HI could you please please complete all the requirements

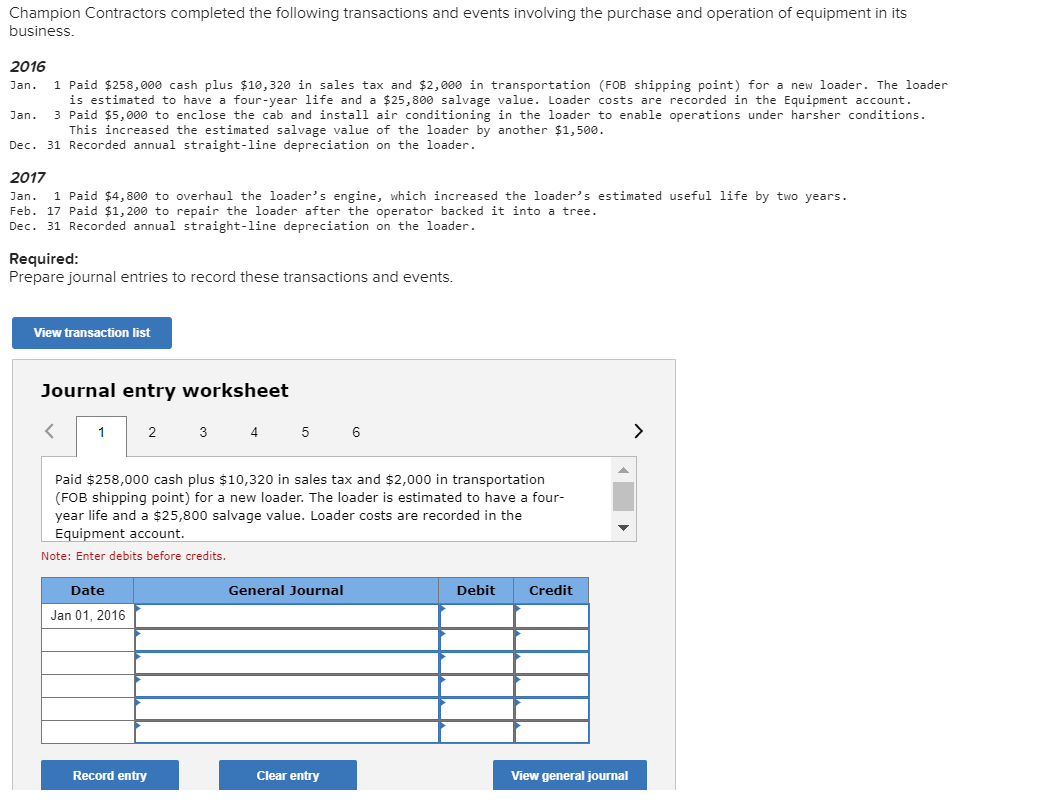

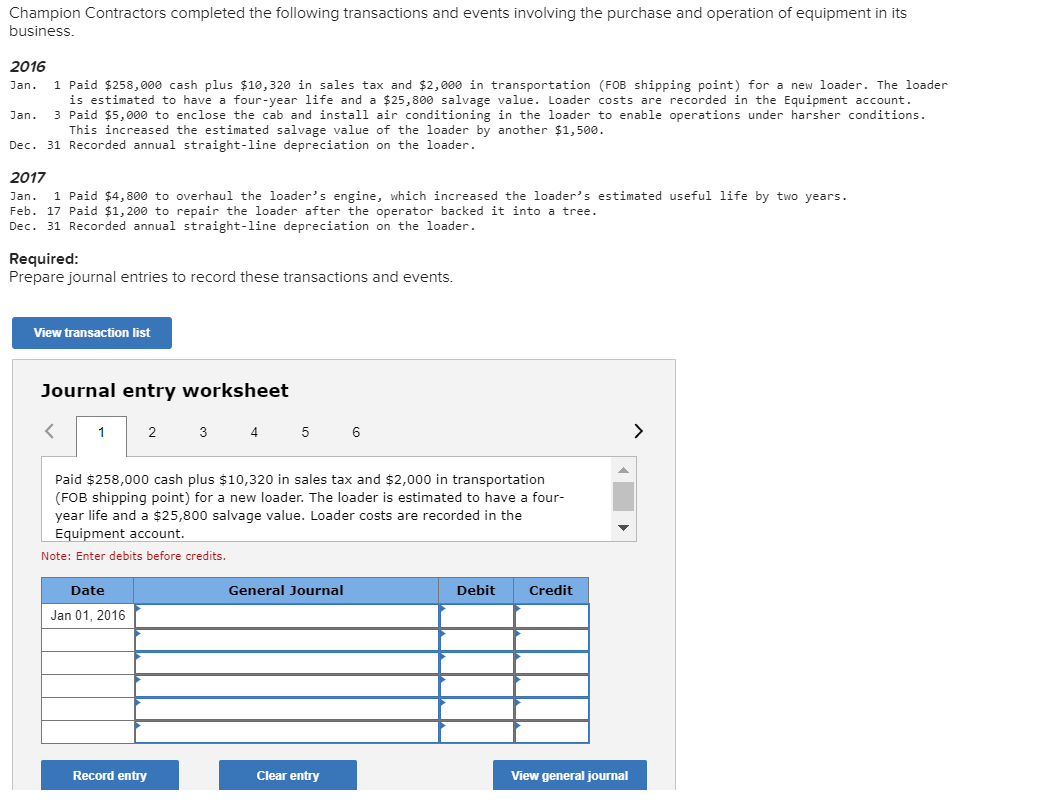

Champion Contractors completed the following transactions and events involving the purchase and operation of equipment in its business 2016 Jan 1 Paid $258,000 cash plus $10, 320 in sales tax and $2,000 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $25,800 salvage value. Loader costs are recorded in the Equipment account. Jan. 3 Paid $5,000 to enclose the cab and install air conditioning in the loader to enable operations under harsher conditions This increased the estimated salvage value of the loader by another $1,500 Dec. 31 Recorded annual straight-line depreciation on the loader. 2017 Jan. 1 Paid $4,800 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. Feb. 17 Paid $1,200 to repair the loader after the operator backed it into a tree Dec. 31 Recorded annual straight-line depreciation on the loader Required Prepare journal entries to record these transactions and events View transaction list Journal entry worksheet 2 4 6 Paid $258,000 cash plus $10,320 in sales tax and $2,000 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four- year life and a $25,800 salvage value. Loader costs are recorded in the Equipment account. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01, 2016 Record entry Clear entry View general journal Champion Contractors completed the following transactions and events involving the purchase and operation of equipment in its business 2016 Jan 1 Paid $258,000 cash plus $10, 320 in sales tax and $2,000 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $25,800 salvage value. Loader costs are recorded in the Equipment account. Jan. 3 Paid $5,000 to enclose the cab and install air conditioning in the loader to enable operations under harsher conditions This increased the estimated salvage value of the loader by another $1,500 Dec. 31 Recorded annual straight-line depreciation on the loader. 2017 Jan. 1 Paid $4,800 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. Feb. 17 Paid $1,200 to repair the loader after the operator backed it into a tree Dec. 31 Recorded annual straight-line depreciation on the loader Required Prepare journal entries to record these transactions and events View transaction list Journal entry worksheet 2 4 6 Paid $258,000 cash plus $10,320 in sales tax and $2,000 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four- year life and a $25,800 salvage value. Loader costs are recorded in the Equipment account. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01, 2016 Record entry Clear entry View general journal