please answer clearly. thank you!

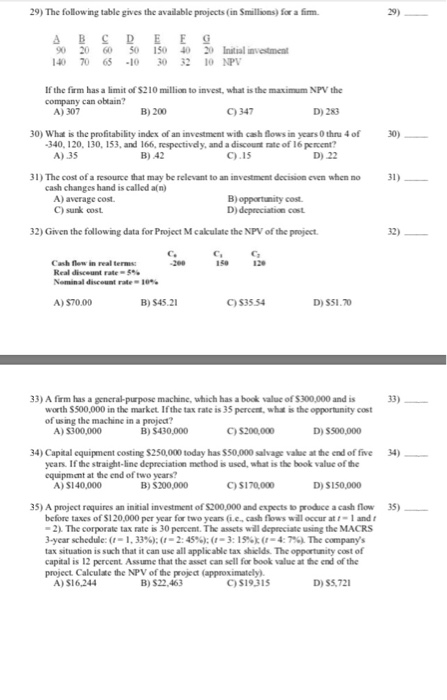

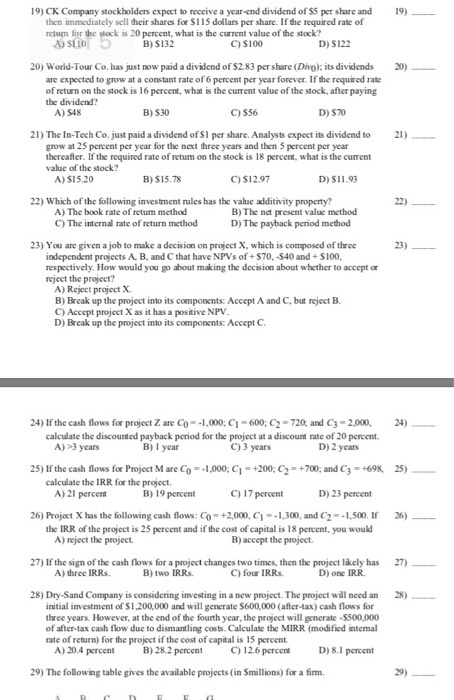

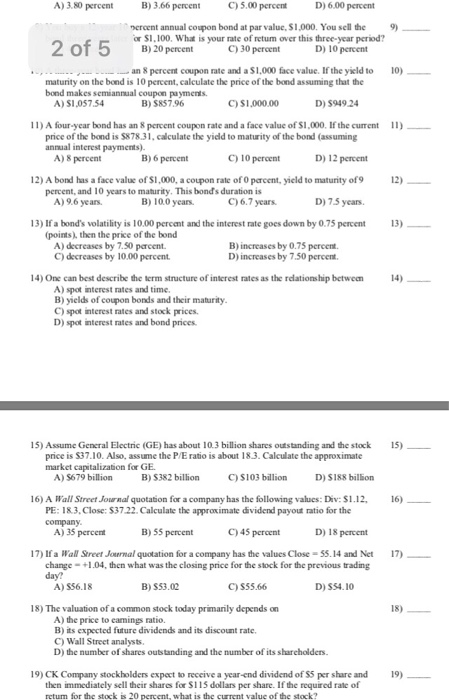

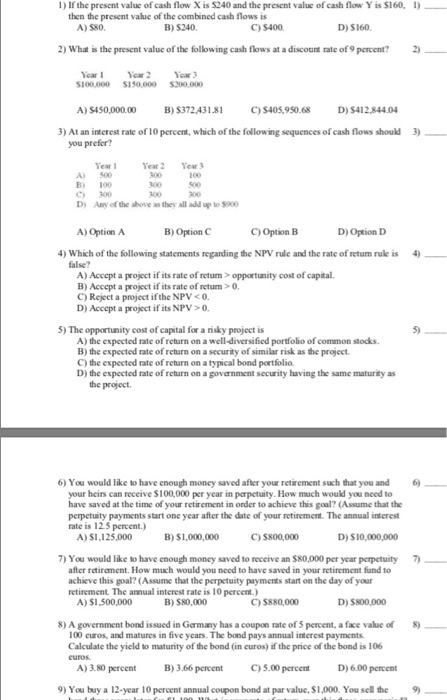

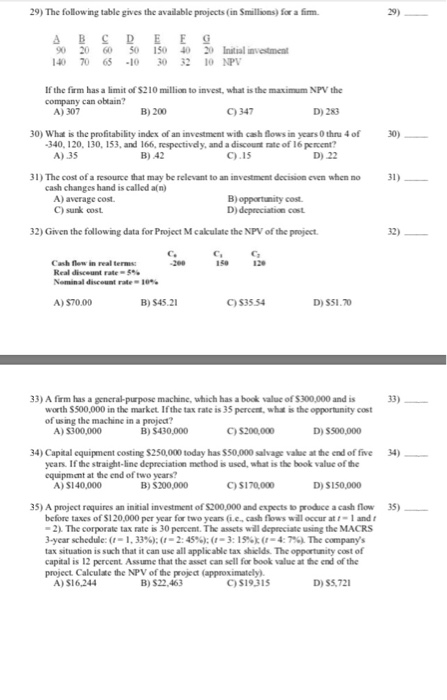

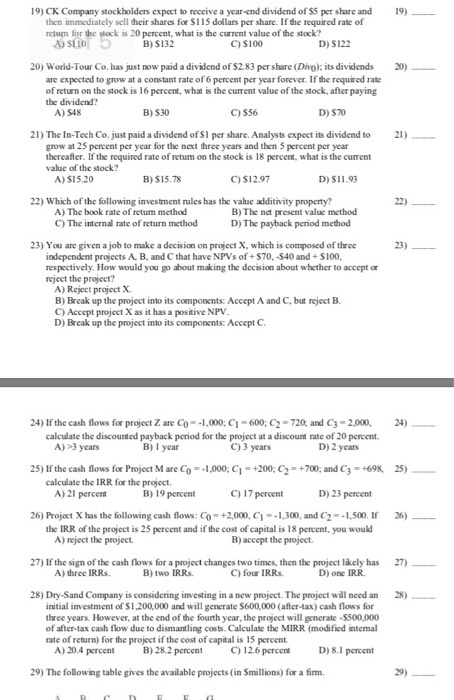

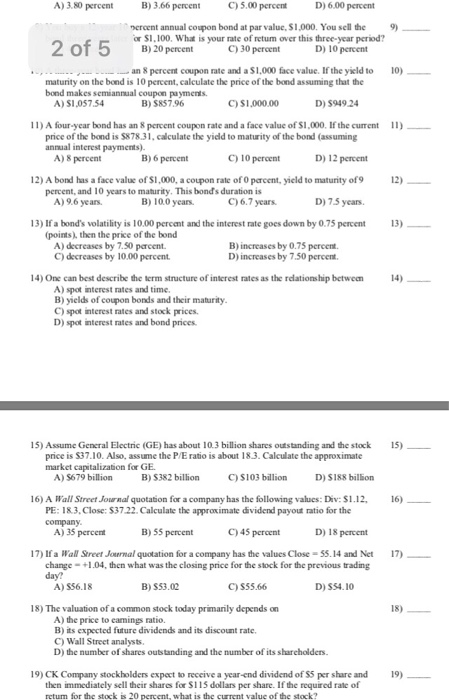

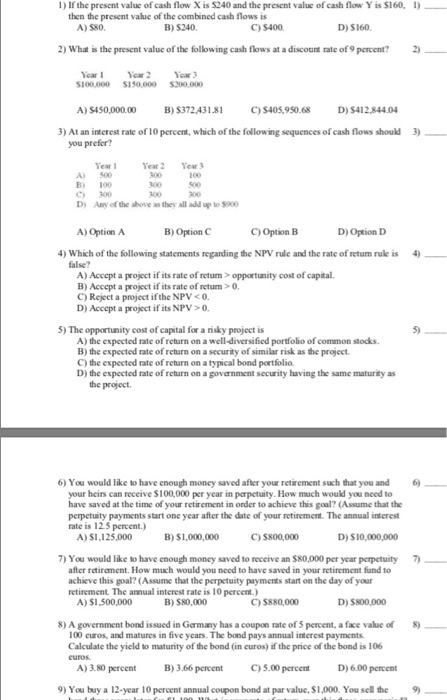

29) The following table gives the available projects in Smillions) for a fim. A 90 130 B 20 70 C 60 65 D 50 10 E F G 150402 Titial investment 30 32 10 NPU If the firm has a limit of $210 million to invest, what is the maximum NPV the company can obtain? A) 307 B) 200 9347 D) 283 30) 30) What is the profitability index of an investment with cash flows in years thru 4 of -340, 120, 130, 153, and 166, respectivdy, and a discutate of 16 percent? A) 35 B) 42 C).15 D) 22 31) The cost of a resource that may be relevant to an investment decision even when no cash changes and is called a() A) average cost B) opportunity cost C) sunk cost D) depreciation cost 32) Given the following data for Project Mcalculate the NPV of the project. Cash flow in real terms Realdira Nominal de 10 A) 570.00 B) $45.21 C) 535 54 D) 551.70 33) A firm has a general-purpose machine, which has a book value of $300,000 and is worth $500,000 in the market. If the tax rate is 35 percent, what is the opportunity cost of using the machine in a project? A) 5300,000 B) $430,000 C) $200.000 D) $500,000 34) 34) Capital equipment costing $250,000 today has $50,000 salvage value at the end of five years. If the straight-line depreciation method is used, what is the book value of the equipment at the end of two years! A) $140,000 B) S200,000 $170,000 D) S150,000 35) 35) A project requires an initial investment of $200,000 and expects to produce a cash flow before taxes of $120,000 per year for two years i.c.cash flows will occur at 1 and - 2). The corporate tax rate is 30 percent. The assets will depreciate using the MACRS 3-year schedule: -1.33%)(-2: 45% = 3:19% -47% The company's tax situation is such that it can use all applicable tax shields. The opportunity cost of capital is 12 percent. Assume that the asset can sell