Hi, this is macro economics: monetary and fiscal policy question, I have completed the tables, I need help with the questions 1, 2, 3 and 4.

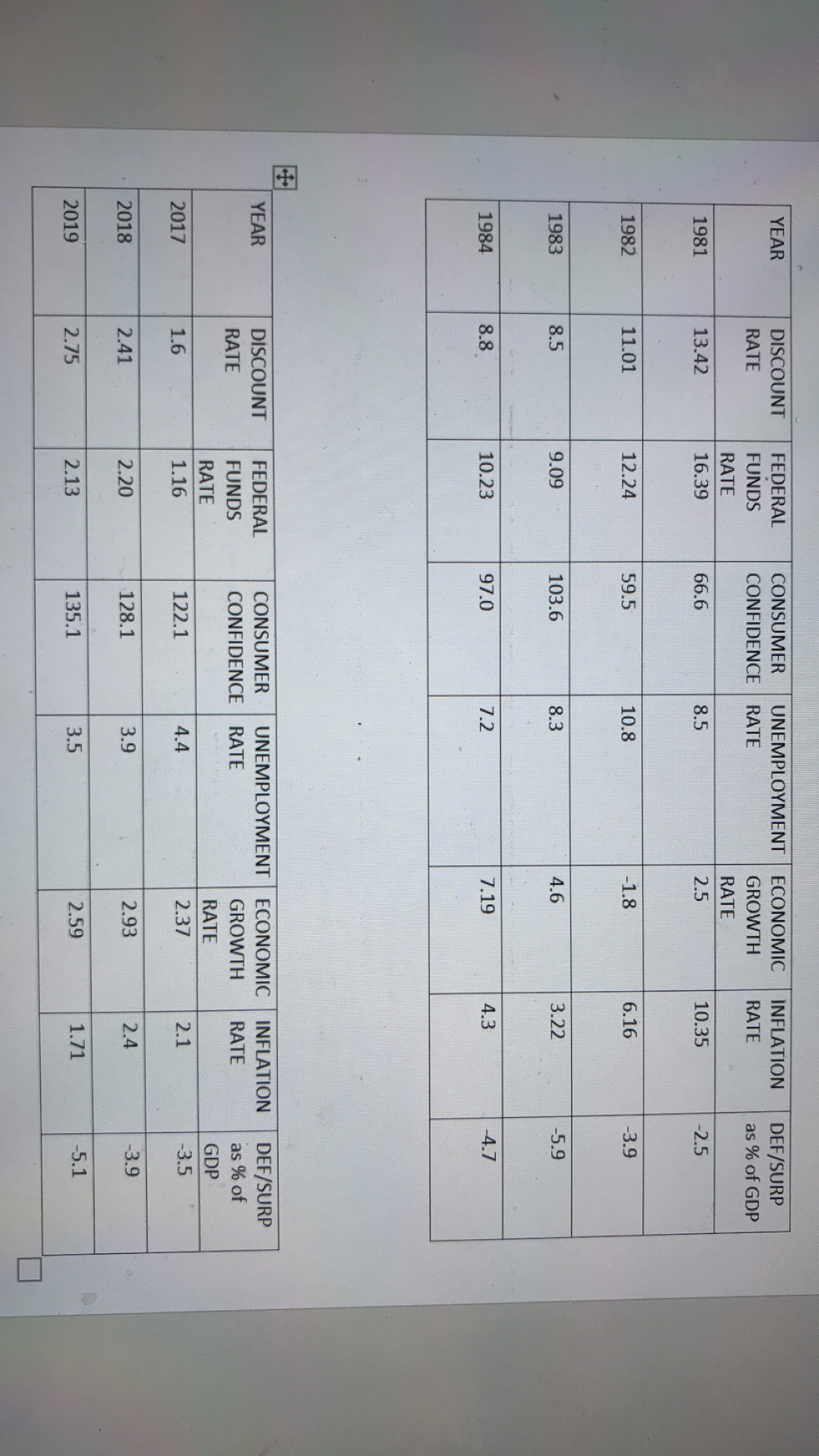

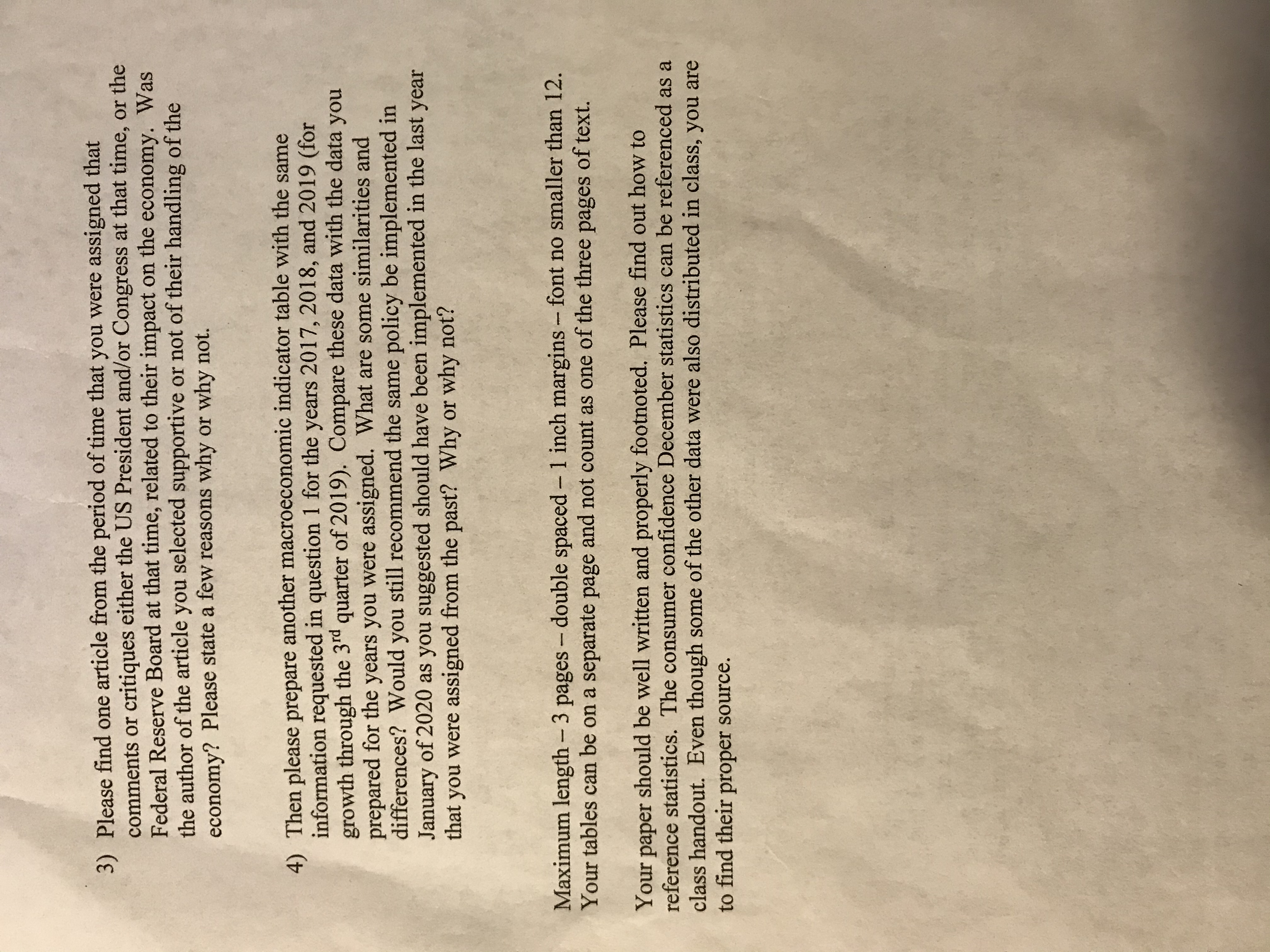

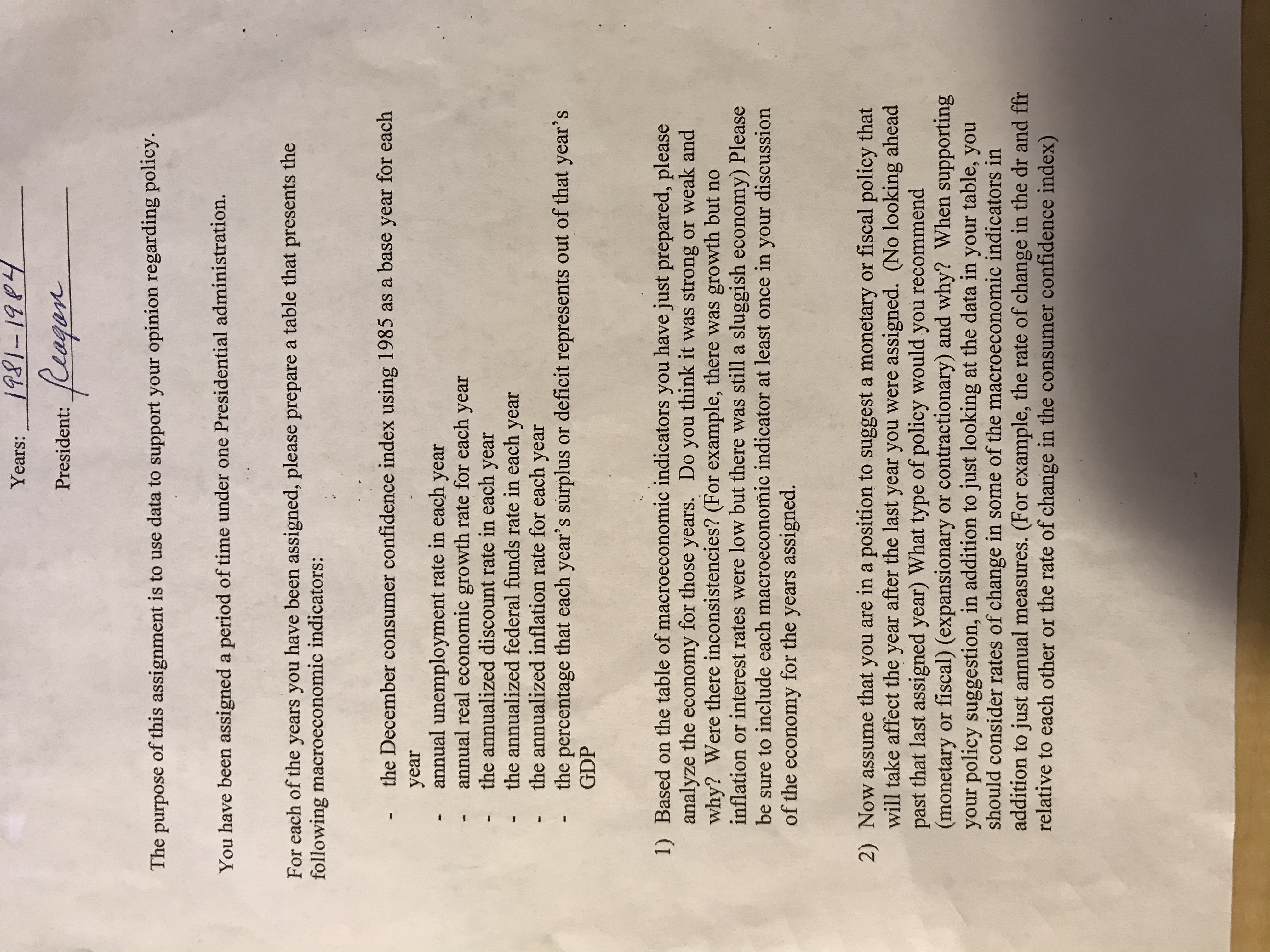

YEAR DISCOUNT FEDERAL CONSUMER UNEMPLOYMENT ECONOMIC INFLATION DEF/SURP RATE FUNDS CONFIDENCE RATE GROWTH RATE as % of GDP RATE RATE 1981 13.42 16.39 66.6 8.5 2.5 10.35 -2.5 1982 11.01 12.24 59.5 10.8 -1.8 6.16 -3.9 1983 8.5 9.09 103.6 8.3 4.6 3.22 -5.9 1984 8.8 10.23 97.0 7.2 7.19 4.3 4.7 YEAR DISCOUNT FEDERAL CONSUMER UNEMPLOYMENT ECONOMIC INFLATION DEF/SURP RATE FUNDS CONFIDENCE RATE GROWTH RATE as % of RATE RATE GDP 2017 1.6 1.16 122.1 4.4 2.37 2.1 -3.5 2018 2.41 2.20 128.1 3.9 2.93 2.4 -3.9 2019 2.75 2.13 135.1 3.5 2.59 1.71 -5.13) Please find one article from the period of time that you were assigned that comments or critiques either the US President and/or Congress at that time, or the Federal Reserve Board at that time, related to their impact on the economy. Was the author of the article you selected supportive or not of their handling of the economy? Please state a few reasons why or why not. 4 ) Then please prepare another macroeconomic indicator table with the same information requested in question 1 for the years 