Question

Hi! I need help with this homework problem, please answer all parts of question. Especially, how did Zebra come to the number of $424,200 for

Hi! I need help with this homework problem, please answer all parts of question. Especially, how did Zebra come to the number of $424,200 for the Investment in Hippo account?

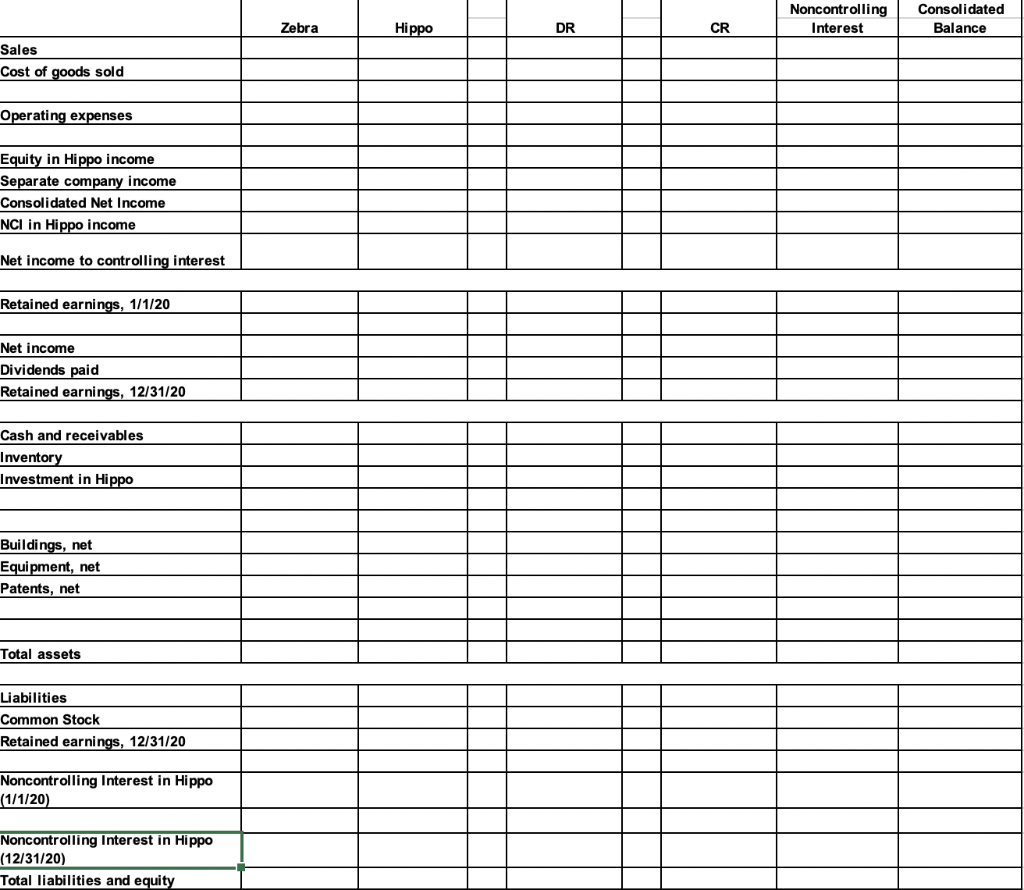

2. Transfer the financial statement information above for Zebra and Hippo to the first two blank columns of the worksheet. The 4th and 6th columns (narrow ones) of the worksheet are for the consolidation entry identification letter (S, A, I, D, E, etc.). The 5th (DR) and 7th (CR) columns are for the consolidation entry dollar amounts. The 8th column is for Noncontrolling Interest numbers where appropriate. The 9th column (last one) is for consolidation totals.

3. Determine and fill in the amounts to be reported in the Noncontrolling Interest and Consolidated Balances columns based on your consolidation entries and preliminary calculations. Some accounts may not be listed on the worksheet. You will need to supply an appropriate name.

4. Hint: When *G arises from an upstream transfer, make that entry first on the consolidation worksheet. Then the amount in entry S for that same account is whatever remains in that account after adjusting for *G.

