Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can you pleasw help me with this question ASAP thank you Reuse Files Paragraph 5 Styles Voice Editor Firstly, the banks would like to

hi can you pleasw help me with this question ASAP thank you

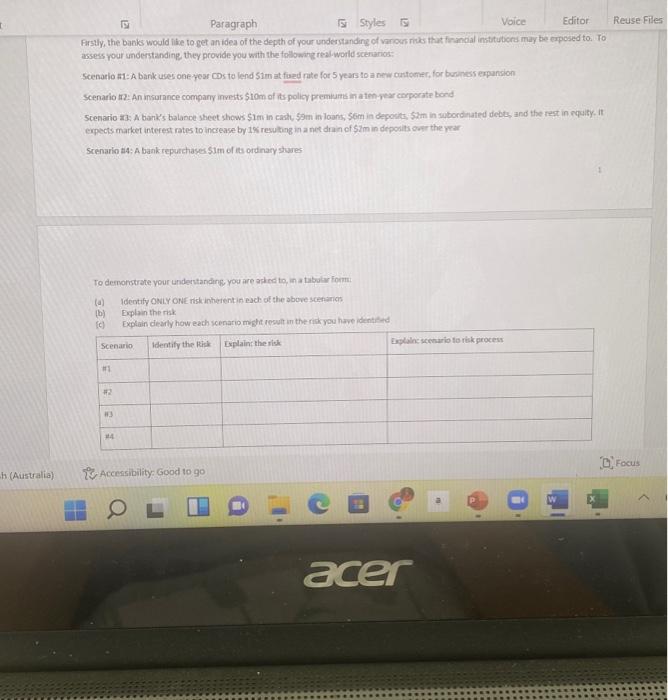

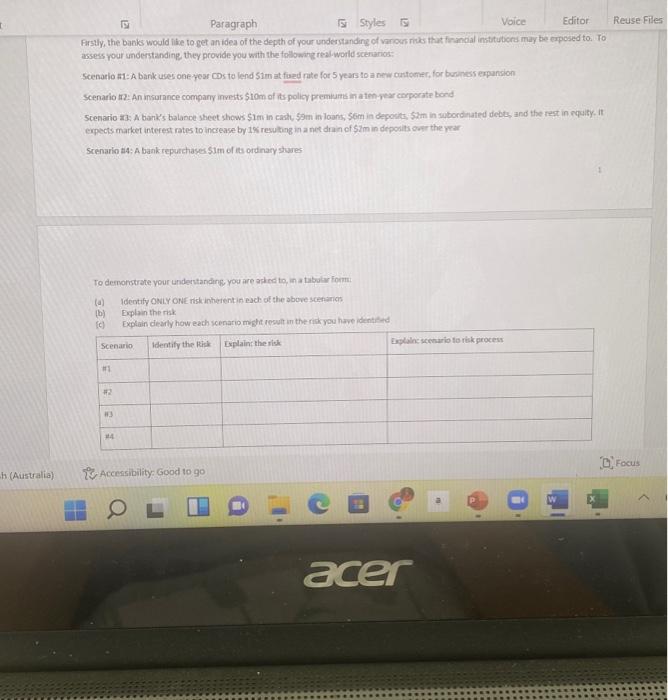

Reuse Files Paragraph 5 Styles Voice Editor Firstly, the banks would like to get an idea of the depth of your understanding of various that financial institutions may be exposed to. To assess your understanding, they provide you with the following real-world scenarios: Scenario #1: A bank uses one year CDs to lend Sim at fed rate for 5 years to a new customer, for business expansion Scenario #2: An Insorance company invests Stom of its polley premiums mato per corporate bond Scenario #3: A bank's balance sheet shows $um in cash, Sam in loans, Som in deposits 52m in subordinated debts, and the rest in equity. It expects market interest rates to increase by 1% resulting in a net drain of $im in deposits over the year Scenario #4 A bank repurchases Sim or its ordinary stores To demonstrate your understanding, you are asked to in tabular form Identify ONLY ONE skinherent in each of the above scenaries b) Explain the Explain dearly how each scenario might result in the risk you have identid Scenario Identify the Explain the risk Explain scenario torisk process #2 Focus h (Australia) Accessibility: Good to go acer Reuse Files Paragraph 5 Styles Voice Editor Firstly, the banks would like to get an idea of the depth of your understanding of various that financial institutions may be exposed to. To assess your understanding, they provide you with the following real-world scenarios: Scenario #1: A bank uses one year CDs to lend Sim at fed rate for 5 years to a new customer, for business expansion Scenario #2: An Insorance company invests Stom of its polley premiums mato per corporate bond Scenario #3: A bank's balance sheet shows $um in cash, Sam in loans, Som in deposits 52m in subordinated debts, and the rest in equity. It expects market interest rates to increase by 1% resulting in a net drain of $im in deposits over the year Scenario #4 A bank repurchases Sim or its ordinary stores To demonstrate your understanding, you are asked to in tabular form Identify ONLY ONE skinherent in each of the above scenaries b) Explain the Explain dearly how each scenario might result in the risk you have identid Scenario Identify the Explain the risk Explain scenario torisk process #2 Focus h (Australia) Accessibility: Good to go acer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started