for book value at the end of the project Calculate the NPV of the project approximately A) 516-244 B) 63 C) 519315 D) 55.721 19) 19) CK Company stockholders expect to receive a year-end dividend of S5 per share and then immediately sell their shares for S115 dollars per share. If the required rate of retum for the stock is 20 percent, what is the current value of the stock? A) SUD B ) S132 CS100 D) 5122 20) 20) World Tour Co. has just now paid a dividend of $2.83 per share (Divo its dividends are expected to grow at a constant rate of 6 percent per year forever. If the required rate of return on the stock is 16 percent, what is the current value of the stock, after paying the dividend? A) 548 B) 530 556 D) S70 21) The In-Tech Co. just paid a dividend of Si per share. Analysts expect its dividend to grow at 25 percent per year for the next three years and then 5 percent per year thereafter. If the required rate of return on the stock is 18 percent, what is the current value of the stock? A) 515.20 B) S15.78 $12.97 D) $11.93 21) 22) Which of the following investment rules has the value additivity property? A) The book rate of return method B) The net present value method C) The internal rate of return method D) The payback period method 23) You are given a job to make a decision on project X, which is composed of three independent projects A, B, and that have NPVs of +$70,-$40 and + S100. respectively. How would you go about making the decision about whether to accept or reject the project? A) Reject project X B) Break up the project into its components: Accept A and C, but reject B. C) Accept project X as it has a positive NPV. D) Break up the project into its components: Accept C. 24) If the cash flows for project Z are Co--1.000: - 600; 2-720, and C3 -2,000, 24) calculate the discounted payback period for the project at a discount rate of 20 percent A) > 3 years B) 1 year C) 3 years D) 2 years 25) If the cash flows for Project Mare Co --1,000: - +2002 - +700, and Cz - +69825) calculate the IRR for the project ) 21 r B) 19 percent 17 percent D) 23 percent 26) Project X has the following cash flows: Co - +2,000, --1,300 and 2-1,500. If 26) the