Answered step by step

Verified Expert Solution

Question

1 Approved Answer

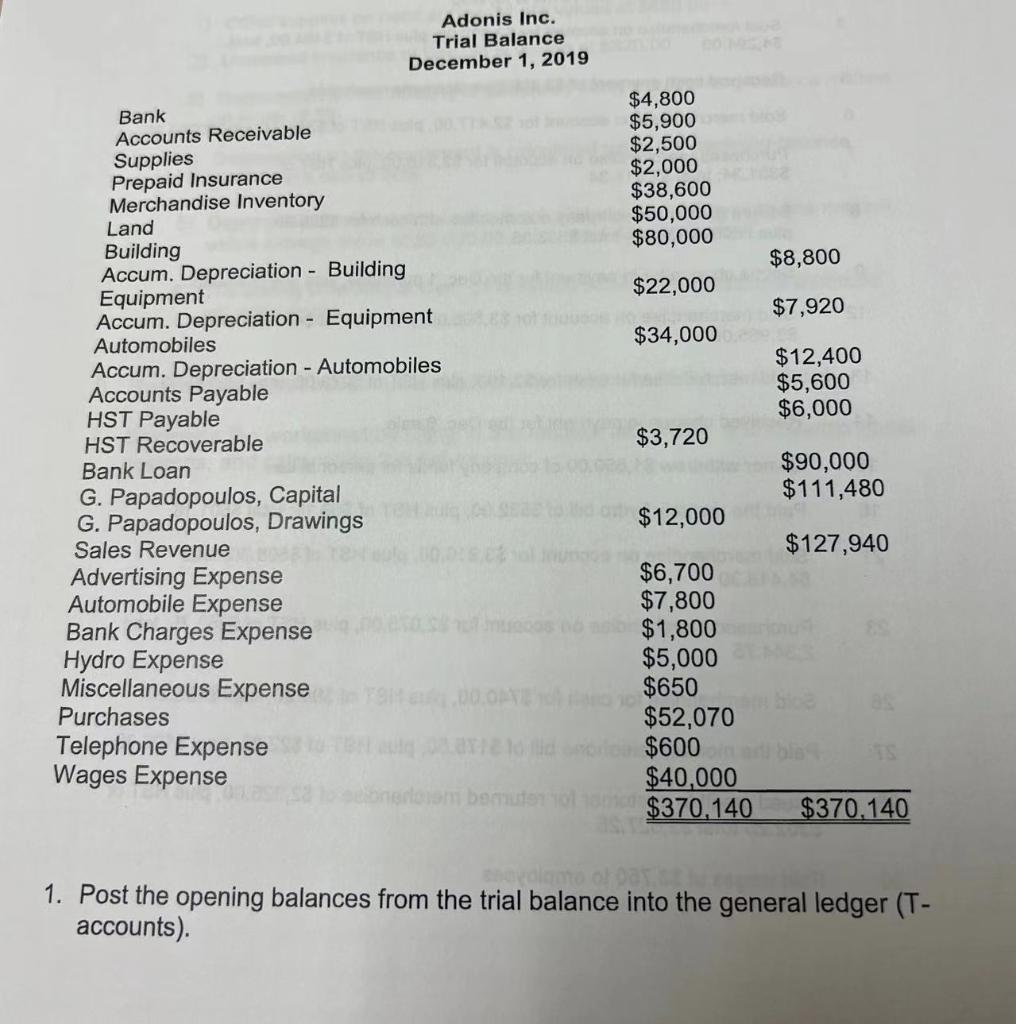

Hi, I just need the answer to questions 3 and 4! Thank you! Adonis Inc. Trial Balance December 1, 2019 $4,800 $5,900 $2,500 $2,000 $38,600

Hi, I just need the answer to questions 3 and 4! Thank you!

