Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can you please help with this question thankyou Total: 10 marks Question 5 Business combinations Parkinson Ltd and Fanning Ltd are two family-owned companies

hi can you please help with this question thankyou

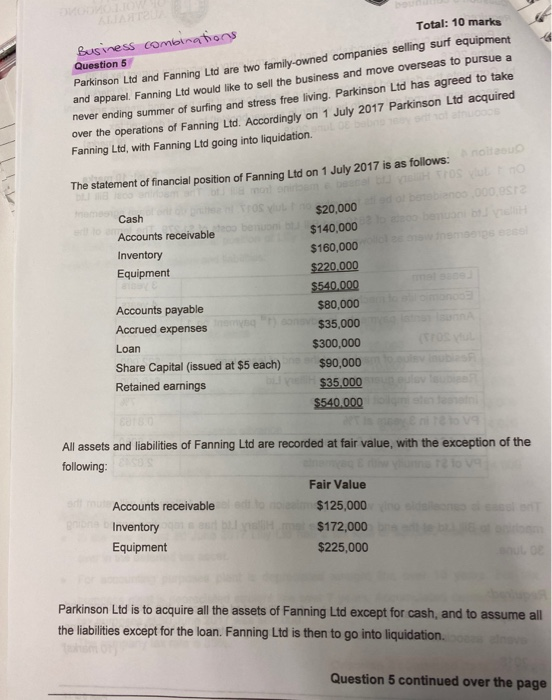

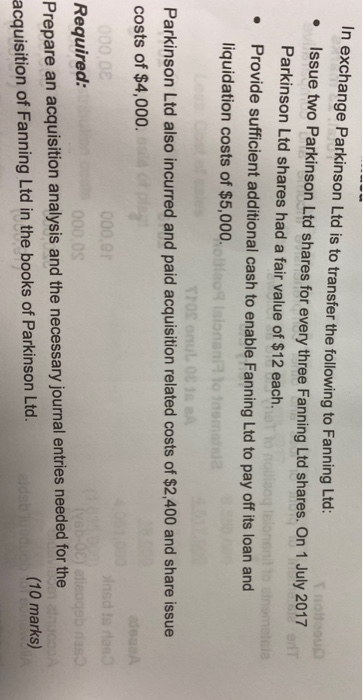

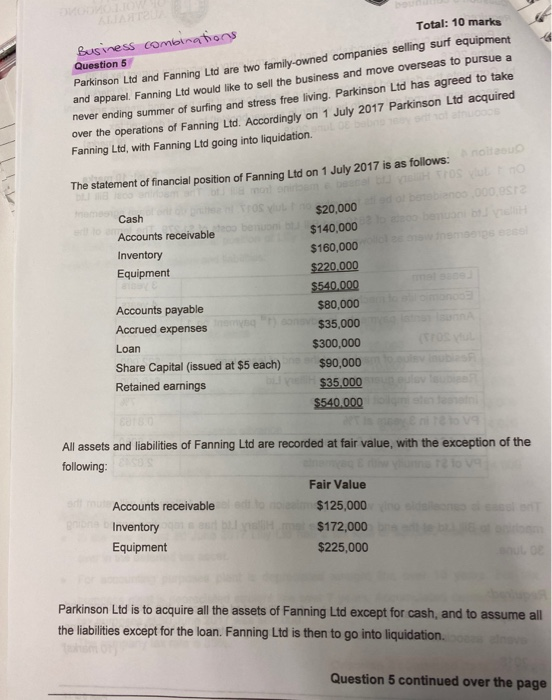

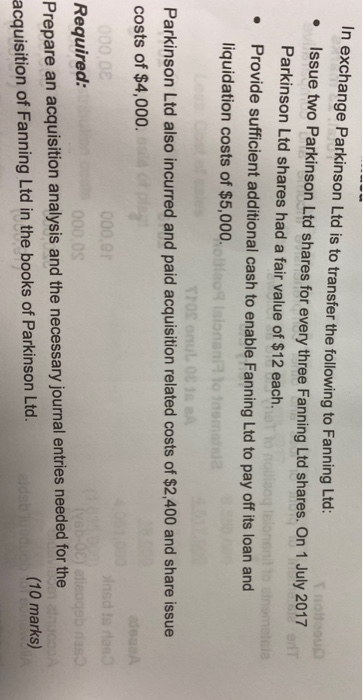

Total: 10 marks Question 5 Business combinations Parkinson Ltd and Fanning Ltd are two family-owned companies selling surf equipment and apparel. Fanning Ltd would like to sell the business and move overseas to pursue a never ending summer of surfing and stress free living, Parkinson Ltd has agreed to take over the operations of Fanning Ltd. Accordingly on 1 July 2017 Parkinson Ltd acquired Fanning Ltd, with Fanning Ltd going into liquidation The statement of financial position of Fanning Ltd on 1 July 2017 is as follows: moteur HOS OOST Cash $20,000 Accounts receivable $140,000 Inventory $160,000 Equipment $220.000 $540,000 Accounts payable $80,000 Accrued expenses $35,000 Loan $300,000 Share Capital (issued at $5 each) $90,000 Retained earnings $35.000 $540,000 All assets and liabilities of Fanning Ltd are recorded at fair value, with the exception of the following: 12 love Fair Value Accounts receivable $125,000 Inventory $172,000 Equipment $225,000 Parkinson Ltd is to acquire all the assets of Fanning Ltd except for cash, and to assume all the liabilities except for the loan. Fanning Ltd is then to go into liquidation. Question 5 continued over the page In exchange Parkinson Ltd is to transfer the following to Fanning Ltd: soltou Issue two Parkinson Ltd shares for every three Fanning Ltd shares. On 1 July 2017 Parkinson Ltd shares had a fair value of $12 each. nouisode Provide sufficient additional cash to enable Fanning Ltd to pay off its loan and liquidation costs of $5,000. oblaststolnoma STOS anul 01 BA Parkinson Ltd also incurred and paid acquisition related costs of $2,400 and share issue costs of $4,000 to 000,00 000.01 lista