IRR of the project is 25 percent and if the cost of capital is 18 percent, you would A) reject the project B) accept the project 27) If the sign of the cash flows for a project changes two times, then the project likely has 27) A) three IRRSB ) two IRRS C ) four IRRSD ) one IRR ) 28) Dry-Sand Company is considering investing in a new project. The project will need an initial investment of S1,200,000 and will generate $600,000 (after-tax) cash flows for three years. However, at the end of the fourth year, the project will generate -S500,000 of after-tax cash flow due to dismantling costs. Calculate the MIRR (modified intemal rate of return) for the project if the cost of capital is 15 percent A) 20.4 percent B) 28.2 percent C) 12.6 percent D) 8.1 percent 29) The following table gives the available projects in Smillions) for a fimm. A) 3.80 percent B) 3.66 percent C) 5.00 percent D) 6,00 percent Tercent annual coupon bond at par value $1.000. You sell the or S1,100. What is your rate of retum over this three-year period? 2 of 5 B) 20 percent C) 30 percent D) 10 percent .. . an 8 percent coupon rate and a $1,000 face value. If the yield to maturity on the bond is 10 percent, calculate the price of the bond assuming that the bond makes semiannual coupon payments A) 51,05754 B) 585796 C) $1,000.00 D) 5909.24 10) 11) 11) A four year bond has an 8 percent coupon rate and a face value of $1.000. If the current price of the band is 5x7831. calculate the vided to maturity of the bond assuming annual interest payments) A) 8 percent B) 6 percent C) 10 percent D) 12 percent 1 2) 12) A bond has a face value of $1,000, a coupon rate of percent, yield to maturity of 9 percent, and 10 years to maturity. This bonds duration is A) 9.6 years. B) 100 years. C) 6.7 years D) 75 years 13) If a bond's volatility is 10.00 percent and the interest rate goes down by 0.75 percent (points), then the price of the bond A) decreases by 7.50 percent. B) increases by 0.75 percent C) decreases by 10.00 percent. D) increases by 7.50 percent 14) 14) One can best describe the term structure of interest rates as the relationship between A) spot interest rates and time B) yields of coupon bonds and their maturity. C) spot interest rates and stock prices D) spot interest rates and bond prices. 