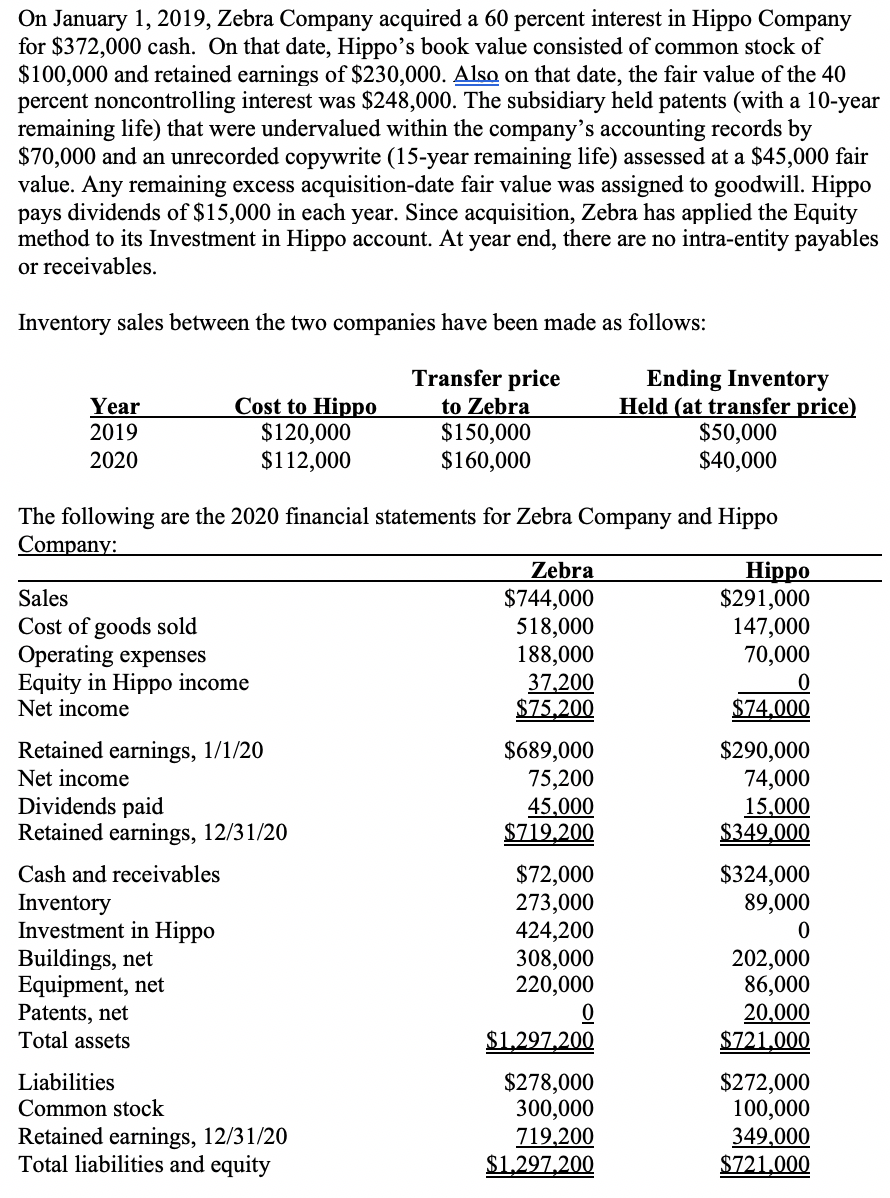

On January 1, 2019, Zebra Company acquired a 60 percent interest in Hippo Company for $372,000 cash. On that date, Hippo's book value consisted of common stock of $100,000 and retained earnings of $230,000. Also on that date, the fair value of the 40 percent noncontrolling interest was $248,000. The subsidiary held patents (with a 10-year remaining life) that were undervalued within the company's accounting records by $70,000 and an unrecorded copywrite (15-year remaining life) assessed at a $45,000 fair value. Any remaining excess acquisition-date fair value was assigned to goodwill. Hippo pays dividends of $15,000 in each year. Since acquisition, Zebra has applied the Equity method to its Investment in Hippo account. At year end, there are no intra-entity payables or receivables. Inventory sales between the two companies have been made as follows: Year 2019 2020 Cost to Hippo $120,000 $112,000 Transfer price to Zebra $150,000 $160,000 Ending Inventory Held (at transfer price) $50,000 $40,000 The following are the 2020 financial statements for Zebra Company and Hippo Company: Zebra $744,000 518,000 188,000 37,200 $75.200 Hippo $291,000 147,000 70,000 Sales Cost of goods sold Operating expenses Equity in Hippo income Net income Retained earnings, 1/1/20 Net income Dividends paid Retained earnings, 12/31/20 $689,000 75,200 45,000 $719,200 $74,000 $290,000 74,000 15,000 $349.000 Cash and receivables Inventory Investment in Hippo Buildings, net Equipment, net Patents, net Total assets $72,000 273,000 424,200 308,000 220,000 $324,000 89,000 0 202,000 86,000 20,000 $721.000 Liabilities Common stock Retained earnings, 12/31/20 Total liabilities and equity $1.297,200 $278,000 300,000 719,200 $1.297,200 $272,000 100,000 349,000 $721,000 Noncontrolling Interest Consolidated Balance Zebra Hippo Sales Cost of goods sold Operating expenses Equity in Hippo income Separate company income Consolidated Net Income NCI in Hippo income Net income to controlling interest Retained earnings, 1/1/20 Net income Dividends paid Retained earnings, 12/31/20 Cash and receivables Inventory Investment in Hippo Buildings, net Equipment, net Patents, net Total assets Liabilities Common Stock Retained earnings, 12/31/20 Noncontrolling Interest in Hippo (1/1/20) Noncontrolling Interest in Hippo (12/31/20) Total liabilities and equity On