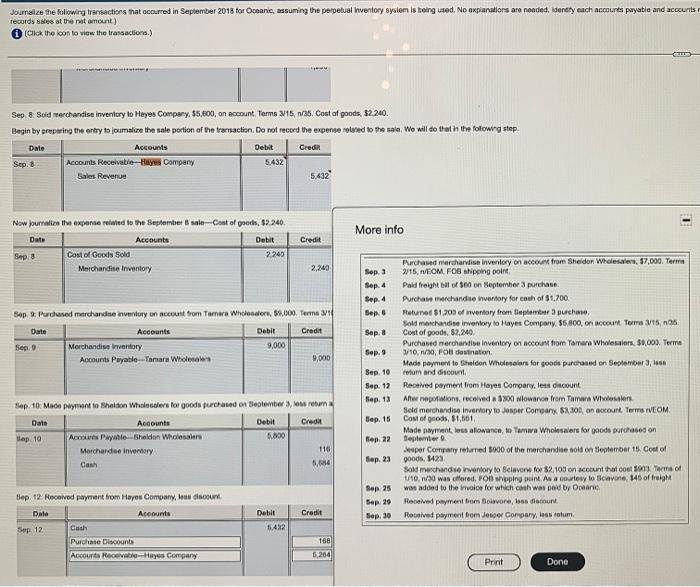

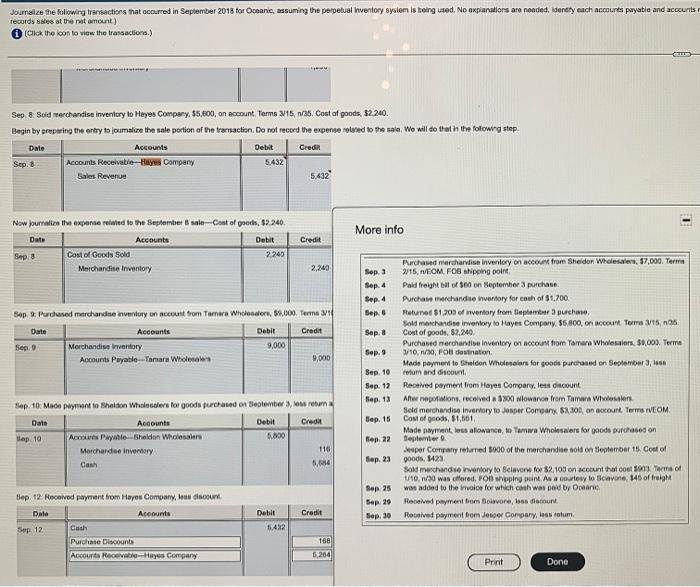

hi, i keep getting the entry for september 12 wrong. thanks!

