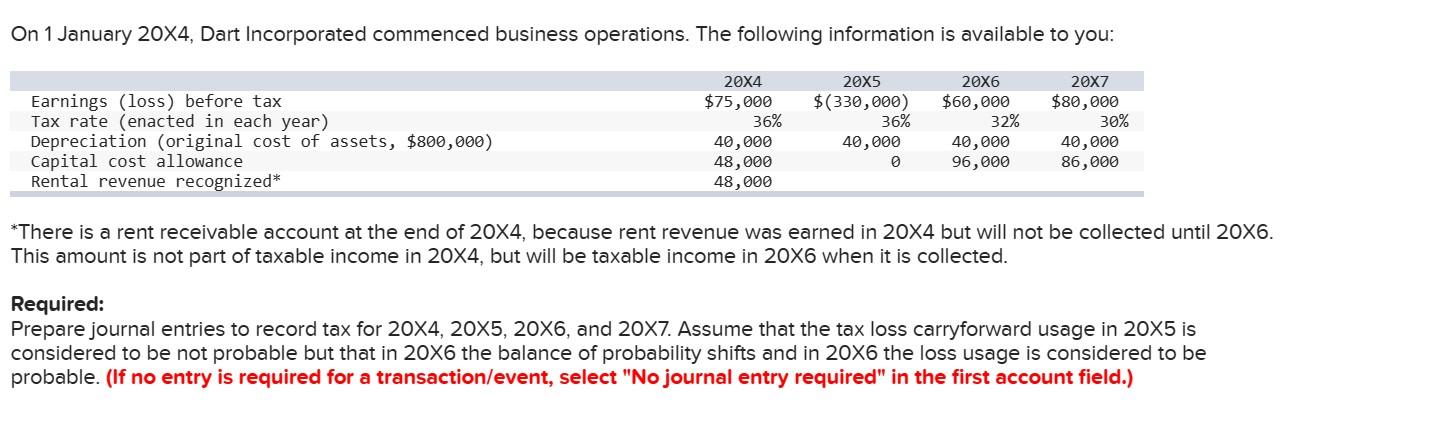

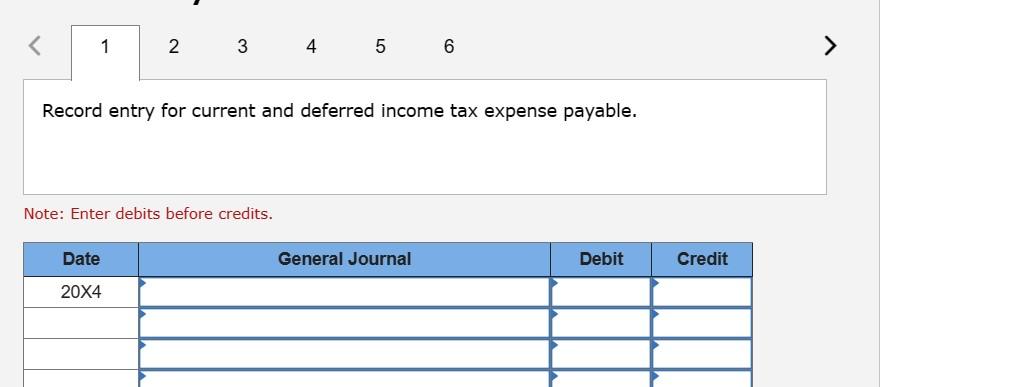

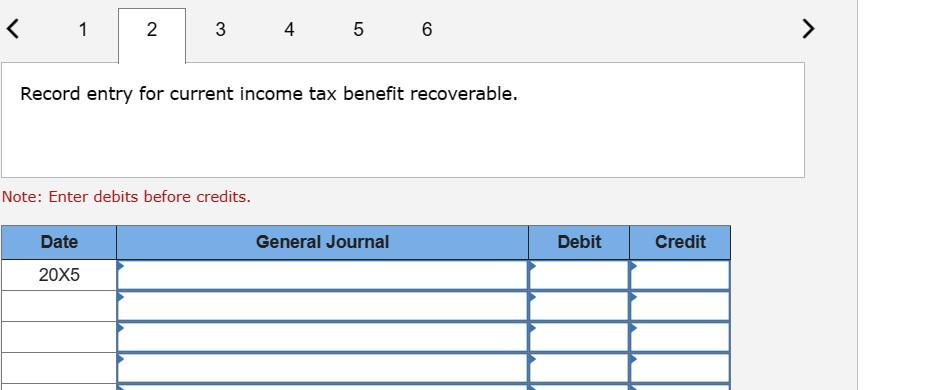

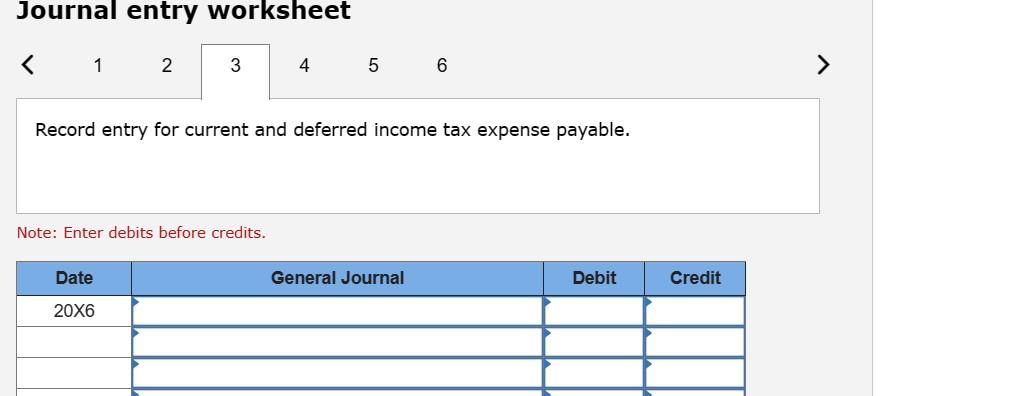

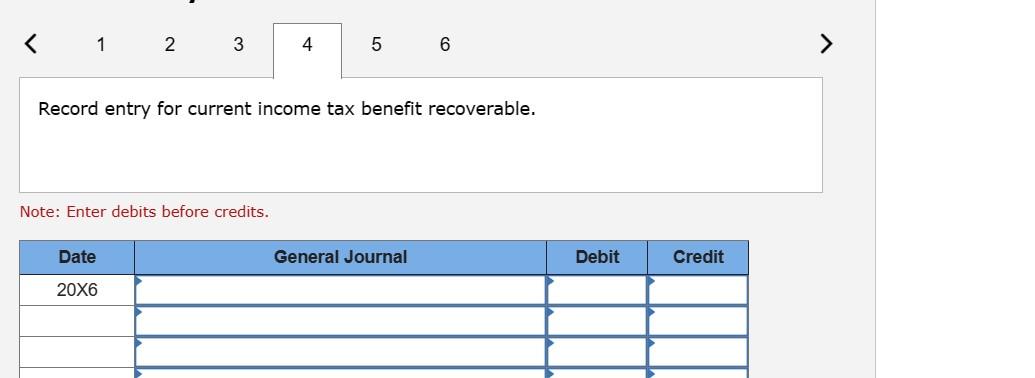

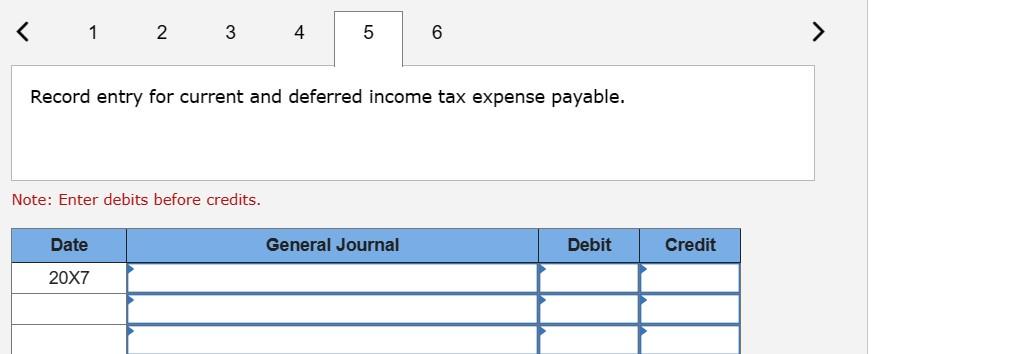

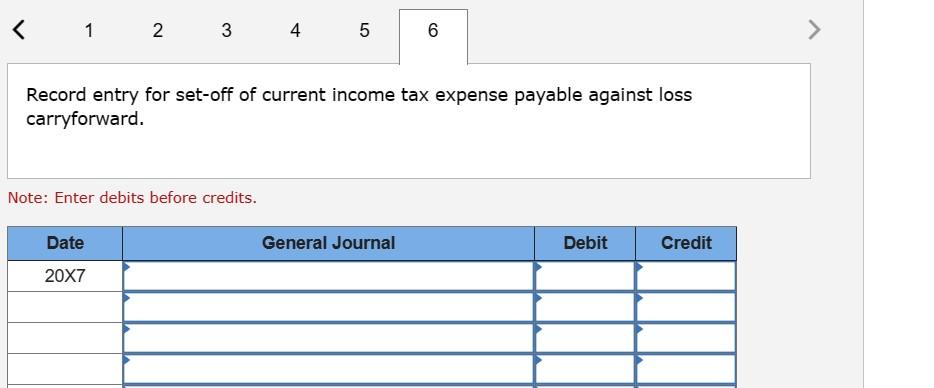

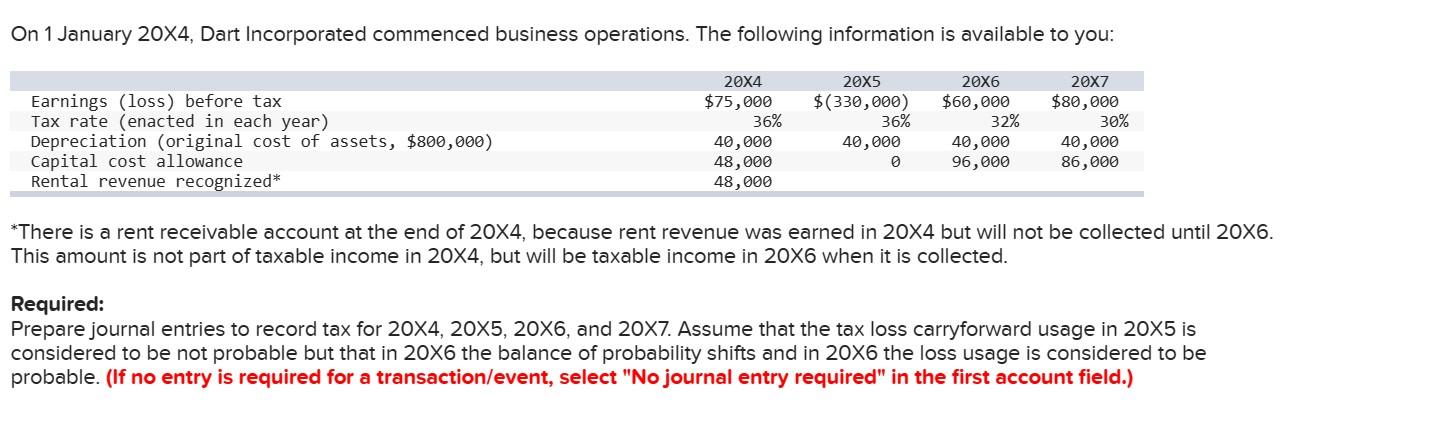

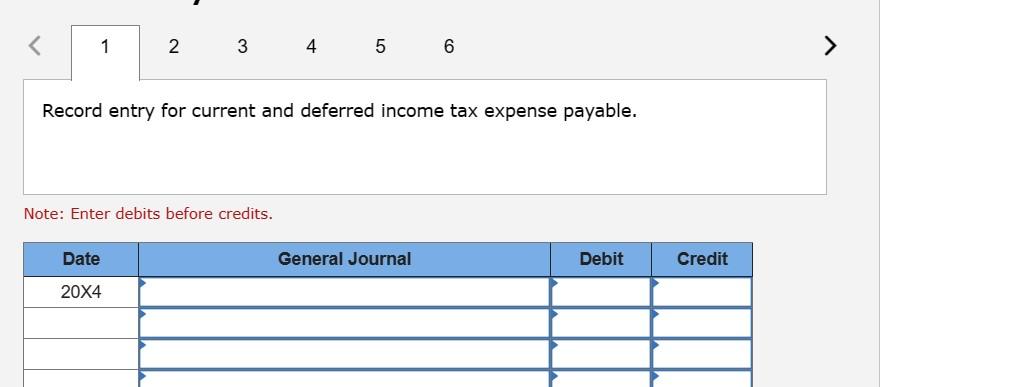

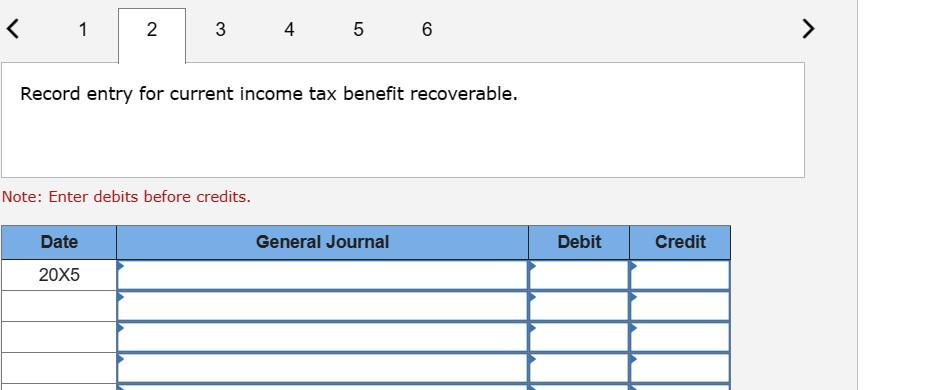

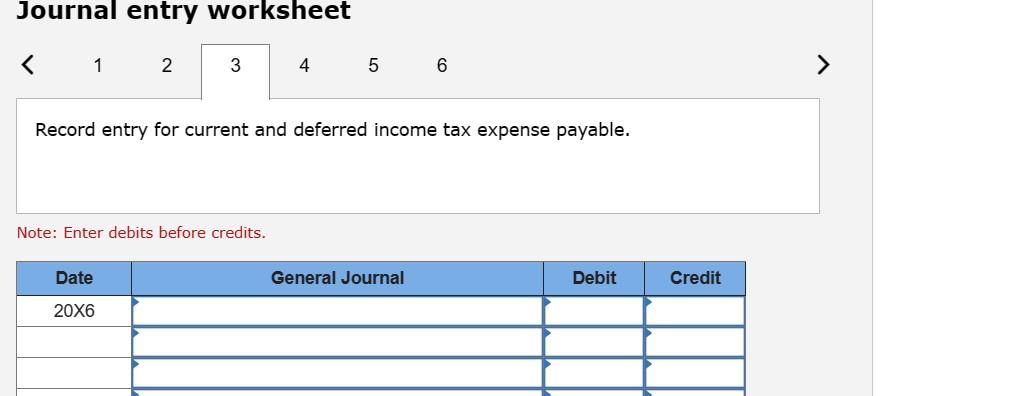

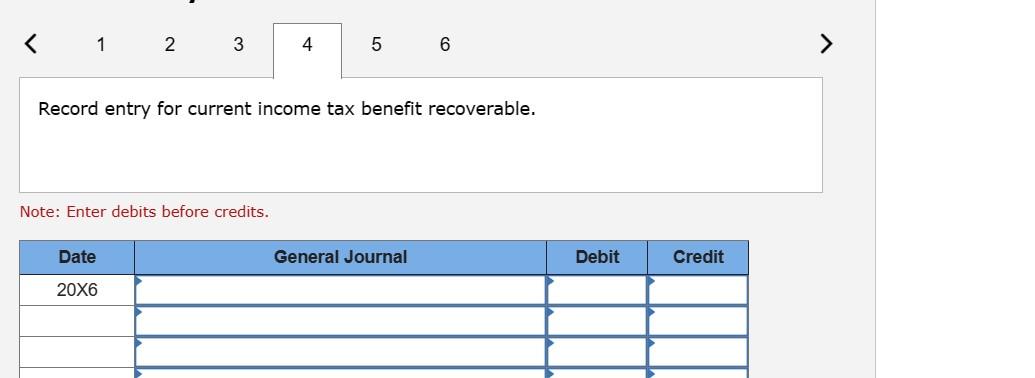

On 1 January 204, Dart Incorporated commenced business operations. The following information is available to you: *There is a rent receivable account at the end of 204, because rent revenue was earned in 20X4 but will not be collected until 20X This amount is not part of