Hi, please only answer question C. Thanks.

Hi, please only answer question C. Thanks.

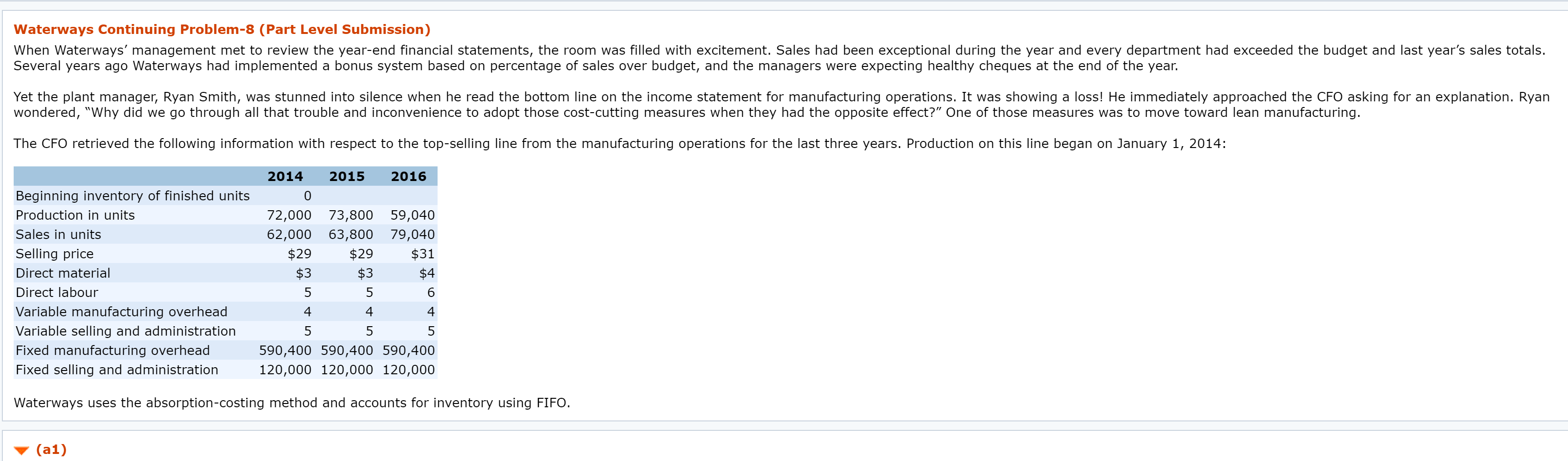

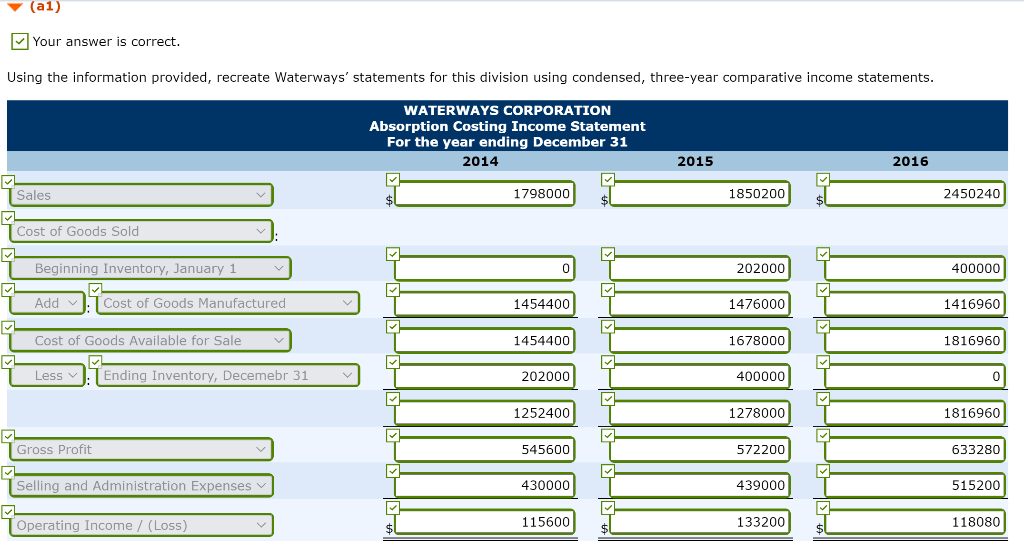

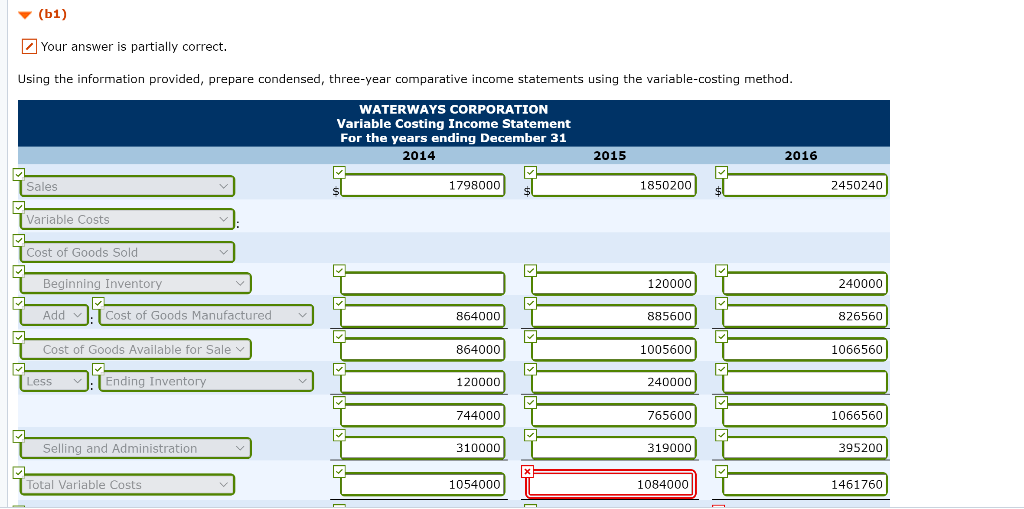

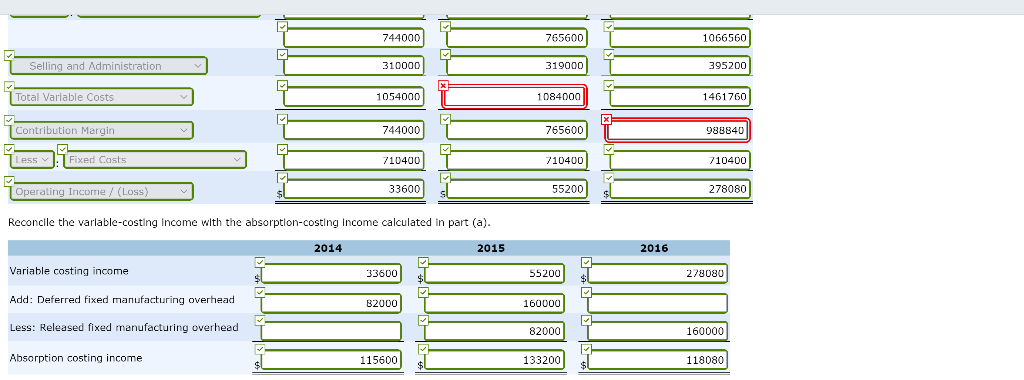

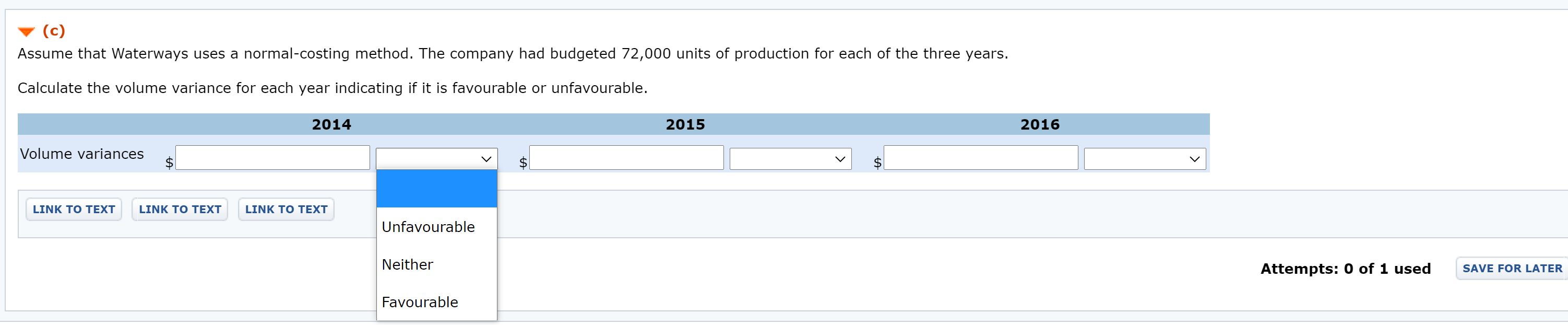

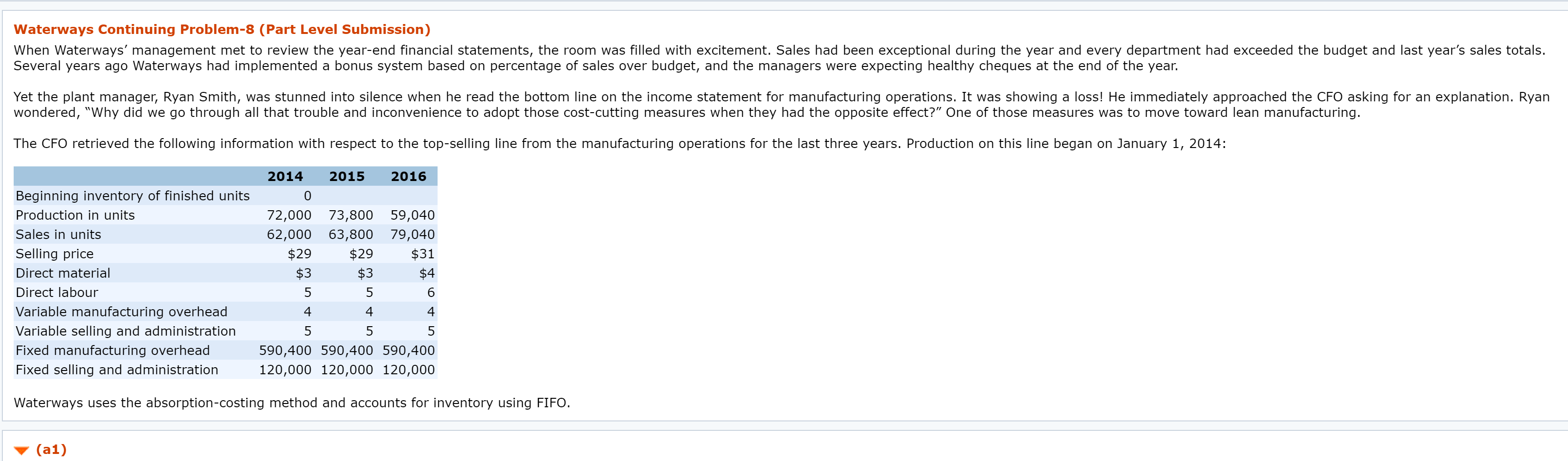

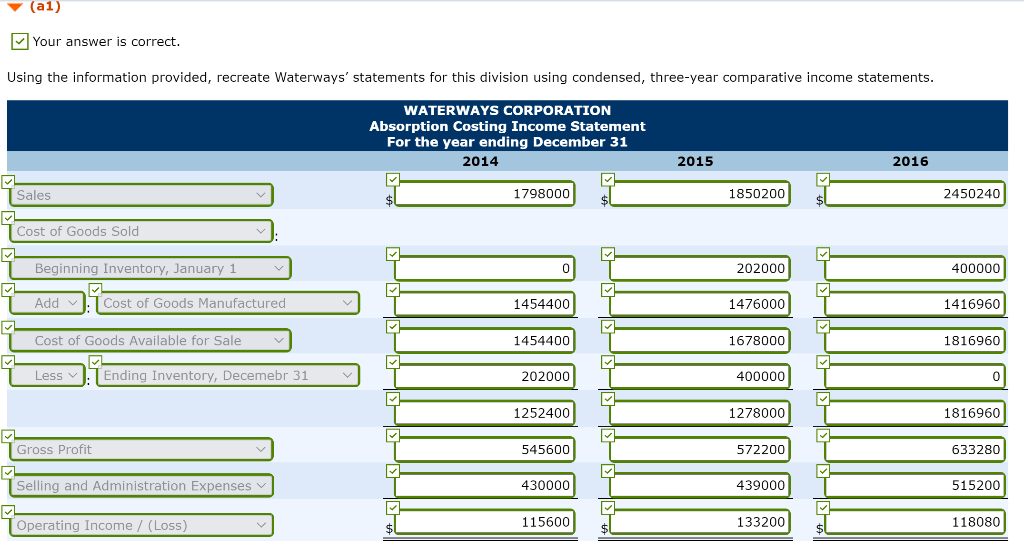

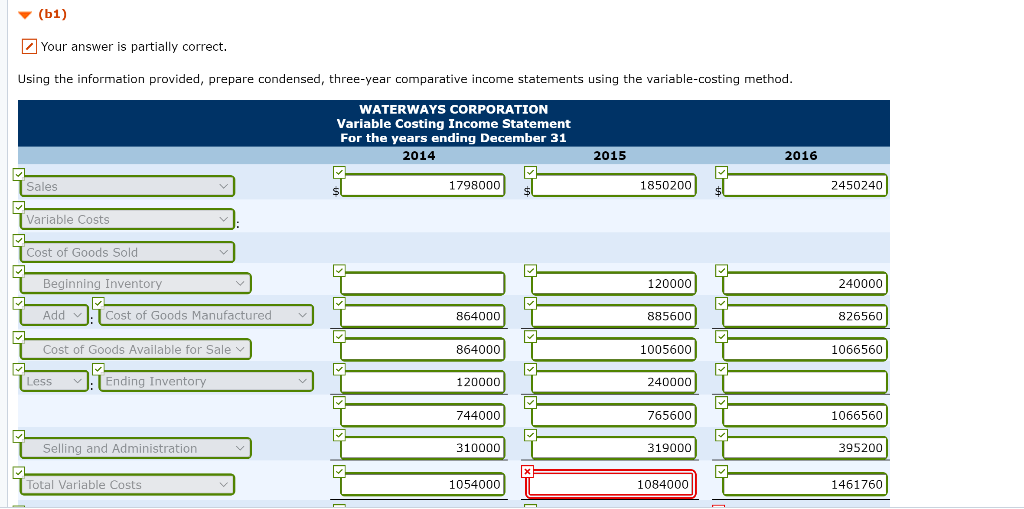

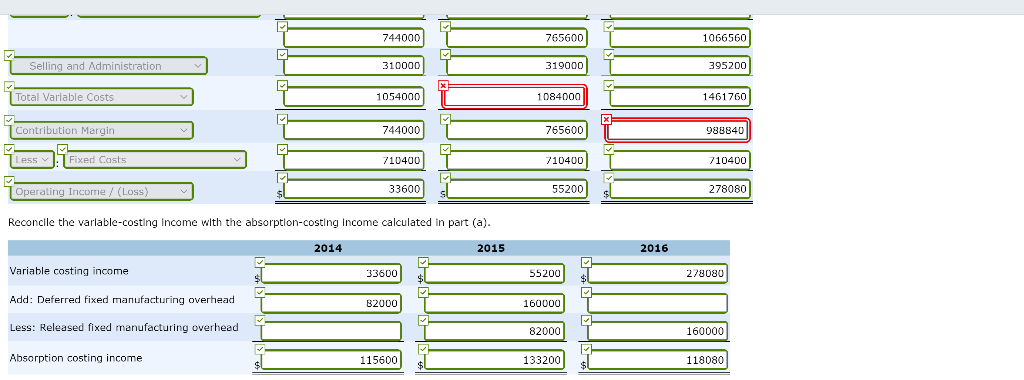

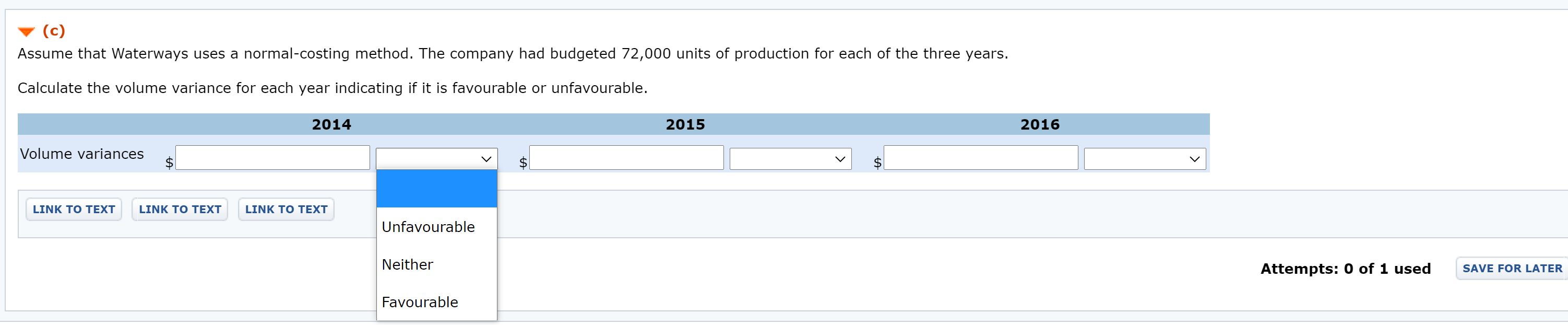

Waterways Continuing Problem-8 (Part Level Submission) When Waterways' management met to review the year-end financial statements, the room was filled with excitement. Sales had been exceptional during the year and every department had exceeded the budget and last year's sales totals. Several years ago Waterways had implemented a bonus system based