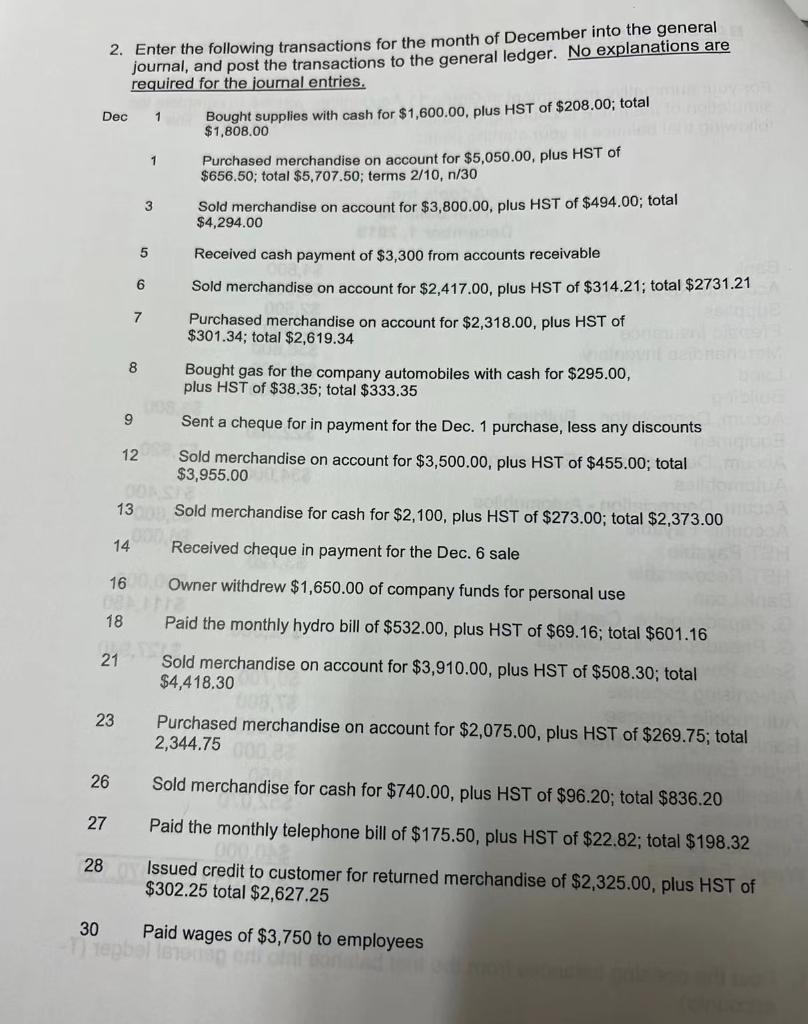

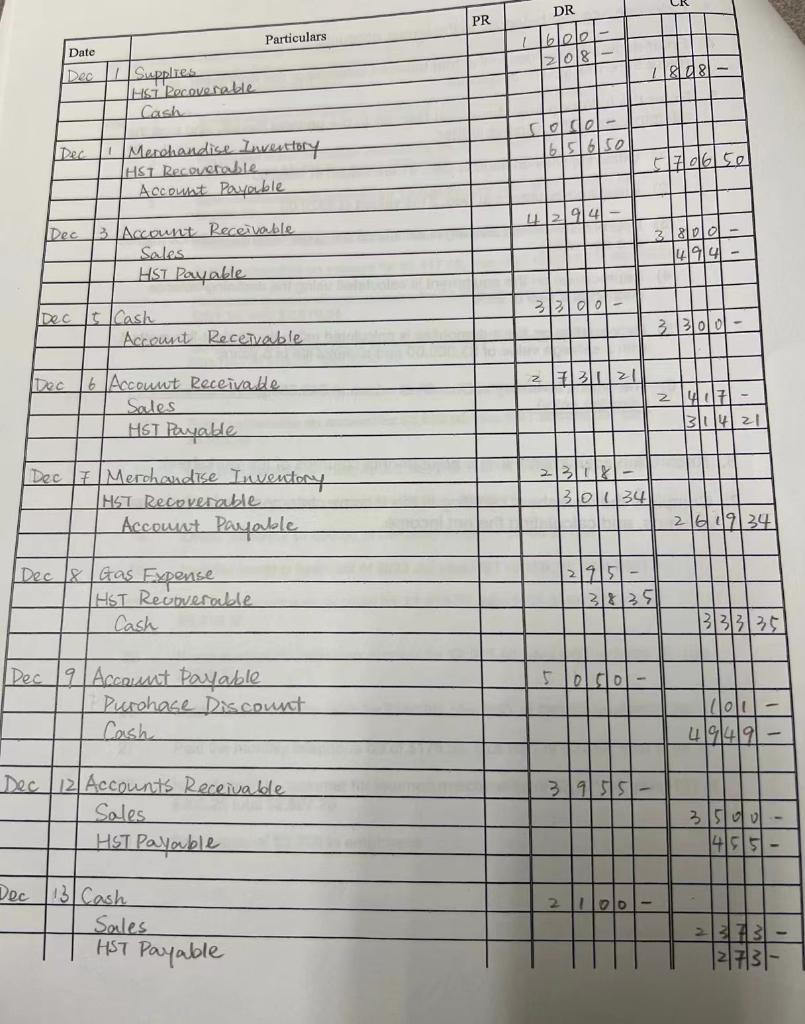

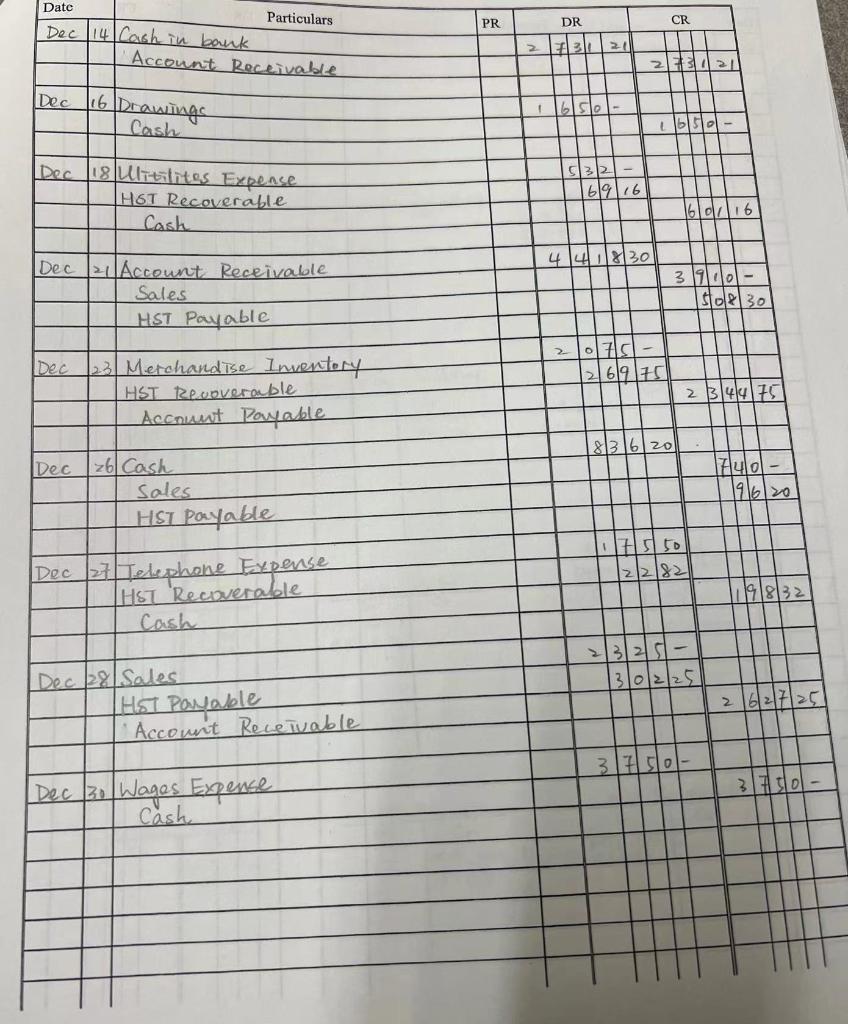

Adonis Inc. Trial Balance December 1, 2019 $4,800 $5,900 $2,500 $2,000 $38,600 $50,000 $80,000 $22,000 $34,000 $3,720 $12,000 $6,700 $7,800 $1,800 $5,000 $650 $52,070 $600 on a bla $40,000 Bank Accounts Receivable Supplies Prepaid Insurance Merchandise Inventory Land Building Accum. Depreciation - Building Equipment Accum. Depreciation - Equipment Automobiles Accum. Depreciation - Automobiles Accounts Payable HST Payable HST Recoverable Bank Loan G. Papadopoulos, Capital G. Papadopoulos, Drawings Sales Revenue Advertising Expense Automobile Expense Bank Charges Expense Hydro Expense Miscellaneous Expense Purchases 00.0PT Telephone Expense Wages Expense nem bemuter 101 1m $370,140 $370.140 soyolame of Day. 1. Post the opening balances from the trial balance into the general ledger (T- accounts). $8,800 $7,920 $12,400 $5,600 $6,000 $90,000 $111,480 $127,940 2. Enter the following transactions for the month of December into the general journal, and post the transactions to the general ledger. No explanations are required for the journal entries. 107 Dec 1 Bought supplies with cash for $1,600.00, plus HST of $208.00; total $1,808.00 Purchased merchandise on account for $5,050.00, plus HST of $656.50; total $5,707.50; terms 2/10, n/30 Sold merchandise on account for $3,800.00, plus HST of $494.00; total $4,294.00 5 Received cash payment of $3,300 from accounts receivable 6 Sold merchandise