dos Required: 000.0 (Y6b-0) alleogebra Prepare an acquisition analysis and the necessary journal entries needed for the (10 marks) acquisition of Fanning Ltd in the books of Parkinson Ltd. Total: 10 marks Question 5 Business combinations Parkinson Ltd and Fanning Ltd are two family-owned companies selling surf equipment and apparel. Fanning Ltd would like to sell the business and move overseas to pursue a never ending summer of surfing and stress free living, Parkinson Ltd has agreed to take over the operations of Fanning Ltd. Accordingly on 1 July 2017 Parkinson Ltd acquired Fanning Ltd, with Fanning Ltd going into liquidation The statement of financial position of Fanning Ltd on 1 July 2017 is as follows: moteur HOS OOST Cash $20,000 Accounts receivable $140,000 Inventory $160,000 Equipment $220.000 $540,000 Accounts payable $80,000 Accrued expenses $35,000 Loan $300,000 Share Capital (issued at $5 each) $90,000 Retained earnings $35.000 $540,000 All assets and liabilities of Fanning Ltd are recorded at fair value, with the exception of the following: 12 love Fair Value Accounts receivable $125,000 Inventory $172,000 Equipment $225,000 Parkinson Ltd is to acquire all the assets of Fanning Ltd except for cash, and to assume all the liabilities except for the loan. Fanning Ltd is then to go into liquidation. Question 5 continued over the page In exchange Parkinson Ltd is to transfer the following to Fanning Ltd: soltou Issue two Parkinson Ltd shares for every three Fanning Ltd shares. On 1 July 2017 Parkinson Ltd shares had a fair value of $12 each. nouisode Provide sufficient additional cash to enable Fanning Ltd to pay off its loan and liquidation costs of $5,000. oblaststolnoma STOS anul 01 BA Parkinson Ltd also incurred and paid acquisition related costs of $2,400 and share issue costs of $4,000 to 000,00 000.01 lista dos Required: 000.0 (Y6b-0) alleogebra Prepare an acquisition analysis and the necessary journal entries needed for the (10 marks) acquisition of Fanning Ltd in the books of Parkinson Ltd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started