Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, I was a bit confused about this question, could someone help me understand the computation behind it in a step-by-step way? Thank you very

Hi, I was a bit confused about this question, could someone help me understand the computation behind it in a step-by-step way?

Thank you very much for your help.

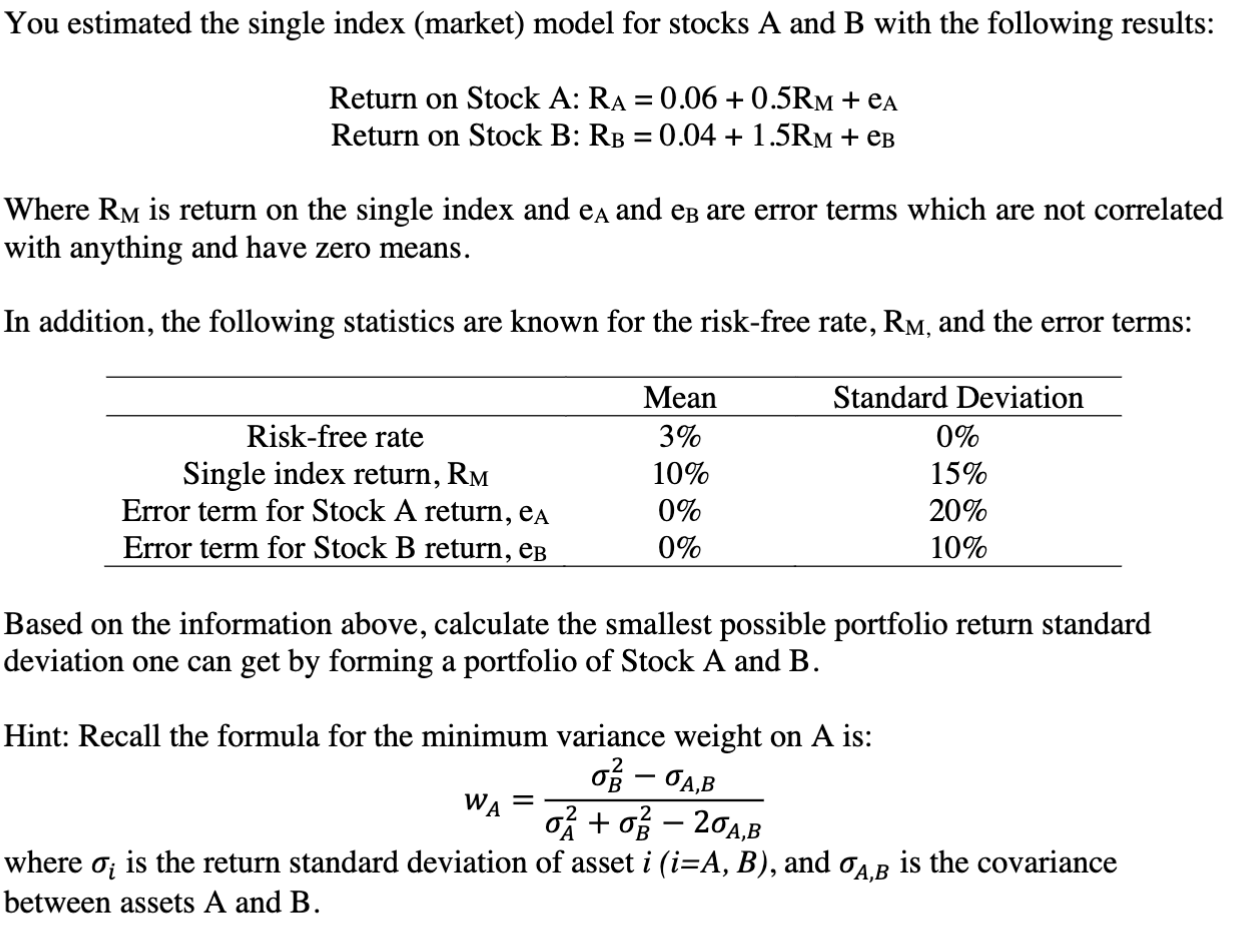

Return on Stock A: RA=0.06+0.5RM+eA Return on Stock B: RB=0.04+1.5RM+eB Where RM is return on the single index and eA and eB are error terms which are not correlated with anything and have zero means. In addition, the following statistics are known for the risk-free rate, RM, and the error terms: Based on the information above, calculate the smallest possible portfolio return standard deviation one can get by forming a portfolio of Stock A and B. Hint: Recall the formula for the minimum variance weight on A is: wA=A2+B22A,BB2A,B where i is the return standard deviation of asset i(i=A,B), and A,B is the covariance between assets A and BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started