Question: Hi our professor did not upload solutions to these practice problems on expected utility, and was wondering if you could give a step by step

Hi our professor did not upload solutions to these practice problems on expected utility, and was wondering if you could give a step by step solution. I have the lecture notes down below.

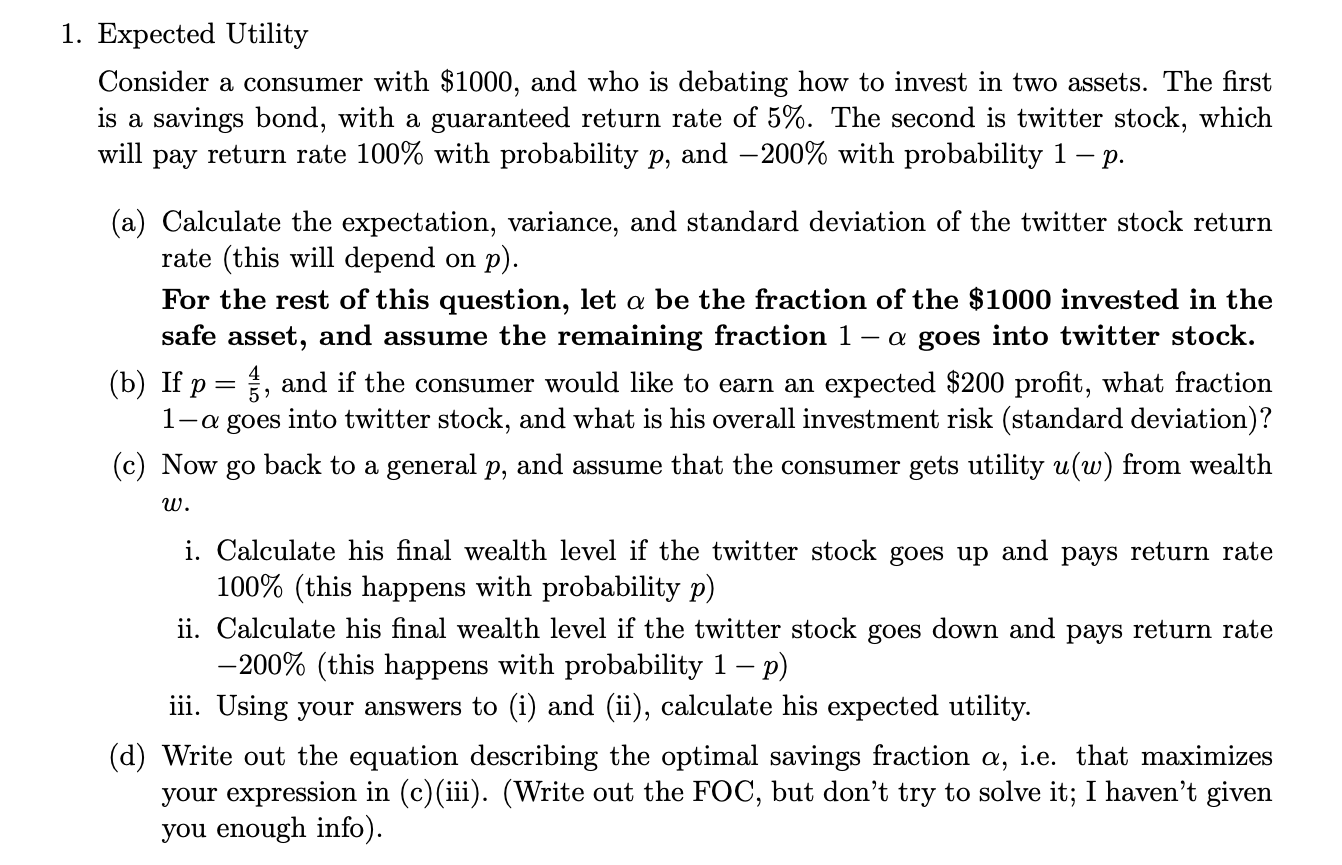

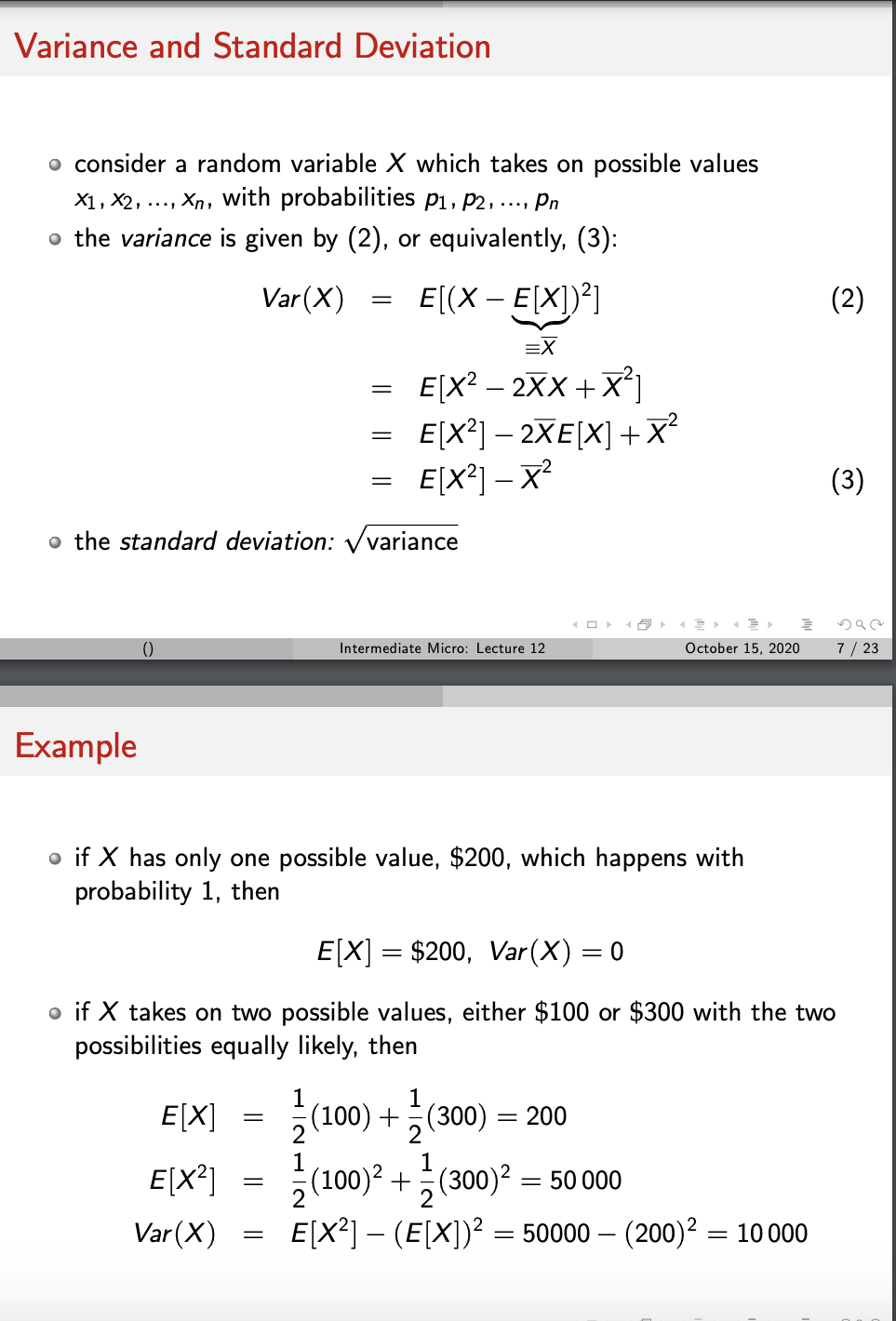

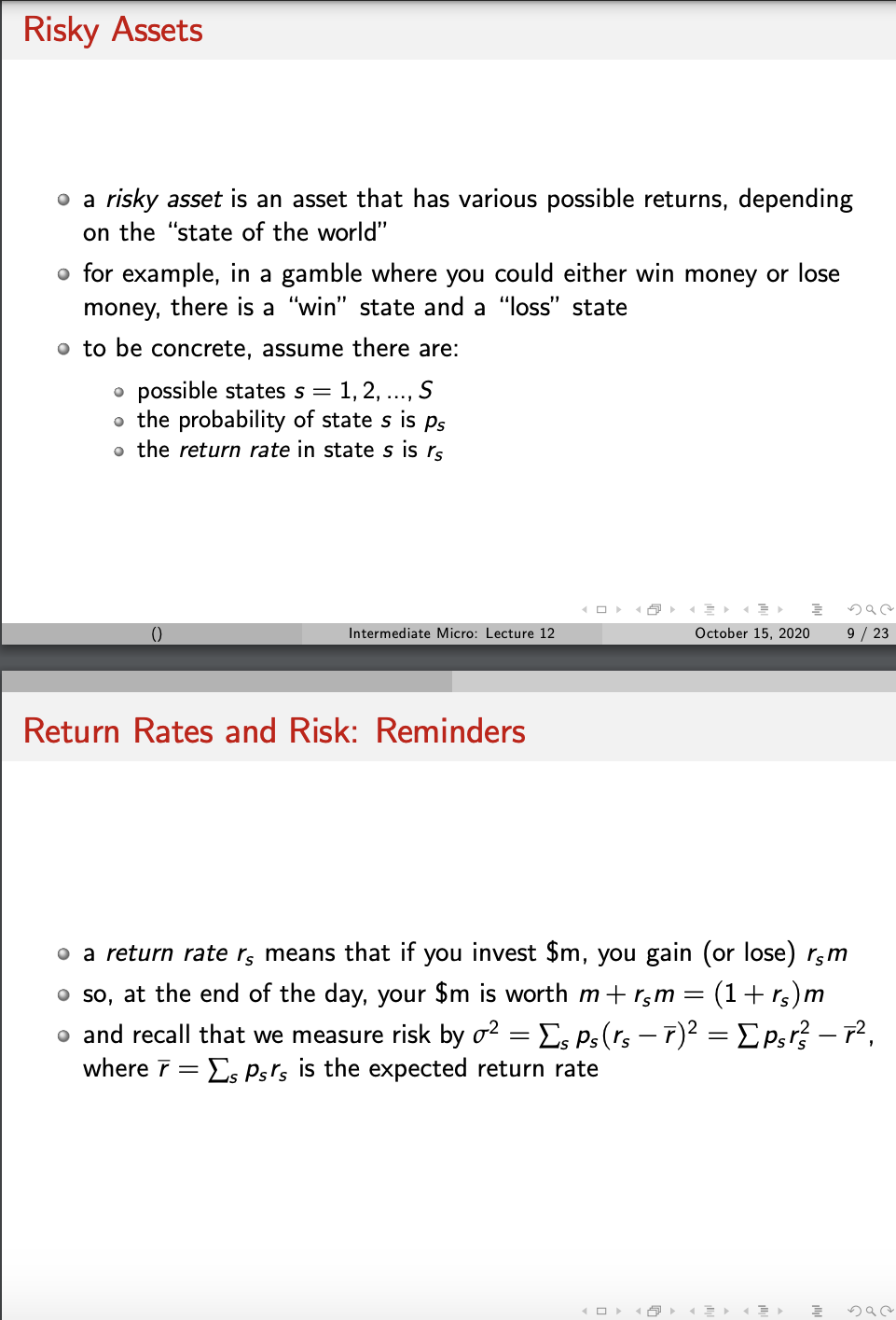

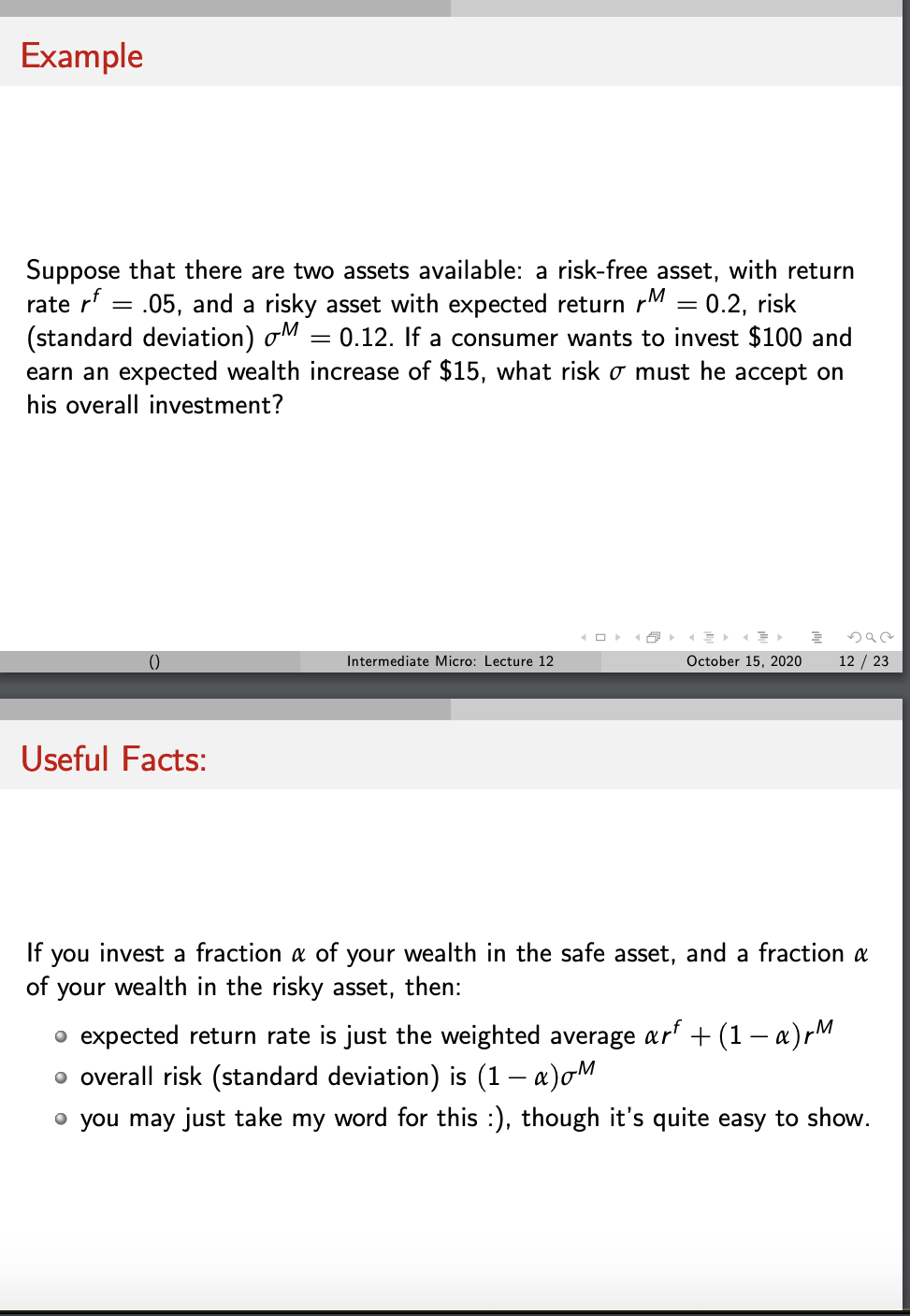

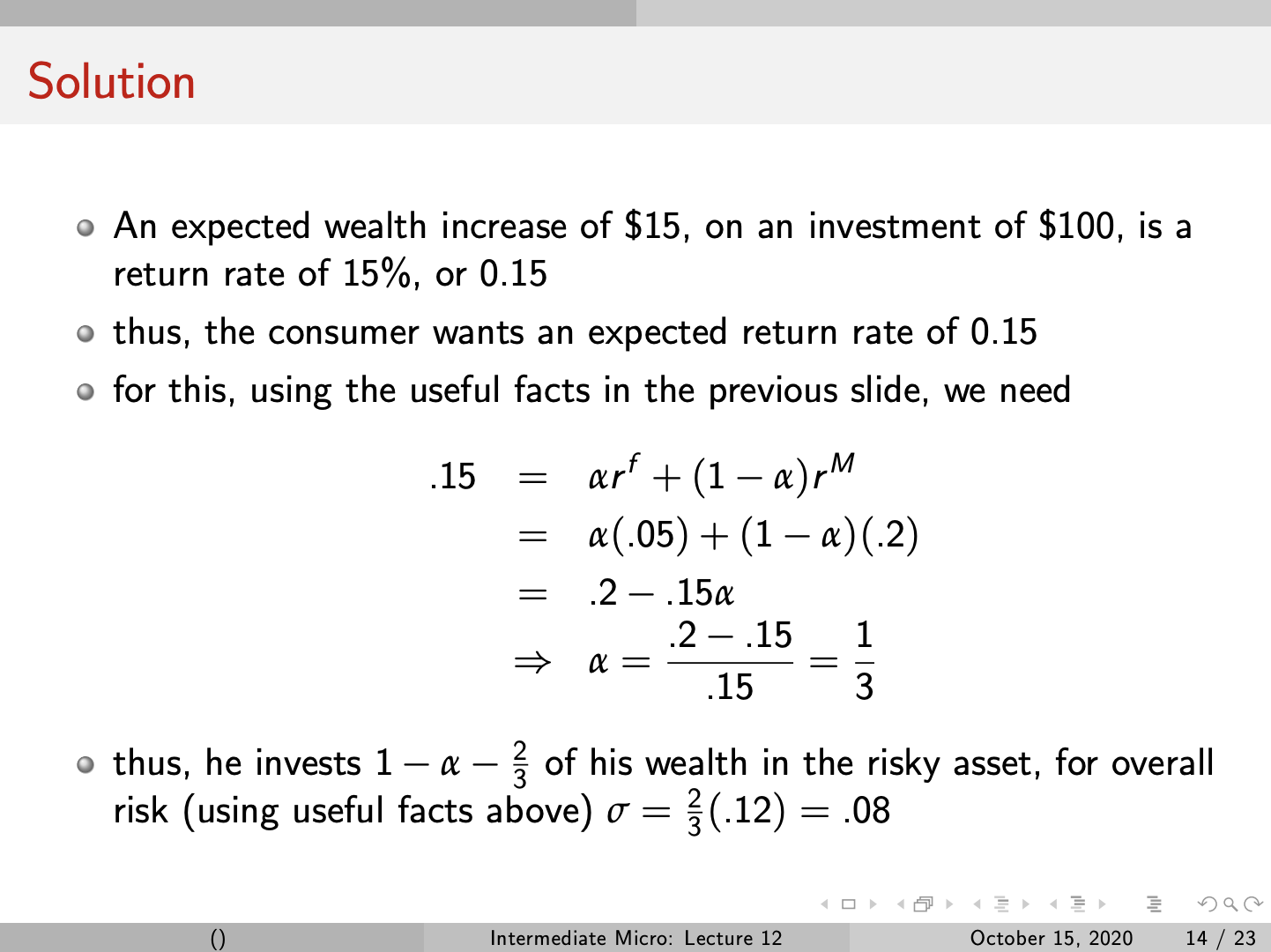

1. Expected Utility Consider a consumer with $1000, and who is debating how to invest in two assets. The rst is a savings bend, with a guaranteed return rate of 5%. The second is twitter