Hi, Im not understanding these questions. Please help.

Hi, Im not understanding these questions. Please help.

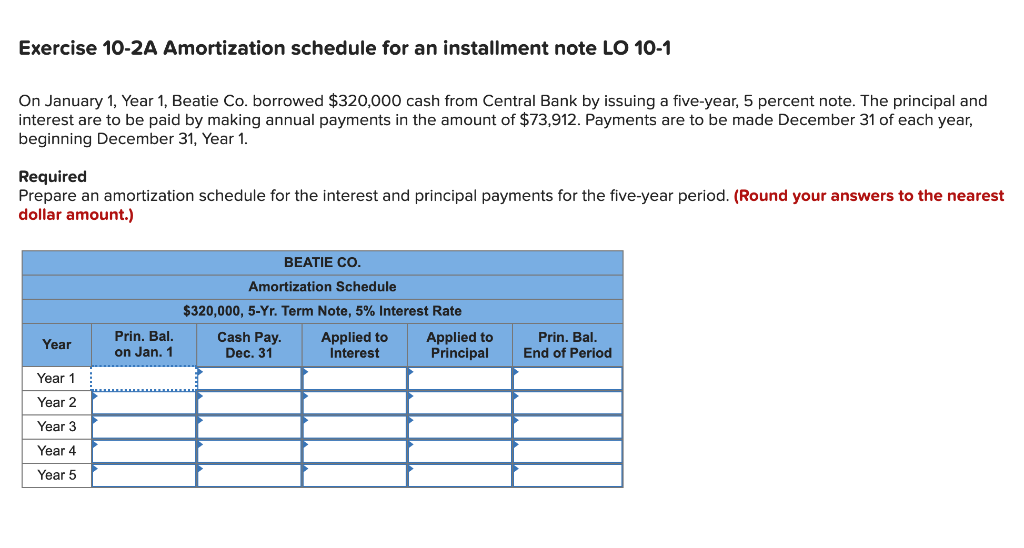

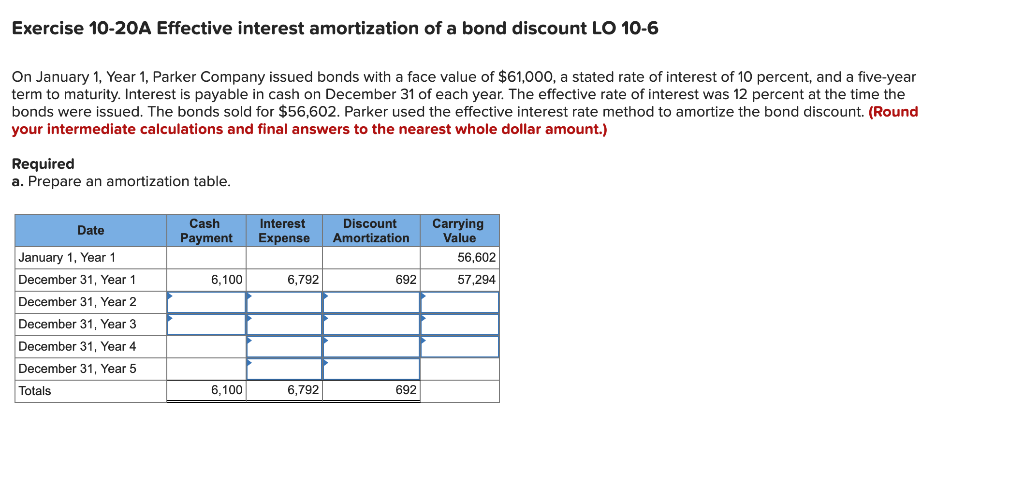

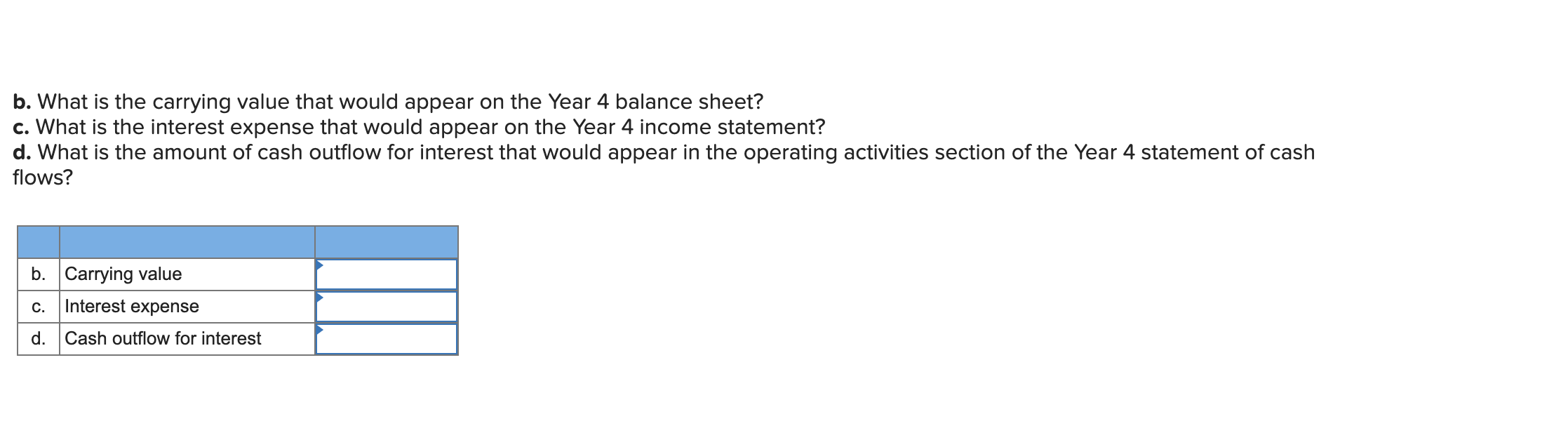

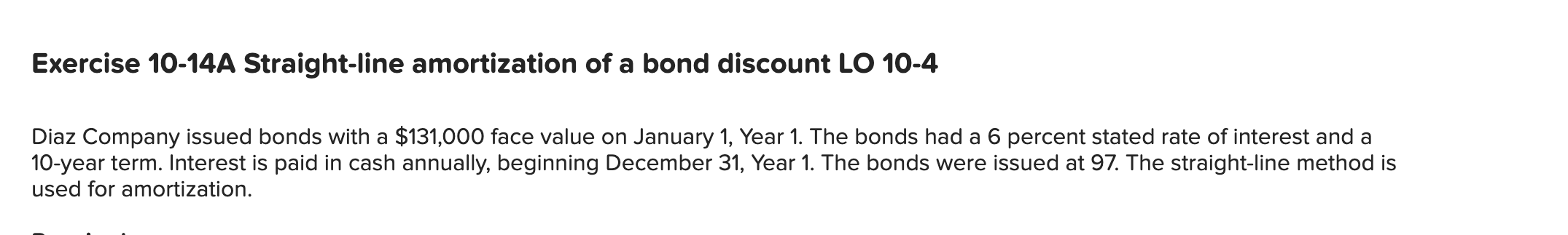

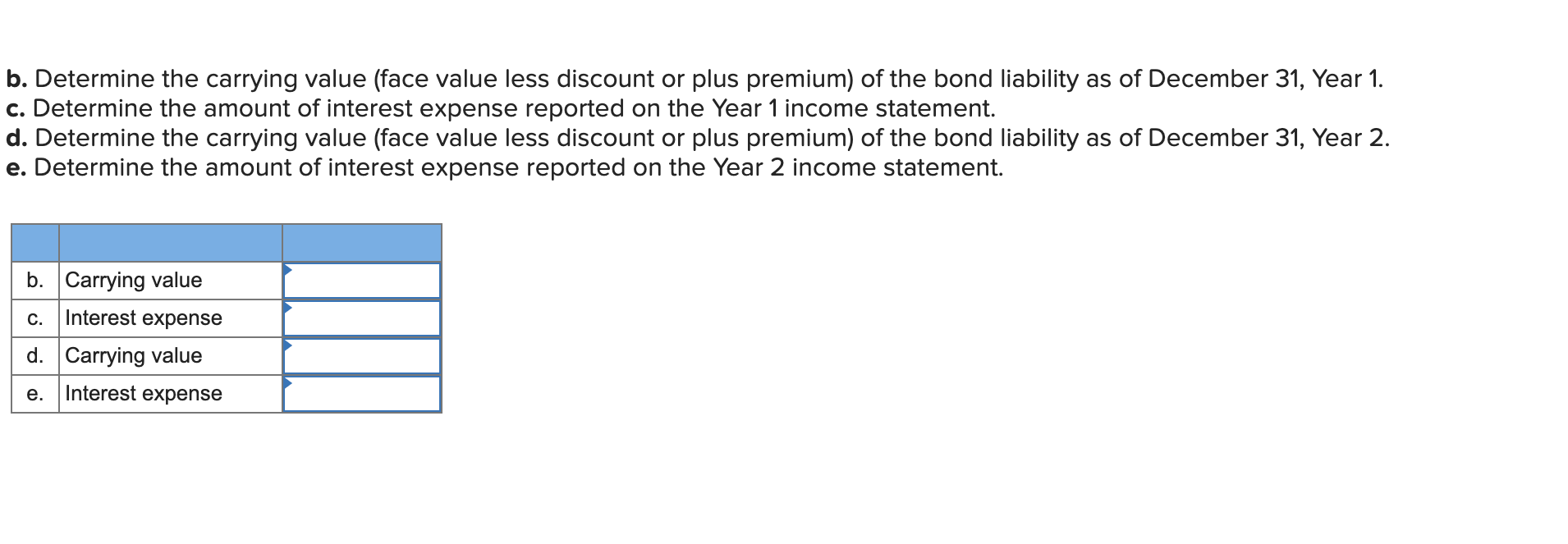

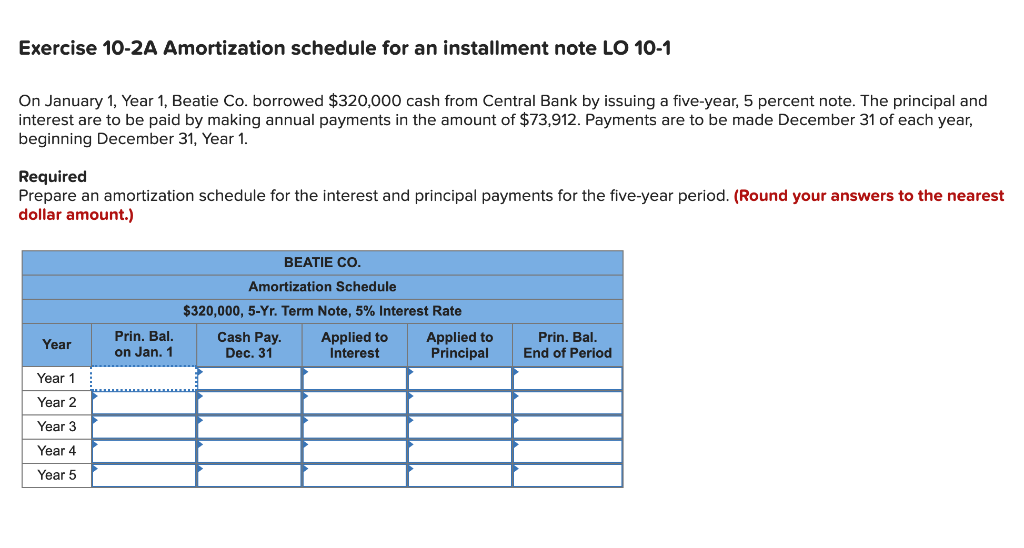

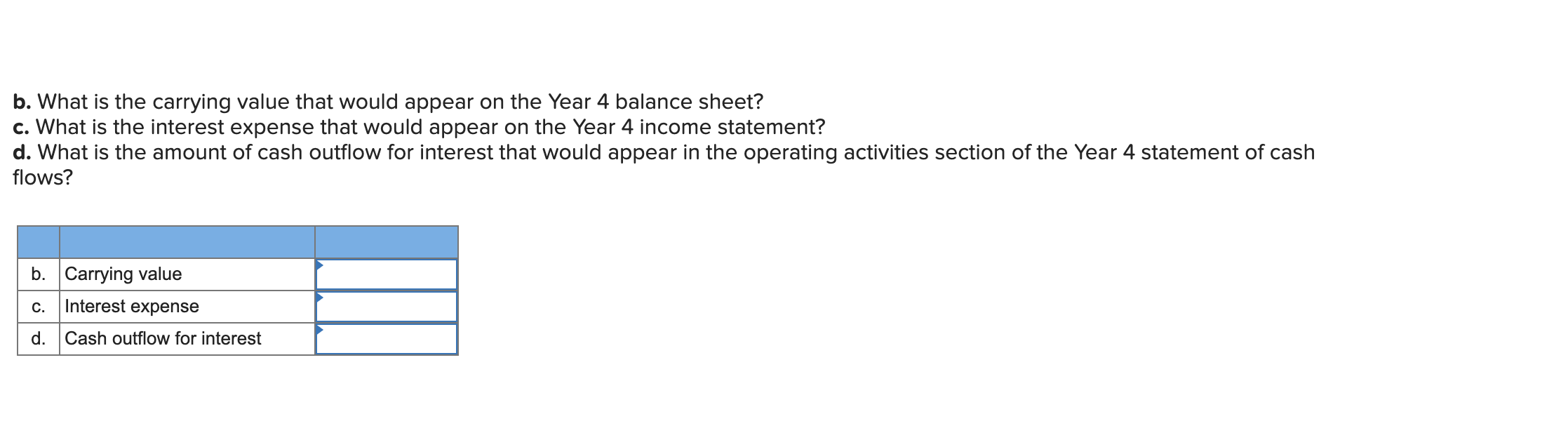

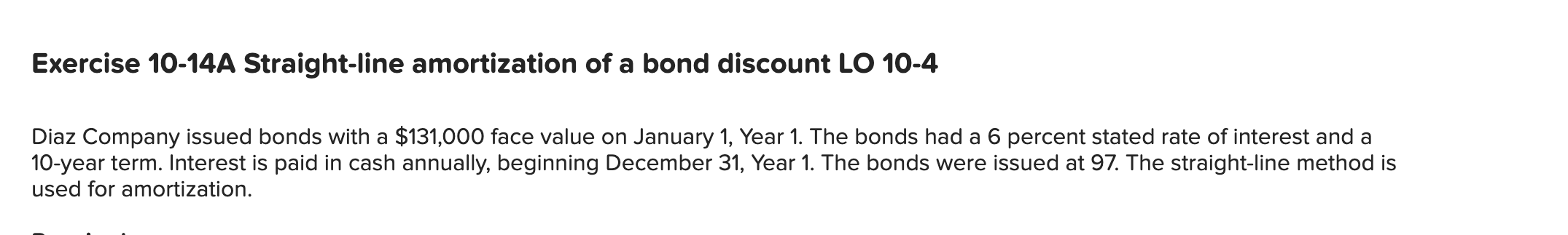

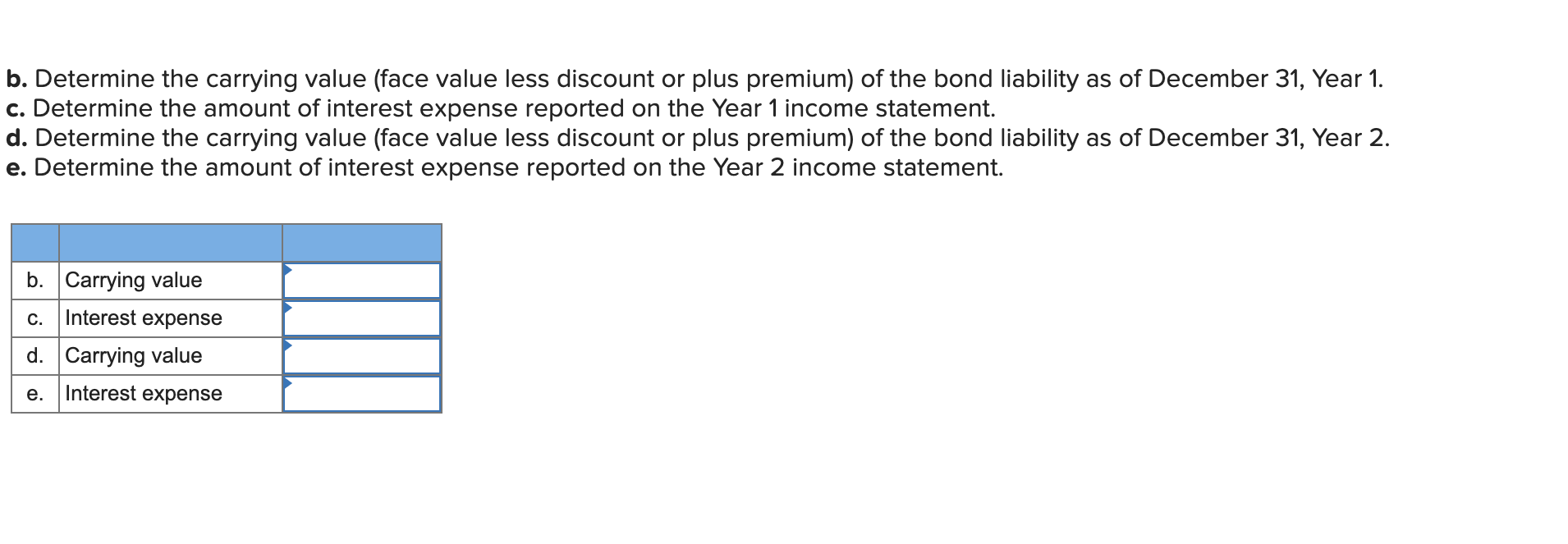

Exercise 10-14A Straight-line amortization of a bond discount LO 10-4 Diaz Company issued bonds with a $131,000 face value on January 