2017, 2018, and 2019 (for growth through the 3"d quarter of 2019). Compare these data with the data you prepared for the years you were assigned. What are some similarities and differences? Would you still recommend the same policy be implemented in January of 2020 as you suggested should have been implemented in the last year that you were assigned from the past? Why or why not? Maximum length - 3 pages - double spaced - 1 inch margins - font no smaller than 12. Your tables can be on a separate page and not count as one of the three pages of text. Your paper should be well written and properly footnoted. Please find out how to reference statistics. The consumer confidence December statistics can be referenced as a class handout. Even though some of the other data were also distributed in class, you are to find their proper source.Years: 1981- 1984 President: Reagan The purpose of this assignment is to use data to support your opinion regarding policy. You have been assigned a period of time under one Presidential administration. For each of the years you have been assigned, please prepare a table that presents the following macroeconomic indicators: the December consumer confidence index using 1985 as a base year for each year annual unemployment rate in each year annual real economic growth rate for each year the annualized discount rate in each year the annualized federal funds rate in each year the annualized inflation rate for each year the percentage that each year's surplus or deficit represents out of that year's GDP 1) Based on the table of macroeconomic indicators you have just prepared, please analyze the economy for those years. Do you think it was strong or weak and why? Were there inconsistencies? (For example, there was growth but no inflation or interest rates were low but there was still a sluggish economy) Please be sure to include each macroeconomic indicator at least once in your discussion of the economy for the years assigned. 2) Now assume that you are in a position to suggest a monetary or fiscal policy that will take affect the year after the last year you were assigned. (No looking ahead past that last assigned year) What type of policy would you recommend (monetary or fiscal) (expansionary or contractionary) and why? When supporting your policy suggestion, in addition to just looking at the data in your table, you should consider rates of change in some of the macroeconomic indicators in addition to just annual measures. (For example, the rate of change in the dr and ffr relative to each other or the rate of change in the consumer confidence index)