on percentage of sales over budget, and the managers were expecting healthy cheques at the end of the year. Yet the plant manager, Ryan Smith, was stunned into silence when he read the bottom line on the income statement for manufacturing operations. It was showing a loss! He immediately approached the CFO asking for an explanation. Ryan wondered, "Why did we go through all that trouble and inconvenience to adopt those cost-cutting measures when they had the opposite effect?" One of those measures was to move toward lean manufacturing. The CFO retrieved the following information with respect to the top-selling line from the manufacturing operations for the last three years. Production on this line began on January 1, 2014: 2014 2015 2016 Beginning inventory of finished units Production in units Sales in units Selling price Direct material Direct labour Variable manufacturing overhead Variable selling and administration Fixed manufacturing overhead Fixed selling and administration 72,000 73,800 59,040 62,000 63,800 79,040 $29 $29 $31 $3 $3 $4 5 6 4 5 5 5 590,400 590,400 590,400 120,000 120,000 120,000 Waterways uses the absorption-costing method and accounts for inventory using FIFO. (a1) (al) Your answer is correct. Using the information provided, recreate Waterways' statements for this division using condensed, three-year comparative income statements. WATERWAYS CORPORATION Absorption Costing Income Statement For the year ending December 31 2014 2015 2016 Sales 1798000 1850200 2450240 Cost of Goods Sold Beginning Inventory, January 1 202000 400000 Add Cost of Goods Manufactured 1454400 1476000 1416960 Cost of Goods Available for Sale 1454400 1678000 1816960 Less Ending Inventory, Decemebr 31 