Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I want 4 of these answers done as someone didn't do it as Cheggs rules. In each question 4 questions can be answered. Thank

Hi, I want 4 of these answers done as someone didn't do it as Cheggs rules. In each question 4 questions can be answered. Thank you

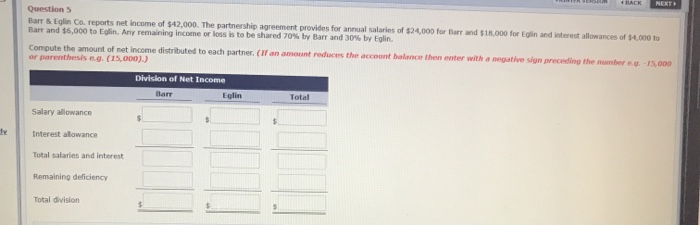

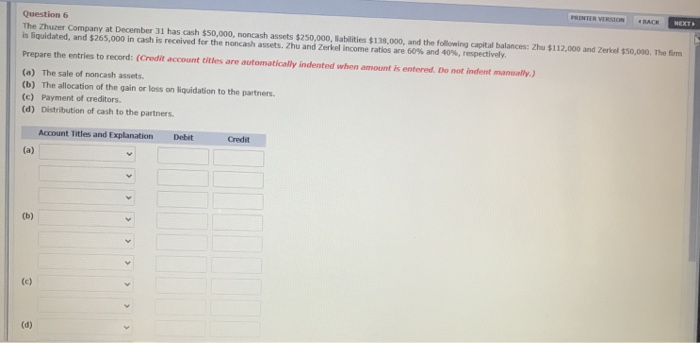

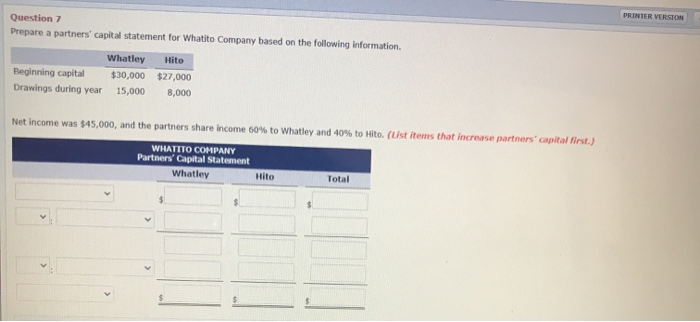

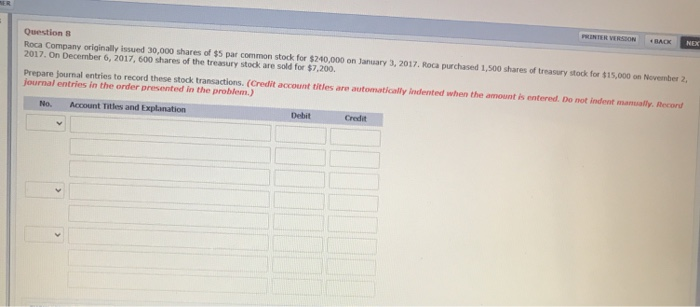

4 HER NEXT Questions Barr & Eglin Co. reports net income of $42,000. The partnership agreement provides for annual salaries of $24,000 for Barr and $18,000 for Egin and interest allowances of $4,000 to Barr and $5,000 to Eolin. Any remaining income or loss is to be shared 70%. by Barr and 30% by Eglin. Compute the amount of net income distributed to each partner. (If an amount reduces the account balance then enter with a negative sign preceding the number ..-15.000 or parenthesis .. (15,000).) Division of Net Income Harr Eglin Total Salary allowance he Interest allowance Total salaries and interest Remaining deficiency Total division NEXT PRINTER VERSION BACK Question 6 The Zhuzer Company at December 31 has cash $50,000, noncash assets $250,000, Sabities $135,000, and the following capital balances: Zhu $112,000 and Zerkel $50,000. The firm is liquidated, and $265,000 in cash is received for the noncash assets. Zhu and Zerbal income ratios are 60% and 40%, respectively. Prepare the entries to record: (Credit account titles are automatically indented when amount is entered. Do not indent manually) (a) The sale of noncash assets. (b) The allocation of the gain or loss on liquidation to the partners (c) Payment of creditors (d) Distribution of cash to the partners. Account Titles and Explanation (a) Debit Credit > (c) (d) PRINTER VERSION Question 7 Prepare a partners' capital statement for Whatito Company based on the following information. Whatley Hito Beginning capital $30,000 $27,000 Drawings during year 15,000 8,000 Net Income was $45,000, and the partners share income 60% to Whatley and 40% to Hito. (List items that increase partners' capital first.) WHATITO COMPANY Partners' Capital Statement Whatley Hito Total FR PRINTER VERSION HACK NEX Questions Roca Company originally issued 30,000 shares of $5 par common stock for $240,000 on January 3, 2017. Roca purchased 1,500 shares of treasury stock for $15,000 on November 2, 2017. On December 6, 2017, 600 shares of the treasury stock are sold for $7.200. Prepare journal entries to record these stock transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) No. Account Titles and Explanation Debit Credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started