Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi just after the multiple choice answer to these homework questions so i can cross check. TIA Question 22). Michelin Jewellers completed the following transactions.

Hi just after the multiple choice answer to these homework questions so i can cross check. TIA

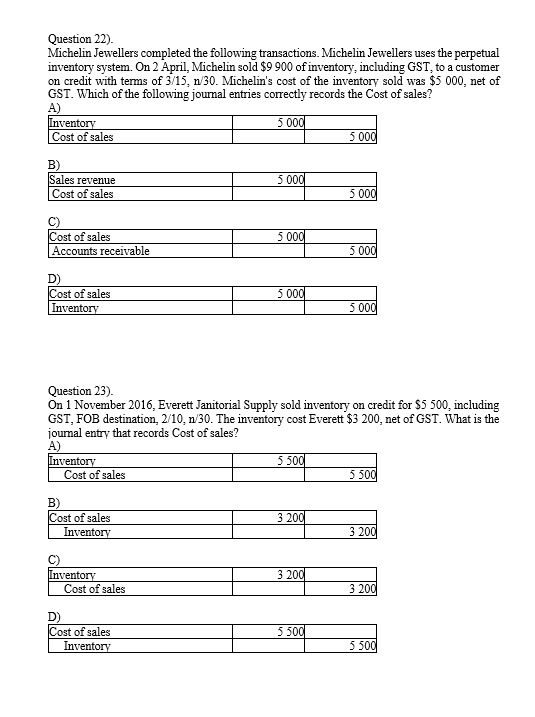

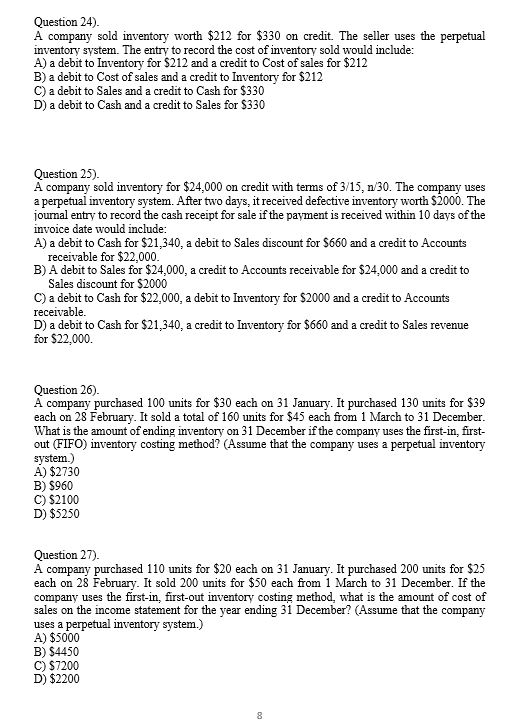

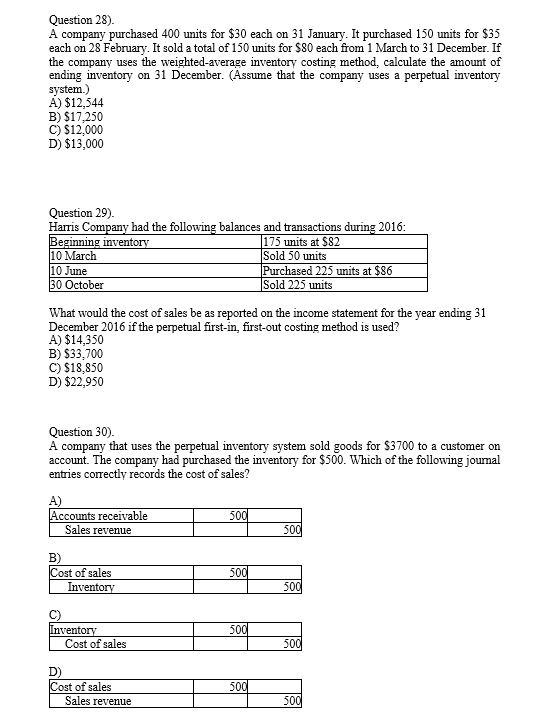

Question 22). Michelin Jewellers completed the following transactions. Michelin Jewellers uses the perpetual inventory system. On 2 April, Michelin sold $9 900 of inventory, including GST, to a customer on credit with terms of 3/15, n/30. Michelin's cost of the inventory sold was $5 000, net of GST. Which of the following journal entries correctly records the Cost of sales? A) Inventory 5 000 Cost of sales 5 000 B) Sales revenue 5 000 Cost of sales 5 000 C) Cost of sales Accounts receivable 5 000 5 000 D) Cost of sales Inventory 5000 5 000 Question 23). On 1 November 2016. Everett Janitorial Supply sold inventory on credit for $5 500, including GST, FOB destination, 2/10, 1/30. The inventory cost Everett $3 200, net of GST. What is the joumal entry that records Cost of sales? A) Inventory 5 500 Cost of sales 5500 B) Cost of sales Inventory 3 200 3 200 3 200 Inventory Cost of sales 3 200 D) Cost of sales Inventory 5 500 5 500 Question 24). A company sold inventory worth $212 for $330 on credit. The seller uses the perpetual inventory system. The entry to record the cost of inventory sold would include: A) a debit to Inventory for $212 and a credit to Cost of sales for $212 B) a debit to Cost of sales and a credit to Inventory for $212 C) a debit to Sales and a credit to Cash for $330 D) a debit to Cash and a credit to Sales for $330 Question 25). A company sold inventory for $24.000 on credit with terms of 3/15, n/30. The company uses a perpetual inventory system. After two days, it received defective inventory worth $2006. The journal entry to record the cash receipt for sale if the payment is received within 10 days of the invoice date would include: A) a debit to Cash for $21,340, a debit to Sales discount for $660 and a credit to Accounts receivable for $22,000. B) A debit to Sales for $24,000, a credit to Accounts receivable for $24.000 and a credit to Sales discount for $2000 C) a