202000 400000 0 1252400 1278000 1816960 Gross Profit 545600 572200 633280 Selling and Administration Expenses 430000 439000 515200 Operating Income / (Loss) 115600 133200 118080 (61) Your answer is partially correct. Using the information provided, prepare condensed, three-year comparative income statements using the variable-costing method. WATERWAYS CORPORATION Variable Costing Income Statement For the years ending December 31 2014 2015 2016 Sales 1798000 1850200 2450240 Variable Costs Cost of Goods Sold Beginning Inventory 120000 240000 Add Cost of Goods Manufactured 864000 885600 826560 Cost of Goods Available for Sale v 864000 1005600 1066560 Less Ending Inventory 120000 240000 744000 765600 1066560 Selling and Administration 310000 319000 395200 x Total Variable Costs 1054000 1084000 1461760 744000 765600 1066560 Selling and Administration 310000 319000 395200 Total Variable Costs 1054000 1084000 1461760 x Contribution Margin 744000 765600 989840 Less Fixed Casts 710400 710400 710400 Operating Income / (Loss) 33600 55200 278080 Reconcile the variable-costing Income with the absorption-costing Income calculated in part (a). 2014 2015 2016 Variable costing income 33600 4 55200 278080 Add: Deferred fixed manufacturing overhead 82000 160000 Less: Released fixed manufacturing overhead 82000 160000 Absorption costing income 115600 133200 $ 118080 (c) Assume that Waterways uses a normal-costing method. The company had budgeted 72,000 units of production for each of the three years. Calculate the volume variance for each year indicating if it is favourable or unfavourable. 2014 2015 2016 Volume variances > $

Hi, please only answer question C. Thanks.

Hi, please only answer question C. Thanks.