Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi.. please explain these journal entries numbers with calculation Isolde Ltd owns all the share capital of Annabelle Ltd. The incom e tax rate is

hi.. please explain these journal entries numbers with calculation

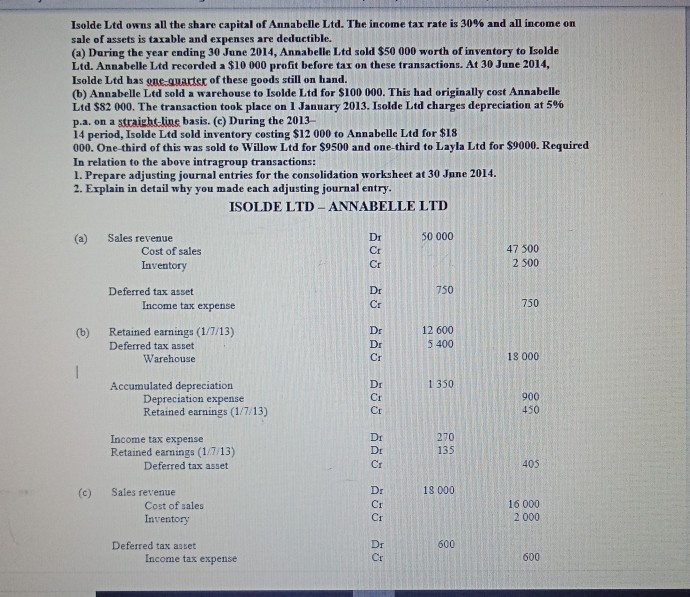

Isolde Ltd owns all the share capital of Annabelle Ltd. The incom e tax rate is 30% and all income on sale of assets is taxable and expenses are deductible. (a) During the year ending 30 June 2014, Annabelle Ltd sold $50 000 worth of inventory to Isolde Ltd. Annabelle Ltd recorded a $10 000 profit before tax on these transactions. At 30 June 2014, Isolde Ltd has gne-quarter of these goods still on hand. (b) Annabelle Ltd sold a warehouse to Isolde Ltd for $100 000. This had originally cost Annabelle Ltd S82 000. The transaction took place on 1 January 2013. Isolde Ltd charges depreciation at 5% p.a. on a atraight lins basis. (c) During the 2013 14 period, Isolde Ltd sold inventory costing $12 000 to Annabelle Ltd for $I8 000. One-third of this was sold to Willow Ltd for $9500 and one-third to Layla Ltd for $9000. Required In relation to the above intragroup transactions: 1. Prepare adjusting journal entries for the consolidation worksheet at 30 June 2014. 2. Explain in detail why you made each adjusting journal entry ISOLDE LTD-ANNABELLE LTD 50 000 Dr Cr Cr (a) Sales revenue Cost of sales Inventory 47 500 2 500 Deferred tax asset Dr 750 750 Income tax expense Retained earnings (1/7/13) Deferred tax asset Dr Dr Cr 12 600 5 400 (b) Warehouse 18 000 Accumulated depreciation Dr 1 350 Depreciation expense Retained earnings (1/7.13) 900 450 Income tax expense Retained earnings (1/1/13) Dr Dr Cr 270 135 Deferred tax asset 405 Dr Cr (c) Sales revenue 18 000 Cost of sales Inventory 16 000 2 000 Dr Cr Deferred tax asset Income tax expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started