hi,

E10-1, questions 1-10, please. thank you!

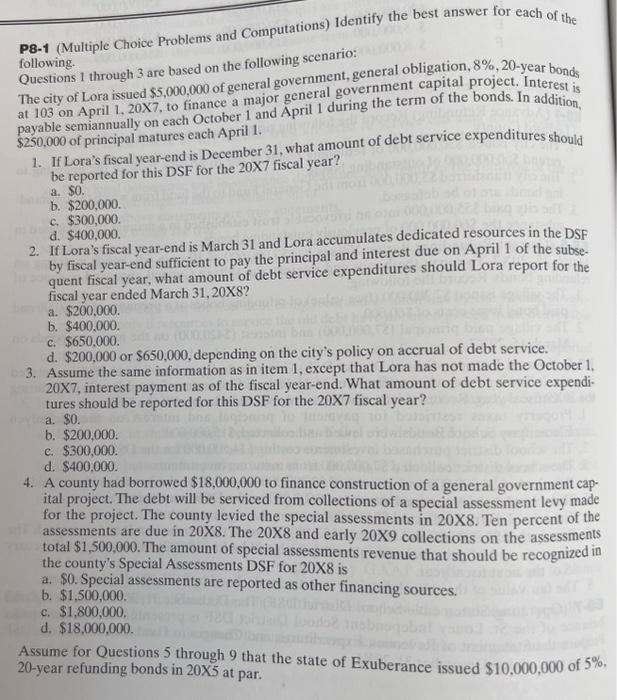

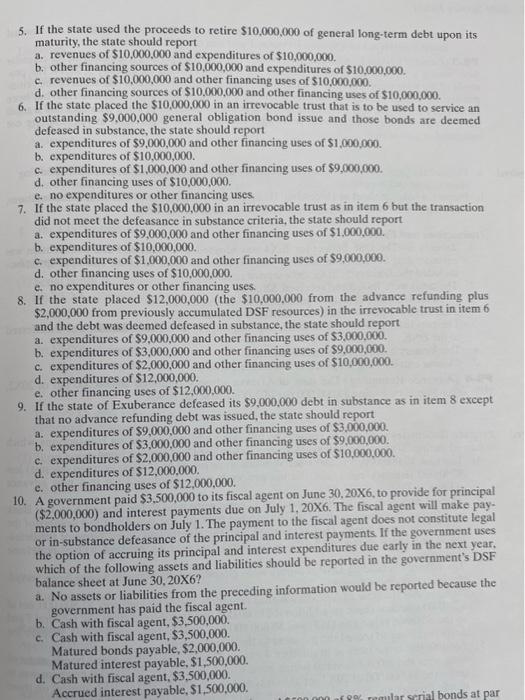

P8-1 (Multiple Choice Problems and Computations) Identify the best answer for each of the Questions 1 through 3 are based on the following scenario: The city of Lora issued $5,000,000 of general government, general obligation, 8\%, 20-year bonds following. at 103 on April 1, 20X7, to finance a major general government capital project. Interest is payable semiannually on each October 1 and April 1 during the term of the bonds. In addition, 1. If Lora's fiscal year-end is December 31 , what amount of debt service expenditures should $250,000 of principal matures each April 1 . be reported for this DSF for the 20X7 fiscal year? a. $0. b. $200,000. c. $300,000 2. If Lora's fiscal year-end is March 31 and Lora accumulates dedicated resources in the DSF d. $400,000. by fiscal year-end sufficient to pay the principal and interest due on April 1 of the subsequent fiscal year, what amount of debt service expenditures should Lora report for the fiscal year ended March 31,20X8 ? a. $200,000. b. $400.000. c. $650,000. d. $200,000 or $650,000, depending on the city's policy on accrual of debt service. 3. Assume the same information as in item 1 , except that Lora has not made the October 1 , 20X7, interest payment as of the fiscal year-end. What amount of debt service expendi. tures should be reported for this DSF for the 20X7 fiscal year? a. $0. b. $200,000. c. $300,000. d. $400,000. 4. A county had borrowed $18,000,000 to finance construction of a general government capital project. The debt will be serviced from collections of a special assessment levy made for the project. The county levied the special assessments in 208. Ten percent of the assessments are due in 208. The 20X8 and early 20X9 collections on the assessments total $1,500,000. The amount of special assessments revenue that should be recognized in the county's Special Assessments DSF for 20X8 is a. \$0. Special assessments are reported as other financing sources. b. $1,500,000. c. $1,800,000. d. $18,000,000. Assume for Questions 5 through 9 that the state of Exuberance issued $10,000,000 of 5%. 20 -year refunding bonds in 205 at par. 5. If the state used the proceeds to retire $10,000,000 of general long-term debt upon its. maturity, the state should report a. revenues of $10,000,000 and expenditures of $10,000,000. b. other financing sources of $10,000,000 and expenditures of $10,000,000. c. revenues of $10,000,000 and other financing uses of $10,000,000. d. other financing sources of $10,000,000 and other financing uses of $10,000,000. 6. If the state placed the $10,000,000 in an irrevocable trust that is to be used to service an outstanding $9,000,000 general obligation bond issue and those bonds are deemed defeased in substance, the state should report a. expenditures of $9,000,000 and other financing uses of $1,000,000. b. expenditures of $10,000,000. c. expenditures of $1,000,000 and other financing uses of $9,000,000. d. other financing uses of $10,000,000. e. no expenditures or other financing uses. 7. If the state placed the $10,000,000 in an irrevocable trust as in item 6 but the transaction did not meet the defeasance in substance criteria, the state should report a. expenditures of $9,000,000 and other financing uses of $1,000,000. b. expenditures of $10,000,000. c. expenditures of $1,000,000 and other financing uses of $9,000,000. d. other financing uses of $10,000,000. e. no expenditures or other financing uses. 8. If the state placed $12,000,000 (the $10,000,000 from the advance refunding plus $2,000,000 from previously accumulated DSF resources) in the irrevocable trust in item 6 and the debt was deemed defeased in substance, the state should report a. expenditures of $9,000,000 and other financing uses of $3,000,000. b. expenditures of $3,000,000 and other financing uses of $9,000,000. c. expenditures of $2,000,000 and other financing uses of $10,000,000. d. expenditures of $12,000,000. e. other financing uses of $12,000,000. 9. If the state of Exuberance defeased its $9,000,000 debt in substance as in item 8 except that no advance refunding debt was issued, the state should report a. expenditures of $9,000,000 and other financing uses of $3,000,000. b. expenditures of $3,000,000 and other financing uses of $9,000,000. c. expenditures of $2,000,000 and other financing uses of $10,000,000. d. expenditures of $12,000,000. e. other financing uses of $12,000,000. 10. A government paid $3.500,000 to its fiscal agent on June 30,20X6, to provide for principal ($2,000,000) and interest payments due on July 1,206. The fiscal agent will make payments to bondholders on July 1 . The payment to the fiscal agent does not constitute legal or in-substance defeasance of the principal and interest payments. If the government uses the option of accruing its principal and interest expenditures due early in the next year. which of the following assets and liabilities should be reported in the government's DSF balance sheet at June 30,20X6 ? a. No assets or liabilities from the preceding information would be reported because the government has paid the fiscal agent. b. Cash with fiscal agent, $3,500,000. c. Cash with fiscal agent, $3,500,000. Matured bonds payable, $2,000,000. Matured interest payable, $1,500,000. d. Cash with fiscal agent, $3,500,000. Accrued interest payable, $1,500,000