Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi guys i need a solution for this question especially parts 3 and 4 but i know that can only be solved with the first

hi guys i need a solution for this question especially parts 3 and 4 but i know that can only be solved with the first two parts , any help would be appreciated

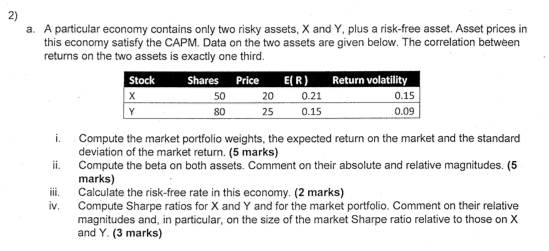

a. A particular economy contains only two risky assets, X and Y, plus a risk-free asset. Asset prices in this economy satisfy the CAPM. Data on the two assets are given below. The correlation between returns on the two assets is exactly one third. Stock Shares Price E(R) Return volatility 50 200 0.15 0.15 0.09 80 25 i. Compute the market portfolio weights, the expected return on the market and the standard deviation of the market return. (5 marks) ii. Compute the beta on both assets. Comment on their absolute and relative magnitudes. (5 marks) iii. Calculate the risk-free rate in this economy. (2 marks) iv, Compute Sharpe ratios for X and Y and for the market portfolio. Comment on their relative magnitudes and, in particular, on the size of the market Sharpe ratio relative to those on X and Y. (3 marks) a. A particular economy contains only two risky assets, X and Y, plus a risk-free asset. Asset prices in this economy satisfy the CAPM. Data on the two assets are given below. The correlation between returns on the two assets is exactly one third. Stock Shares Price E(R) Return volatility 50 200 0.15 0.15 0.09 80 25 i. Compute the market portfolio weights, the expected return on the market and the standard deviation of the market return. (5 marks) ii. Compute the beta on both assets. Comment on their absolute and relative magnitudes. (5 marks) iii. Calculate the risk-free rate in this economy. (2 marks) iv, Compute Sharpe ratios for X and Y and for the market portfolio. Comment on their relative magnitudes and, in particular, on the size of the market Sharpe ratio relative to those on X and Y

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started