on account for $2,417.00, plus HST of $314.21; total $2731.21 7 Purchased merchandise on account for $2,318.00, plus HST of $301.34; total $2,619.34 BODE UTM Bought gas for the company automobiles with cash for $295.00, plus HST of $38.35; total $333.35 9 Sent a cheque for in payment for the Dec. 1 purchase, less any discounts 12 Sold merchandise on account for $3,500.00, plus HST of $455.00; total $3,955.00 00%SE holis 1300 Sold merchandise for cash for $2,100, plus HST of $273.00; total $2,373.00 14 Received cheque in payment for the Dec. 6 sale Owner withdrew $1,650.00 of company funds for personal use Paid the monthly hydro bill of $532.00, plus HST of $69.16; total $601.16 Sold merchandise on account for $3,910.00, plus HST of $508.30; total $4,418.30 Purchased merchandise on account for $2,075.00, plus HST of $269.75; total 2,344.75 26 Sold merchandise for cash for $740.00, plus HST of $96.20; total $836.20 27 Paid the monthly telephone bill of $175.50, plus HST of $22.82; total $198.32 Issued credit to customer for returned merchandise of $2,325.00, plus HST of $302.25 total $2,627.25 28 30 Paid wages of $3,750 to employees lenous eni cint 21 8 23 1 16 CREDFIE 18 3 Particulars Supplies HST Recoverable Cash 1 Merchandise Inventory HST Recoverable Account Payable 3 Account Receivable Sales HST Payable It Cash Account Receivable Dec 6 Account Receivable Sales HST Payable Dec 7 Merchandise Inventory HST Recoverable Account Payable Dec & Gas Expense HST Recoverable Cash Dec 9 Account Payable Purchase