Question

Hi! I have a question about sources of funds and cost of capital. In the exercise I have attached, we are supposed to calculate the

Hi!

I have a question about sources of funds and cost of capital.

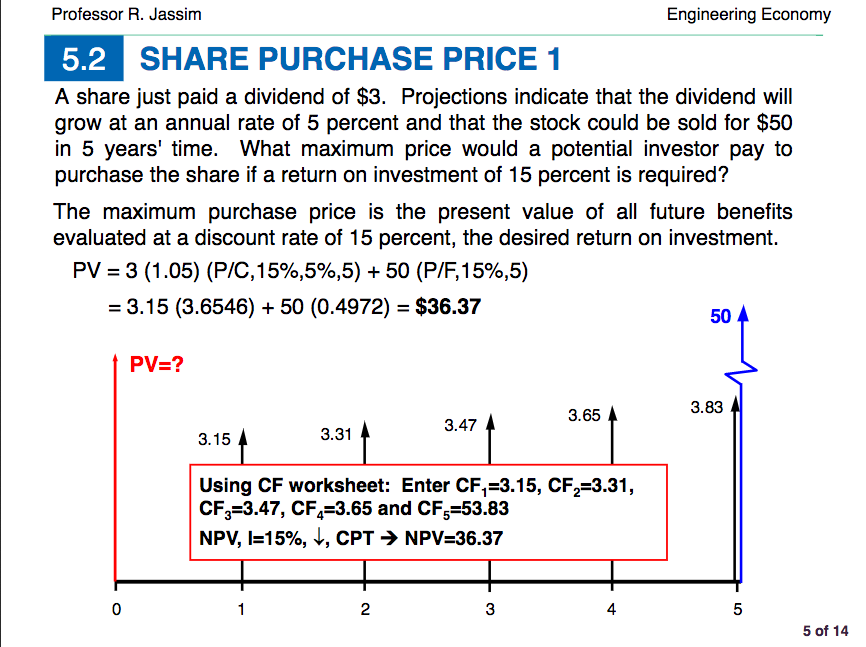

In the exercise I have attached, we are supposed to calculate the present value of common shares growing at a certain rate for 5 years.

I don't understand why in the first term of the calculation, (i.e. PV = 3*(1.05)*(P/C, 15%, 5%, 5), we choose 5 for the value of n. In my mind, the dividend D1 = 3*(1.05) only grows from year 1 to 5, which should be n = 4 instead of n=5.

I tried to do it and found two ways, which are not correct apparently:

- PV = 3 (P/C, 15%, 5%, 5) + other term or

- PV = 3*1.05 (P/C, 15%, 5%, 4)*(P/F, 15%, 1) + other term.

Could you please let me know what is wrong with my reasoning? thanks a lot in advance!

Cece

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started