stock, which will pay return rate 100% with probability p, and 200% with probability 1 p. (a) Calculate the expectation, variance, and standard deviation of the twitter stock return rate (this will depend on p). For the rest of this question, let a be the fraction of the $1000 invested in the safe asset, and assume the remaining fraction 1 or goes into twitter stock. (b) If p = '5', and if the censumer would like to earn an expected $200 prot, what fraction 101 goes into twitter stock, and what is his overall investment risk (standard deviation)? (0) Now go back to a general p, and assume that the consumer gets utility u(w) from wealth to. i. Calculate his nal wealth level if the twitter stock goes up and pays return rate 100% (this happens with probability 19) ii. Calculate his nal wealth level if the twitter stock goes down and pays return rate 200% (this happens with probability 1 p) iii. Using your answers to (i) and (ii), calculate his expected utility. ((1) Write out the equation describing the optimal savings fraction or, i.e. that maximizes your expression in (c)(iii). (Write out the F00, but don't try to solve it; I haven't given you enough info). Variance and Standard Deviation a consider a random variable X which takes on possible values X1,X2, ...,x,,, with probabilities p1.p2, pH 0 the variance is given by (2), or equivalently, (3): Var(X) = El(X - E[X])2] (2) '33? E[X2 x + X2] = E[X2] 275 [X] + X2 E[X2] 72 (3) o the standard deviation: \\/ variance El 5' ' = :E \"'3 0' 0\" October 15. 