Discount Cash Dec 12 Accounts Receivable Sales HST Payable Dec 13 Cash Sales HST Payable Date Dec Dec Dec PR DR 50 08 301 34 1808 5706 50 400- 31421 261934 01 4949- 3500 2 373 1351 5050- 3 2 100 N 5- Date Dec Dec 16 Drawings Cash Dec 18 Ulitilites Expense HOT Recoverable Cash Dec 21 Account Receivable Sales HST Payable Dec 23 Merchandise Inventory HST Recoverable Account Payable Dec Sales HST Payable Dec 27 Telephone Expense HST Recoverable Cash Dec 28 Sales HST Payable Account Receivable Dec 30 Wages Expense Cash Particulars Account Receivable 14 Cash in bank 26 Cash PR 2 1 DR 50 21 2 CR 1/61 69 16 4 4 8130 75 2 26975 836 20 175 50 2: 182 32- |3|0|2|25 3750- 16/01/ 16 3910- 508 30 2 3 44 75 A40 19/6 20 8' 2 |6|2| 251 3 to ACCOUNTS Bank Accounts Receivable Supplies Prepaid Insurance Merchandise Inventory Land Building Accum. Deprec. Building Equipment Accum. Deprec. Equipment Automobiles Accum. Deprec. Automobiles Accounts Payable HST Payable HST Recoverable Bank Loan G. Papadopoulos, Capital G. Papadopoulos, Drawings Sales Revenue Sales Returns & Allowances Advertising Expense Automobile Expense Bank Charges Expense Hydro Expense Miscellaneous Expense Purchases Discounts Earned Telephone Expense Wages Expense TRIAL BALANCE DR CR WORKSHEE ADJUSTMENTS DR CR INCOME STATEMENT CR DR DR CR 11 3. Calculate account balances in the ledger accounts. 4. Enter account balances in the trial balance columns of the worksheet, and make sure that you're in balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started