hi this is one question only please solve it

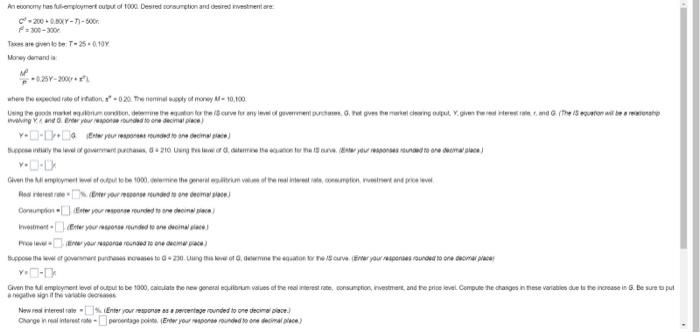

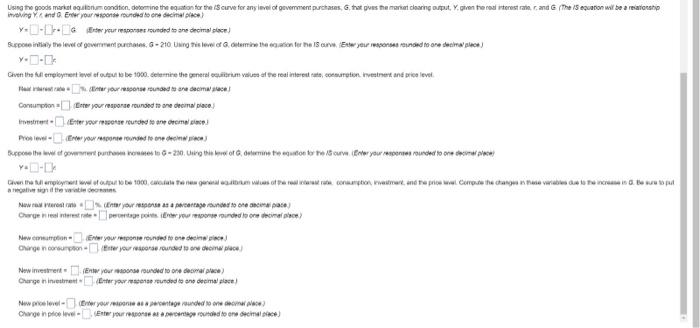

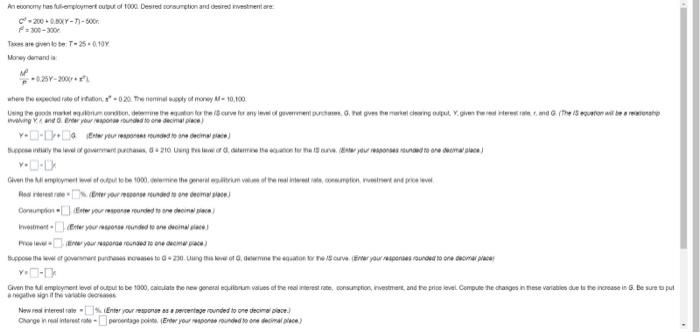

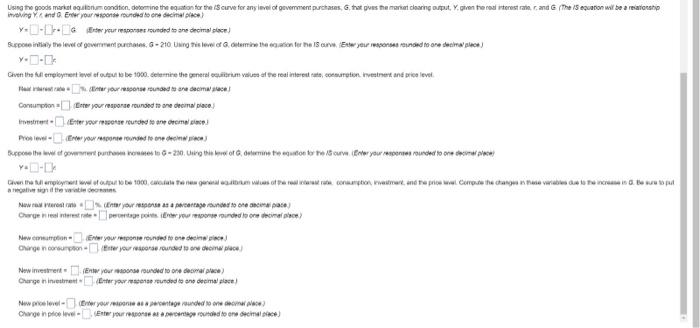

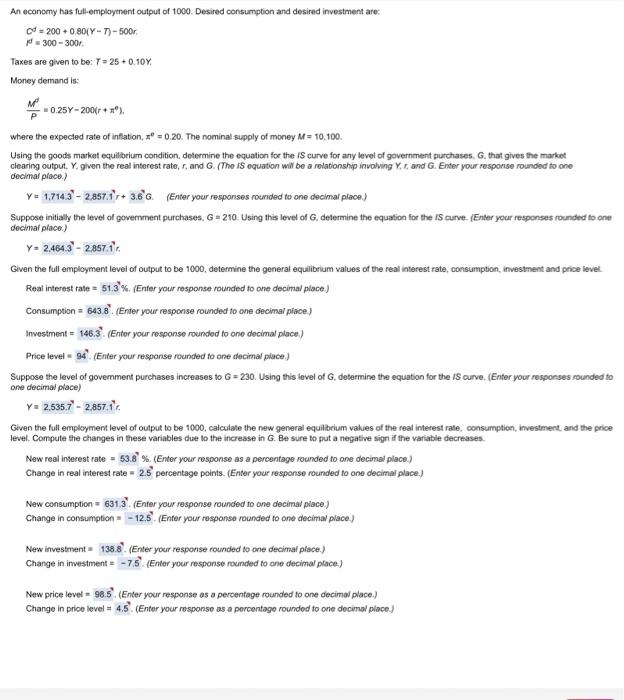

0=200+6.00xy600rF4=3003000 Poces are giente te: T=35=0.10Y Moneydervard a rM2=028200r+r2i y=k y=r Conumphon a Core jour resporse rounsed ti sne decmalpe. ya. Nuw inestrent = (Enter poor aascase raunded to one deswar phese ) An econeery has fullemployenent output of 1000 . Desired consumption and desired investment are: Cd=200+0.80(YT)500r.f=300300r. Taxes are given to be: T=25+0.10Y. Money demand is: PM4=0.25200(r+0)h where the expected rate of infation, xe=0.20. The nominal supply of money M=10.100. Using the goods market equilizrium condition, determine the equation for the iS curve for any level of government purchases, G, that gives the market clearing output, Y, given the reat interest rate, r, and G. The IS equation will be a relationship invalving Y,r, and G. Enter your response rounded to ane decimar place.) y=1.714.372.857.1r+3.6 G. (Enter your responses rounded to one decimal place) Suppose initially the level of powernment purchases, G=210. Using this level of G, determine the equation for the IS curve. (Enter your responses rounded fo one docimal fiace.) y=2.464.32.857.1% Given the full employment level of output to be 1000 , determine the general equalibrium values of the real interest rate, consumption, investment and price ievel. Real interest rate =51.3%. (Enfer your response rounded to one decimal place.) Consumption =643.8. (Enter your response rounded to one decimal place) Investment =146.3. (Enter your response rounded to one docimal place.) Price level = 94. (Enter your response rounded to ane decimal place.) Suppose the level of govemment purcheses increases to G=230. Using this level of G, determine the equation for the IS curve. (Enter your responses rounded to one decim piace) =2,535.72.857.1% Given the full employment level of output to be 1000, calculate the new general equilbrium values of the real interest rate, consumption, investment, and the price level. Compute the changes in these variables due to the increase in G. Be sure to put a negative sign if the variable decreases. New real interest rate =53.8% \%. (Enter your response as a percentage rounded to ane decimal place) Change in real interest rate =2.5 percentage points. (Enter your response rounded to ane decimal place.) New consumption =631.3. (Enter your response rounded to one decimal place.) Change in consumption = (Enter your response rounded to one decimal place.) New investment = 138.8". (Enter your response rounded to one decimal place.) Change in investment = (Enter your response rounded to ane decimal place.) New price level = 98.5. (Enter your response as a percentage