2020 7 f 23 Example 0 if X has only one possible value. $200. which happens with probability 1, then E[X] = $200, Var(X) = 0 o if X takes on two possible values. either $100 or $300 with the two possibilities equally likely, then E[X] 000) + $800) = 200 E[X2] Var(X) 000)2 + 2%(300)2 = 50000 E[X2] (E[X])2 = 50000 (200)2 = 10 000 Risky Assets 0 a risky asset is an asset that has various possible returns, depending on the \"state of the world" 0 for example, in a gamble where you could either win money or lose money. there is a \"win" state and a \"loss" state 0 to be concrete. assume there are: a possible states 5 = 1, 2, ..., S o the probability of state 5 is p; o the return rate in state 5 is rs III it I II I III I'II' 6 p 0 Return Rates and Risk: Reminders o a return rate r5 means that if you invest $m. you gain (or lose) rsm 0 so. at the end of the day. your Slim is worth m+ rsm = (1 + rs)m o and recall that we measure risk by (72 = Es p505 F)2 = Epsrs2 F2, where T = [)5 psrs is the expected return rate Example Suppose that there are two assets available: a risk-free asset, with return rate rf = .05, and a risky asset with expected return rM = 0.2, risk (standard deviation) U\" = 0.12. If a consumer wants to invest $100 and earn an expected wealth increase of $15, what risk or must he accept on his overall investment? III a I II I III IIIII 6 p '2 Useful Facts: If you invest a fraction 0: of your wealth in the safe asset, and a fraction an of your wealth in the risky asset, then: 0 expected return rate is just the weighted average rxrf + (1 Mr\" 0 overall risk (standard deviation) is (1 Ma\" 0 you may just take my word for this :) though it's quite easy to show. Solution 0 An expected wealth increase of $15, on an investment of $100, is a return rate of 15%. or 0.15 0 thus, the consumer wants an expected return rate of 0.15 o for this, using the useful facts in the previous slide, we need .15 our\"r + (1 a)rM (.05) + (1 00(2) .2 .150; => a_.2.15_1 _ .15 _3 0 thus, he invests 1 rx g of his wealth in the risky asset, for overall risk (using useful facts above) 0' = (.12) = .08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts