Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, Could you show me how to calculate the NPV and IRR? Thank you in advance! 1) Abe Simpson's Historical Aircraft, Inc. (ASHAI) is considering

Hi, Could you show me how to calculate the NPV and IRR?

Thank you in advance!

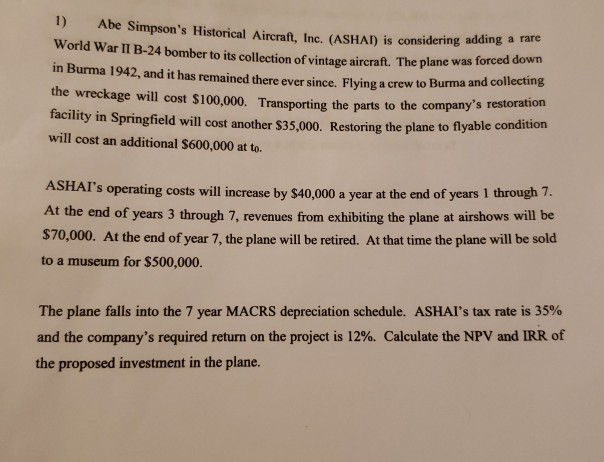

1) Abe Simpson's Historical Aircraft, Inc. (ASHAI) is considering adding World War II B-24 bomber to its collection of vintage aircraft. The plane was forced down in Burma 1942, and it has remained there ever since. Flying a a rare crew to Burma and collecting the wreckage will cost $100,000. Transporting the parts to the company's restoration facility in Springfield will cost another $35,000. Restoring the plane to flyable condition will cost an additional $600,000 at to. ASHAI's operating costs will increase by $40,000 a year at the end of years 1 through 7. At the end of years 3 through 7, revenues from exhibiting the plane at airshows will be $70,000. At the end of year 7, the plane will be retired. At that time the plane will be sold to a museum for $500,000. The plane falls into the 7 year MACRS depreciation schedule. ASHAI's tax rate is 35% and the company's required return on the project is 12%. Calculate the NPV and IRR of the proposed investment in the planeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started