rounded to one decimal place.) Change in price level =4.5. (Enter your response as a percentage rounded to ane docimal place) 0=200+6.00xy600rF4=3003000 Poces are giente te: T=35=0.10Y Moneydervard a rM2=028200r+r2i y=k y=r Conumphon a Core jour resporse rounsed ti sne decmalpe. ya. Nuw inestrent = (Enter poor aascase raunded to one deswar phese ) An econeery has fullemployenent output of 1000 . Desired consumption and desired investment are: Cd=200+0.80(YT)500r.f=300300r. Taxes are given to be: T=25+0.10Y. Money demand is: PM4=0.25200(r+0)h where the expected rate of infation, xe=0.20. The nominal supply of money M=10.100. Using the goods market equilizrium condition, determine the equation for the iS curve for any level of government purchases, G, that gives the market clearing output, Y, given the reat interest rate, r, and G. The IS equation will be a relationship invalving Y,r, and G. Enter your response rounded to ane decimar place.) y=1.714.372.857.1r+3.6 G. (Enter your responses rounded to one decimal place) Suppose initially the level of powernment purchases, G=210. Using this level of G, determine the equation for the IS curve. (Enter your responses rounded fo one docimal fiace.) y=2.464.32.857.1% Given the full employment level of output to be 1000 , determine the general equalibrium values of the real interest rate, consumption, investment and price ievel. Real interest rate =51.3%. (Enfer your response rounded to one decimal place.) Consumption =643.8. (Enter your response rounded to one decimal place) Investment =146.3. (Enter your response rounded to one docimal place.) Price level = 94. (Enter your response rounded to ane decimal place.) Suppose the level of govemment purcheses increases to G=230. Using this level of G, determine the equation for the IS curve. (Enter your responses rounded to one decim piace) =2,535.72.857.1% Given the full employment level of output to be 1000, calculate the new general equilbrium values of the real interest rate, consumption, investment, and the price level. Compute the changes in these variables due to the increase in G. Be sure to put a negative sign if the variable decreases. New real interest rate =53.8% \%. (Enter your response as a percentage rounded to ane decimal place) Change in real interest rate =2.5 percentage points. (Enter your response rounded to ane decimal place.) New consumption =631.3. (Enter your response rounded to one decimal place.) Change in consumption = (Enter your response rounded to one decimal place.) New investment = 138.8". (Enter your response rounded to one decimal place.) Change in investment = (Enter your response rounded to ane decimal place.) New price level = 98.5. (Enter your response as a percentage rounded to one decimal place.) Change in price level =4.5. (Enter your response as a percentage rounded to ane docimal place)