taxable income in 204, but will be taxable income in 206 when it is collected. Required: Prepare journal entries to record tax for 204,205,206, and 207. Assume that the tax loss carryforward usage in 205 is considered to be not probable but that in 20X6 the balance of probability shifts and in 206 the loss usage is considered to be probable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record entry for current and deferred income tax expense payable. Note: Enter debits before credits. Record entry for current income tax benefit recoverable. Note: Enter debits before credits. Journal entry worksheet 6 Record entry for current and deferred income tax expense payable. Note: Enter debits before credits. Record entry for current income tax benefit recoverable. Note: Enter debits before credits. Record entry for current and deferred income tax expense payable. Note: Enter debits before credits. Record entry for set-off of current income tax expense payable against loss carryforward. Note: Enter debits before credits. On 1 January 204, Dart Incorporated commenced business operations. The following information is available to you: *There is a rent receivable account at the end of 204, because rent revenue was earned in 20X4 but will not be collected until 20X This amount is not part of taxable income in 204, but will be taxable income in 206 when it is collected. Required: Prepare journal entries to record tax for 204,205,206, and 207. Assume that the tax loss carryforward usage in 205 is considered to be not probable but that in 20X6 the balance of probability shifts and in 206 the loss usage is considered to be probable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record entry for current and deferred income tax expense payable. Note: Enter debits before credits. Record entry for current income tax benefit recoverable. Note: Enter debits before credits. Journal entry worksheet 6 Record entry for current and deferred income tax expense payable. Note: Enter debits before credits. Record entry for current income tax benefit recoverable. Note: Enter debits before credits. Record entry for current and deferred income tax expense payable. Note: Enter debits before credits. Record entry for set-off of current income tax expense payable against loss carryforward. Note: Enter debits before credits