Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi guys, I got wrong answers please help me out finding right anwers! first one - question this one , end of the blank is

Hi guys, I got wrong answers please help me out finding right anwers!

this one , end of the blank is [Total]

this one , end of the blank is [Total]  got wrong numbers of capitals....!

got wrong numbers of capitals....!

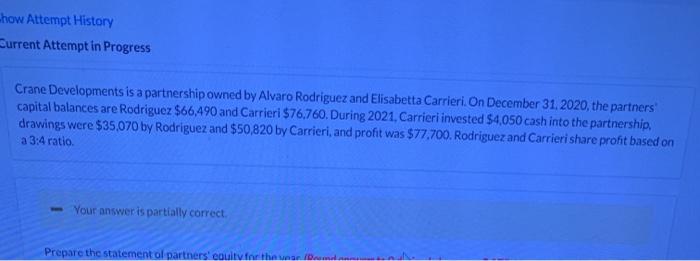

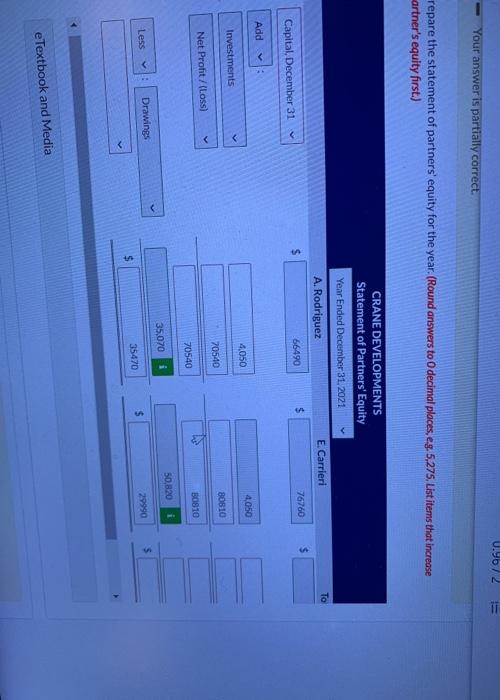

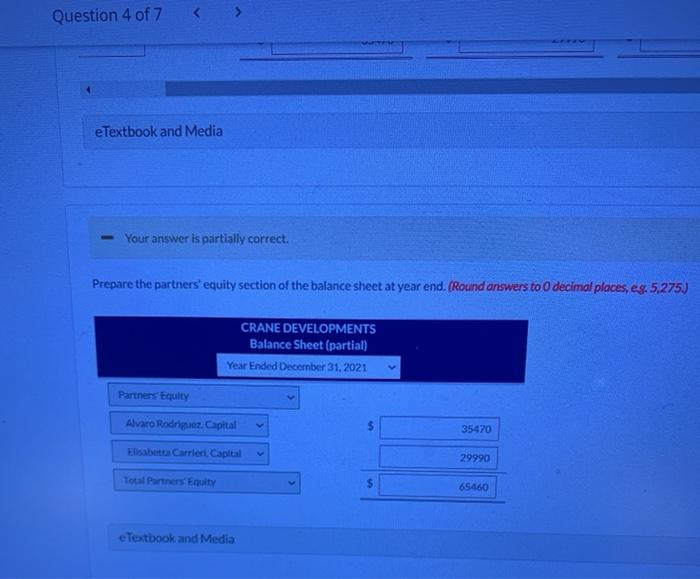

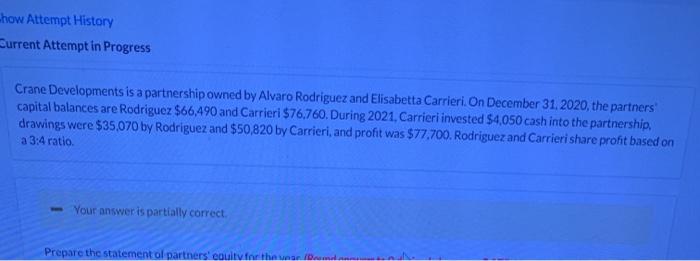

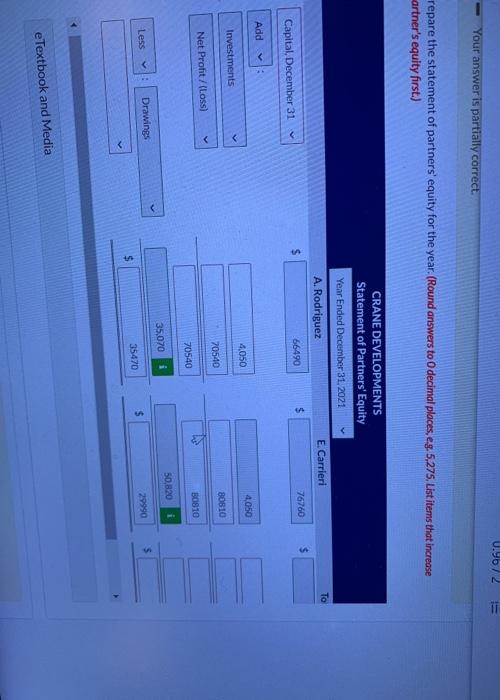

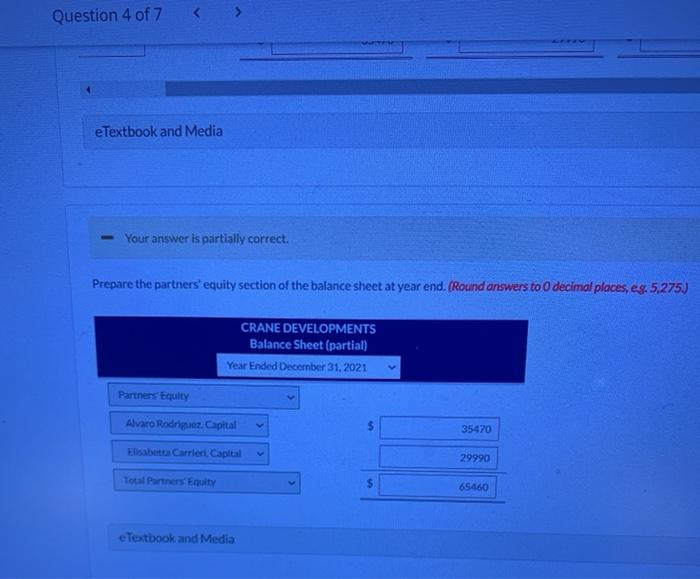

-how Attempt History Current Attempt in Progress Crane Developments is a partnership owned by Alvaro Rodriguez and Elisabetta Carrieri. On December 31, 2020, the partners capital balances are Rodriguez $66,490 and Carrieri $76,760. During 2021, Carrieri invested $4,050 cash into the partnership, drawings were $35.070 by Rodriguez and $50,820 by Carrieri, and profit was $77,700. Rodriguez and Carrieri share profit based on a 3:4 ratio Your answer is partially correct. Prepare the statement of partners' equity for the name 0.96 / 2 !! Your answer is partially correct. repare the statement of partners' equity for the year. (Round answers to O decimal places, eg. 5,275. List items that increase artner's equity first.) CRANE DEVELOPMENTS Statement of Partners' Equity Year Ended December 31, 2021 E Carrieri A. Rodriguez To $ $ $ 66490 76760 Capital, December 31 Add VE 4,050 4,050 Investments B0810 20540 Net Profit/(Loss) 2 B0810 70540 i 50,820 i 35.070 $ Drawings Less $ 29990 $ 35470 e Textbook and Media Question 4 of 7 e Textbook and Media Your answer is partially correct. Prepare the partners' equity section of the balance sheet at year end. (Round answers to 0 decimal places, eg: 5,275.) CRANE DEVELOPMENTS Balance Sheet (partial) Year Ended December 31, 2021 Partners Equity Alvaro Rodriguez, Capital 35470 Elisabetta Carrier Capital 29990 Total Partners' Equity 65460 e Textbook and Media first one - question

this one , end of the blank is [Total]

this one , end of the blank is [Total]need to get an answer as total.

got wrong numbers of capitals....!

got wrong numbers of capitals....!Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started