1, Year 1. The bonds had a 6 percent stated rate of interest and a 10-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 97. The straight-line method is used for amortization. b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1. c. Determine the amount of interest expense reported on the Year 1 income statement. d. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 2. e. Determine the amount of interest expense reported on the Year 2 income statement. b. Carrying value C. Interest expense d. Carrying value e. Interest expense Exercise 10-2A Amortization schedule for an installment note LO 10-1 On January 1, Year 1, Beatie Co. borrowed $320,000 cash from Central Bank by issuing a five-year, 5 percent note. The principal and interest are to be paid by making annual payments in the amount of $73,912. Payments are to be made December 31 of each year, beginning December 31, Year 1. Required Prepare an amortization schedule for the interest and principal payments for the five-year period. (Round your answers to the nearest dollar amount.) BEATIE CO. Amortization Schedule $320,000, 5-Yr. Term Note, 5% Interest Rate Cash Pay. Applied to Applied to Dec. 31 Interest Year Prin. Bal. on Jan. 1 Principal Prin. Bal. End of Period Year 1 Year 2 Year 3 Year 4 Year 5 Exercise 10-20A Effective interest amortization of a bond discount LO 10-6 On January 1, Year 1, Parker Company issued bonds with a face value of $61,000, a stated rate of interest of 10 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 12 percent at the time the bonds were issued. The bonds sold for $56,602. Parker used the effective interest rate method to amortize the bond discount. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Required a. Prepare an amortization table. Date Cash Payment Interest Expense Discount Amortization Carrying Value 56,602 57,294 6,100 6,792 692 January 1, Year 1 December 31, Year 1 December 31, Year 2 December 31, Year 3 December 31, Year 4 December 31, Year 5 Totals 6,100 6,792 692 b. What is the carrying value that would appear on the Year 4 balance sheet? c. What is the interest expense that would appear on the Year 4 income statement? d. What is the amount of cash outflow for interest that would appear in the operating activities section of the Year 4 statement of cash flows? b. Carrying value C. Interest expense d. Cash outflow for interest

Hi, Im not understanding these questions. Please help.

Hi, Im not understanding these questions. Please help.