Hi I need help on what is the answer to this problems? Below is the question and other concerns will be in the comment section. I hope you can help me and surely I will give you full positive feedback

1.

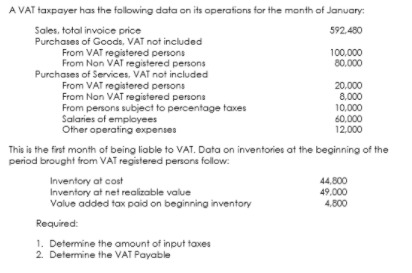

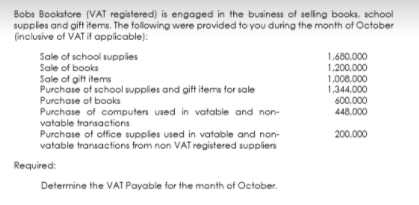

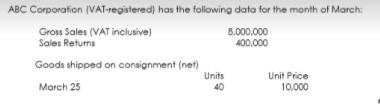

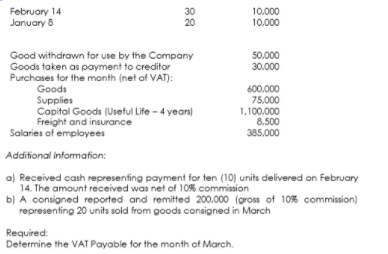

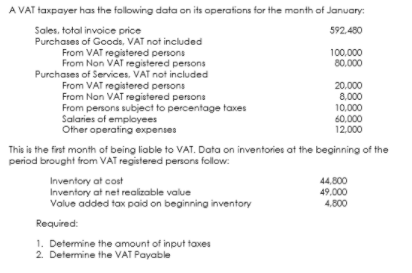

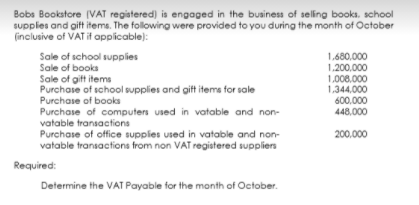

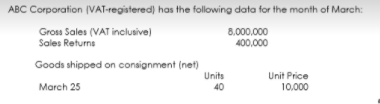

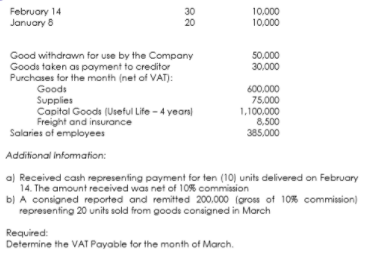

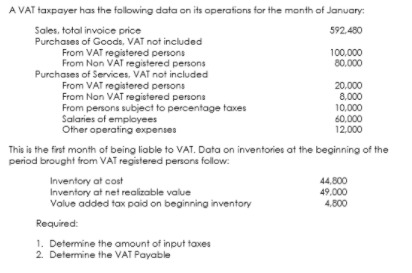

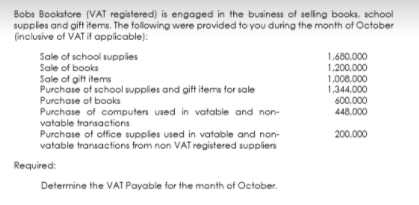

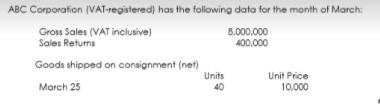

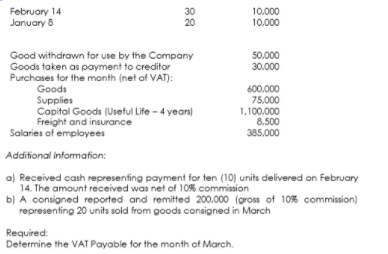

A VAT taxpayer has the following data on its operations for the month of January: Sales, total invoice price 592,450 Purchases of Goods, VAT not included From VAT registered persons 100,000 From Non VAT registered persons 80,000 Purchases of Services, VAT not included From VAT registered persons 20,000 From Non VAT registered persons 8,000 From persons subject to percentage taxes 10,000 Salaries of employees 60,000 Other operating expenses 12,000 This is the first month of being liable to VAT. Data on inventories at the beginning of the period brought from VAT registered persons follow: Inventory at cost 44,800 Inventory at net realizable value 49.000 Value added tax paid on beginning inventory 4,800 Required: 1. Determine the amount of input taxes 2. Determine the VAT PayableBobs Bookstore [VAT repatered) is engaged in the business of selling books, school supplies and gift items. The following were provided to you during the month of October (inclusive of VAT if applicable]: Sale of school supplies 1,680,000 Sale of books 1.200,000 Sale of gift items 1.008,000 Purchase of school supplies and gift items for sale 1,344,000 Purchase of books 600,000 Purchase of computers used in votable and non- 448,000 vatable transactions Purchase of office supplies used in vatable and non- 200,000 vatable transactions from non VAT registered supplien Required: Determine the VAT Payable for the month of October.ABC Corporation (VAT-recatered) has the following data for the month of March: Grow Sales (VAT inclusive] 8/000,000 Sales Returns 400,000 Goods shipped on consignment (net) Units Unit Price March 25 40 10/000February 14 30 10.000 January 5 20 10/000 Good withdrawn for use by the Company 50.000 Goods taken as payment to creditor 30/000 Purchases for the month (net of VAT): Goods 600,000 Supplies 75,000 Capital Goods (Useful Life - 4 years) 1,100,000 Freight and insurance 8.500 Salaries of employees 385,000 Additional Information: al Received cash representing payment for ten (10) units delivered on February 14. The amount received was net of 10% commission bj A consigned reported and remitted 200,000 [gross of 10% commission) representing 20 units sold from goods consigned in March Required: Determine the VAT Payable for the month of March