hi expert help me answer number 6-10 and ll thank you

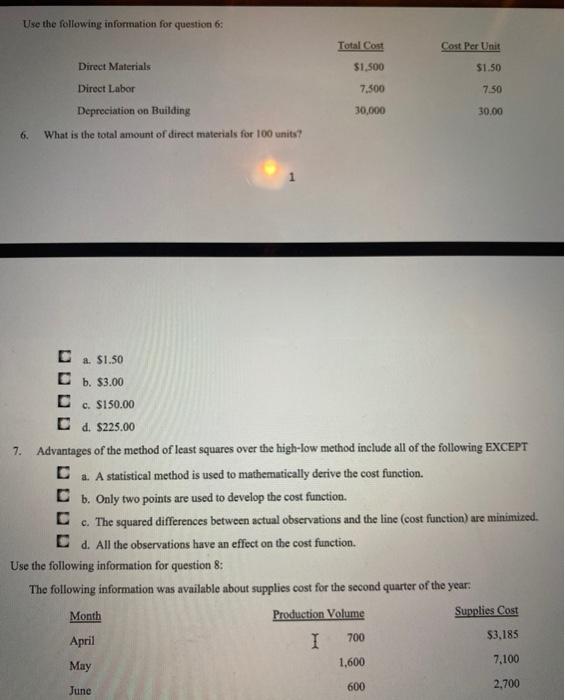

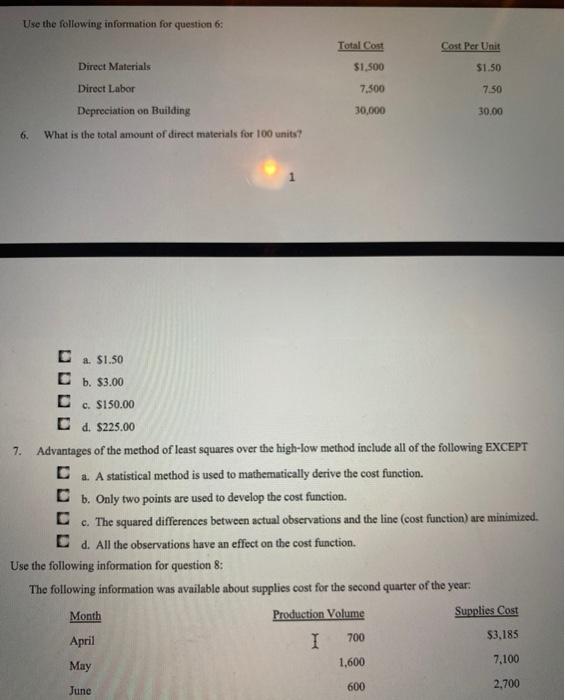

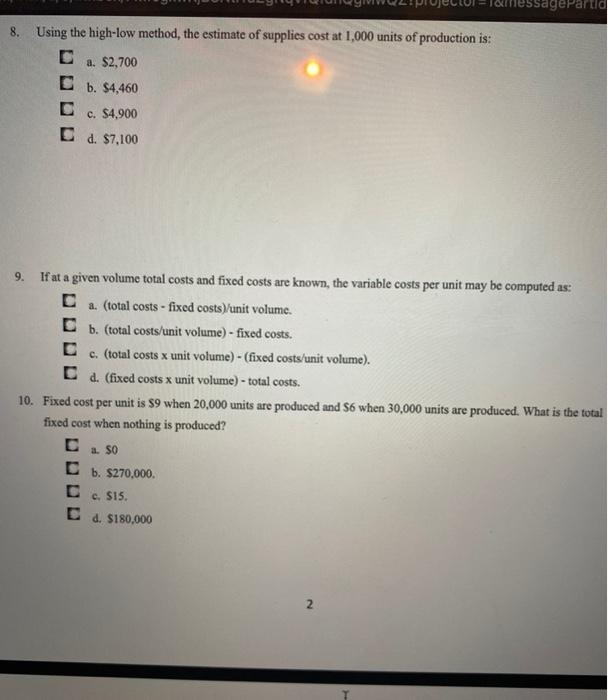

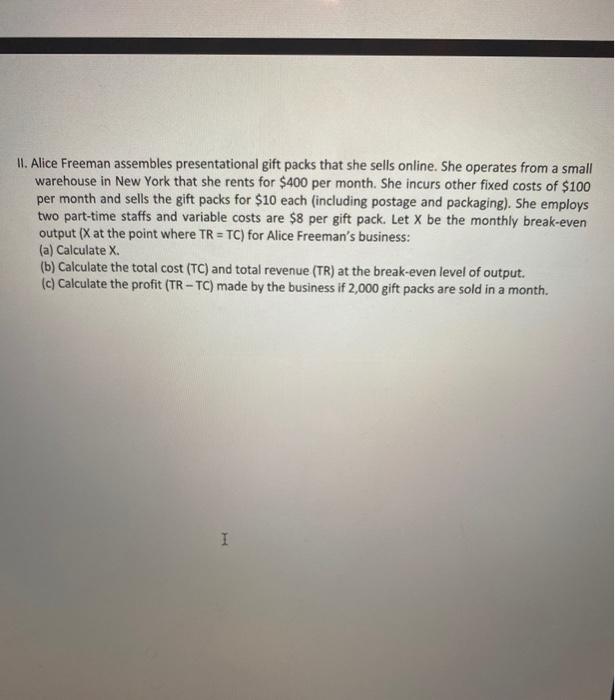

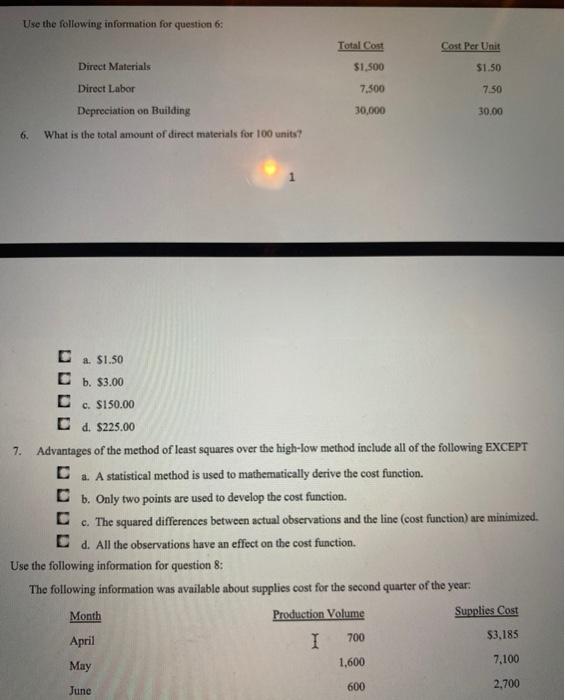

Use the following information for question 6: Total Cost Cost Per Unit $1.500 $1.50 7,500 7.50 Direct Materials Direct Labor Depreciation on Building What is the total amount of direct materials for 100 units? 30,000 30.00 6. a $1.50 D b. $3.00 c. $150.00 D d. $225.00 7. Advantages of the method of least squares over the high-low method include all of the following EXCEPT 1. A statistical method is used to mathematically derive the cost function. b. Only two points are used to develop the cost function. C. The squared differences between actual observations and the line (cost function) are minimized. d. All the observations have an effect on the cost function. Use the following information for question 8: The following information was available about supplies cost for the second quarter of the year: Production Volume Supplies Cost April I May 1,600 7.100 2,700 Month 700 $3.185 June 600 5sagerar 8. Using the high-low method, the estimate of supplies cost at 1,000 units of production is: a. $2,700 b. $4,460 c. $4,900 d. $7,100 9 If at a given volume total costs and fixed costs are known, the variable costs per unit may be computed as: a. (total costs - fixed costs)/unit volume. b. (total costs/unit volume) - fixed costs. c. (total costs x unit volume) - (fixed costs/unit volume). D d. (fixed costs x unit volume) - total costs. 10. Fixed cost per unit is $9 when 20,000 units are produced and S6 when 30,000 units are produced. What is the total fixed cost when nothing is produced? a. SO b. $270,000 c. $15. d. $180,000 2 11. Alice Freeman assembles presentational gift packs that she sells online. She operates from a small warehouse in New York that she rents for $400 per month. She incurs other fixed costs of $100 per month and sells the gift packs for $10 each (including postage and packaging). She employs two part-time staffs and variable costs are $8 per gift pack. Let X be the monthly break-even output (Xat the point where TR = TC) for Alice Freeman's business: (a) Calculate X (b) Calculate the total cost (TC) and total revenue (TR) at the break-even level of output. (c) Calculate the profit (TR-TC) made by the business if 2,000 gift packs are sold in a month