Answered step by step

Verified Expert Solution

Question

1 Approved Answer

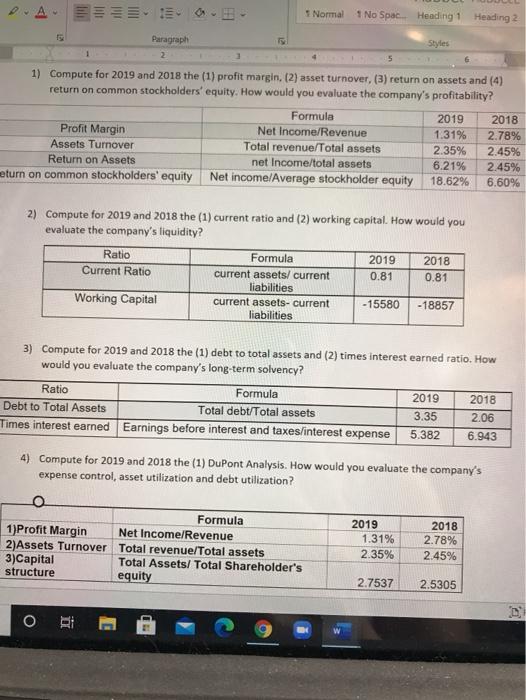

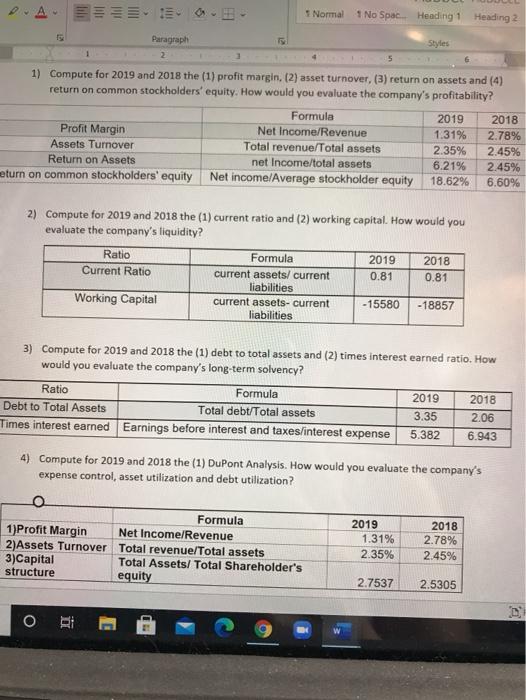

Hi I want you to explain company ( profitability, liquidity, solvency, and Dupont analysis) depend on these data on the table. this information is for

Hi I want you to explain company ( profitability, liquidity, solvency, and Dupont analysis) depend on these data on the table.

this information is for walmart

Normal 1 No Spac. Heading 1 Heading 2 Paragraph Styles 1 2 5 1) Compute for 2019 and 2018 the (1) profit margin, (2) asset turnover, (3) return on assets and (4) return on common stockholders' equity. How would you evaluate the company's profitability? Formula 2019 2018 Profit Margin Net Income/Revenue 1.31% 2.78% Assets Turnover Total revenue/Total assets 2.35% 2.45% Return on Assets net Income/total assets 6.21% 2.45% return on common stockholders' equity Net income/Average stockholder equity 18.62% 6.60% 2) Compute for 2019 and 2018 the (1) current ratio and (2) working capital. How would you evaluate the company's liquidity? Ratio Formula 2019 2018 Current Ratio current assets/ current 0.81 0.81 liabilities Working Capital current assets-current - 15580 -18857 liabilities 3) Compute for 2019 and 2018 the (1) debt to total assets and (2) times interest earned ratio. How would you evaluate the company's long-term solvency? Ratio Formula 2019 2018 Debt to Total Assets Total debt/Total assets 3,35 2.06 Times interest earned Earnings before interest and taxes/interest expense 5.382 6.943 4) Compute for 2019 and 2018 the (1) DuPont Analysis. How would you evaluate the company's expense control, asset utilization and debt utilization? Formula 1) Profit Margin Net Income/Revenue 2)Assets Turnover Total revenue/Total assets 3)Capital Total Assets/ Total Shareholder's structure equity 2019 1.31% 2.35% 2018 2.78% 2.45% 2.7537 2.5305 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started