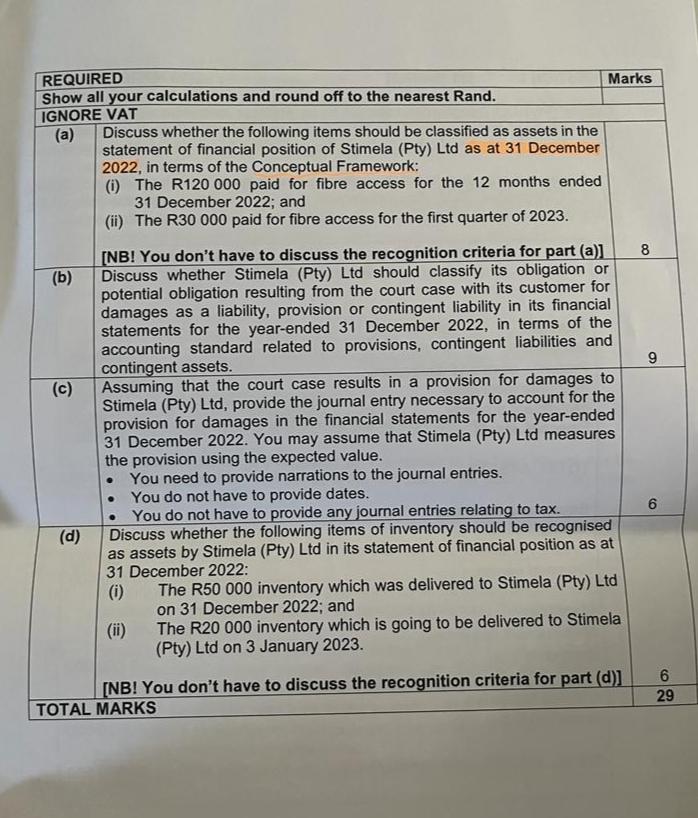

QUESTION 1 [29 MARKS] [52 MINUTES] Stimela (Pty) Ltd (hereinafter referred to as Stimela) is a South African company with its head office in Johannesburg. Stimela was founded in 2002 and has a 31 December year-end. Stimela has the following items in which it wishes to recognise as assets and liabilities: 1. The company paid R120 000 for fibre access for the 12 months ended 31 December 2022. In terms of a three-year contract for the fibre access, Stimela is required to pay R10 000 per month in advance for the access for that month. If payment is not received by the service provider on the first of each month, access to fibre is cancelled immediately and the contract is terminated. At 31 December 2022, Stimela paid a further R30 000 for fibre access for the first quarter of 2023. 2. Stimela is engaged in a court case with a customer who is suing the Stimela for negligence because of an injury allegedly sustained while at Stimela's head office. The incident relates to the customer allegedly slipping and falling when the staff who cleans the floors did not place adequate signage to indicate that the floors were wet at the time of the alleged incident. Stimela has been found guilty by a presiding magistrates court on 15 December 2022. The court has postponed the finalisation of the damages to be paid by Stimela to 15 March 2022. Stimela has consulted its attorneys who have advised that Stimela might have to pay the following amounts with the related probabilities: 3. Stimela purchased inventory from a local supplier for R50000 which was delivered on 31 December 2022. Stimela has also ordered inventories of R20 000 which will only be delivered on 3 January 2023 when its supplier reopens for the new work year. Stimela can cancel the order at anytime before delivery is made by the supplier. Stimela has not paid any amounts to the supplier in relation to either inventory batches mentioned above at 31 December 2022. The financial statements of Stimela was finalised on 30 January 2023. REQUIRED Show all your calculations and round off to the nearest Rand. IGNORE VAT (a) Discuss whether the following items should be classified as assets in the statement of financial position of Stimela (Pty) Ltd as at 31 December 2022, in terms of the Conceptual Framework: (i) The R120 000 paid for fibre access for the 12 months ended 31 December 2022; and (ii) The R30 000 paid for fibre access for the first quarter of 2023. [NB! You don't have to discuss the recognition criteria for part (a)] (b) Discuss whether Stimela (Pty) Ltd should classify its obligation or potential obligation resulting from the court case with its customer for damages as a liability, provision or contingent liability in its financial statements for the year-ended 31 December 2022, in terms of the accounting standard related to provisions, contingent liabilities and contingent assets. (c) Assuming that the court case results in a provision for damages to Stimela (Pty) Ltd, provide the journal entry necessary to account for the provision for damages in the financial statements for the year-ended 31 December 2022. You may assume that Stimela (Pty) Ltd measures the provision using the expected value. - You need to provide narrations to the journal entries. - You do not have to provide dates. - You do not have to provide any journal entries relating to tax (d) Discuss whether the following items of inventory should be recognised as assets by Stimela (Pty) Ltd in its statement of financial position as at 31 December 2022: (i) The R50 000 inventory which was delivered to Stimela (Pty) Ltd on 31 December 2022; and (ii) The R20 000 inventory which is going to be delivered to Stimela (Pty) Ltd on 3 January 2023. \begin{tabular}{|l|l|} \hline [NB! You don't have to discuss the recognition criteria for part (d)] & 6 \\ \hline \end{tabular} TOTAL MARKSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started