Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, please help me solve the problem. QUESTION 1 (25 MARKS) (UNIT 3) The following is the data on RM1,000 par value bonds issued by

Hi, please help me solve the problem.

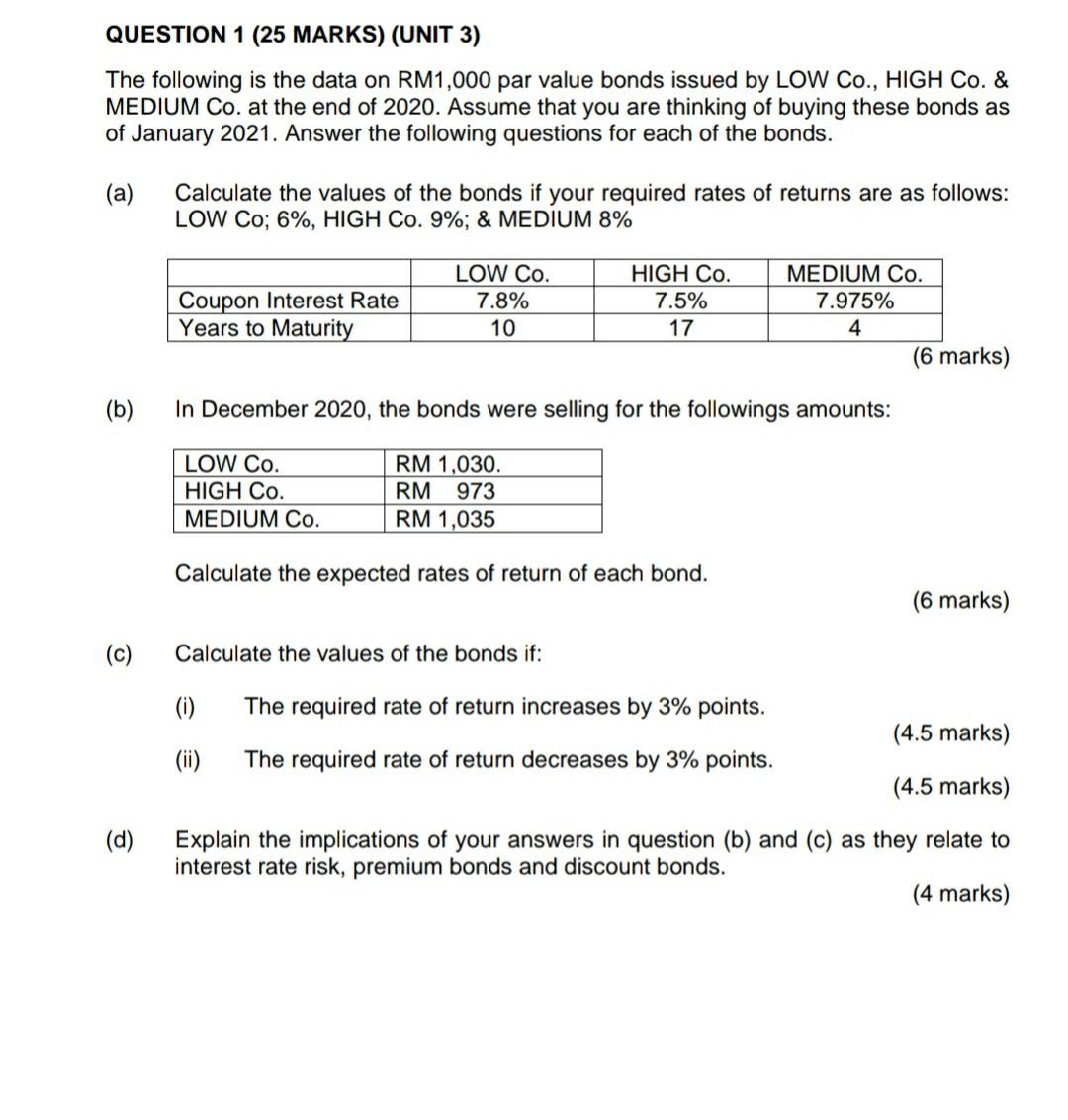

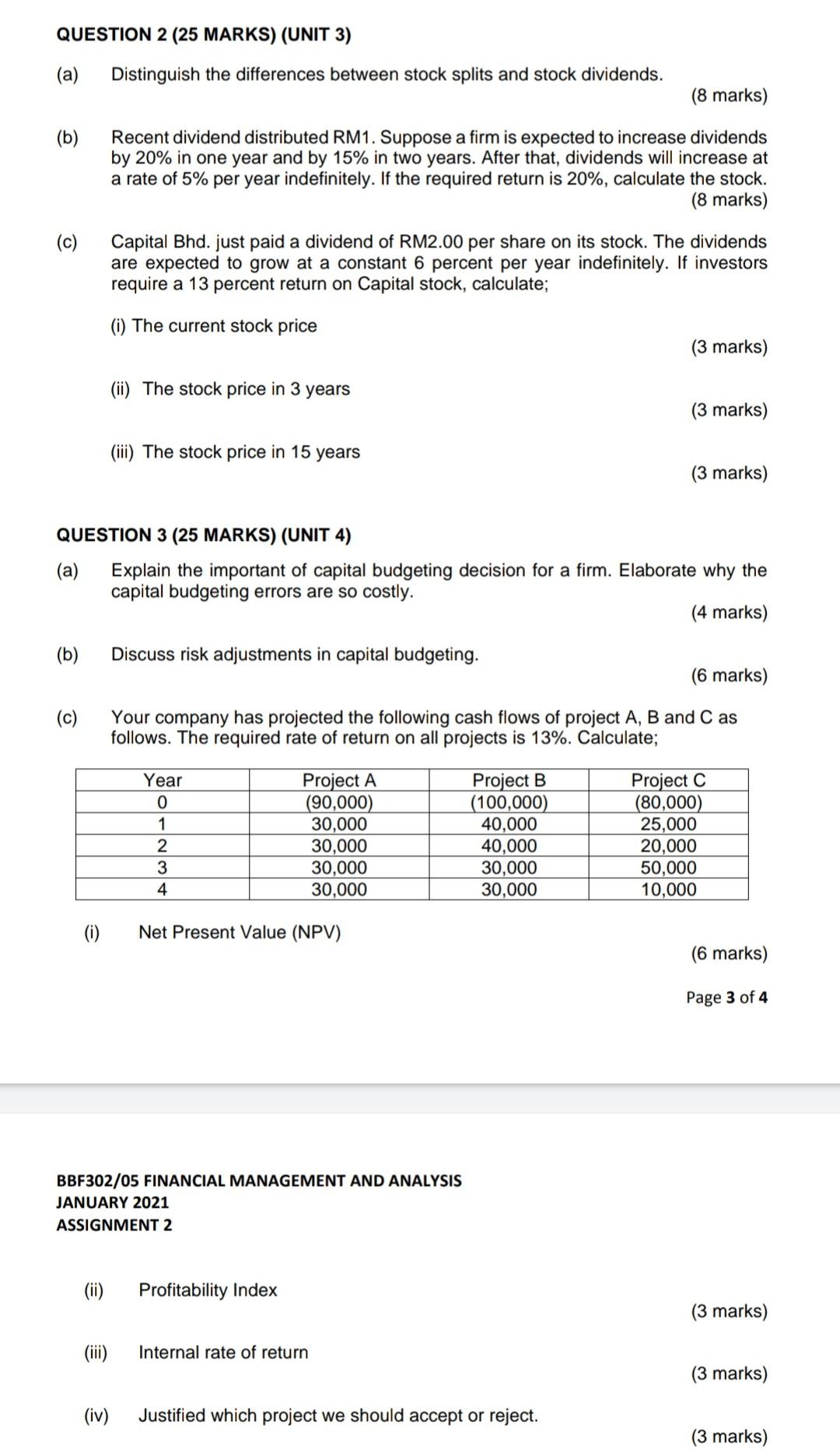

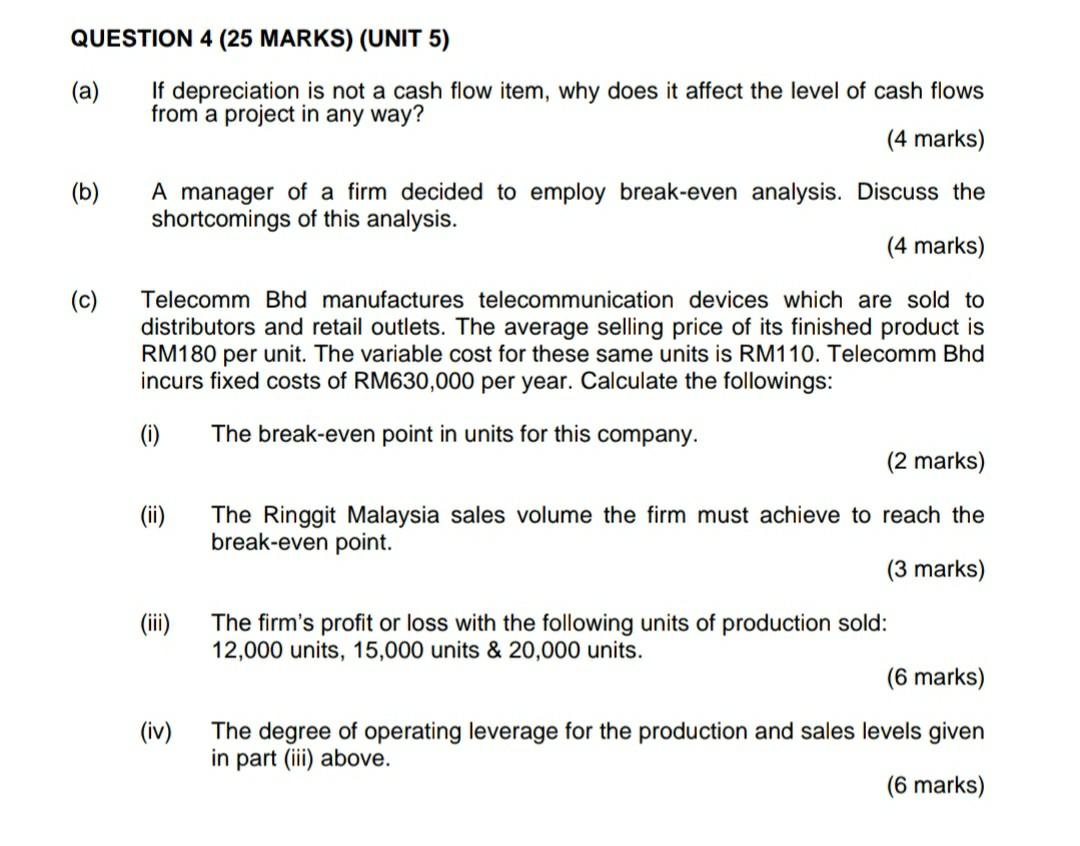

QUESTION 1 (25 MARKS) (UNIT 3) The following is the data on RM1,000 par value bonds issued by LOW Co., HIGH CO. & MEDIUM Co. at the end of 2020. Assume that you are thinking of buying these bonds as of January 2021. Answer the following questions for each of the bonds. (a) Calculate the values of the bonds if your required rates of returns are as follows: LOW Co; 6%, HIGH Co. 9%; & MEDIUM 8% Coupon Interest Rate Years to Maturity LOW Co. 7.8% 10 HIGH Co. 7.5% 17 MEDIUM Co. 7.975% 4 (6 marks) (b) In December 2020, the bonds were selling for the followings amounts: LOW Co. HIGH Co. MEDIUM Co. RM 1,030. RM 973 RM 1,035 Calculate the expected rates of return of each bond. (6 marks) (c) Calculate the values of the bonds if: (i) The required rate of return increases by 3% points. (4.5 marks) (ii) The required rate of return decreases by 3% points. (4.5 marks) (d) Explain the implications of your answers in question (b) and (c) as they relate to interest