15) 15) Assume General Electric (GE) has about 10.3 billion shares outstanding and the stock price is $37.10. Also, assume the P/E ratio is about 18.3. Calculate the approximate market capitalization for GE A) 5679 billion B) 5382 billion C) S103 billion D) S188 billion 16) 16) A Wall Street Journal quotation for a company has the following values: Div: S1.12. PE: 18.3. Close: $37.22. Calculate the approximate dividend payout ratio for the company A) 35 percent B) 55 percent C) 45 percent D) 18 percent 17) Ifa Wall Street Journal quotation for a company has the values Close = 55.14 and Net change-1.04, then what was the closing price for the stock for the previous trading day! A) 556.18 B) 553.00 555.66 D) 554.10 17) 18) The valuation of a common stock today primarily depends on A) the price to caming mati. B) is expected future dividends and its discount rate. C) Wall Street analysts. D) the number of shares outstanding and the number of its shurcholders 19) 19) CK Company stockholders expect to receive a year-end dividend of 85 per share and then immediately sell their shares for SIIS dollars per share. If the required rate of return for the stock is 20 percent, what is the current value of the stock? 1) If the present value of cash flow X is 5240 and the present value of cash flow Y is $160, 1) then the present value of the combined cash flows is A) SNO B) $240. C) 5400 D) $160 2) What is the present value of the following cash flows at a discount rate of 9 percent? 2) Varl S100.000 Vox2 SI 50.000 S Ver3 OOD A) S450,000.00 B) 372,43181 8 405.950.68 D) $412.844.04 3) At an interest rate of 10 percent, which of the following sequences of cash flows should you prefer? 3) Yea Year 2 A 000 B 100 Year 3 100 Di Anothebeve as they all add up to A) Option A B) Option C C ) Option B D) Option 4 4) Which of the following statements regarding the NPV rule and the rate of retum rule is false? A) Accept a project if its rate of retum > opportunity cost of capital B) Accept a project if its rate of retum >0. C) Reject a project if the NPV