Journalize the following transactions that occurred in September 2018 for Oceanic, assuming the perpetual Inventory system is being used. No explanations are needed. Identity each accounts payable and accounts records sales at the amount) (Click the icon to view the transactions.) CU Sep 8 Sold merchandise inventory to Hayes Company, $5,600, on account. Terms 215, 1/35. Cost of goods, $2.240. Begin by preparing the entry to jumalize the sale portion of the transaction. Do not record the expense related to the sale. We will do thoth the following step. Date Accounts Detit Credit Sep. 8 Accounts Receivable-Hay Company 5.432 Sales Revenue 5,432 More info Date Debit Credit Now purnalize the expense related to the September sale-Coat of goods, $2.240. Accounts Sep Cost of Goods Sold 2240 Merchandise Inventory 2,240 Sep. a Sep.4 Sep.4 Sep. Debit Sep. 8 Sep Purchased marchandise nventory on account from Tamara Wholesalers, 60,000. Terma Date Accounts Credit Sego Merchandise Inventory 9,000 Accounts Payable. Tomata Wholesale 9,000 Sep. Sep 10 Sep. 12 Sep 13 Purchased merchandise inventory on from Sheldon Wholesalers, 57,000. Terme 2/15, VEOM. FOB shipping point Pald freight of 500 on September purchase Purchase mechandise nventory for each of $1,700 Futuned 1.200 of ventory from September purchase Sold merchandise inventory to Hayes Company 55.000, on count Term 115 Cost of goods. 82.240 Purchased merchandie Inventory on account from Tamara Wholesalers, 38,00), Terme 310,30, FOB destination Made payment to Sheldon Wholesalers for goods purchased on September 3, retum and discount Received payment from Hayes Company, less cincount Aller reportions, received a 300 wlowanvoe from Tamara Wholesalers Seld merchandise invertory to Jesper Company $4,300, an account. Terms VEOM Cost of goods, $1,661 Made wyment boss alowanen, no Tumwa Wholesalers for goods purchased on Deplete Jesper Company returned 1900 of the merchandise sold on September 15. Cost of 9000, 1423 Sold mechando ventory to slavone for $2,100 on account that conso03 Terms of V10.30 was offered, FOB shoping point. As a courtesy to Boavante, 146 of freight was added to the rivale for which canh was paid by Oranie Received payment from Bouvore, hoe dio court Roosived payment from Joser Company loss totum Sep. 15 Sep 10 Mate payment to Shelton Wholesalers for goodo purchased on September 3, es retum Date Accounts Debit Credit Sep 10 Acours Payable-Sheldon Wholesalers 5.000 Merchandise Invertory 116 Cash 0.64 ta Sep. 23 Sep 25 Sep 29 Sep 30 Debit Credit Sep 12 Received payment from Hayes Company, Hraudoune Dale Accounts Sep 12 Cash Purchase Discounts Accounts Receivable-Hayes Company $42 168 5.204 Print Done Journalize the following transactions that occurred in September 2018 for Oceanic, assuming the perpetual Inventory system is being used. No explanations are needed. Identity each accounts payable and accounts records sales at the amount) (Click the icon to view the transactions.) CU Sep 8 Sold merchandise inventory to Hayes Company, $5,600, on account. Terms 215, 1/35. Cost of goods, $2.240. Begin by preparing the entry to jumalize the sale portion of the transaction. Do not record the expense related to the sale. We will do thoth the following step. Date Accounts Detit Credit Sep. 8 Accounts Receivable-Hay Company 5.432 Sales Revenue 5,432 More info Date Debit Credit Now purnalize the expense related to the September sale-Coat of goods, $2.240. Accounts Sep Cost of Goods Sold 2240 Merchandise Inventory 2,240 Sep. a Sep.4 Sep.4 Sep. Debit Sep. 8 Sep Purchased marchandise nventory on account from Tamara Wholesalers, 60,000. Terma Date Accounts Credit Sego Merchandise Inventory 9,000 Accounts Payable. Tomata Wholesale 9,000 Sep. Sep 10 Sep. 12 Sep 13 Purchased merchandise inventory on from Sheldon Wholesalers, 57,000. Terme 2/15, VEOM. FOB shipping point Pald freight of 500 on September purchase Purchase mechandise nventory for each of $1,700 Futuned 1.200 of ventory from September purchase Sold merchandise inventory to Hayes Company 55.000, on count Term 115 Cost of goods. 82.240 Purchased merchandie Inventory on account from Tamara Wholesalers, 38,00), Terme 310,30, FOB destination Made payment to Sheldon Wholesalers for goods purchased on September 3, retum and discount Received payment from Hayes Company, less cincount Aller reportions, received a 300 wlowanvoe from Tamara Wholesalers Seld merchandise invertory to Jesper Company $4,300, an account. Terms VEOM Cost of goods, $1,661 Made wyment boss alowanen, no Tumwa Wholesalers for goods purchased on Deplete Jesper Company returned 1900 of the merchandise sold on September 15. Cost of 9000, 1423 Sold mechando ventory to slavone for $2,100 on account that conso03 Terms of V10.30 was offered, FOB shoping point. As a courtesy to Boavante, 146 of freight was added to the rivale for which canh was paid by Oranie Received payment from Bouvore, hoe dio court Roosived payment from Joser Company loss totum Sep. 15 Sep 10 Mate payment to Shelton Wholesalers for goodo purchased on September 3, es retum Date Accounts Debit Credit Sep 10 Acours Payable-Sheldon Wholesalers 5.000 Merchandise Invertory 116 Cash 0.64 ta Sep. 23 Sep 25 Sep 29 Sep 30 Debit Credit Sep 12 Received payment from Hayes Company, Hraudoune Dale Accounts Sep 12 Cash Purchase Discounts Accounts Receivable-Hayes Company $42 168 5.204 Print Done