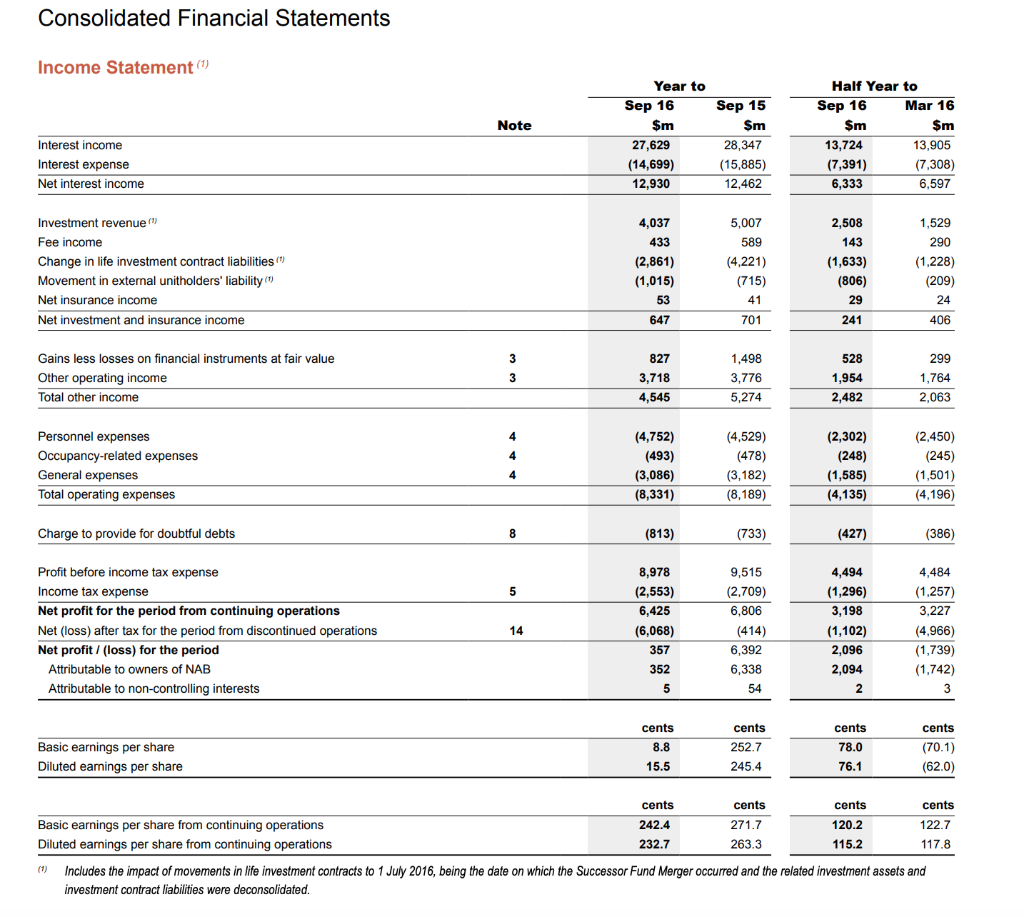

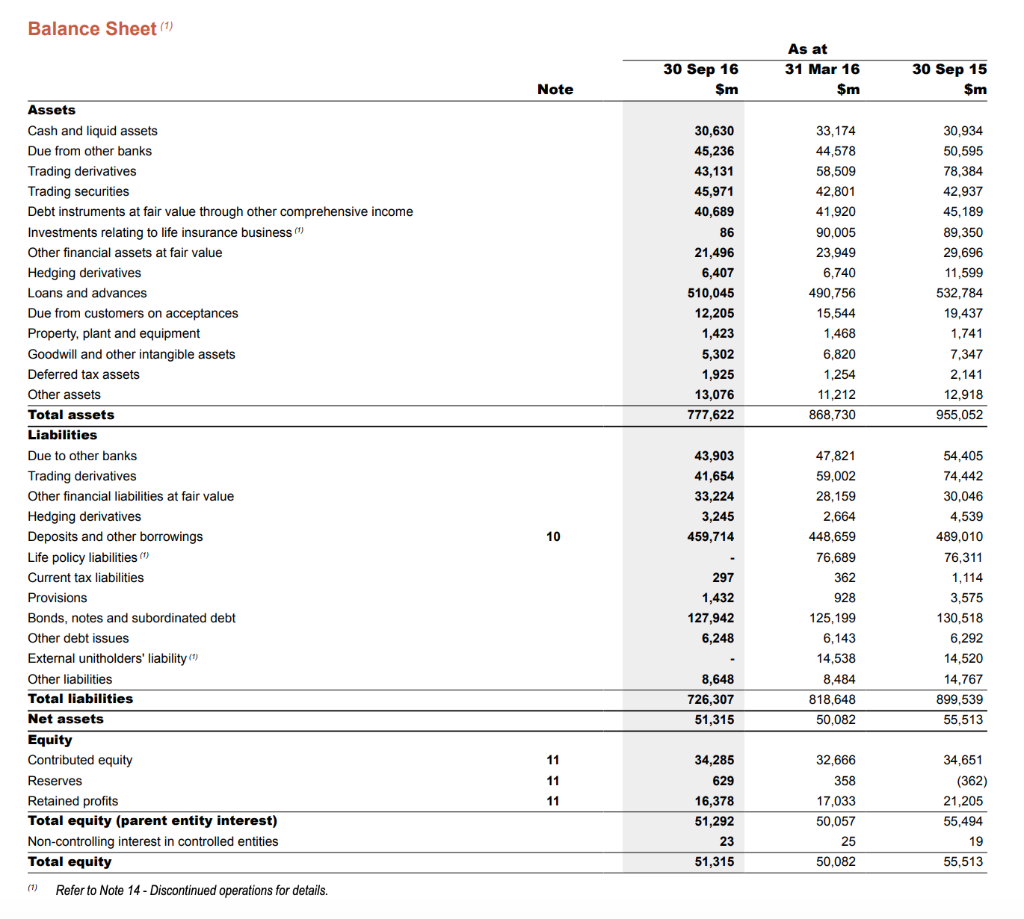

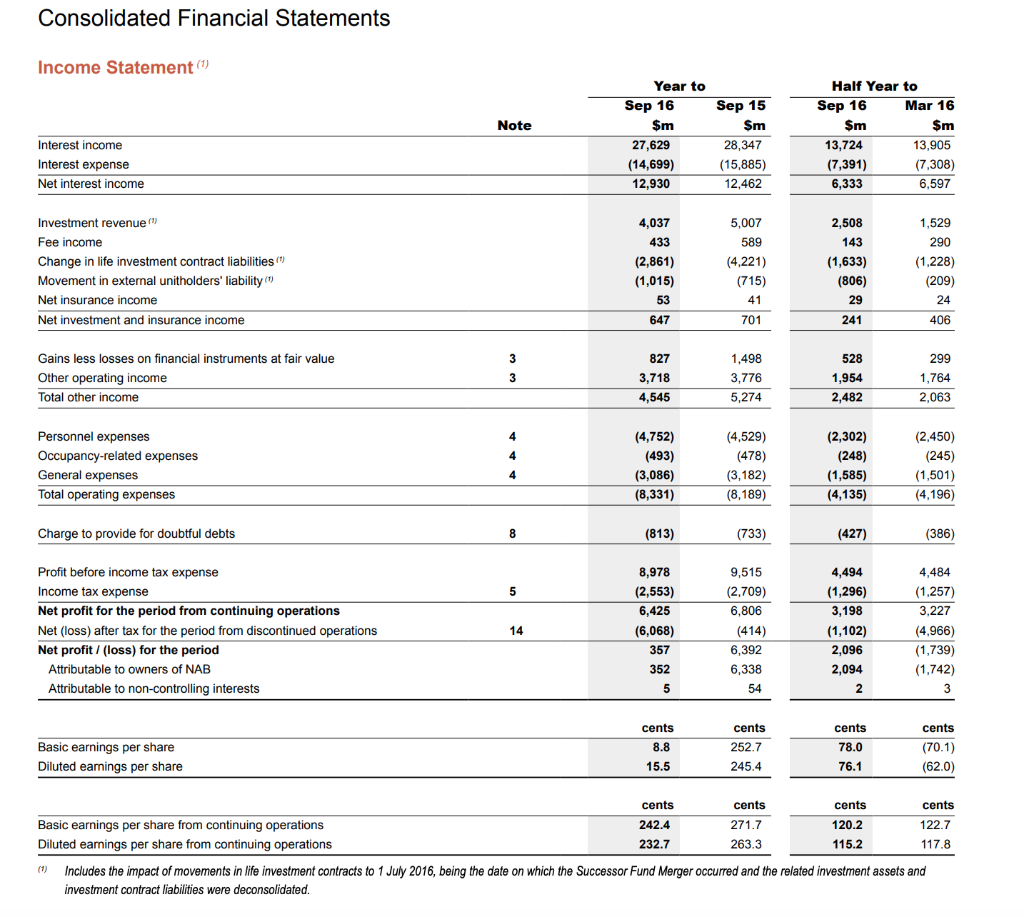

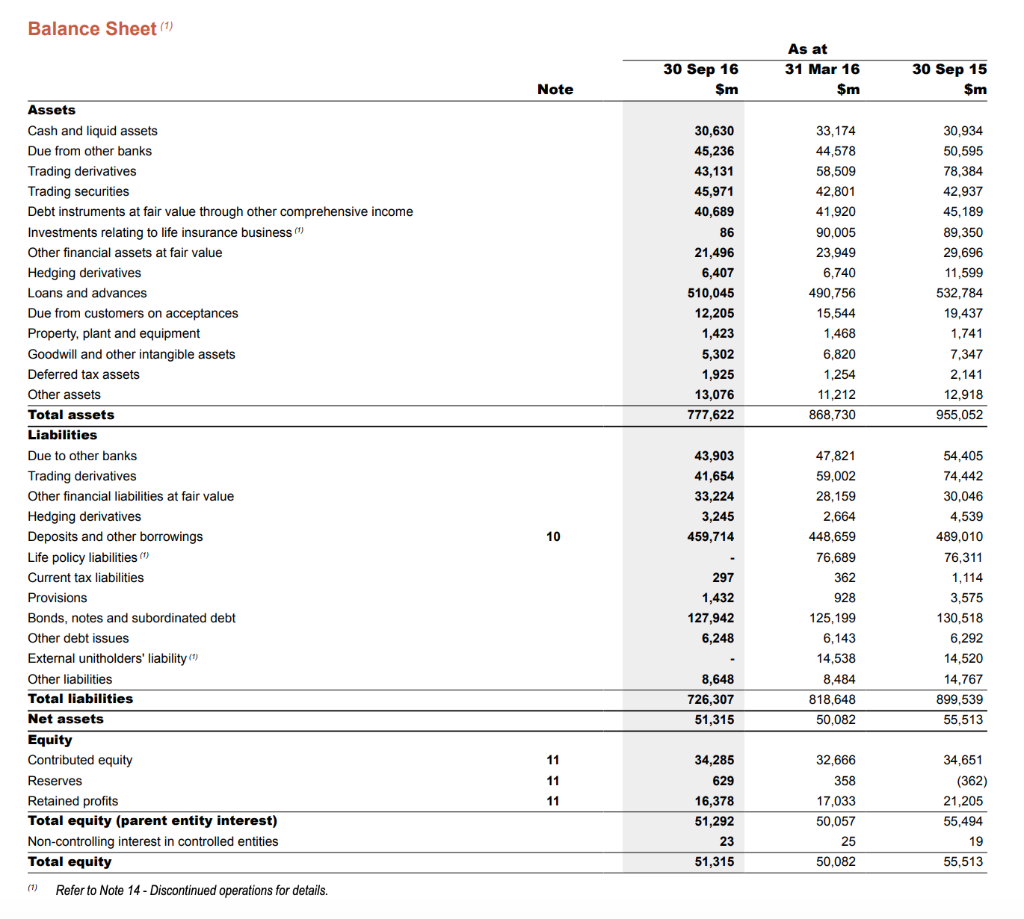

Hi, can you please show working on how you get the ROA from these photos, PLEASE show how you get the net income from the income statement and total assets from the balance sheet

Consolidated Financial Statements Income Statement (1) Note Year to Sep 16 $m 27,629 (14,699) 12,930 Half Year to Sep 16 Mar 16 $m $m 13,724 13,905 (7,391) (7,308) 6,333 6,597 Sep 15 $m 28,347 (15,885) 12,462 Interest income Interest expense Net interest income Investment revenue Fee income Change in life investment contract liabilities Movement in external unitholders' liability Net insurance income Net investment and insurance income 4,037 433 (2,861) (1,015) 5,007 589 (4,221) (715) 2,508 143 (1,633) (806) 1,529 290 (1,228) (209) 53 41 24 647 701 241 406 Gains less losses on financial instruments at fair value Other operating income Total other income 