rate risk, premium bonds and discount bonds. (4 marks) QUESTION 2 (25 MARKS) (UNIT 3) (a) Distinguish the differences between stock splits and stock dividends. (8 marks) (b) Recent dividend distributed RM1. Suppose a firm is expected to increase dividends by 20% in one year and by 15% in two years. After that, dividends will increase at a rate of 5% per year indefinitely. If the required return is 20%, calculate the stock. (8 marks) (c) Capital Bhd. just paid a dividend of RM2.00 per share on its stock. The dividends are expected to grow at a constant 6 percent per year indefinitely. If investors require a 13 percent return on Capital stock, calculate; (i) The current stock price (3 marks) (ii) The stock price in 3 years (3 marks) (iii) The stock price in 15 years (3 marks) QUESTION 3 (25 MARKS) (UNIT 4) (a) Explain the important of capital budgeting decision for a firm. Elaborate why the capital budgeting errors are so costly. (4 marks) (b) Discuss risk adjustments in capital budgeting. (6 marks) (c) Your company has projected the following cash flows of project A, B and C as follows. The required rate of return on all projects is 13%. Calculate; Year 0 1 2 3 4 Project A (90,000) 30,000 30,000 30,000 30,000 Project B (100,000) 40,000 40,000 30,000 30,000 Project C (80,000) 25,000 20,000 50,000 10,000 (1) Net Present Value (NPV) (6 marks) Page 3 of 4 BBF302/05 FINANCIAL MANAGEMENT AND ANALYSIS JANUARY 2021 ASSIGNMENT 2 (ii) Profitability Index (3 marks) (iii) Internal rate of return (3 marks) (iv) Justified which project we should accept or reject. (3 marks) QUESTION 4 (25 MARKS) (UNIT 5) (a) If depreciation is not a cash flow item, why does it affect the level of cash flows from a project in any way? (4 marks) (b) A manager of a firm decided to employ break-even analysis. Discuss the shortcomings of this analysis. (4 marks) (c) Telecomm Bhd manufactures telecommunication devices which are sold to distributors and retail outlets. The average selling price of its finished product is RM180 per unit. The variable cost for these same units is RM110. Telecomm Bhd incurs fixed costs of RM630,000 per year. Calculate the followings: (i) The break-even point in units for this company. (2 mar (ii) The Ringgit Malaysia sales volume the firm must achieve to reach the break-even point. (3 marks) (iii) The firm's profit or loss with the following units of production sold: 12,000 units, 15,000 units & 20,000 units. (6 marks) (iv) The degree of operating leverage for the production and sales levels given in part (iii) above. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started