Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, i need the complete answer for all the requierments please, please answer this question correctly and completely. thanks. Assume that Quick Meal Canada, famous

hi, i need the complete answer for all the requierments please, please answer this question correctly and completely. thanks.

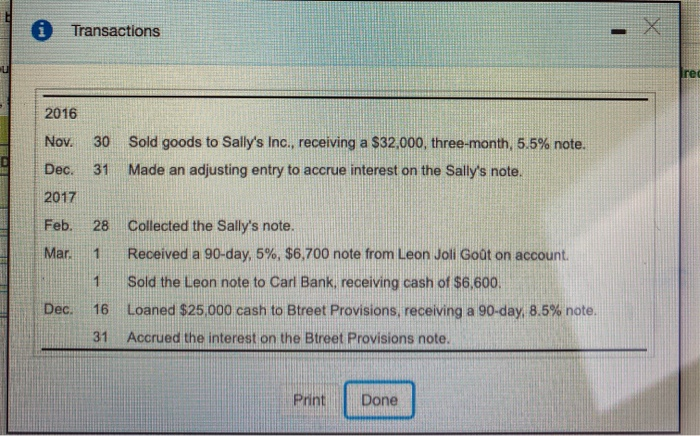

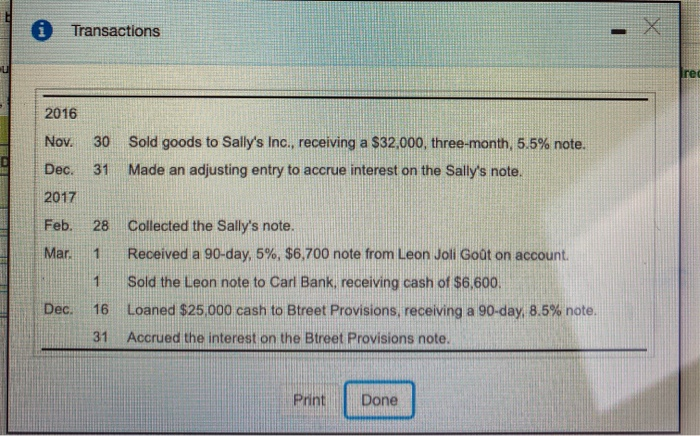

Assume that Quick Meal Canada, famous for Cheerios, Chex snacks, and Yoplait yogurt, completed the following selected transactions: Click the icon to see the transactions.) Requirements 1. Record the transactions in Quick Meal's journal. Round interest amounts to the nearest dollar. Explanations are not required. 2. Show what Quick Meals will report on its comparative classified balance sheet at December 31, 2016, and December 31, 2017 Requirement 1. Record the transactions in Quick Meal's journal. Round interest amounts to the nearest dollar. (Record debits first, then credits. Explanations are not required.) Nov 30. Sold goods to Sally's Inc., receiving a $32,000, three month, 5.5% note. Journal Entry Date Accounts Debit Credit 2016 Nov 30 0 Transactions 2016 Nov. 30 Sold goods to Sally's Inc., receiving a $32,000, three-month, 5.5% note. 31 Made an adjusting entry to accrue interest on the Sally's note. Dec. 2017 Feb. 28 Mar. 1 1 Collected the Sally's note. Received a 90-day, 5%, $6,700 note from Leon Joli Gout on account. Sold the Leon note to Carl Bank, receiving cash of $6,600. Loaned $25,000 cash to Btreet Provisions, receiving a 90-day, 8.5% note. Accrued the interest on the Btreet Provisions note. Dec. 16 31 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started