debit to Cash for $22,000, a debit to Inventory for $2000 and a credit to Accounts receivable. D) a debit to Cash for $21,340, a credit to Inventory for $660 and a credit to Sales revenue for $22,000. Question 26). A company purchased 100 units for $30 each on 31 January. It purchased 130 units for $39 each on 28 February. It sold a total of 160 units for $45 each from 1 March to 31 December. What is the amount of ending inventory on 31 December if the company uses the first-in, first- out (FIFO) inventory costing method? (Assume that the company uses a perpetual inventory system.) A) $2730 B) $960 C) $2100 D) $5250 Question 27). A company purchased 110 units for $20 each on 31 January. It purchased 200 units for $25 each on 28 February. It sold 200 units for $50 each from 1 March to 31 December. If the company uses the first-in, first-out inventory costing method, what is the amount of cost of sales on the income statement for the year ending 31 December? (Assume that the company uses a perpetual inventory system.) A) $5000 B) $4450 C) $7200 D) $2200 8 Question 28). A company purchased 400 units for $30 each on 31 January. It purchased 150 units for $35 each on 28 February. It sold a total of 150 units for $80 each from 1 March to 31 December. If the company uses the weighted-average inventory costing method, calculate the amount of ending inventory on 31 December. (Assume that the company uses a perpetual inventory system.) A) $12,544 B) $17,250 C) $12,000 D) $13,000 Question 29). Harris Company had the following balances and transactions during 2016: Beginning inventory 175 units at $82 10 March Sold 50 units 10 June Purchased 225 units at $86 30 October Sold 225 units What would the cost of sales be as reported on the income statement for the year ending 31 December 2016 if the perpetual first-in, first-out costing method is used? A) $14,350 B) $33.700 C) $18,850 D) $22,950 Question 30). A company that uses the perpetual inventory system sold goods for $3700 to a customer on account . The company had purchased the inventory for $500. Which of the following journal entries correctly records the cost of sales? A) Accounts receivable Sales revenue 500 500 B) Cost of sales Inventory 500 500 500 Inventory Cost of sales 500 D) Cost of sales Sales revenue 500 500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started