January 1, 2019, Zebra Company acquired a 60 percent interest in Hippo Company for $372,000 cash. On that date, Hippo's book value consisted of common stock of $100,000 and retained earnings of $230,000. Also on that date, the fair value of the 40 percent noncontrolling interest was $248,000. The subsidiary held patents (with a 10-year remaining life) that were undervalued within the company's accounting records by $70,000 and an unrecorded copywrite (15-year remaining life) assessed at a $45,000 fair value. Any remaining excess acquisition-date fair value was assigned to goodwill. Hippo pays dividends of $15,000 in each year. Since acquisition, Zebra has applied the Equity method to its Investment in Hippo account. At year end, there are no intra-entity payables or receivables. Inventory sales between the two companies have been made as follows: Year 2019 2020 Cost to Hippo $120,000 $112,000 Transfer price to Zebra $150,000 $160,000 Ending Inventory Held (at transfer price) $50,000 $40,000 The following are the 2020 financial statements for Zebra Company and Hippo Company: Zebra $744,000 518,000 188,000 37,200 $75.200 Hippo $291,000 147,000 70,000 Sales Cost of goods sold Operating expenses Equity in Hippo income Net income Retained earnings, 1/1/20 Net income Dividends paid Retained earnings, 12/31/20 $689,000 75,200 45,000 $719,200 $74,000 $290,000 74,000 15,000 $349.000 Cash and receivables Inventory Investment in Hippo Buildings, net Equipment, net Patents, net Total assets $72,000 273,000 424,200 308,000 220,000 $324,000 89,000 0 202,000 86,000 20,000 $721.000 Liabilities Common stock Retained earnings, 12/31/20 Total liabilities and equity $1.297,200 $278,000 300,000 719,200 $1.297,200 $272,000 100,000 349,000 $721,000 Noncontrolling Interest Consolidated Balance Zebra Hippo Sales Cost of goods sold Operating expenses Equity in Hippo income Separate company income Consolidated Net Income NCI in Hippo income Net income to controlling interest Retained earnings, 1/1/20 Net income Dividends paid Retained earnings, 12/31/20 Cash and receivables Inventory Investment in Hippo Buildings, net Equipment, net Patents, net Total assets Liabilities Common Stock Retained earnings, 12/31/20 Noncontrolling Interest in Hippo (1/1/20) Noncontrolling Interest in Hippo (12/31/20) Total liabilities and equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started