827 3,718 4,545 1,498 3,776 5,274 528 1,954 2,482 299 1,764 2,063 Personnel expenses Occupancy-related expenses General expenses Total operating expenses (4,752) (493) (3,086) (8,331) (4,529) (478) (3,182) (8,189) (2,302) (248) (1,585) (4,135) (2.450) (245) (1,501) (4,196) Charge to provide for doubtful debts (813) (733) (427) (386) Profit before income tax expense Income tax expense Net profit for the period from continuing operations Net (loss) after tax for the period from discontinued operations Net profit / (loss) for the period Attributable to owners of NAB Attributable to non-controlling interests 8,978 (2,553) 6,425 (6,068) 9,515 (2,709) 6,806 (414) 6,392 6,338 54 4,494 (1,296) 3,198 (1,102) 2,096 2,094 4,484 (1,257) 3,227 (4,966) (1,739) (1,742) 357 352 Basic earnings per share Diluted earnings per share cents 8.8 15.5 cents 252.7 245.4 cents 78.0 76.1 cents (70.1) (62.0) cents cents cents 242.4 232.7 271.7 Basic earnings per share from continuing operations Diluted earnings per share from continuing operations cents 120.2 115.2 122.7 263.3 117.8 (9) Includes the impact of movements in life investment contracts to 1 July 2016, being the date on which the Successor Fund Merger occurred and the related investment assets and investment contract liabilities were deconsolidated. Balance Sheet() 30 Sep 16 $m As at 31 Mar 16 $m 30 Sep 15 $m Note 30,630 45,236 43,131 45,971 40,689 86 21,496 6,407 510,045 12,205 1,423 5,302 1,925 13,076 777,622 33,174 44,578 58,509 42,801 41,920 90,005 23,949 6,740 490,756 15,544 1,468 6,820 1,254 11,212 868,730 30,934 50,595 78,384 42,937 45,189 89,350 29,696 11,599 532,784 19,437 1,741 7,347 2,141 12,918 955,052 Assets Cash and liquid assets Due from other banks Trading derivatives Trading securities Debt instruments at fair value through other comprehensive income Investments relating to life insurance business Other financial assets at fair value Hedging derivatives Loans and advances Due from customers on acceptances Property, plant and equipment Goodwill and other intangible assets Deferred tax assets Other assets Total assets Liabilities Due to other banks Trading derivatives Other financial liabilities at fair value Hedging derivatives Deposits and other borrowings Life policy liabilities Current tax liabilities Provisions Bonds, notes and subordinated debt Other debt issues External unitholders' liability") Other liabilities Total liabilities Net assets Equity Contributed equity Reserves Retained profits Total equity (parent entity interest) Non-controlling interest in controlled entities Total equity (1) Refer to Note 14 - Discontinued operations for details. 43,903 41,654 33,224 3,245 459,714 297 1,432 127,942 47,821 59,002 28,159 2,664 448,659 76,689 362 928 125,199 6,143 14,538 8,484 818,648 50,082 54,405 74,442 30,046 4,539 489,010 76,311 1,114 3,575 130,518 6,292 14,520 14,767 899,539 55,513 6,248 8,648 726,307 51,315 34,285 629 16,378 51,292 23 51,315 32,666 358 17,033 50,057 34,651 (362) 21,205 55,494 25 19 50,082 55,513