Question

Hi, can you answer this question in more detail? Subject: Taxation and Estate Planning Q3. A Mr. B is a HKPR and does not own

Hi, can you answer this question in more detail?

Subject: Taxation and Estate Planning

Q3. A

Mr. B is a HKPR and does not own any residential property in Hong Kong. On 1 December 2016, he entered into an agreement for sale to acquire a residential property at a purchase price of $25M. On 30 December 2016, his spouse Ms. C, who is a HKPR and owned a residential property in Hong Kong on that date, was added in the assignment as one of the joint owners of the property. Both Mr. B and Ms. C acted on their own behalf in acquiring the property.

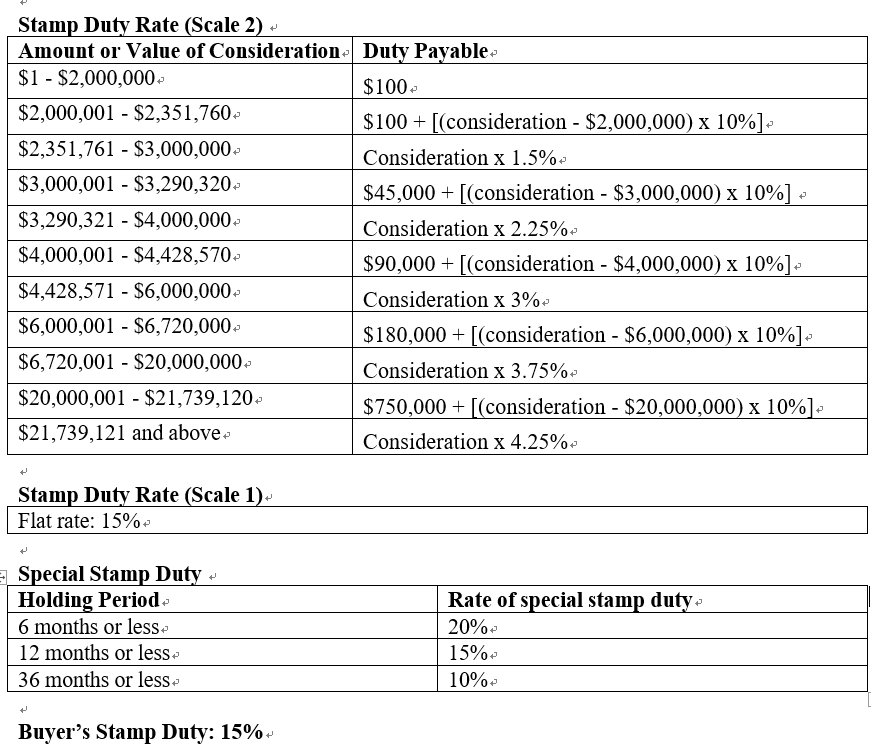

(a) Calculate the stamp duty payable and elaborate the answers in detail.

(b) Same as part (a), but Ms. C is not Mr. Bs close relative. What is the amount of AVD payable? Show the calculations and elaborate your answer.

(c) Mr. F is a HKPR who owns a single residential property (the original property) in Hong Kong. On 20 November 2016, he entered into a PASP to acquire another residential property (the new property) at a purchase price of $6M. On 15 May 2017, he entered into a PASP to dispose of the original property. Can Mr. F claim a partial refund of the AVD paid? If yes, show the calculations and elaborate your answer; if no, explain why not.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started